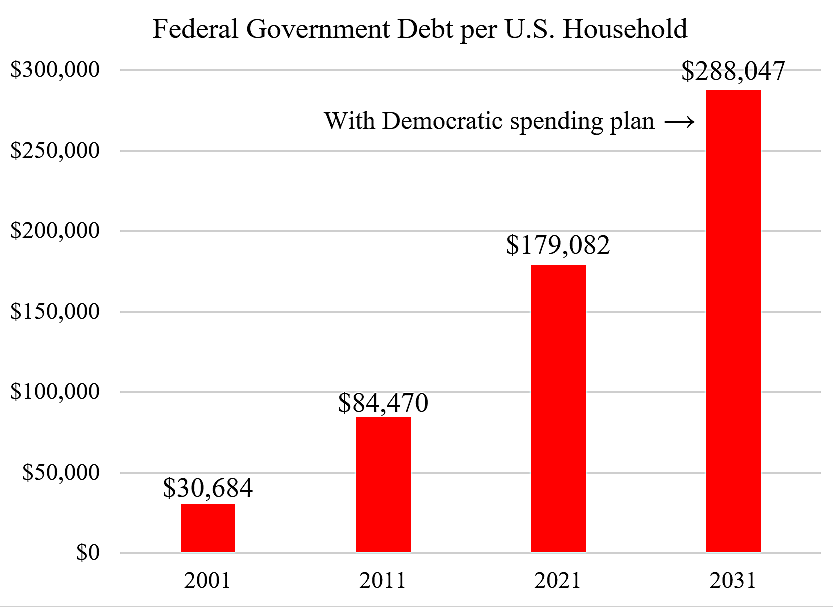

Federal government debt rose from $3.3 trillion in 2001, to $10.1 trillion in 2011, to $23.0 trillion in 2021. Under current law, the CBO expects debt to rise to $35.8 trillion by 2031. If Congress passes the spending increases in the Democratic budget resolution, debt will rise to $40.1 trillion by 2031, according to CRFB. This is “debt held by the public,” meaning federal borrowing from domestic and foreign creditors.

The chart scales the debt to the number of U.S. households. Debt per household under the Democratic plan would rise from $179,082 in 2021 to $288,047 by 2031. That debt is not like mortgage debt where households have a hard asset to match what they owe. Rather, it is the government going on a consumption spending spree and putting $288,047 on each household’s credit card. That is because just 5 percent of federal spending is for hard assets such as highways and fighter jets. By ballooning the debt today, politicians are imposing large and rising burdens on households tomorrow.

Here are further observations:

- Federal debt today is 103 percent of GDP and would rise to 119 percent by 2031 under the Democratic spending plan. That level of debt is higher than the 31 percent reached in the Civil War, 33 percent reached in World War I, and 106 percent reached in World War II. Today we are not at war, and politicians show no interest in paying down the debt as they did after past wars.

- Bill Clinton was the last president to balance the budget, but the chronic red ink began in the 1930s with the rise of Keynesian economics and the invention of auto-pilot entitlement programs. Deficit spending has been supercharged in recent years by the rise in global capital markets, which makes vast borrowing much easier. From 1791 to 1930, federal politicians balanced the budget 68 percent of the years, but since 1931 they have balanced it only 13 percent of the years.

- America’s combined federal and state government debt in 2021 at 141 percent of GDP is far higher than the OECD average of 100 percent of GDP, and much higher than debt levels in Australia, Denmark, Ireland, Israel, Germany, Korea, the Netherlands, New Zealand, and Sweden.

- Rising debt may trigger an economic crisis with soaring interest rates and falling output. Greece’s debt crisis a decade ago created long-lasting damage, and the country’s real income per capita is still down one-quarter from its pre-crisis level. America’s government debt today is about the same size relative to GDP as was Greece’s before its debt crisis.

- With the Democratic spending plan, federal interest costs will top $1 trillion a year by 2031. But that assumes the CBO baseline projection of interest rates rising only to 1.9 percent on short-term federal debt and 3.2 percent on long-term debt. I think that is a rosy scenario. The risk is on the upside. If interest rates rise more than projected, it will have a huge budget impact because the debt is so large.

More on the history and costs of debt here.

Data Notes. The OECD debt measure is general government gross financial liabilities. OECD publishes the weighted average, but I calculated the simple average across countries. The number of U.S. households is here, and I estimated the 2031 figure based on the recent growth rate.