When I published Floored! last October, I thought I’d said all I could say concerning the adverse consequences of the Fed’s then decade-old decision to adopt a “floor”-type operating system. In the new arrangement, the Fed pays interest on bank reserves, and uses changes in the rate it pays, instead of adjustments to the available quantity of bank reserves, to regulate other interest rates. Among other things, I explain in my book, as I’ve also done to some extent here at Alt‑M, that decision contributed to the U.S. economy’s deep downturn in late 2008, that it undermined banks’ incentives to monitor each other’s safety, and that it has made it more tempting for politicians to treat the Fed as a giant piggy-bank to drawn upon for their pet trillion-dollar projects.

But it turns out I overlooked a serious shortcoming of the Fed’s floor system. Not that I’m kicking myself: I could hardly be blamed for overlooking a problem that wasn’t at all evident in the fall of 2018. But the problem has since become all-too obvious. I refer to the new operating system’s inability to get interest rates to go where it wants them to.

Interest-Rate Control under the Fed’s Pre-Crisis System…

To see what I mean, let’s first consider how successful the Fed’s pre-crisis “corridor”-style operating system was at keeping interest rates on target. Then as now, the Fed’s official rate targets were targets for the “federal funds rate,” which is the rate at which banks and other financial institutions that keep accounts with the Fed, and have larger balances than they need, lend those balances, typically overnight, to institutions that are anxious to borrow them. Because the “effective” fed funds rate reflects rates negotiated in such bilateral exchanges, it can vary relative to whatever target the Fed sets for it. We can therefore assess the success of any Fed mechanism for regulating interest rates by looking at how much the effective fed funds rate varies relative to the Fed’s target, and especially by checking to see how completely and fully it responds to changes in that target.

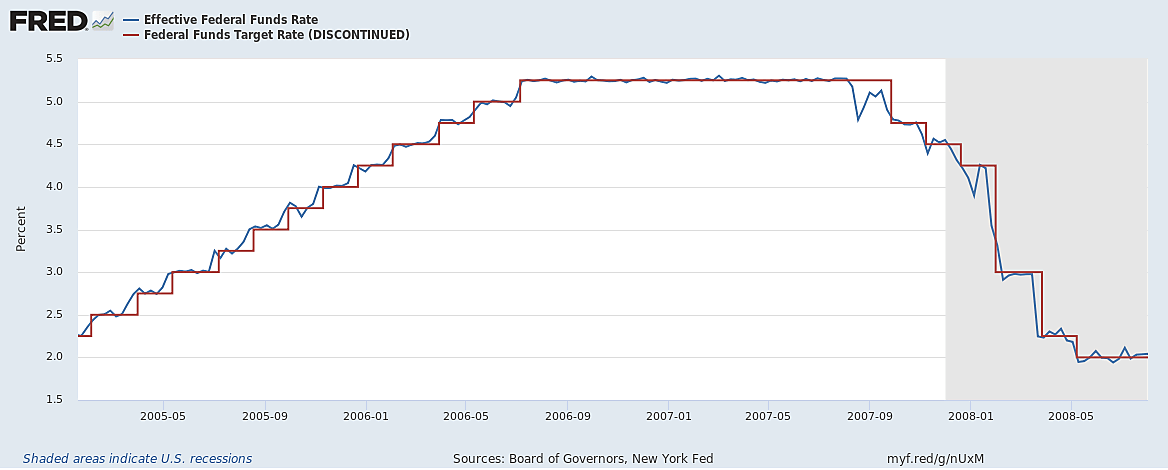

With that in mind, here’s a FRED chart showing target and actual fed funds rates from the start of 2005 until just before the October 2008 switch to a floor system. I’ve chosen weekly averages rather than daily effective fed funds rate values because my concern is with the persistent behavior of the effective rate rather than with its short-run volatility: that volatility, I hasten to add, was itself generally greater under the corridor system than it’s been under the present one.

This chart illustrates two important tendencies under the Fed’s corridor system. First, the effective funds rate tended to increase in step with, or somewhat in anticipation of, changes to the Fed’s target. Just as importantly, it increased by the same amount as that target. (The main exception is the drop in the effective funds rate coinciding with the Fed’s response, consisting of an emergency liquidity injection, to the BNP Paribus crisis of August 2007.) Finally, when the target itself didn’t change, as was the case between mid-2006 and mid-2007, the effective funds rate did not persistently deviate from it. These tendencies continued to be evident as the financial crisis worsened, and the recession deepened; and they are just the tendencies one expects from an operating system that succeeds well in implementing the Fed’s interest-rate decisions.

