It is well known that the Federal Reserve System expanded its assets more than four-fold during and after the 2007-09 financial crisis by making massive purchases of mortgage-backed securities and Treasuries. The balance sheet has not returned to normal since. Total Fed assets stand today at $4.45 trillion, up from less than $1 trillion before the crisis. Whether, when, and how to normalize the size of the Fed’s balance sheet have been under discussion for years.

Economist-blogger David Andolfatto — not speaking for his employer the Federal Reserve Bank of St. Louis — now offers “a public finance argument” for “keeping the Fed’s balance sheet large.” Viewing the Fed as a financial intermediary, he observes that “The Fed transforms high-interest government debt into low-interest Fed liabilities (money),” and that this is a profitable business.

Curiously, Andolfatto omits to mention two important details: the Fed enjoys such a spread only because it is — for the first times in its history — (a) borrowing short and lending very long, also known as practicing “duration transformation” or “playing the yield curve,” and (b) heavily invested in mortgage-backed securities. The Fed is borrowing short by currently paying 0.75% (not 0.50% as Andolfatto reports) on zero-maturity bank reserves. It lends long by holding 10-year and longer Treasuries (paying 2.42% and up as of 17 Feb. 2017) and long-term mortgage-backed securities.

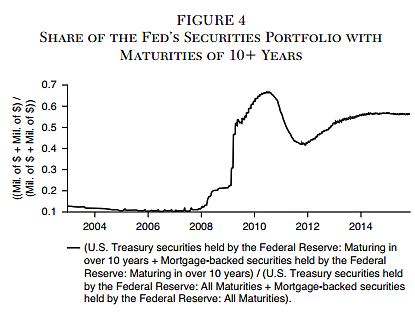

Andolfatto writes that the Fed’s “rate of return has generally followed the path of market interest rates downward.” While that was true in 2007-08, it should be noted that the Fed’s rate of return largely stopped following the downward path of market interest after 2008. As market rates on five-year Treasuries fell closer to the administered interest rate on reserves after 2008, the Fed shifted from a portfolio maturity of 5 years to one of around 12 years, as if determined to keep its interest income large. This is shown in the following two figures from a 2016 Cato Journal article of mine.

Here is Andolfatto’s closing pitch for embracing the status quo: “Reducing the Fed’s balance sheet at this point in time seems like a needless loss for the U.S. taxpayer. … if the Fed holds the debt, the carry cost is generally much lower. This cost-saving constitutes a net gain for the government. So why not take advantage of it?” The Fed faces an “arbitrage opportunity.” Having the Fed hold Treasury debt, in place of the public holding it, yields a pure arbitrage profit, because the Fed can borrow to carry the debt at a rate lower than the rate at which the Treasury borrows.

Characterizing the situation this way, however, neglects the simple difference between borrowing short and borrowing long. When the Fed borrows short from the banks to lend long to the Treasury, it does not do so costlessly. Duration transformation carries a risk of capital loss, also known as duration risk. Suppose the yield curve shifts up, both short and long interest rates rising together. The Fed will experience a decline in present value of its assets that will swamp the smaller decline in the present value of its liabilities. Such an event is not unknown: in 1979–81 it rendered insolvent about two-thirds of US thrift institutions, who were financing 30-year fixed-rate mortgages with 1- and 2‑year deposits. In cash-flow terms, such an event would mean that the Fed would quickly have to start paying higher interest rates to borrow, while its asset portfolio continues to pay low yields and roll over much more slowly. The Fed’s annual net transfer to the Treasury might even go negative. Smaller or negative transfers from the Fed to the Treasury would mean a sudden jump in the present value of the public’s ordinary tax liabilities. Net interest income from playing the yield curve is not a free lunch.

The Fed has also been carrying significant default risk by holding $1.7 trillion of its portfolio not in Treasuries but in mortgage-backed securities. It was not so many years ago that MBS were trading well below par because of their default risk. Indeed it was to push their prices back towards par that the Fed purchased so many.

Responding to a commentator on his blog who pointed out the Fed’s duration risk, Andolfatto remarks: “the duration risk … could be mitigated considerably if the Fed restricted itself to short-duration assets.” He proposes that “If a one-year UST is yielding anything significantly higher than the interest on Fed liabilities, then the Fed can make a profit for the government.” But when we look at the actual numbers, we find that the yield on one-year UST is not significantly higher. The Fed could not in fact continue to make a profit for the government. One-year Treasuries are currently yielding just 82 basis points (0.82%), only 7 basis points more than the 75 basis points that the Fed pays on reserves. Multiplying 7 basis points by the Fed’s $4.45 trillion asset portfolio yields only $3.1 billion in net interest income, less than the Fed’s 2016 budget of $4.5 billion or its ex-post 2015 operating expenses of $4.2 billion. Mitigating the duration risk by going to a portfolio of one-year Treasuries would thus eliminate the Fed’s profit from borrowing from banks and relending to the Treasury.

The principal cases for normalizing the Fed’s balance sheet are (1) the Fed should not distort the allocation of credit by holding trillions in MBS, and (2) normalizing the size of the balance sheet would allow the Fed to normalize the conduct of monetary policy by making bank reserves scarce again. There is no fiscal-free-lunch case for holding off on normalization.