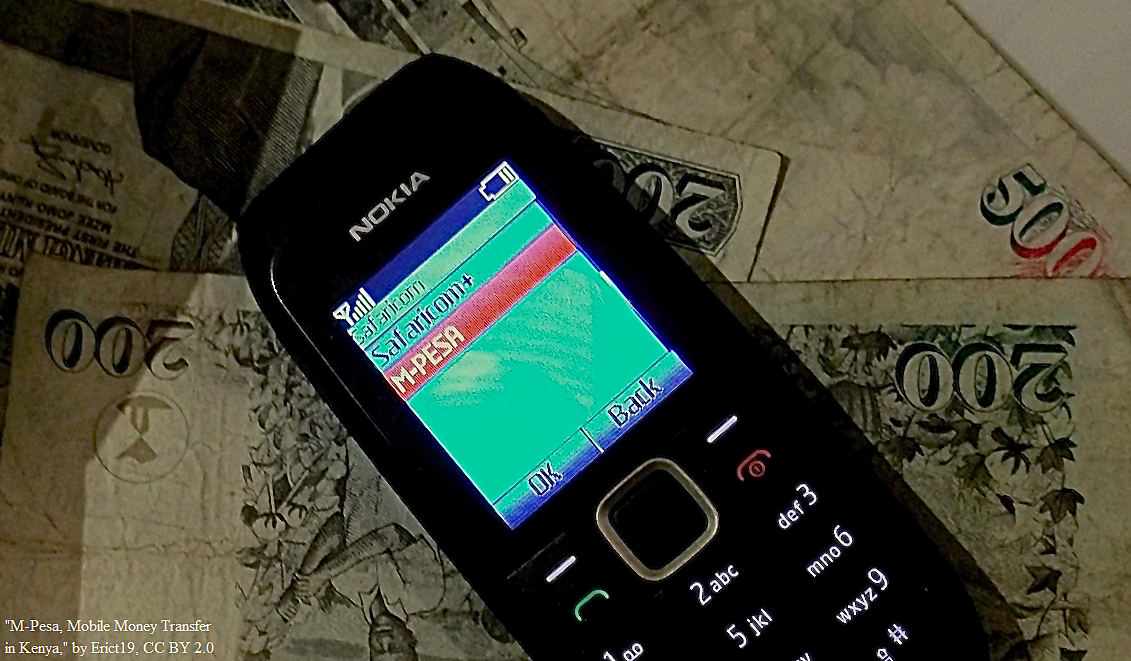

Kenya has been ground zero for this digital financial revolution. In 2007, the nation’s dominant cellular provider, Safaricom, launched M‑PESA. M‑PESA allowed users to send and receive digital payments anywhere in the country as simply as they send a text message. It also enabled customers to safely store money in their mobile wallet, pay for goods and services at virtually any retail shop, and deposit and withdraw cash from thousands of “agents” located across the country — all without ever stepping foot in a physical bank branch. Today, Kenya is one of the world’s leaders in mobile money with roughly 26.2 million accounts — more active accounts than adults in its population.

Why did mobile money first take off in Kenya? A variety of factors, such as its very high rates of theft and low rates of financial inclusion, helped create a latent demand for alternative financial services. However, the key to its success was its “enabling” regulatory environment. Unlike governments elsewhere, Kenya’s took a fairly “hands-off” approach, exempting innovative payments products offered by non-bank companies from many of the burdensome regulations that made it too costly for banks and traditional financial services providers to serve low-income customers.

In particular, MNOs like Safaricom were allowed to enter the market for payment services and issue digital claims that could circulate as money. They were also permitted to license part-time or full-time employees, or “agents,” to perform basic banking services (open new accounts, accept cash deposits and withdrawals, register customers, facilitate money transfers, etc.) on behalf of their customers.

Under this new “agent banking” model, MNOs were not only able to leverage their extensive networks of retail shops but also enlist other retail shops and upstart entrepreneurs to set up thousands of “mini-bank” branches throughout the country. Like Uber or Lyft drivers, these agents are independent contractors paid on commission. Since many agents operate out of small huts or as a side business at their existing retail shops, agent branches conduct business at a small fraction of the cost of traditional banks, making it a far more economical way to extend basic financial services to unbanked customers in remote regions.

At first, established banks weren’t happy about the Kenyan government issuing these regulatory exemptions. But once their lobbying efforts to ban M‑PESA failed to overcome the tidal wave of public support for the revolutionary product, many banks began partnering with Safaricom, establishing their own agent branches, and offering a fuller array of services to attract unbanked customers.