…and Under the Floor System

Now let’s consider the new system. Fed officials have repeatedly claimed that it implements the Fed’s interest rate decisions just as well as, if not better than, the old system did. But does it?

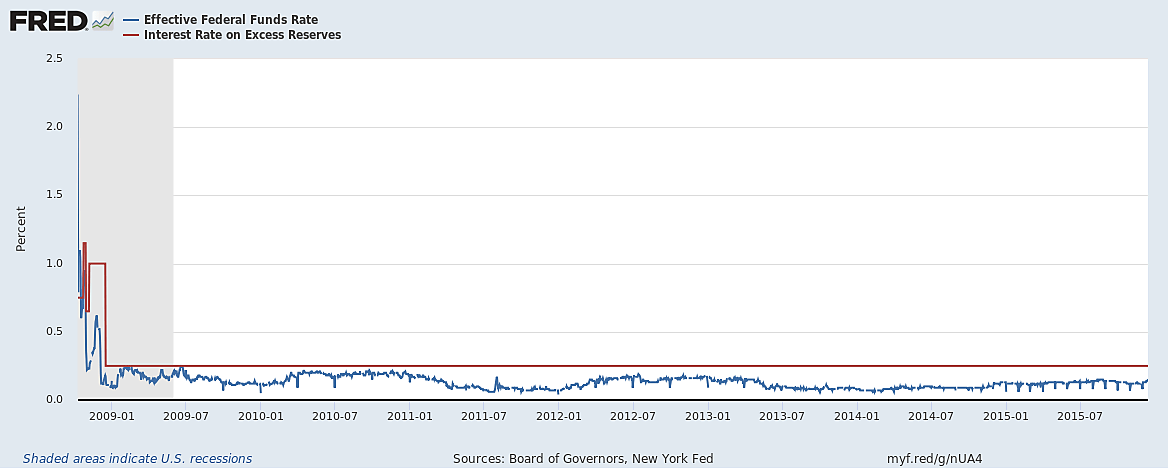

The first thing to note is that the new system very quickly ceased to work as Fed officials initially hoped it would. In an “orthodox” floor system, the central bank deposit rate doubles as its overnight interest-rate target: having satiated the banking system with reserves, the central bank sets the interest rate it pays on balances kept with it, and the overnight rate that it targets is supposed to fall in line with that rate. That’s true because banks have no reason to make overnight loans for less than the deposit rate, and because, being satiated with reserves, none have any reason to borrow funds for more than the deposit rate. The deposit rate therefore rules the roost.

Not so for the Fed’s floor system. The problem, in a nutshell, was that, instead of offering the same “deposit rate” to all institutions keeping balances with it, the Fed was authorized to pay interest on bank reserves only, leaving other Fed account holders, including several GSE, out of luck. Consequently those GSEs found it profitable to lend their unwanted Fed balances overnight to banks for a piece only of the banks’ IOER (interest on excess reserves) earnings. Because competition among the borrowing banks proved inadequate to drive their profit margins toward zero, the Fed’s interest-rate “floor” turned out to be “leaky”: a persistent gap, shown in the chart below, opened-up between the Fed’s IOER rate and the effective funds rate.

In response to the leakiness of the Fed’s floor system, on December 16, 2008, the FOMC announced that it was switching from a single-value fed funds rate target to a target “range” with an upper limit of 25 basis points (the going IOER rate) and a lower limit of zero. This widening of the Fed’s goalpost was the first of several cosmetic changes the Fed would ultimately resort to so as to claim that it was just as able to score goals — that is, to keep the fed funds rate on target — with its new floor system as it had been with its pre-crisis system.

