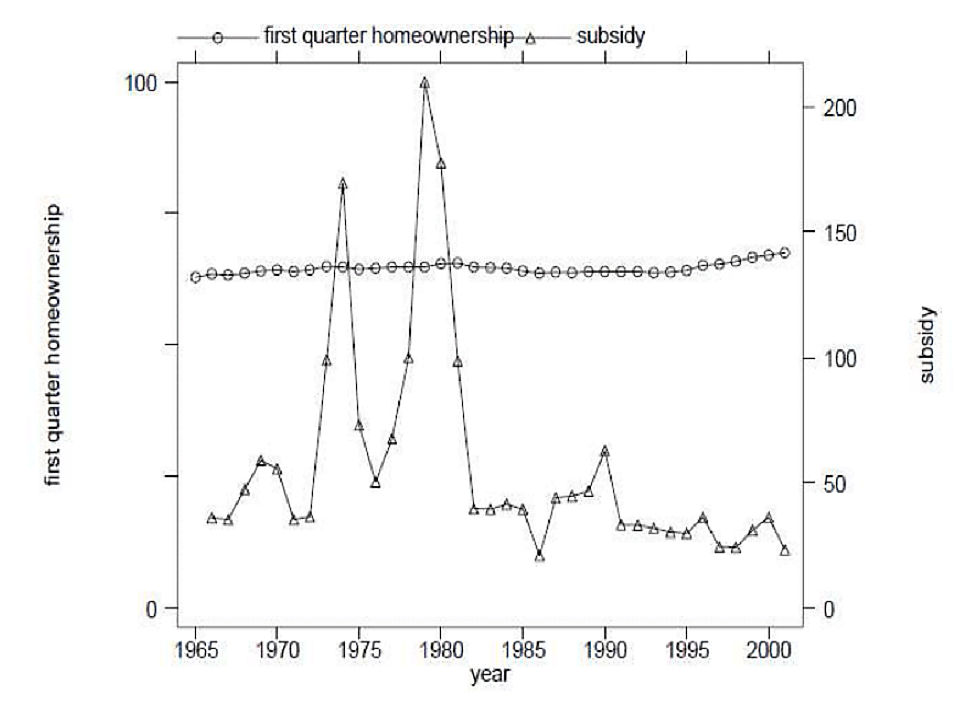

Earlier this week, the Los Angeles Times ran a column repeating the simplistic notion that since homeownership is “good” then subsidies for homeownership must therefore also be “good.” Never asked, or apparently even contemplated, is the question of whether all our various homeownership subsidies actually deliver homeownership. Let’s start with the ever popular mortgage interest deduction (MID). The chart below, reproduced from Glaeser and Shapiro, shows the value of the MID and the homeownership rate. Hard to see any relationship there, probably because there isn’t one. I discuss the MID in more detail here.

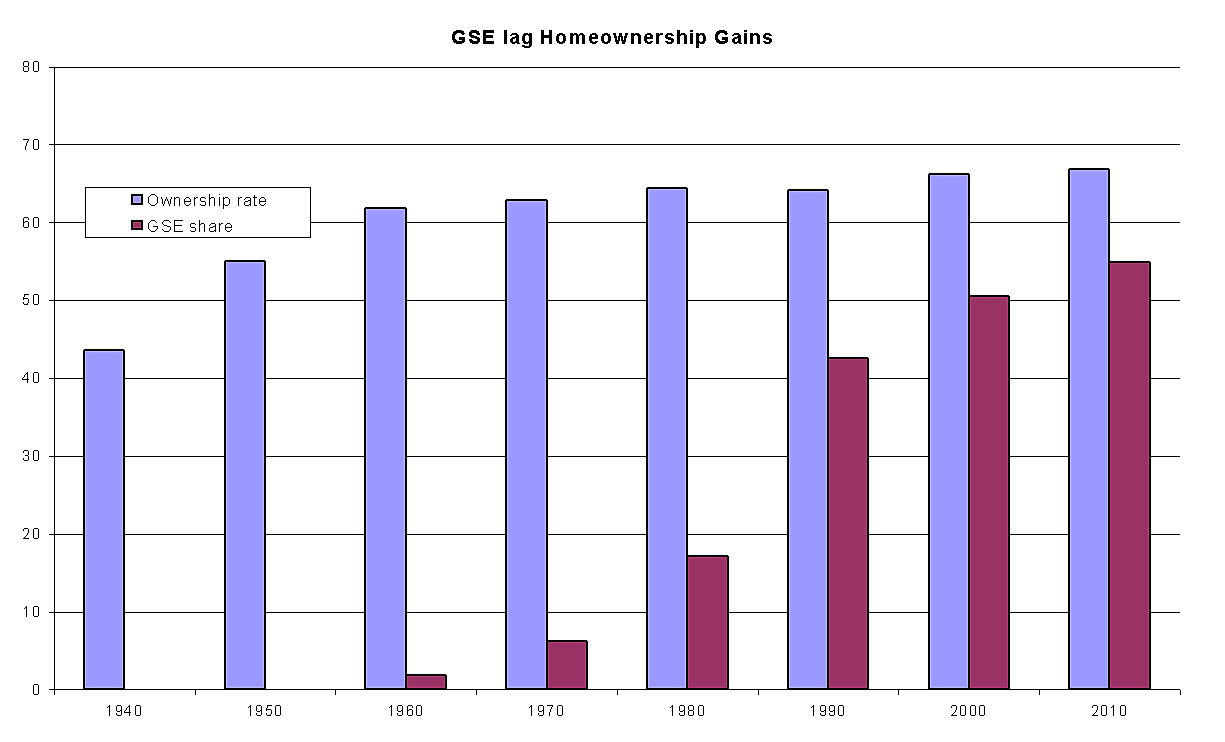

Next would be Fannie Mae and Freddie Mac. The chart below shows the homeownership rate and the Fannie/Freddie share of the mortgage market. What should be immediately obvious is that the long run homeownership rate steadied out in the mid-60 percents when Fannie & Freddie were bit players, having a market share in the single digits. In no way can we say that Fannie & Freddie have increased the long-run trend rate of homeownership.

So even if one believes homeownership is worthy of subsidy, a questionable proposition on its own, it should be beyond question that our current system of homeownership subsidies has not delivered long run gains in the homeownership rate.