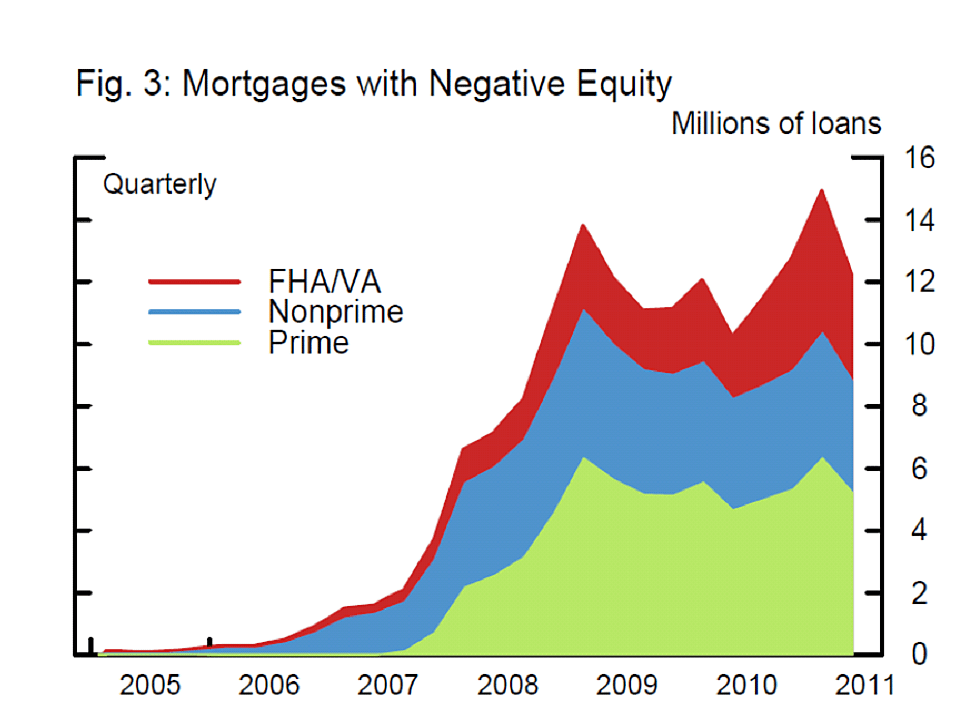

The recently released Federal Reserve White Paper on the Housing Market has received considerable attention, at least for its policy proposals. I found one of the more interesting pieces of data in the paper to be the number of mortgages with negative equity, reproduced below (Figure 3 in the Fed paper).

What I found both interesting and distressing is that despite the fact that the Federal Housing Administration (FHA) was only about 2 percent of mortgages at the height of the bubble in 2005/2006, FHA is now over a fourth of total mortgages with negative equity. Of course this was all predictable (I actually predicted it). If you decide, as did our federal government, to get lots of borrowers into loans with very little equity, at a time when prices are falling, you will create a whole lot of loans with negative equity. Thank you FHA for creating a mess that was completely 100% avoidable. But who cares when you’re ultimately just sticking it to the taxpayer, right?