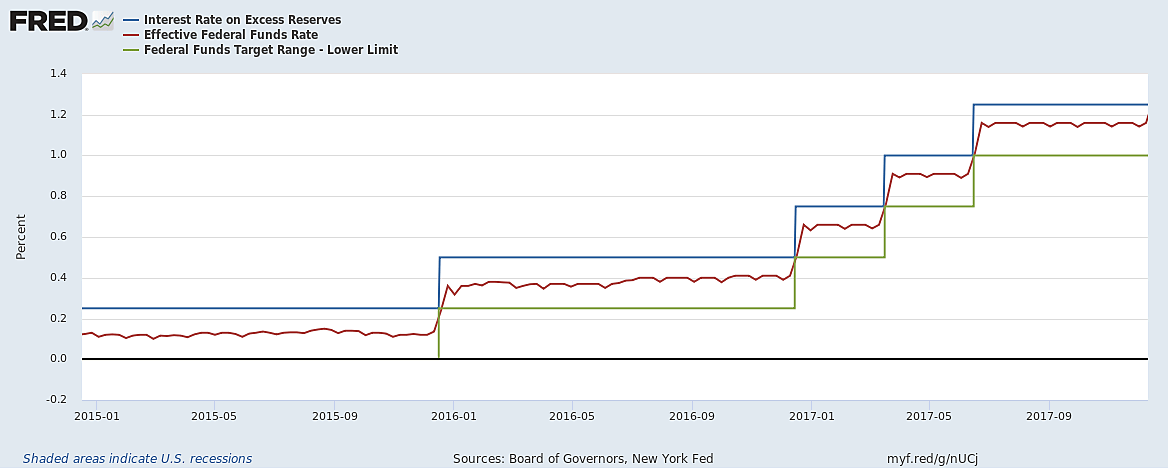

The next big adjustment was real rather than cosmetic. Anticipating its first rate-range hike, the Fed experimented with and then implemented its “overnight reverse repurchase” (ON-RRP) facility, the aim of which was to create a leak-proof interest rate sub-floor below the leaky IOER floor. In essence, the facility gave the GSEs and certain other financial institutions, including Money Market funds, the option of lending unwanted balances to the Fed for a rate that, though lower than the IOER rate, would establish a lower-bound to the effective fed funds rate by making it unworthwhile for GSEs to lend to banks for less.

Mind the Gap

The new facility had its first test at the end of December 2015, when the Fed raised the upper (IOER) and lower (ON-RRP) limits of its fed funds target range by 25 basis points, which it appeared to pass with flying colors. Several subsequent target-range increases also seemed to translate, as the next chart shows, into roughly proportional adjustments to the effective funds rate. As FRBNY Vice-President Lorie Logan reported in a May 2017 speech,

The Federal Reserve has successfully raised the overnight federal funds rate three times since December 2015 in the gradual process of normalizing the stance of monetary policy. During this time, the effective federal funds rate has printed within the prevailing target range set by the Federal Open Market Committee.