The most famous example is M‑Shwari, a partnership between the Commercial Bank of Kenya and Safaricom. Since its inception in 2013, more than 10 million Kenyans have gained access to interest-bearing mobile savings accounts (Cook & McKay, 2015). Customers also have access to mobile credit and insurance products. Since mobile providers can digitally collect and share information on how often customers pay their bills, which enables banks to construct reliable credit ratings, customers can apply for and receive up to $1,200 in loans (at 7.5 percent interest) with just a few clicks. Today, virtually every Kenyan commercial bank offers “branchless banking” services through a mobile money platform.

Thanks to these partnerships, the cell phone has become a catalyst for promoting financial development. Since the inception of M‑PESA, financial inclusion rates — that is, the percentage of Kenyans with any sort of access to formal financial institutions — have nearly tripled from fewer than 25 percent in 2006 to 67 percent in 2013 (GSMA, 2014). Kenya has also experienced increased financial deepening, defined as the ratio of private bank liabilities to GDP. The ratio rose from roughly 33 percent to 44 percent in the five years after M‑PESA (Ndirangu & Nyamongo, 2013, p. 3). The Economist Intelligence Unit projects that thanks in large part to mobile banking the amount of private bank credit and deposits will rise as much as 300–500 percent by 2020 (The Economist, 2011).

What lessons should economists draw from the mobile money revolution? For decades, many economists and policymakers assumed the private market would fail to profitably extend services to poor, unbanked customers. This is why many development officials in the postwar era have played an active, “hands-on” role in trying to engineer both financial and economic development. This government-led approach is what prevailed, incidentally, in Sub-Saharan Africa in the post-independence era. During the 1960s and 1970s, many newly established governments nationalized foreign-owned banks and used foreign aid to launch state-owned commercial banks. Unsurprisingly, these initiatives were an abject failure. Only 1 in 7 adults had access to a bank account before the advent of mobile money, giving Sub-Saharan Africa by far the lowest financial inclusion rate in the world.

The mobile money revolution provides a compelling example of a “market-led approach” to financial development. Based on Kenya’s success, the best thing governments can do to promote financial innovation and development is create a more enabling — that is, laissez-faire — regulatory environment, promoting what Mercatus’s Adam Thierer calls “permissionless innovation” and encouraging entrepreneurs to experiment with transformative new business models. Safaricom founder and CEO Michael Joseph aptly summarized this lesson:

I wouldn’t say the government needs to do anything. I would say the government just needs to have a “light touch” regulatory environment in order to encourage entrepreneurship and innovation.

Beyond mobile money and banking, the digital financial revolution also matters because it could help contribute to more rapid economic development. Economists from Adam Smith to Walter Bagehot to Joseph Schumpeter to more recent scholars like Rondo Cameron, Ronald McKinnon and Edward Shaw have argued that more developed private financial systems play a direct causal role in fostering economic growth and development.[1]

One reason the private financial system sparks more rapid growth is because the private sector can better allocate credit. The more people who hold their monetary wealth in the form of bank-issued liabilities such as mobile savings and checking accounts as opposed to government-issued currency, the more loanable funds they in effect provide to private financial intermediaries instead of governments and central bankers (Selgin & Lastrapes, 2012). These private banks can, in turn, intermediate these savings into productive loans in commercial investments. In fact, some authors have noted that Kenyans have reduced their demand for cash, opting instead to hold their savings in the form of mobile bank accounts. This, in turn, has been associated with a notable rise in loans to the private sector (Ndirangu & Nyamongo, 2013).

Today, mobile money is spreading like wildfire across the developing world. There are now 271 mobile money services available in 93 countries servicing more than 411 million customers (GSMA 2015). More than half of these services are connected to mobile banking accounts. The World Bank’s Global Financial Inclusion Database (2015) reports that mobile money is now available in 81 percent of low-income countries. Despite such rapid growth, the service has failed to gain traction in countries whose governments prohibit competitors from offering mobile money and strictly regulate agent banks. As the writers at The Economist (2012) aptly noted, “many of the poor countries that would most benefit from mobile money seemed intent on keeping its suppliers out — mainly by insisting they should be regulated like banks.” Due in large part to these repressive policies, mobile money has still only reached less than one-tenth of the unbanked population in the developing world.

Fortunately, a number of countries have begun emulating Kenya’s “hands-off” approach, arguably the strongest predictor of a successful mobile money launch. In fact, in countries that have adopted an enabling regulatory environment, active mobile money accounts are 220 percent higher (Di Castri, 2015). With a little insight from free banking theory, and practical experiences like Kenya’s, perhaps regulators could be encouraged to take their financial liberalization even further.

___________

[1] Over the past two decades, the “finance matters” theme has received an ample amount of empirical support in the development finance literature. See, for instance, the work of David Fry, Robert King, and Ross Levine, among others. Indeed, the link between a well-developed private banking system and the process of economic development has been stressed on this very blog here and here. These authors argue that developed financial systems help increase not only the total volume of loanable funds that banks have at their disposal to intermediate into productive investments, but also the marginal efficiency of investment and capital allocation.

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.