The words “default” and “dysfunction” are again showing up on the front pages as the debt ceiling suddenly looms along with the Taxmageddon deadline. Treasury Secretary Tim Geithner’s letter to Congress, raising the specter of “default” and “extraordinary measures,” set off much of the new hand-wringing. Journalists and pundits lecture Congress about its “dysfunctional” failure to raise taxes and promise to cut spending.

But as I told a journalist who was very concerned about dysfunction the last time the debt ceiling began to bite, the real problem is not the dysfunctional process that’s getting all the headlines, but the dysfunctional substance of governance. The real dysfunction is a federal budget that has doubled in 10 years, an annual deficit of some $1.5 trillion, and a national debt bursting through its statutory limit of $14.3 trillion and approaching 70 percent of GDP.

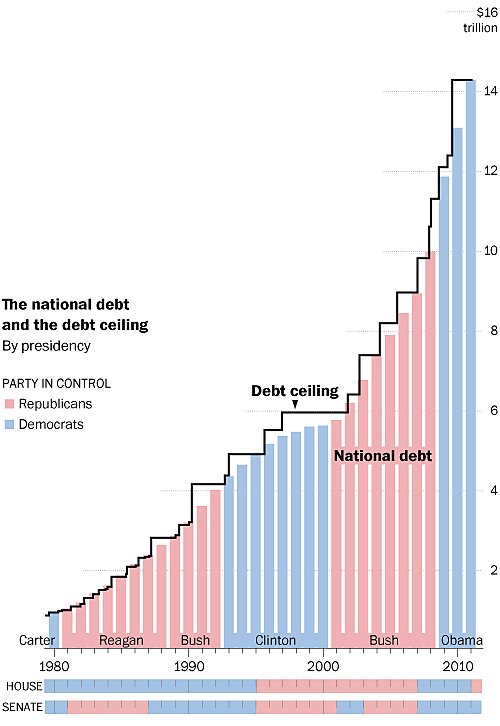

We’ve become so used to these unfathomable levels of deficits and debt—and to the once-rare concept of trillions of dollars—that we forget how new all this debt is. In 1981, after 190 years of federal spending, the national debt was “only” $1 trillion. Now, just 30 years later, it’s more than $16 trillion — and all that debt rung up during a period without a major war or Great Depression. Here’s a graphic representation of dysfunction (through mid-2011; now you can visualize the blue line bursting through the $16 trillion level at the top of the chart):

Those are the kinds of numbers that caused the rise of the Tea Party and the election of members of Congress who vowed to stop out-of-control spending and debt. It’s too bad that Congress hasn’t been able to rein in spending without the pressure of a debt ceiling or a “fiscal cliff.” But it hasn’t. And so if fiscal conservatives in Congress can use those deadlines to put some caps on the money-shoveling, more power to them.

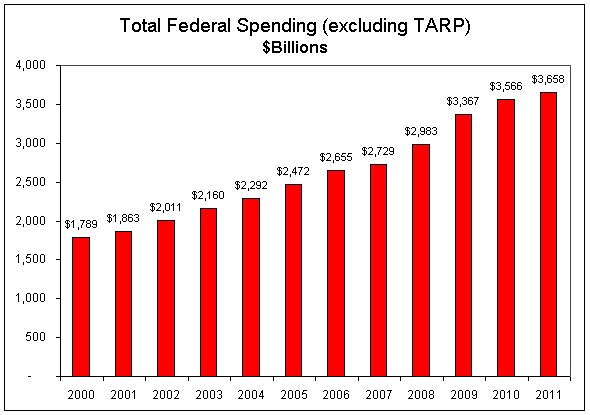

Where did all this debt come from? As the Tea Partiers know, it came from the rapid increase in federal spending over the past decade:

Annual federal spending rose by a trillion dollars when Republicans controlled the government from 2001 to 2007. It has risen another trillion during the Bush-Obama response to the financial crisis. So spending every year is now twice what it was when Bill Clinton left office, and the national debt is three times as high. Republicans and Democrats alike should be able to find wasteful, extravagant, and unnecessary programs to cut back or eliminate. And yet many voters, especially Tea Partiers, know that both parties have been responsible. Most Republicans, including today’s House leaders, voted for the No Child Left Behind Act, the Iraq war, the prescription drug entitlement, and the TARP bailout during the Bush years. That’s why fiscal conservatives should look very skeptically at the “fiscal cliff” and “grand bargain” proposals, most of which promise to cut spending some day—not this year, not next year, but swear to God some time in the next 10 years. As the White Queen said to Alice, ”Jam to-morrow and jam yesterday—but never jam to-day.” Cuts tomorrow and cuts in the out-years—but never cuts today.

If the “dysfunctional” fight that has sent us to the edge of the fiscal cliff finally results in some constraint on out-of-control spending, then it will have been well worth all the hand-wringing headlines. But that doesn’t seem likely. The problem is not a temporary mess on Capitol Hill and not a mythical default; it’s spending, deficits, and debt.