Lately the old-timers here at Cato’s Center for Monetary and Financial Alternatives — which is to say, Jim Dorn and I — have been talking a lot about the Phillips Curve, which seems to be playing a part in monetary policy discussions today almost as big as the one it played in the 1970s. And you can bet that, because both Jim and I actually remember what happened in the 70s, and afterwards, neither of us has a good word to say about the concept, except as a very reduced-form means for describing very transient relationships.

Because Jim has a CMFA Policy Briefing on Phillips Curve reasoning in the works, I won’t belabor here his — and my — general objections to it. My main concern is to draw attention to a current example of that reasoning at work, in the shape of a recent New York Times op-ed by Jared Bernstein, entitled “Why Real Wages Still Aren’t Rising.”

Noting that, despite the low and still falling U.S. unemployment rate, real wage rates for workers in factories and the service industries have been stagnant for several years. Mr. Bernstein finds this stagnancy puzzling: According to the BLS, he writes, as of this June money “wages” (presumably meaning hourly wage rates) grew at an annual rate of 2.7 percent, whereas “looking at the historical link between wages and unemployment, wage growth should have been rising about a percentage point faster.” The “historical link” to which Mr. Bernstein refers is based partly on the Phillips Curve — a negative relation between the unemployment rate on one hand and the rate of either nominal “wage” or price inflation on the other — and partly on the historical tendency for the rate of nominal wage inflation to exceed that of price inflation. In the present instance, prices have failed to rise as rapidly as the decline in unemployment suggests they should, while wages — factory workers’ wages especially — have been rising still less rapidly.

How to account for this recent failure of reality to conform to the implications of the Phillips Curve? For Mr. Bernstein, this development

is mainly the outcome of a long power struggle that workers are losing. Even at a time of low unemployment, their bargaining power is feeble… . Hostile institutions — the Trump administration, the courts, the corporate sector — are limiting their avenues for demanding higher pay.

Eventually Mr. Bernstein also points a finger at “the increased concentration of companies and their unchecked ability to collude against workers.”

We’ve No Need for These Hypotheses

The least unfavorable thing that can be said about such shadowy conjectures is that one ought not to resort to them without first exhausting more prosaic possibilities.

To his credit Mr. Bernstein himself recognizes one such possibility: the well-known, general slowdown in productivity growth since the recession, which he allows to have placed “another constraint on wages.” He recognizes as well the possibility that the recent Trump-initiated trade war may have exacerbated the decline, though he dismisses it on the grounds that “ ‘final products’ — things that consumers buy versus intermediate materials used for production — have so far been spared.” Here Bernstein is surely mistaken: when intermediate materials get more expensive, so do final products produced at home. Yet the trade war does nothing to boost nominal wages. So real wages may already have been adversely affected, not by a Trump administration anti-labor conspiracy, informed by its hostility to ordinary workers, but by one of that administration’s avowed policies, informed by its ignorance of rudimentary trade theory.

In fact, as we’ll see, the general decline in productivity since the Great Recession and the more recent trade war are alone quite capable of accounting for a considerable decline in the once substantial difference between the rate of wage inflation and that of output price inflation, and hence in the growth rate of real wages.

A Phillips Curve Refresher Course

Any historical Phillips Curve relationship is just that: a historical relationship. Whatever it was then, it may have shifted around since. Consequently a decline in real wages that might, for any given Phillips Curve relationship, point to a weakening of the labor market, may point to other developments, including declining productivity, when the (short run) Phillips Curve itself has been on the move.

To overlook the ever-shifting nature of Phillips Curves is to neglect something that was driven home, painfully, to an entire generation of economists during the 1970s, as they witnessed the baneful consequences of attempts to exploit the “historical link” between inflation and unemployment represented by the 1960s vintage Phillips Curve. In particular, it’s to neglect the fact that any short-run Phillips Curve relationship depends on some underlying state of aggregate supply. When that state changes, either because workers come to anticipate future inflation, as they did in the 70s, or because productivity declines, as it has recently, the former Phillips Curve breaks down, and a new one takes its place.

