In his first speech as a member of the Federal Reserve’s Board of Governors, Christopher Waller defended Fed independence and reassured his audience that “deficit financing and debt servicing issues play no role in our policy decisions and never will.” His goal was to dispel the “narrative” that, with massive federal debt and fiscal deficits, the Fed may become subservient to the Treasury. Large-scale debt monetization could then lead to inflation and a loss of Fed independence.

Waller was adamant that the Fed would not “succumb to pressures (1) to keep interest rates low to help service the debt and (2) to maintain asset purchases to help finance the federal government.” Despite his statement, there may be reason to fear fiscal dominance. As Harvard economist Greg Mankiw warns, “It would be a mistake to put too much faith in the prescience and skill of central bankers.”

Fiscal dominance occurs when central banks use their monetary powers to support the prices of government securities and to peg interest rates at low levels to reduce the costs of servicing sovereign debt. Although the Fed may not call its unconventional monetary policies “fiscal dominance,” there is no doubt that the distance between fiscal and monetary policy has narrowed since the 2007–2008 financial crisis, and especially since the pandemic.

Downplaying the risk of the Fed financing the fisc by monetary accommodation—and complacency about the consequent risk of inflation—is itself risky. As former Treasury Secretary Lawrence H. Summers declared,

As I look at $3 trillion of stimulus, $2 trillion of savings overhang, a major acceleration coming from COVID in the rear-view mirror, rates expected by the Federal Reserve to be at zero for three years even in a booming economy, record growth this year, major expansion of the Fed balance sheet, and much new fiscal stimulus to come—I’m worried.

In the remainder of this article, I will delve into the question of whether there is after all good reason to fear a future episode of fiscal dominance.

Episodes of Fiscal Dominance

Fiscal authorities normally dominate central banks during wartime. That was certainly the case during the two world wars. The Fed kept yields low on government securities by monetizing a large share of the U.S. debt. In their Monetary History of the United States, Milton Friedman and Anna J. Schwartz report that the Fed “strongly favored” supporting the price of government debt, even though officials understood the limits that it put on monetary policy in terms of controlling inflation (p. 620). They also remind us that “the Treasury had been the active maker of monetary policy since 1933,” and it was “natural” to continue that policy during World War II (pp. 620–21). Following the war, the Fed continued to support government debt and hold rates low. However, as inflation took hold, the central bank sought greater independence and reached an Accord with the Treasury in 1951 to end the support program and gain control over monetary policy. Nevertheless, the Fed did not “explicitly forswear support of the prices of government securities as an aim of policy” until September 1953 (p. 625).

Fiscal dominance has also appeared occasionally during peacetime, such as in the 1960s and early 1970s. The Fed engaged in easy monetary policies to fund fiscal deficits, which led to inflation. The Johnson administration (1963–69) leaned heavily on Fed Chairman William McChesney Martin to keep rates low and maintain the economic expansion via adequate money growth. However, the most egregious example of the capture of the Fed for political purposes occurred under Arthur Burns, who catered to President Nixon’s demand for easy money. From 1971 to 1973, inflationary pressures grew as Burns accommodated Nixon’s demands for lower interest rates and expansionary money growth.

In 1977, President Carter thought inflation was much less of an issue than unemployment was and called for Burns to shift to easy money once more. “It is not unfair to conclude,” said Robert Weintraub, an economist who served on the House Subcommittee on Domestic Monetary Policy, “that the Federal Reserve accelerated M1 growth in 1977 above its own target range because it perceived its ‘assignment’ in the new administration’s economic game plan be to resist upward pressures on short‐term rates.”

The policy coordination that was evident under Arthur Burns was super-charged under Ben Bernanke during the Great Recession. The Fed, of course, had an obligation to provide liquidity to stressed banks and financial institutions, but its emergency lending programs and bailouts stretched its powers considerably.

