I’m not the gambling sort. However, were I so I’d bet dollars to donuts that the Standing Repo Facility (henceforth “SRF”) plan proposed by David Andolfatto and Jane Ihrig in a pair of St. Louis Fed articles (here and here) will be an important topic of discussion at the upcoming Chicago Fed Conference on Monetary Policy Strategy, Tools, and Communication Practices. That plan is supposed to allow the Fed to go on trimming its balance sheet for some time, instead of ending its unwind this October, despite Basel’s LCR requirements and despite the Fed’s determination to stick with its current floor system of monetary control.

Although I’d rather see the Fed switch to a corridor system, which requires hardly any excess reserves, if we’re to have a floor system I’d rather it be one that keeps the Fed as slim as possible. For that reason, I consider the SRF proposal fully worthy of the attention I expect it to receive in Chicago. Here I’ll review the events that inspired the plan’s development, and review its workings. I’ll also offer a suggestion for improving it by having it serve, not just the purposes that Andolfatto and Ihrig have in mind, but also in place of the Fed’s discount facilities. Finally, I’ll argue that, although adding an SRF to the Fed’s present floor system would improve that system considerably, its presence would also undermine some of the arguments for preferring a floor system to a corridor system. I conclude that an enhanced SRF would be most valuable were it employed, not to improve the efficiency of the current floor system, but to establish the ceiling of a new corridor system.

From Corridor to Floor

The Fed’s October 2008 decision to start paying interest on banks’ excess reserve balances, combined with its large-scale additions to the supply of bank reserves, led to a spontaneous switch in its system of monetary control. Finding that holding excess reserves paid more than lending them overnight, banks stopped relying on the federal funds market either as a dumping ground for unwanted reserves or as a source of last-minute liquidity. Changes to the stock of reserves in turn ceased to influence short-term interest rates, which instead varied with the interest rate paid on excess reserves. In short, the Fed had swapped its former asymmetric “corridor” system of monetary control for a new “floor” system.

