According to a White House release, the Federal Housing Administration (FHA), which insures lenders’ against borrower default, will be lowering its annual premiums. While I believe this to be a reckless move in the wrong direction, I am the first to say that setting the appropriate premium is a lot harder than it looks.

The fundamental problem facing any insurer, like the FHA, is that the risk profile of borrowers is influenced by the premium rates they are charged. Obviously a rate that is set too low will not cover losses and the insurance fund will lose money. But a rate set too high will drive away low-risk borrowers and leave the insurer covering only high risk borrowers (and likely also losing money). An insurance fund can easily find itself in a position where it needs to raise rates to cover losses from risky borrowers, but each rate increase only drives out the good borrowers, making the risk composition of the pool ever worse. If you want to see this spelled out with a lot of fancy math, I refer you to Joe Stiglitz and Andrew Weiss’s classic paper on the topic (which builds upon earlier work by Dwight Jaffee).

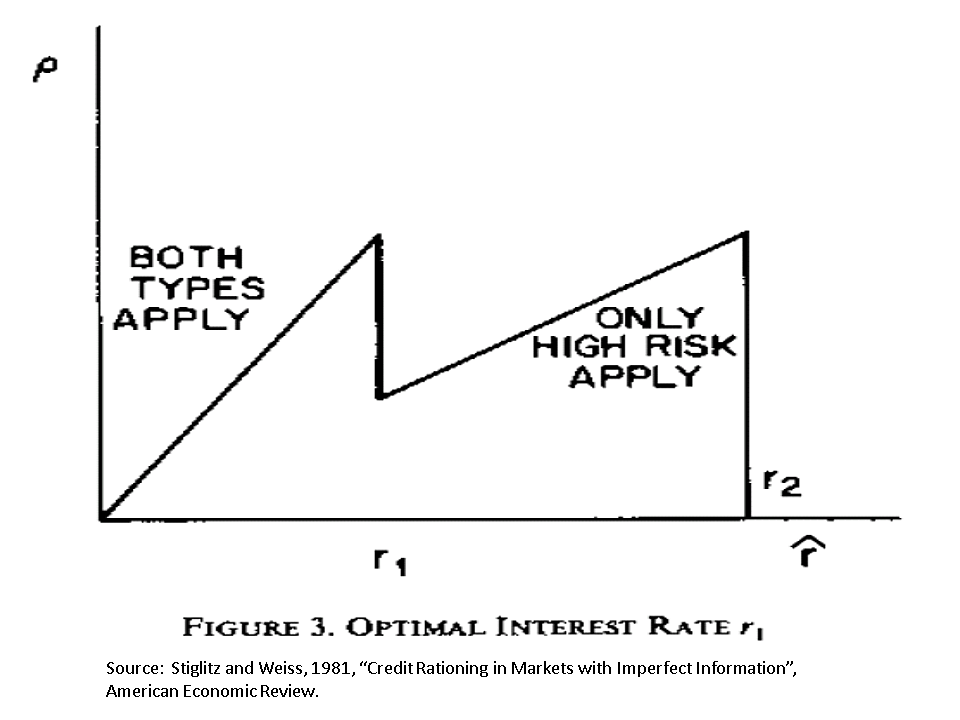

Figure 3 from Stiglitz and Weiss (below the jump) illustrates this tension. If you want to attract both low- and high-risk borrowers, you need to have a much lower rate than if you only want to attract high-risk borrowers. In fact, one of the rationales I often hear from advocates of expanding the FHA is that doing so will improve the health of the fund by attracting better quality borrowers.

The problem with this is that President Obama is quite explicit that his desire is to lower the credit quality of FHA borrowers. From the White House fact sheet: “FHA premium reduction will help hundreds of thousands of additional families own a home for the first time.” This initiative is targeted at first-time buyers, those who have not been able to get a loan previously. First-time buyers who have been previously “waiting on the sidelines” are likely to be younger and hence have lower credit scores on average, or else be older buyers who have had trouble finding credit because they are high-risk.

Such is also borne out in the FHA’s most recent origination report, which shows average FICO scores (a measure of creditworthiness) declining over recent years. Almost 60 percent of recent FHA borrowers have FICOs below 680. Almost 75 percent made a down-payment of less than 5 percent. If they would need to sell their homes within a few years of purchase, then given the transactions costs they’d need to bring cash to the table. This is not a high-quality book of business.

As I wrote almost three years ago, if the FHA is serious about rebuilding its financial health and protecting the taxpayer, it needs to move in the direction of reducing its lending to higher-risk borrowers. If the agency is unwilling to do so, which appears to be the case, then any change in premiums should be up not down.