The Fed’s actions since 2008 reveal that one should not be complacent about the risks of fiscal dominance. We may not be at war today, but the financial crisis and the pandemic have ratcheted up U.S. debt, and the Fed’s unconventional monetary policies have set a precedent for Fed support. Political pressure to keep rates “lower for longer,” monetize the debt, and allocate credit to appease special interest groups should not be ignored. Indeed, as Michael D. Bordo and Mickey Levy note in their recent survey of fiscal dominance:

The lessons from our historical survey are: avoid war, be cautious of sustained monetary accommodation of fiscal deficits, avoid fiscal dominance, maintain central bank independence, keep inflationary expectations anchored, and pursue pro-growth economic policies. The evidence suggests that ignoring the lessons from history could be at the policy makers’ peril.

Of course, we haven’t been at war—not at least in the usual sense; and inflation expectations seem well anchored. Yet there are other reasons why the problem of future fiscal dominance can’t be lightly brushed aside.

Looming Debt Issues

In his detailed examination of U.S. debt sustainability, William Cline, president of Economics International, concludes “that even with a new environment of low-interest rates, the medium- and long-term outlook for the interest burden of U.S. debt indicates that a major fiscal adjustment will be needed in which primary deficits are curbed from their present trajectory.” Doing so, however, “will be a major political challenge, especially in an environment in which there is a broad-based demand for more rather than less spending for social, anti-poverty, infrastructural and environmental purposes.” In such an environment, there will also be considerable pressure for the Fed to intervene on behalf of the Treasury to support bond prices and peg interest rates at artificially low levels—just as it did during World War II.