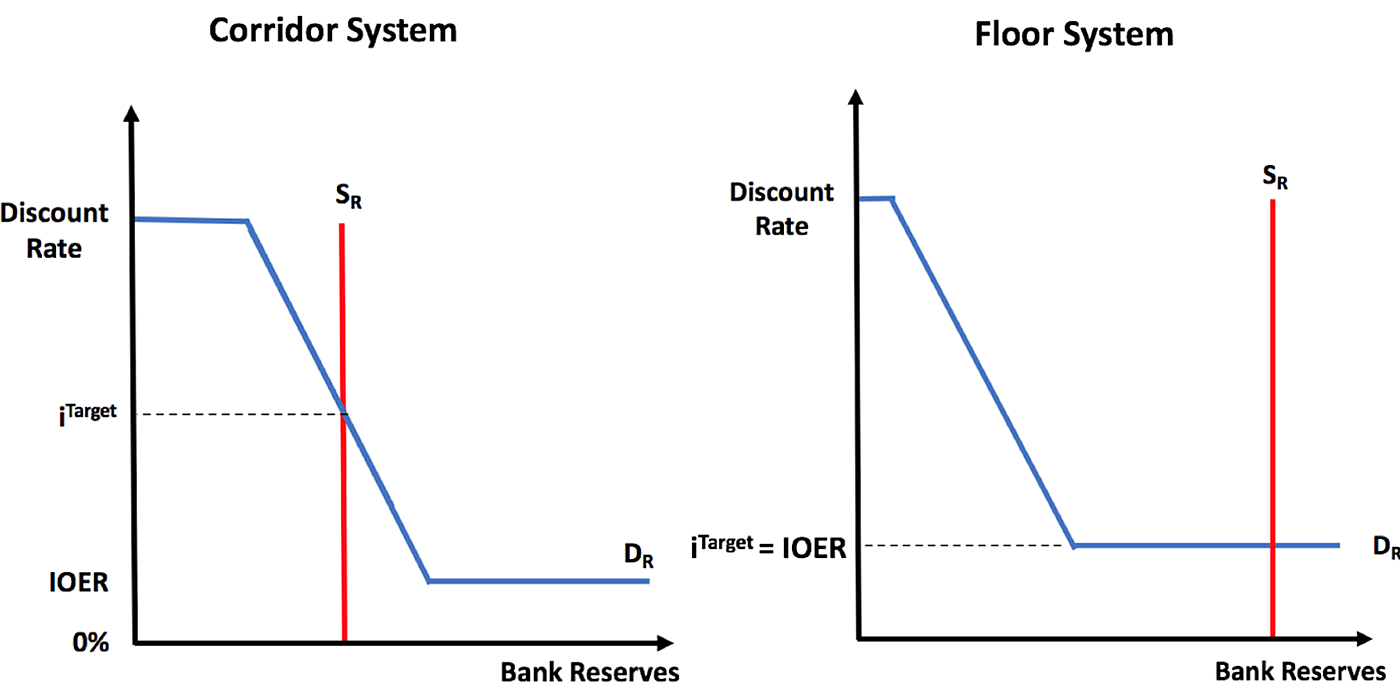

The following illustration, adapted from one in a December 2018 David Beckworth blogpost, shows the difference between these two arrangements. In the scarce-reserves corridor system, shown on the left, Fed authorities adjust the supply of bank reserves to achieve some target fed funds rate. In the abundant-reserves floor system, on the right, the banking system finds itself on the horizontal portion of the reserves/fed funds demand schedule. Consequently, prevailing rates depend only on the IOER rate setting.

How Much Is Enough?

As the diagram makes clear, having a floor system system means having enough reserves in the system to keep somewhere to the right of the downward-sloping part of the demand schedule for reserves. But after three rounds of Quantitative Easing that increased U.S. banks’ excess reserve holdings from under $20 billion to about $2.5 trillion, the U.S. banking system had presumably traveled quite far indeed from that inflection point.

Fed officials insisted, however, that much of the vast increase in bank reserves would be undone once the recession was over. For a time they entertained the possibility of eventually returning to a corridor system. But ultimately their goal became one of reducing the quantity of bank reserves to its minimum level consistent with a floor system. According to the “Policy Normalization Principles and Plans” it set out in September 2014, the FOMC planned “to reduce the Federal Reserve’s securities holdings in a gradual and predictable manner,” so that the Fed would eventually “hold no more securities than necessary to implement monetary policy efficiently and effectively.” Although that plan didn’t say just how low reserves could go, a 2011 Fed Study concluded “the level of reserve balances required to keep the funds rate close to the target in a floor system could be on the order of $100 to $500 billion.”

In June 2017, several months before the Fed actually started to unwind its balance sheet, the FOMC still anticipated reducing bank reserves “to a level appreciably below that seen in recent years but larger than before the financial crisis.” And according to survey the Fed took that December, roughly half of the primary dealers and other market participants who took part anticipated that reserves would eventually decline to somewhere between $400 and $750 billion.

By October 2018, the fact that the effective fed funds rate was no longer persistently below the IOER had many wondering whether reserves were becoming scarce again. However, Fed officials, including Simon Potter (then the New York Fed’s SOMA account manager), assured them that this wasn’t so. “Despite some of the recent upward moves in overnight rates,” Potter said in a speech that month, “I don’t believe we’ve reached the ‘steep’ portion of the demand curve, where aggregate reserves are scarce. … [I]f we were closing in on the ‘steep’ part, I might expect to see substantial above-IOR lending in the unsecured overnight markets, as at least some banks each day found themselves short of reserves and had to borrow them from other banks.” So despite hints that the reserve market was tightening, when the Fed announced this February that it would stop shrinking in September, after an unwind lasting less than two years that would leave over $1 trillion of reserves outstanding, the decision caught many by surprise.

