President Trump’s new budget proposes to increase federal spending on infrastructure by $200 billion over 10 years. Many members of Congress are supportive. Some favor raising federal gas taxes to fund more highway spending, and President Trump may be on board.

However, increasing federal gas taxes and federal infrastructure spending is a bad idea. For one thing, the vast majority of government infrastructure is owned by the states, including 98 percent of all U.S. streets and highways. The states have many options to finance their highways and other infrastructure including state gas taxes, sales taxes, debt, user charges, public-private partnerships, and privatization.

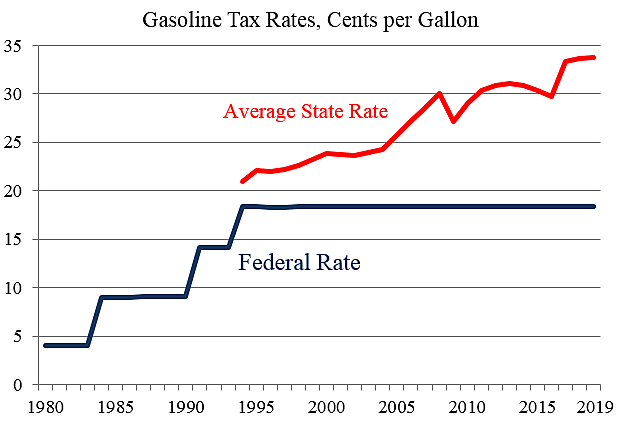

A federal gas tax hike makes no sense because states can raise their own gas taxes anytime they want. Indeed, half the states have raised their gas taxes in just the past six years, as the Wall Street Journal reported yesterday:

Ohio Gov. Mike DeWine is pushing for an 18-cent-per-gallon increase in the state’s gas tax after he said he discovered a $1 billion infrastructure spending hole that transportation officials say was masked for more than a decade by borrowing.

The proposal is running into objections from some state lawmakers and sparking debate over how much the state should spend on new transportation projects and how much of that should be borne by taxpayers.

Governors in more than half a dozen states are considering boosting gas taxes. They follow more than two dozen states that have done so since 2013, as rising construction costs and greater fuel efficiency erode revenue generated from the taxes.

The chart shows that while the federal gas tax has been held at 18 cents per gallon, state gas taxes have risen steadily, according to API data. The average state gas tax increased from 21 cents per gallon in 1994 to 34 cents per gallon today, which includes excise taxes and other taxes on gasoline.