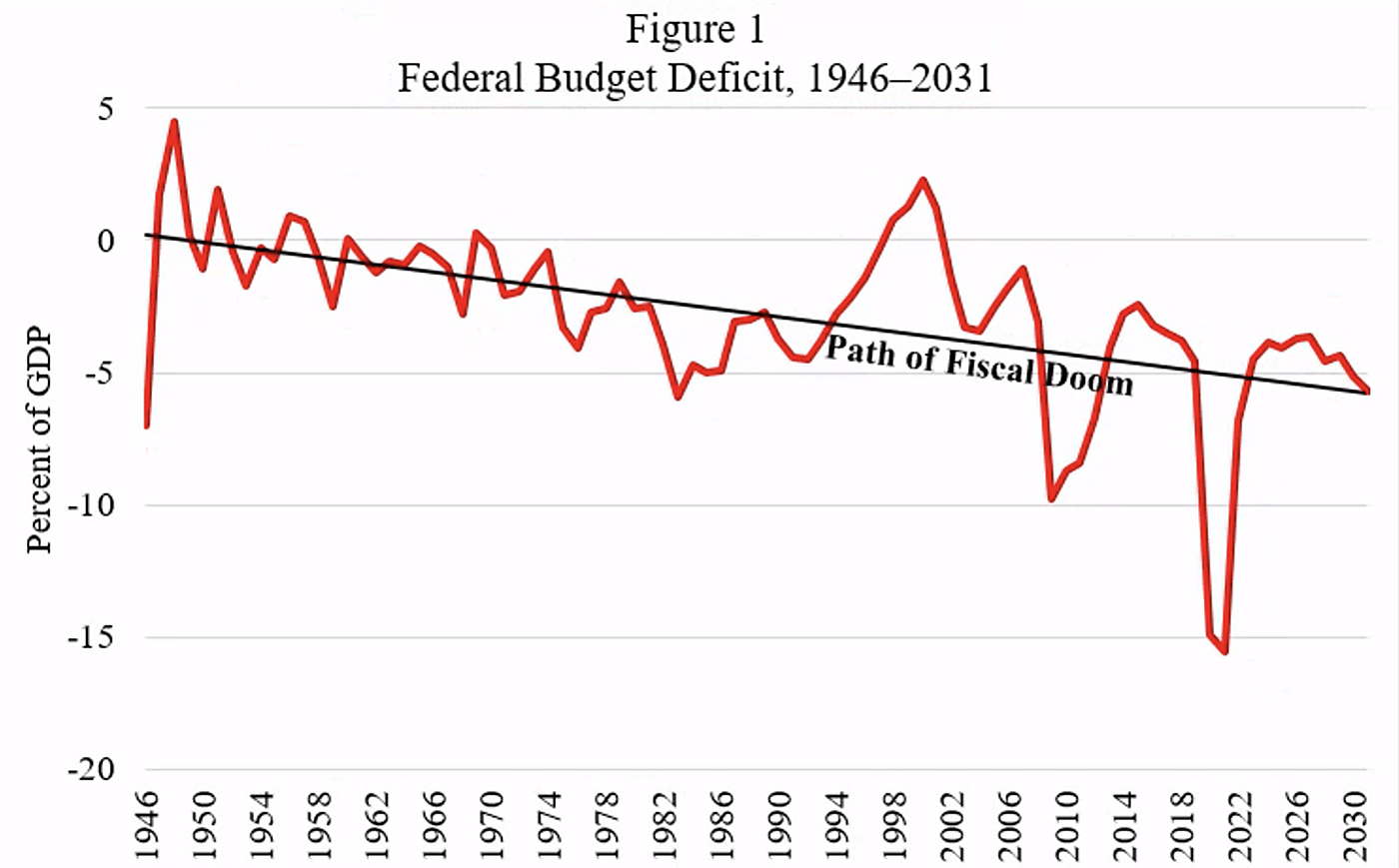

Figure 1 shows the deteriorating trend of U.S. fiscal deficits as a percent of GDP from the end of World War II projected to 2031 (using the CBO baseline from February 2021, plus the impact of the $1.9 trillion American Rescue Plan that President Biden signed into law in March). As fiscal deficits stack up, the ratio of U.S. debt to GDP will continue to rise. In 2007, that ratio was 72 percent; today it is slightly more than 100 percent; by 2030, it is projected to increase to 116 percent, and by 2050 to 203 percent (see Cline).

Source: Chris Edwards, “Federal Budget Deficits: Path of Fiscal Doom” (March 30, 2021).