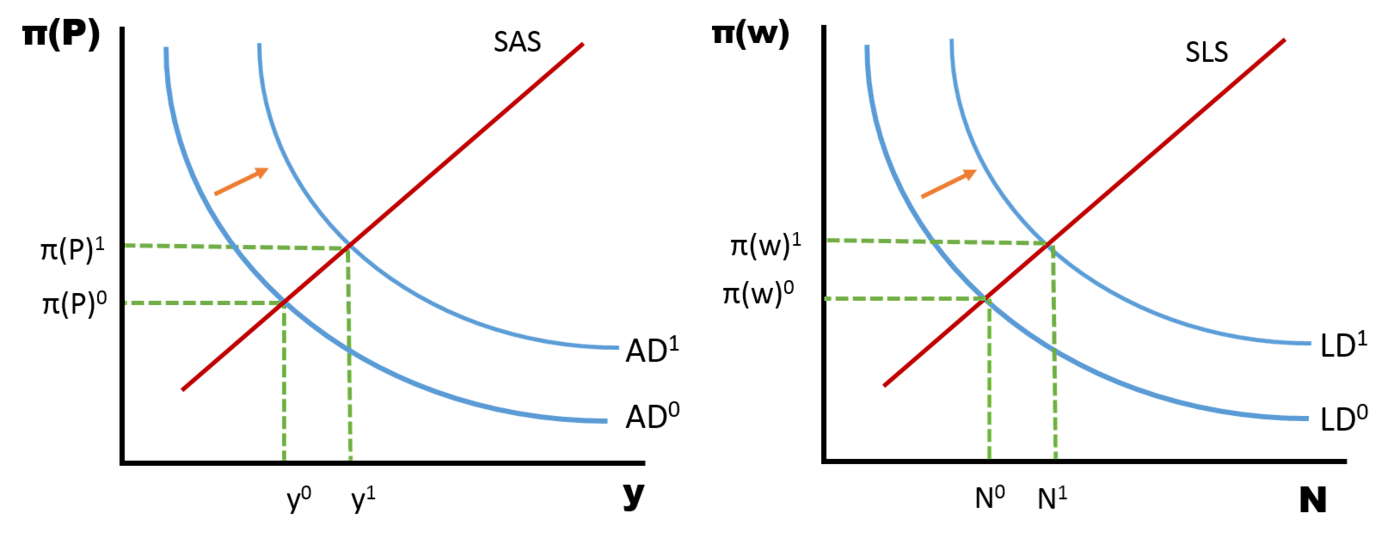

For the sake of readers seeking a more explicit explanation of the logic behind naive Phillips Curve reasoning, and why such reasoning goes awry when Phillips Curves don’t stand still, I offer here a quick review, starting with some simple supply and demand diagrams representing the markets of goods and services (left) and labor (right).

Given some state of aggregate supply, as reflected by fixed, upward-sloping short-run aggregate supply (SAS) and labor supply (LAS) schedules, changes in nominal spending on goods (AD, for aggregate demand) and labor (LD) will cause prices and wages (or their respective inflation rates), employment, and output to increase together, with no tendency for wages to fall behind prices.

The standard Phillips Curve, portraying a negative relationship between the rate of price inflation and the unemployment rate, is just a reduced-form representation of these more involved relationships, showing the set of alternative, equilibrium values of inflation, π(P), and unemployment (L‑N, where L is the size of the labor force) consistent with different levels of spending (AD and LD), consistent with given short-run, upward-sloping SAS and SLS schedules. By noting that one can also express the relationship in question as one between the rate of wage inflation, π(w), and the unemployment rate, one arrives at “the historical link between wages and unemployment” to which Mr. Bernstein refers. What that relationship really means is that, for any given short-run labor supply schedule, as aggregate and labor demand schedules shift out, unemployment declines, while wage rates go up.

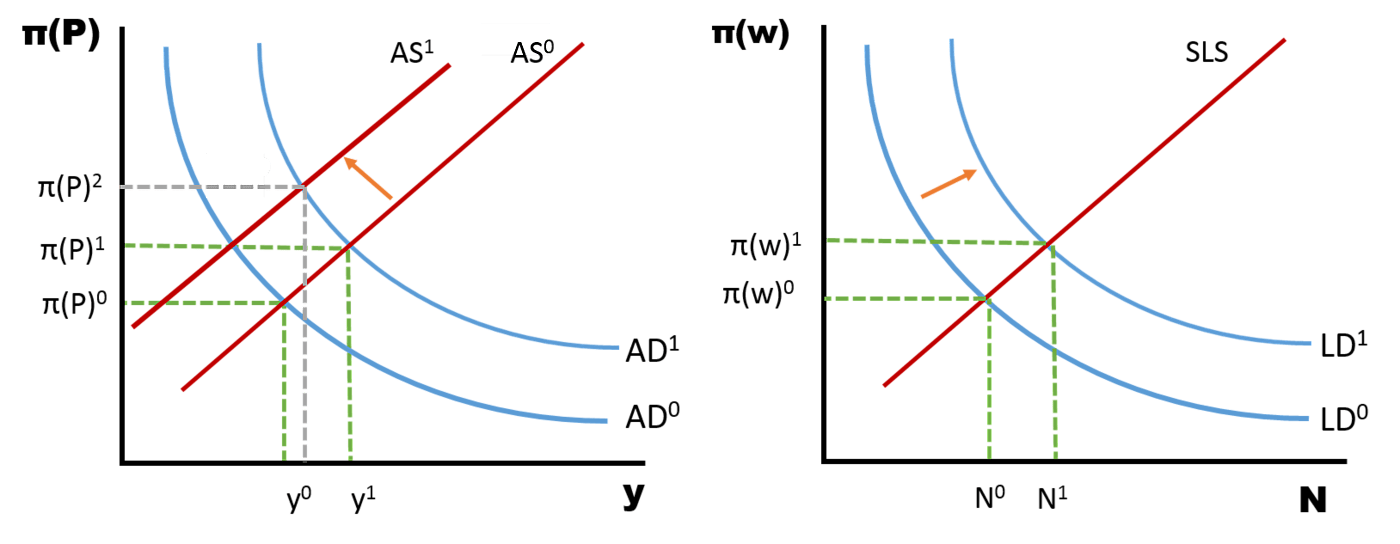

But a historical Phillips Curve relation, whatever it may be, ceases to hold once short-run aggregate or labor supply schedules themselves start shifting. In particular, if there’s a general productivity setback, due to a trade war or for any other reason, the aggregate supply schedule shifts in, or at least fails (in a dynamic setting) to shift out as fast as the aggregate demand, labor demand, and labor supply schedules. That difference is all it takes to cause a growing gap between the equilibrium nominal wage rate and the equilibrium price level, so that real wages stagnate, assuming they don’t actually decline.