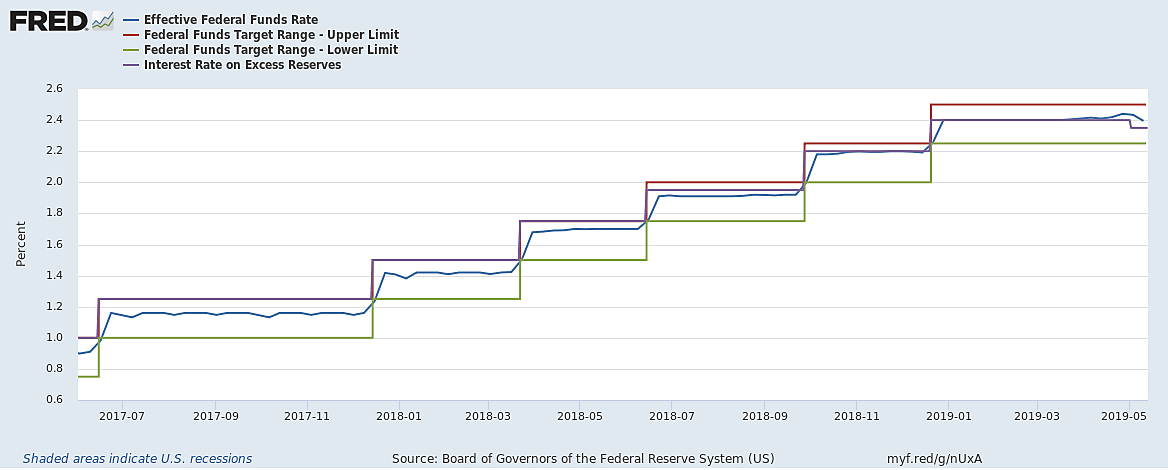

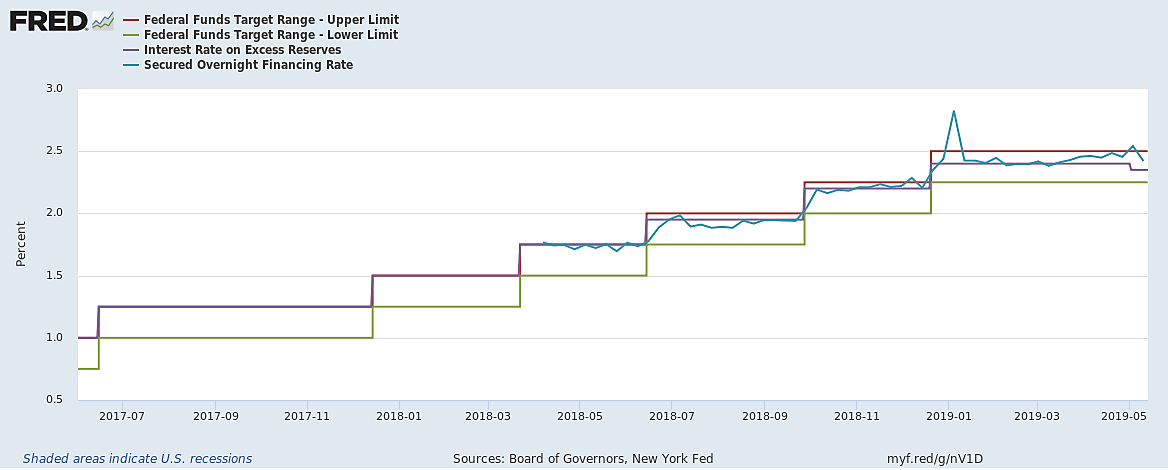

It wasn’t long, though, before the FOMC found itself struggling to get the effective federal funds to “print” within its target range, let alone near the center of that range. As the next chart shows, with each of its subsequent rate increase, the gap between the IOER rate and the effective fed funds rate narrowed until, in late 2018, it vanished altogether. More disappointingly still, for over a month now the effective fed funds rate has been persistently above the IOER rate. In short, instead of rising in proportion with increases in the IOER rate, the effective fed funds rate has been rising more than proportionately, as if the “suction power” of IOER rose with every Fed rate change. It was an odd sort of transmission-mechanism failure — the usual fear is that market rates might respond only weakly to Fed target-rate changes. But it was a failure nonetheless.

In response to this development, the Fed resorted to more window dressing, consisting of three “minor technical adjustments” to its target-range upper limit (the red line in the above chart) coinciding with its rate settings for June and December 2018 and this January. In the first two adjustments the Fed raised the IOER rate by 5 basis-points less than it increased its rate range, hence by that much less than the ranges’ upper limit. In the last, it reduced the IOER rate by 5 basis points while leaving its target rate range unchanged. Were it not for these adjustments the Fed would no longer be able to claim that the effective fed funds rate is still “printing within” the FOMC’s rate-target range.

Nor is it just the effective fed funds rate that isn’t responding to changes in the Fed’s administered rates as it’s supposed to. As the next chart shows, although the New York Fed’s Secured Overnight Lending Rate (“SOFR”) — an average of rates for a broad set of overnight repos collateralized by Treasury securities — has always been closer to the Fed’s IOER rate than to its ON-RRP, it has recently been persistently above it. Despite its broad base, consisting of several lending markets that are far larger and thicker than the fed funds market, the SOFR has also been considerably more volatile than the effective fed funds rate. It’s therefore far from obvious that the Fed could improve its rate-targeting score simply by switching, as some have suggested, from a fed-funds-based target to one based on overnight repo rates.

The Scramble for Reserves

Several reasons have been offered for the deteriorating performance of the Fed’s interest-rate transmission mechanism, including a surge in Treasury security sales and the Fed’s ongoing balance-sheet unwind. Regarding the first of these Bloomberg’s Alex Harris, citing the FOMC’s own September 2018 account, explains that Treasury security sales

pushed other key overnight rates higher, especially in the market for repurchase. As these other short-term assets became more attractive alternatives to lending reserves to other banks, the availability of funding has lessened, putting upward pressure on the effective fed funds rate.

The Federal Home Loan Banks in particular now find it attractive to exchange their surplus Fed balances for securities in the repo market instead of offering them on the fed funds market . The Fed’s unwind has in turn reduced the total supply of such balances available to banks for meeting their LCR and other regulatory requirements. Consequently some banks have found themselves having to bid more aggressively for fed funds. It’s owing mainly to its desire to avoid seeing this tendency increase that the Fed decided earlier this year to end its balance-sheet unwind in October.

Whether the Fed’s decision will ultimately suffice to maintain a more-or-less fixed relationship between the effective fed funds rate and the Fed’s IOER rate, or whether still more modifications to the Fed’s operating system will be needed to achieve that end, remains to be seen. But one thing at least seems clear: for the moment it’s no longer possible to claim, as Ms. Logan did a year ago, that the Fed’s new operating system allows it to “provide effective control of rates with operational simplicity.”