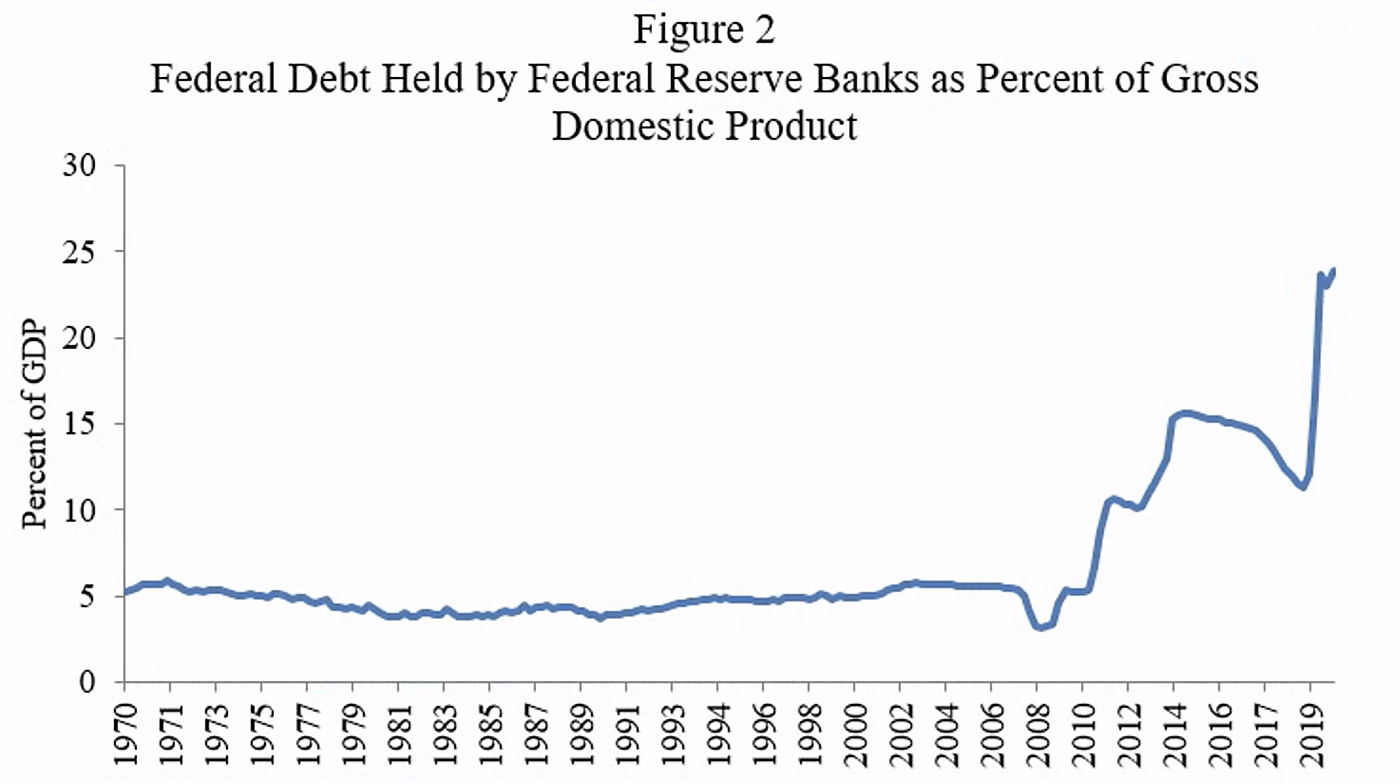

Figure 2 shows the sharp increase in the public debt held by Federal Reserve Banks (as a percent of GDP) that has occurred since the Fed’s large-scale asset purchase program began in November 2008, and especially since March 2020, when lockdowns due to COVID-19 caused negative supply-side and demand-side shocks. The monetization of new debt by the Fed has increased money growth. However, inflation has been subdued by the decline in monetary velocity and the Fed’s new operating system, known as the “floor system.”

Although Governor Waller and other Fed officials may be complacent about the threat of fiscal dominance, one ex-Fed official, Charles Plosser, former president of the Federal Reserve Bank of Philadelphia, has pointed to several factors that could increase the risk of fiscal dominance.

Sources: OMB; St. Louis Fed.

First, under the floor system and QE, “once the demand for reserves is satiated, there is no limit, in principle, to how big the balance sheet or volume of reserves can be. A large balance sheet unconstrained by monetary policy is ripe for abuse. Congress and an administration would be tempted to look to the balance sheet for their own purposes, including credit policy and off-budget fiscal policy.”

Second, Modern Monetary Theory (MMT) reinforces the idea that countries cannot go bankrupt if they fund debt with their own currency, so using the Fed to engage in fiscal policy might appear theoretically feasible and appeal to politicians who like to take credit for spending, but don’t want to increase taxes. What might look like a free lunch, however, could lead to inflation—and ultimately to defaults on sovereign debt. According to Plosser,

[The] growing appeal of MMT by some is exactly the sort of threat to independence that looms large. Yet, the Fed itself has contributed to this misguided use of its balance sheet through its unconventional policy choices, including QE, and … its new operating regime that untethers the balance sheet from monetary policy. Perhaps this threat will pass and we will muddle through somehow, but there is reason to be concerned as the price could prove quite high for Fed independence and the economy.

Finally, the Fed’s mission creep, beginning with the 2008 financial crisis and accelerating since the 2020 pandemic, implies that every time there is a crisis, the Fed gains power, but loses some independence as the Treasury oversees emergency lending programs under Section 13(3) of the Federal Reserve Act. In Plosser’s opinion, emergency lending programs—such as the corporate, municipal, and Main Street credit facilities—“blurred the traditional boundary between monetary and fiscal policy.” Moreover, when the Fed is asked to do too much, hubris may develop, with the consequent loss of perspective regarding the limits of monetary policy. Plosser, therefore, warns that expanding the “scope for monetary policy invites politicization and undermines central bank credibility when it fails to achieve the desired results.”

Clark Warburton would not be surprised with Plosser’s concern over “an evolving trend toward the explicit use of the Fed’s balance sheet to fund fiscal initiatives.” Warburton himself warned of the danger of “fiscal dominance” in the conduct of monetary policy—that is, using the central bank to fund government debt incurred via deficit spending. In “Monetary Control under the Federal Reserve Act,” published by the Political Science Quarterly, in December 1946, Warburton discussed the “subservience of monetary policy to government borrowing policy.” He argued that “whenever the federal government wishes to borrow money in large amounts, the Federal Reserve Board ceases to be an independent agency.” The Fed’s current financing of government debt, which is reaching historic levels under the Biden administration’s “stimulus” spending, is a case in point.

