Let’s do some fact checking on President Obama’s corporate tax comments in last night’s State of the Union.

Claim: “Right now, companies get tax breaks for moving jobs and profits overseas.”

False: There are no such breaks. Instead, we punish U.S. and foreign businesses for investing and creating jobs here.

Claim: “If you’re a business that wants to outsource jobs, you shouldn’t get a tax deduction for doing it.”

False: There is no such tax deduction.

Claim: “No American company should be able to avoid paying its fair share of taxes by moving jobs and profits overseas.”

False: America is not a prison camp. Besides, imposing a 40-percent tax rate on corporations that invest here is not a “fair share.”

Claim: “From now on, every multinational company should have to pay a basic minimum tax.”

False: We’ve already got a corporate “alternative minimum tax,” and it’s an idiotic waste of accounting resources that ought to be repealed.

Claim: “It is time to stop rewarding businesses that ship jobs overseas.”

False: We penalize them for locating jobs here. Besides, the overseas operations of U.S. companies generally complement domestic jobs by boosting U.S. exports.

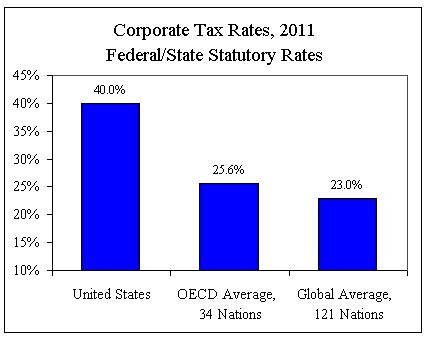

Claim: “Companies that choose to stay in America get hit with one of the highest tax rates in the world.”

True: Our rate is 40 percent, which compares to the global average rate of just 23 percent. See the chart below, which is based on KPMG data.

Claim: “If you’re an American manufacturer, you should get a bigger tax cut. If you’re a high-tech manufacturer, we should double the tax deduction you get for making your products here. And if you want to relocate in a community that was hit hard when a factory left town, you should get help financing a new plant, equipment, or training for new workers.”

False: It’s a horrible idea to create special breaks for certain types of government-favored businesses. It would simply encourage the exact type of tax game-playing and lobbying that the president decries. What’s a “high-tech” manufacturer? What’s an “American” manufacturer? What’s a “manufacturer”? How “hard hit” do towns need to be?

Upshot: From the president’s one “true” comment we can derive the simple and logical solution to our corporate tax problem. We should stop “hitting” companies with a 40-percent sledgehammer, and cut our corporate statutory rate to boost investment and reduce corporate tax avoidance.

Note to self: Mail copies of Global Tax Revolution to WH speechwriters.