As our diagrams are necessarily static, getting from them to a more accurate, dynamic account of recent labor market developments takes a little imagination. In reality, for starters, all of the schedules tend to be shifting outwards over time. Typically the AS schedule shifts out faster than the LS schedule, thereby providing for a general increase in real wages. Since the Great Recession, however, although AS never actually shifted to the left, the difference between the growth rate of AS and that of LS has shrunk. Consequently, instead of actually declining, real wages have merely ceased to increase as quickly as they once did.

The Real Puzzle: Labor’s Fallen Share of Productivity Gains

There remains, however, one real wage rate puzzle that post-crisis aggregate supply developments alone can’t explain. The puzzle consists, not of the breakdown of the “historical link between wages and unemployment” to which Mr. Bernstein refers, but of the breakdown of the historical link between the real wages of workers, apart from managerial-level workers, and overall productivity growth. The puzzle is that, while productivity growth has slowed down considerably, it’s still positive, whereas real wages for many sorts of workers have been altogether flat. Labor’s share of national income has, in other words, fallen. And so far it seems down for the count.

But this more genuine puzzle, which has nothing to do with the relation between wage inflation and the unemployment rate, is itself hard to attribute to some relatively recent rise of “hostile institutions,” either within the Trump administration or elsewhere in the United States. For one thing, labor’s share of income started to decline long before the recent crisis, let alone the most recent presidential election! By most accounts, labor’s share began to drift downward in the 1980s, and reached its nadir just before the 2008 crisis. For another, the decline has occurred, not just in the U.S., but in many other developed and emerging economies — despite large differences in all these countries’ governments, court systems, and collective bargaining arrangements. As Loukas Karabarbounis and Brent Neiman show in a 2017 NBER Report on “Trends in Factor Shares: Facts and Implications,” “Country-specific changes in policies … might be important for specific countries but are unlikely to account for much of the overall trend that the world has experienced.”

And there’s no shortage of explanations for the global decline in labor’s share of income that are far more compelling than vague references to “hostile institutions.” Karabarbounis and Neiman attribute half of it to “progress with IT-related technologies” that has “induced firms to produce with greater capital intensity.” A San Francisco Fed Study by Mary C. Daly, Bart Hobijn, and Benjamin Pyle attributes the stagnation of real wages to “secular shifts in the composition of the labor force.” In particular, while baby boomers earning relatively high wages have been retiring, younger workers “sidelined” during the recession have had to settle for relatively low-paying full-time jobs. A 2017 MIT working paper argues that an increase in product market concentration, particularly as manifested in the rise of “superstar firms,” may also have contributed to the reduction in labor’s share of total income. But the reason isn’t superstar firms’ “unchecked ability to collude against workers”: it’s just that “there is a fixed amount of overhead labor … needed for production” in the industries in question, so that greater concentration means less labor-intensive production.

In a still more recent working paper Princeton’s Gene Grossman and several coauthors suggest that the productivity slowdown may also account for part of the decline, because “when human capital is more complementary with physical capital than with raw labor” such a slowdown “can itself lead to a shift in the functional distribution of income away from labor and toward capital.” Finally, some part of the decline in labor’s share may be a figment of the data. According to a Brookings study published in 2013, “about a third of the decline in the published labor share appears to be an artifact of statistical procedures used to impute the labor income of the self-employed that underlies the headline measure.”

While none of these alternative explanations for the stagnation of workers’ earnings may alone suffice as an alternative to Mr. Bernstein’s more sinister explanations, several could easily do so. And these are but some of many plausible possibilities. For some others, along with a good general discussion of the topic, I recommend this pair of posts by Timothy Taylor.

In short, there’s no need to suppose that the courts, the Executive Branch, and “the corporate sector” have been conspiring — or conspiring more than usual, to be precise — to deprive workers of some portion of their already meager share of the real GDP pie. And even if they were trying, it couldn’t account for the actual historical and global behavior of worker’s earnings.

The moral of the story is that it’s unwise for economists to put too much faith in historical relationships — whether between inflation and unemployment or between total income growth and workers’ real wage rates — and to conclude, when these relationships “break down,” that some conspiracy must be afoot. That courts, corporations, and presidential administrations are capable of perfidy no one can deny. But historical macroeconomic relationships are themselves untrustworthy, for reasons unconnected to goings-on in smoke-filled rooms.