“There Was No Housing Bubble in 2008 and There Isn’t One Now,” concludes Ramesh Ponnuru. Writing in Bloomberg, Ponnuru notes that, ” economists David Beckworth and Scott Sumner have argued that the timing of the last housing bust does not line up with the conventional wisdom that it played a central role in the recession that began in December 2007. The housing market peaked in early 2006, and sustained nearly two years of decline before the economy stopped growing as unemployment stayed low.”

“A monetarist explanation for the Great Recession,” he adds, “is that the Federal Reserve erred from late 2007 onward by failing to loosen monetary policy enough after initial signs of economic weakness, sending tightening signals to markets as the crisis developed, and then failing again to do what it would take to revive spending levels.”

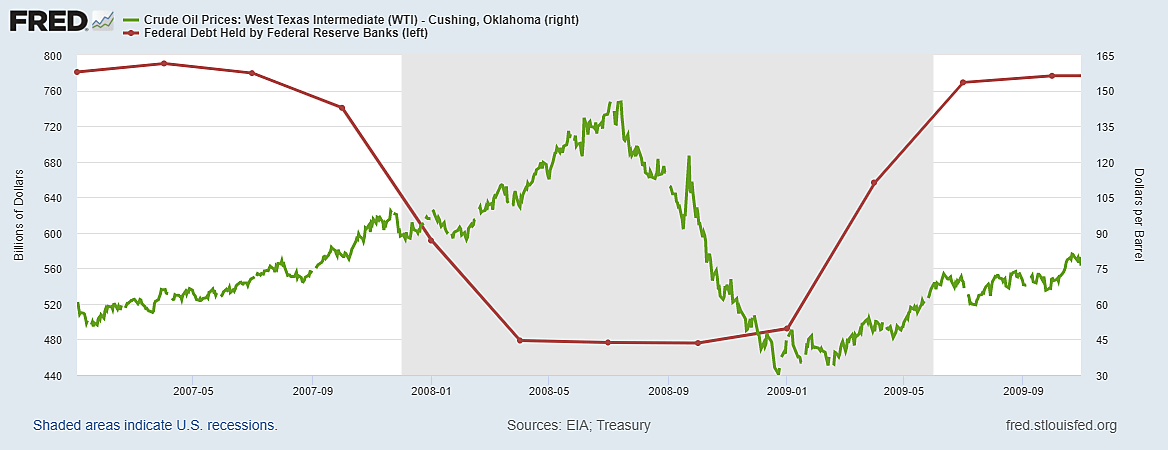

There are couple of vital sub-plots I would like to add to this incisive investigation of economic policy history. First, the price of WTI crude oil soared from $50 a barrel in January 2007 to $89 by the start of the Great Recession, then continued rising to $145 by the middle of 2008, in mid-July. As in 2021, the rapid runup in crude oil prices in 2008 was associated with a simultaneous rise in CPI inflation when measured on a year-to-year basis. Second, as Ponnuru notes, both years were widely considered to be “housing bubbles” which supposedly deserved to be popped by the Fed.

The biggest difference between now and 2008 has to do with “quantitative easing” (QE) – that is, buying Treasury debt with bank reserves that have paid interest since October 2008. Today, the Fed plans to phase-out the latest of four dubious QE experiments. And the Fed also plans to raise the interest rate it pays on bank reserves, which is far more relevant than the fed funds rate in an era when the banks have been flooded with reserves by QE.

The graph shows that in 2008, the Fed went much further and engaged in aggressive Quantitative Tightening (QT). Federal Reserve Bank holdings of Treasury debt were deliberately reduced from $790.5 billion in the second quarter of 2007 to $478.2 billion in the second quarter of 2008. It is hard to imagine why Fed officials thought that was a clever idea unless they saw QT as a way to crash the world price of oil by crashing the world economy.

The fed funds rate was high at 4% in January 2008 and was still 1.8% in September 2008, ten months into a deep contraction. But that was mild poison compared to the astonishing Quantitative Tightening of 2008.