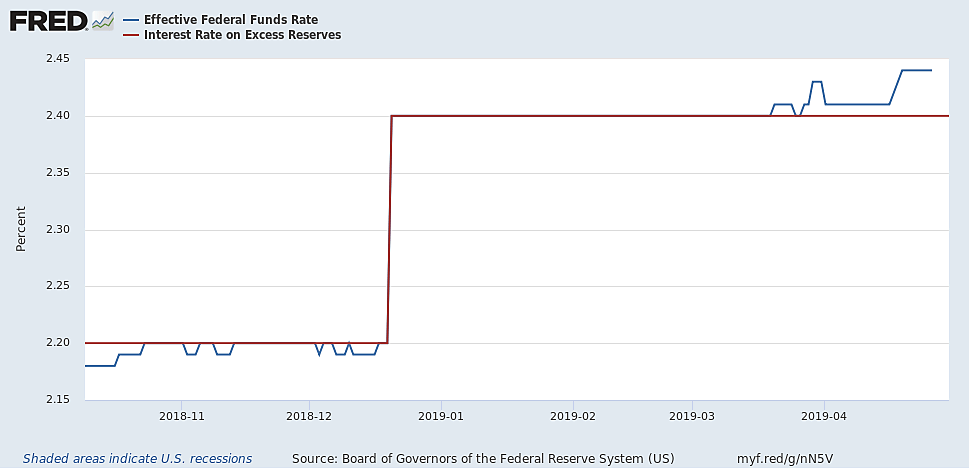

The Fed’s decision was prompted by just the sort of evidence of reserve scarcity that Potter had referred to several months before. The once positive gap between the IOER and effective fed funds rates had by then all but vanished, while occasions when fed funds were being borrowed at rates above IOER had multiplied. It therefore seemed clear that at least some banks were borrowing fed funds not simply to arbitrage the difference between the two rates, but to meet their own liquidity needs. The supply of reserves appeared to be approaching the sloping part of the reserve-demand schedule after all.

Subsequent developments suggest that the Fed’s fears were warranted. As the FRED chart below shows, since mid-March the effective fed funds rate has risen persistently and increasingly above the IOER rate. As of this writing it is 5 points higher, leaving little room for doubt that, despite all the excess reserves still in the system, at least some banks have been bidding hard to increase their share.

The Role of Regulations

“What,” Andolfatto and Ihrig ask, “could plausibly account for a fiftyfold increase in the necessary supply of reserves? Is the FOMC really doing all it can to minimize the necessary level of reserves in line with its 2014 Policy Normalization Principles and Plans?”

As for the first question, Basel’s “Liquidity Coverage Ratio” (LCR) requirements, which after a two-year phase-in period became fully effective in the U.S. in January 2017, seems like an obvious culprit. According to the BIS, “the LCR is designed to ensure that banks hold a sufficient reserve of high-quality liquid assets (HQLA) to allow them to survive a period of significant liquidity stress lasting 30 calendar days.”

But as Andolfatto and Ihrig explain, it won’t do to blame the LCR requirements. According to those requirements, U.S. Treasury securities as well as some other non-reserve assets (Ginnie-Mae mortgage-backed securities, other non-MBS agency securities, and deposits at the Fed’s Term Deposit Facility) also qualify as “High Quality Liquid Assets.” It follows that banks might satisfy those requirements without having to hold substantial amounts of excess reserves. What’s more, when the expected return on any of these other assets exceeds the rate paid on excess reserves, as it frequently does, banks may prefer them, particularly if they’re relatively risk tolerant.

So why don’t they? Andolfatto and Ihrig’s note, first of all, that

Treasuries are not really cash equivalent if funds are needed immediately. In particular, for resolution planning purposes, banks may worry about the market value they would receive in the sale of or agreement to repurchase their securities in an individual stress scenario.

Furthermore, and perhaps most importantly, Andolfatto and Ihrig refer to Randy Quarles’ observation (made during a May 4, 2018 Hoover Institution conference) that, despite Basel’s stipulations, and perhaps owing to the previously-expressed concern, supervisors may be pressuring banks “to satisfy their [high-quality liquid assets] with reserves rather than Treasury securities.” According to BPI’s Bill Nelson, the result is an additional, albeit implicit “LCR reserve requirement” that excess reserves alone can satisfy.

Repo to the Rescue

How might banks do without so many excess reserves whilst still meeting both official and unofficial liquidity requirements? Andolfatto and Ihrig’s proposed solution is commendably simple. Banks, they say, wouldn’t need so many reserves “if higher-yielding Treasuries could be liquidated at a modest discount on a reliable basis in times of stress.” However, as Jeffrey Snider explains, ordinary repo markets can’t be expected to do the trick:

If I have to liquidate, say, billions upon billions of my USTs it stands to reason you will have to liquidate, say, billions upon billions of your USTs, and the guy over in the corner will have to do the same thing as well as the lady in Hong Kong on the phone with the fella in Zurich. If we all have to liquidate at the exact same moment, who is going to buy them all? More to the point, what will they use?

