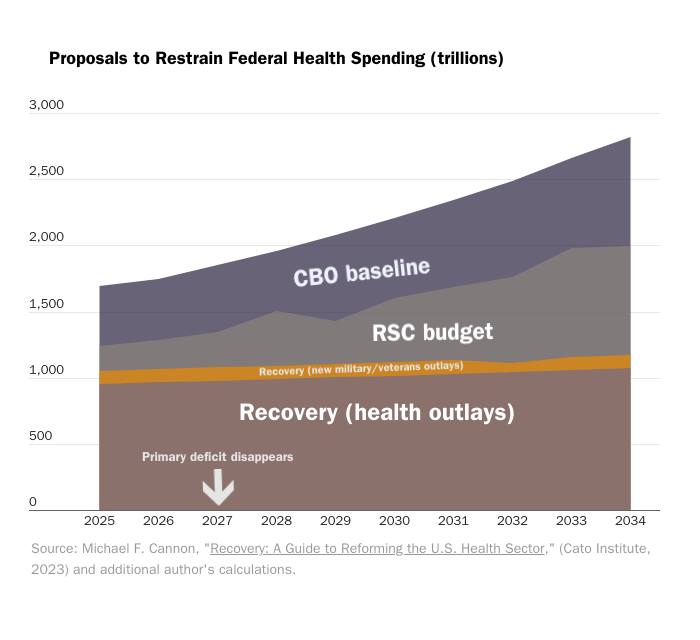

Via this Cato white paper, I submitted the following recommendations to the Department of Government Efficiency, a private-sector organization that will advise President-elect Donald Trump on how to reduce inefficiency in the federal government. The following recommendations would cut federal health spending 49 percent below baseline over the next 10 years and erase the primary federal deficit by 2027, even after increasing military pay $100 billion per year (to pre-fund veterans benefits). I further submitted recommendations relating to federal tax policy and regulatory policy. The three sets of recommendations operationalize the reforms I propose in my latest book, Recovery: A Guide to Reforming the US Health Sector (Cato Institute, 2023).

The long-term federal debt problem is a health care problem. The Congressional Budget Office projects that only two categories of federal outlays will grow faster than gross domestic product (GDP): health care subsidies and interest payments on the debt. The former is, therefore, the primary driver of the latter.

Wasteful government health spending is rampant because nobody spends other people’s money as carefully as they spend their own. The best available data suggest that one-third of Medicare spending is pure waste (i.e., that Congress could cut Medicare spending by one-third without affecting overall health).

Medicare sets and pays excessive prices for medical care. Spending on patients age 65 and up is more out of line with international norms than spending on patients below age 65. Medicare also has a large negative impact on health care quality.

Obamacare promised to make health care “affordable.” In reality, taxpayers are subsidizing enrollees earning up to $600,000 per year. Biden economic adviser Michael Geruso admits that Obamacare rations care for the sick and that “currently healthy consumers cannot be adequately insured.”

Pay-as-you-go funding of veterans benefits allows Congress to kick those costs into the future, which enables policymakers to ignore the largest fiscal cost of putting US troops’ lives at risk. Pre-funding and privatizing veterans benefits would force policymakers to justify those costs at the moment they are putting US lives at risk.

The House Republican Study Committee proposes to cut federal health spending 26 percent below baseline over the next decade.

The following reforms would cut federal health spending 49 percent below baseline over the same period and erase the primary deficit by 2027, even after increasing military pay $100 billion per year (to pre-fund veterans benefits). These reforms would deal a 100 percent cut to high-cost, low-quality health care providers and to the fraudulent schemes of providers and state officials. They would make health care more universal and give states flexibility to meet the needs of patients who cannot afford the medical care they need.

The federal government should do the following:

- Cut Medicare spending by one-third; give Medicare’s remaining budget directly to enrollees as cash; give poorer and sicker enrollees larger “Medicare checks” than healthier and wealthier enrollees; and allow overall Medicare spending to grow no faster than GDP.

- Adopt the Republican Study Committee proposal for Medicaid and Children’s Health Insurance Program spending in 2025 and give those funds to states as unrestricted, zero-growth block grants.

- Repeal what’s left of the Patient Protection and Affordable Care Act of 2010 (i.e., Obamacare), including its grants to states and subsidies to private insurance companies.

- Turn the Veterans Health Administration and its assets into a private, shareholder-owned corporation; give the $36 billion or so in shares away to current veterans; use the Department of Veterans Affairs existing budget to give current veterans annual, risk-adjusted subsidies sufficient to purchase private life, disability, and health insurance at actuarially fair premiums; increase military pay to enable active-duty military personnel to purchase such insurance that pays benefits once they leave active duty; allow that additional military pay to rise and fall automatically with those actuarially fair “veterans benefits” premiums.