Although Waller would like the Fed to stick to its dual mandate of price stability and full employment, and to be independent—the reality is that it has already crossed the line into fiscal policy and credit allocation. By doing so, the Fed has incentivized politicians to use its power to create money and credit as a substitute for the democratic processes and fiscal responsibility that properly belong to Congress.

The challenge will be for the Fed to draw a bright line between fiscal and monetary policy, just as Waller desires. But that will become more difficult as fiscal QE, under the influence of MMT, is more widely seen as a way to give the public free lunches. The Fed’s independence is important for its credibility, but ultimately that will depend on where political and public opinion settles on fiscal issues, debt, and inflation. There are legitimate reasons to believe that inflation could increase in the current policy environment.

Risk of Inflation

While inflation has been low, there is no guarantee that it will remain so in light of the Fed’s move to “flexible average inflation targeting,” the promise to keep rates lower for longer, the dismal of the long-run fiscal picture, continuing adherence to large-scale asset purchases, and pressure from the Biden administration and progressives to keep rates low to help finance increases in government spending.

With the Fed willing to allow annual inflation to exceed 2 percent, to make up for lower past inflation, we may see more inflation over the next several years. Of course, it is possible for the Fed to adhere to average inflation of 2 percent over some time frame. But, so far, that time frame is uncertain. Meanwhile, in the short run, as people experience rising price levels, they may alter their expectations regarding future inflation. If inflation accelerates and monetary velocity increases, the Fed may fail to act soon enough to avoid a recession.

There is also the problem of market interest rates racing ahead of the Fed’s policy rate target range as the government floats more debt to finance bulging deficits. The government’s demand for funds could push rates upward, even though the Fed is determined to keep rates low. As Cline argues:

A fundamental analytical problem with nonchalance about rising debt ratios on grounds of low interest rates is that there are strong theoretical and empirical reasons to think that a rising ratio of debt to GDP causes an increase in the interest rate, making the combination of permanently low rates alongside ever-rising debt ratios an oxymoron.

His message is clear: “there is no fiscal free-lunch forever.”

Inflation would be a way to default on government debt, little by little. But as inflation expectations evolve, investors and the public would be less willing to hold long-term bonds, and yields would increase. The Fed would have to follow suit endangering other asset market prices. Ultimately, argues Cline, default risk does not disappear, even if a country can issue its own currency.

Uncertainty about future Fed policy—under a discretionary government fiat money regime—remains a problem. In particular, with fiscal pressures rising, and the Fed’s insistence on keeping rates near zero, it will be more difficult for the Fed to stop monetizing debt and feeding the Leviathan.