The Fed can of course buy Treasuries even when no one else can. The proposed SRF would have it do so by converting them into reserves on demand at an administered rate set several basis points above the upper limit of the Fed’s rate target range.

The idea is to have the facility operate only “when market repo rates are elevated.” Its mere presence would nonetheless suffice to limit banks’ demand for reserves in normal times, much as the mere appearance of a central bank’s armored truck may suffice to end a bank run. Once the SRF is up and running, Andolfatto and Ihrig explain,

banks should feel comfortable holding Treasuries to help accommodate stress scenarios instead of reserves. The demand for reserves would decline substantially as a result. Ample reserves — and therefore the size of the Fed’s balance sheet — could in fact be much closer to their historical levels.

Regulators must also cooperate, of course. But “with the standing facility in place,” David Andolfatto says (in a personal communication), “the hope is that the regulators will permit banks to hold treasuries instead of reserves for resolution purposes.”

An Interest Rate “Ceiling Tool”

Andolfatto and Ihrig mention several other purposes the proposed SRF might serve, chiefly that of enhancing the Fed’s control of interest rates by serving as a rate “ceiling tool”: because banks would never have reason to pay more for fed funds than it costs them to secure reserves from the SRF, the effective fed funds rate would never rise above the SRF rate. The SRF would thus serve as a counterpart to the Fed’s Overnight Reverse-Repurchase (ON-RRP) facility in keeping the effective fed funds rate from straying beyond the upper or lower limits of the Fed’s rate target range.

But while the SRF can serve both as a means for economizing on reserves and as a “ceiling tool,” it needn’t do so.

While these two motivations are mutually attainable with the same facility, they are conceptually distinct goals. Whether the facility aided in one or both goals would depend on the choice of parameter settings, including the counterparties and offering rate. It would be possible to structure the facility in a manner that reduces reserve demand without serving as a strict ceiling tool.

One Stone, Three Birds

At one point Andolfatto and Ihrig compare their proposed SRF with “the standard … lending tools used in typical floor-operating regimes, such as at the European Central Bank.” The SRF, they say, “is a way for the Fed to lend cash to banks that are in good standing and have high-quality Treasury securities as collateral but may find themselves short of cash. Importantly, this facility would not suffer from stigma problems that make the discount window an ineffective tool in these circumstances.”

But the comparison is somewhat misleading, for both the Fed’s discount window and the ECB’s “marginal lending facility” stand ready to supply reserves against a broad range of collateral, and not merely in exchange for highly-liquid and low-risk sovereign debt. The ECB also allows nonbanks to borrow from its lending facility.

These differences raise the question: why not have the proposed SRF accept the same broad range of a collateral now eligible for discount-window lending, not merely so that it might better resemble the lending facilities of other central banks, but so that it might take the place of discount window lending? Were it to do so, the SRF would serve not two but three major purposes: economizing on reserves, establishing a policy rate ceiling, and serving as the Fed’s sole vehicle for last-resort lending.

The idea of having an auction-based lending facility stand in for the Fed’s discount window isn’t new: the Fed’s crisis-era Term Auction Facility (“TAF”) did just that, with considerable success. In particular banks that took advantage of the TAF managed to avoid much of the stigma that caused many banks to avoid discount-window borrowing. Here, from Atlanta Fed economist Larry Wall, is a chart comparing discount-window and TAF loan volumes during the crisis:

Because the TAF was a temporary facility only, it was, Wall notes, “not designed to set an upper bound on overnight rates.” However, he goes on to say, had “the Fed wanted to establish a new TAF that would be effective for monetary control,” it might have done so by establishing a permanent TAF modified in several ways from the original:

First, the new TAF would need to provide funds at a fixed rate if it were to set an effective upper bound on short-term rates. Additionally, the new TAF would have to provide for full allotment, that is, every bank would have to get the full amount of its request — otherwise, it would need to buy funds at the elevated market rate. Finally, if the new TAF were going to set a limit on overnight rates, it would need to be available every day and would have to settle the same day as the auction.

In short, apart from accepting the full discount-window collateral range, the modified TAF would have closely resembled Andolfatto and Ihlig’s proposed Standing Repo Facility.

This isn’t to say that a broad-collateral version of the SRF would be as effective as the TAF in avoiding stigma. Quite possibly it wouldn’t, because, as Larry Wall notes, the TAF’s success rested in part on the fact that its infrequent auctions and delays between bidding and settlement made it “an expensive way for a weak bank to stockpile funds in anticipation of a future run.” This outcome, it should be said, was itself not necessarily a bad thing: on the contrary, it may have been consistent with the “classical” last-resort lending ideal according to which emergency lending ought to be confined to unquestionably solvent banks.

But the TAF’s success at avoiding stigma wasn’t solely due to its having been unattractive to weak banks: that success was also at least partly due to the fact that many banks “obtained funds from [it] at the same time…making it more difficult for depositors and markets to identify which banks were accessing Fed liquidity.” To that extent, at least, SRF loans would also be less vulnerable to stigma than discount-window loans, and correspondingly preferable.

So why not have the SRF do triple duty by having it accept any eligible discount-window collateral, subject to haircuts like those presently applied at the discount-window itself? Andolfatto and Ihrig say that “that primary reason to restrict acceptance to U.S. Treasuries is to encourage the use of these securities by banks in meeting their liquidity regulations.” But the argument, if you ask me, makes little sense: if a standing repo facility can serve a useful purpose by making Treasury securities as useful as reserves, why not have it serve a still more useful purpose by making other kinds of good collateral just as useful as Treasury securities? And supposing it’s necessary to encourage banks to hold plenty of Treasury securities, isn’t that just what the Basel LCR requirements do? If the answer is yes, then what need to “encourage” banks all over again by allowing only Treasury securities to serve as SRF collateral?

A Leaky Ship

So, what’s not to like about the SRF? The main problem I see isn’t so much that worthy tugboat but the unseaworthy vessel its authors would have it assist — a vessel that carries a lee helm one day, and a weather helm the next, and one that has had to be patched and fothered to keep it from leaking. I refer — you guessed it! — to the Fed’s floor system.

Consider: in a properly-working floor system, the interest rate on excess reserves alone should suffice by keep the policy rate from veering from a specific target. Yet thanks to a leaky IOER floor the Fed has had to settle for a policy rate range. Managing that range requires, not just interest payments on reserves, but an ON-RRP facility to police the range’s lower limit. Keeping the effective fed funds rate from bursting through its upper limit has also been so difficult. That that limit, which was once simply the IOER rate itself, has lately had to be “technically adjusted” on three occasions, each of which put 5 bps of space between the limit and the Fed’s IOER rate.

Yet, the vessel still leaks and wanders. So an S.O.S. to the SRF, which, should it ever arrive, will nudge the sodden thing along.

Why bother? Why not have a tried-and-true monetary policy vessel that doesn’t leak in the first place? A corridor system is such a vessel.

I don’t mean that the Fed should switch to a corridor system instead of establishing a Standing Repo Facility. I mean that, as much sense as it would make to add an SRF to the present system (and I think it would make plenty of sense), it would make still more sense to have it serve as the “ceiling tool” of a corridor arrangement, with interest payments on reserves — or better still, a proper “deposit facility” at which GSEs as well as banks might keep interest-earning balances — as the corresponding “floor tool.”

If, after all, the goal of an SRF is not merely to place an upper limit on policy rate movements, but to allow banks to meet LCR requirements without generating a hefty demand for excess reserves, it makes no sense to link it to the present floor system. That’s because the main argument for keeping the floor system is so that the Fed can stuff banks to the gills with excess reserves, in case it has to do so to keep them liquid!

But if a Standing Repo Facility can make Treasuries, and perhaps other assets, just as good as reserves for meeting banks’ liquidity needs, then it can also achieve a similar degree of effective bank liquidity in a corridor system. The difference is that an SRF-supplemented corridor system would require far fewer reserves than even the most efficient floor system. Banks in such a system could get by with very slim reserve cushions, provided they also kept plenty of Treasury securities (or, for a “broad” SRF, other eligible collateral) on hand. A corridor option will for this reason always be the more efficient option, meaning the one most consistent with a “lean” Fed balance sheet and with a correspondingly smaller risk of departures from an optimal government debt maturity structure and related conflicts of interest between the Fed and the Treasury.

So let’s by all means encourage the Fed to establish a Standing Repo Facility. But let’s also encourage it to not waste that fine device on a foundering floor system that it should have scuttled long ago.