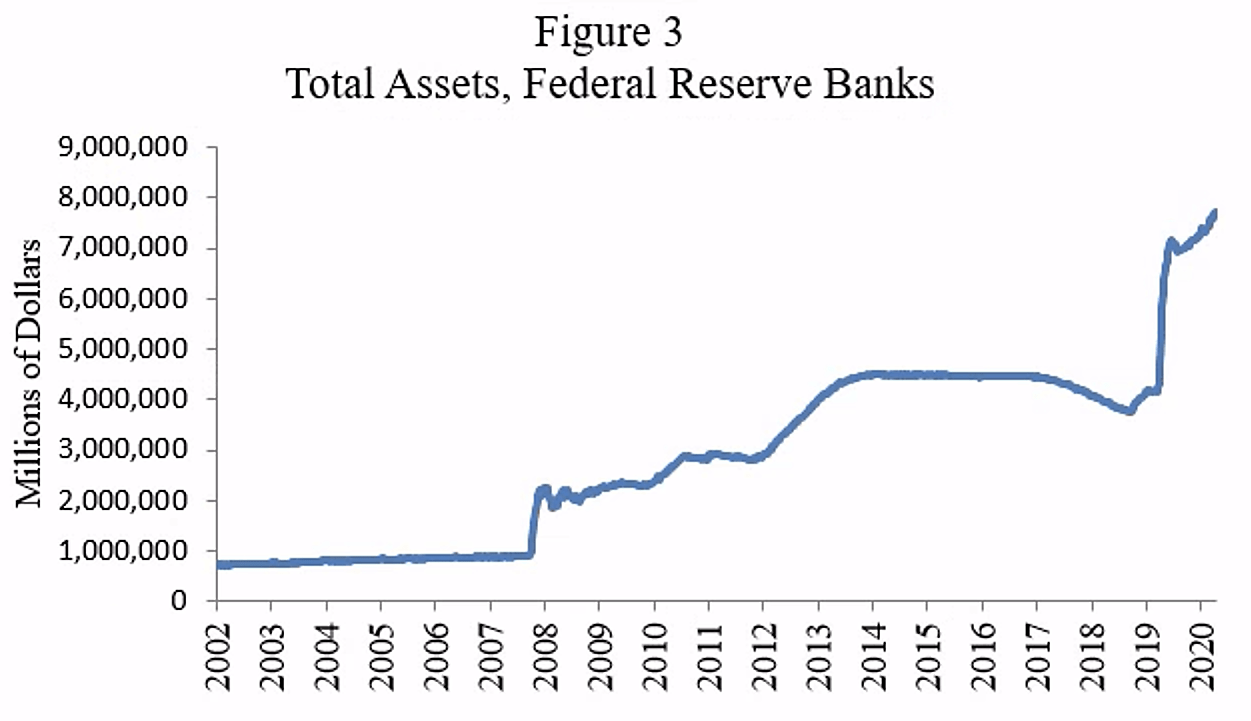

Although the Fed has expanded its balance sheet from less than $1 trillion prior to the 2008 financial crisis to nearly $8 trillion today (Figure 3), inflation remains low. That is because the demand for cash balances has increased and monetary velocity took a sharp dive with the pandemic. Moreover, the Fed has used its post-2008 operating system—the floor system—to adjust interest on reserves (IOR) to incentivize banks to park reserves at the Fed rather than lend them out.

The floor system is based on large-scale asset purchases and administered interest rates. (For a detailed discussion, see Selgin.) Under that system, the key instrument is the IOR. With abundant reserves, small changes in the supply of reserves have no impact on the fed funds rate as it did before 2008, when reserves were scarce. At the zero lower bound for the nominal fed funds rate, QE has been used to “stimulate” the economy and lower long-run rates. However, as long as the IOR rate exceeds the opportunity cost of holding reserves, banks will have an insatiable demand for reserves. The Fed could tighten monetary policy by increasing IOR, but in the current environment that may be difficult. It is also costly, as the Fed would have less revenue from its portfolio to remit to the Treasury. Meanwhile, if rates did rise, the Fed would take a capital loss on its longer-dated securities.

Source: Federal Reserve Board of Governors.

The real problem for the Fed will be if market interest rates begin to rise with the economic recovery and banks start lending out their excess reserves. Money growth could well outpace real GDP growth, and increases in velocity could occur alongside money growth, which would fuel inflation. That process may not occur overnight, but it could become a reality sooner than we think—especially under political pressure for fiscal QE.

Conclusion

While Fed Governor Waller provides a strong case for Fed independence and for separating fiscal from monetary policy, his complacency about the risk of fiscal dominance ignores historical episodes of capturing the Fed for fiscal purposes during peacetime. In particular, since 2007 the Fed has moved closer to fiscal dominance by its intrusion into the fiscal space, using Section 13(3) emergency credit allocation and lending (e.g., housing finance, corporate debt, municipal bonds, and Main Street lending), and monetizing government debt. Moreover, with rising levels of debt to GDP, there is a plausible case that the Fed may once again turn to yield-curve control—that is, peg interest rates on U.S. debt at politically favored rates to keep financing costs under control.

Ignoring those threats allows the Fed to conduct fiscal and credit policy under the pretense of monetary policy. This is a masquerade that eventually will be unmasked. The Fed has already crossed the bright line between fiscal and monetary policy. It’s time, says Plosser, “for the Fed to take a step back and reconsider its commitment to an ‘ample reserves’ operating system and to take more seriously the current threats and how its own actions are undermining its credibility and the case for independence.” Thinking about the risks and implications of fiscal dominance is a worthy endeavor, even if there is no serious threat at the moment.