Recently, however, some have implied that Friedman and Schwartz fudged their data or cooked their numbers. For example, Joe Salerno, in a Mises Institute post entitled “Milton Friedman Debunked -- by Econometricians,” explicitly accuses Friedman and Schwartz of “fudging" their data. Another post at the Institute for New Economic Thinking blog makes a similar claim with the title “Did Milton Friedman Cook His Numbers?”

These charges are very serious, but on close examination they turn out to be based entirely on misrepresentations or misunderstandings of some relatively minor and arcane criticisms of Friedman and Schwartz’s analysis of the velocity of money that they published in a volume that appeared in 1982, nearly two decades after their Monetary History came out. These criticisms, whether valid or not, do not challenge the accuracy of the numbers in the Monetary History but in fact rely on those very numbers.

Both posts are reporting on an article at VOX, CEPR’s Policy Portal, entitled “Milton Friedman and Data Adjustment." Written by Neil Ericsson, David Hendry, and Stedman Hood, the article is a summary of their longer chapter in Milton Friedman: Contributions to Economics and Public Policy, edited by Robert A. Cord and J. Daniel Hammond (Oxford University Press, 2016). What follows is an extended discussion of Ericsson, Hendry, and Hood's criticisms, but those interested in only a summary can just read the next and final sections.

Money Stock Figures

Although Salerno’s description of the VOX article is generally accurate, his post overall, as well as the title of the Institute for New Economic Thinking post, leave the unwary reader with an exaggerated and misleading impression.

To begin with, the criticisms raised by Ericsson, Hendry, and Hood do not even apply to the data series on the U.S. money stock that Friedman and Schwartz presented in their classic Monetary History (1963) or in their subsequent, massive Monetary Statistics of the United States: Estimates, Sources, and Methods (1970). Indeed, the three econometricians in their VOX article are not challenging Friedman and Schwartz' money stock figures at all.

Instead, they are challenging the analysis of money’s velocity that Friedman and Schwartz made in the later, much neglected, 1982 volume, Monetary Trends in the United States and the United Kingdom: Their Relation to Income, Prices, and Interest Rates, 1867-1975. Moreover, their criticisms of Friedman and Schwartz’s velocity analysis is based entirely on Friedman and Schwartz’s own money stock figures.

Velocity Analysis

The 1982 volume that Ericsson, Hendry, and Hood are critiquing was initially supposed to be the first of two volumes looking at the relationship between money and other economic variables. Monetary Trends, as the first of these, looks at those relationships over the long run. The second volume was going to take up the relationship between money and other economic variables over the business cycle, but by the time Monetary Trends appeared, Friedman and Schwartz had unfortunately abandoned this final volume.

Monetary Trends, in its analysis of the factors affecting the demand for money, employs the well-known equation of exchange: MV = Py. The variable y captures the impact of real income or output on the real demand for money (M/P), whereas velocity (V) is a residual variable. This makes the equation of exchange an identity, true by definition, with velocity reflecting all factors other than real income that affect money demand and the price level. If velocity falls, ceteris paribus, the demand for money rises, and vice versa. Much of the early debate between Keynesians and Monetarists was about the behavior of velocity, with Friedman long contending that it had predictable relationship with a small number of other variables.

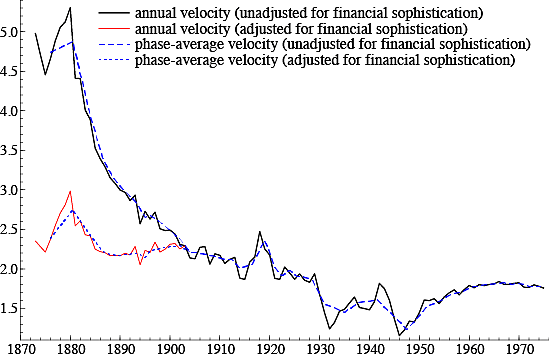

The Ericsson, Hendry, and Hood online critique of Friedman and Schwartz displays a striking chart showing the level of velocity in the U.S. from 1872 to 1975. It contains two sets of lines, one showing a much more drastic decline in velocity over the long run than the other.

The set with the least drastic decline is from Monetary Trends (p. 186) and, as the VOX authors report, results from Friedman and Schwartz "adjusting the US money stock series by a linear trend of 2.5% per annum for observations before 1903, with no trend adjustment thereafter.” In other words, Friedman and Schwartz derived a more stable linear trend for velocity by adjusting upward their money stock figures between 1867 and 1903 and then re-calculating velocity. The VOX post continues: "while the unadjusted money stock for 1867 is $1.28 billion, its adjusted value is $3.15 billion: 246% of its original value.”

Although at first glance, this may seem like a drastic and perhaps unwarranted adjustment, it becomes far less so in the face of several observations.

Relying on Friedman and Schwartz to Criticize Friedman and Schwartz

The raw, unadjusted number of $1.28 billion for the total money stock in 1867 also appears in Friedman and Schwartz’s Monetary Trends (p. 122). It is exactly the same number in their earlier Monetary Statistics (p. 61) and (with trivial differences arising from timing) approximately the same number reported in Monetary History (p. 704; $1.31 billion). All these estimates are for the old M2, and it is only in Monetary Trends that Friedman and Schwartz make the adjustment criticized in the VOX post.

In other words, the authors of the VOX post, as they freely admit, had to rely on Friedman and Schwartz’s own money stock estimates to create the unadjusted estimates of velocity that appear in their graph. Moreover, reading from their graph, their unadjusted series for velocity is roughly identical to velocity series used in Friedman and Schwartz’s older Monetary History (p. 774).

There was absolutely nothing deceptive about the Friedman and Schwartz velocity adjustments in Monetary Trends. Friedman and Schwartz describe in lengthy detail (pp. 216-218) how they made the adjustments and, contrary to the impression left by the VOX authors, provide a persuasive rationale for doing so. Thus, the real question is not whether Friedman and Schwartz’s data was faulty. It is whether their subsequent analysis was correct.

Financial Sophistication

What was the rationale for these adjustments? Friedman and Schwartz noticed a huge difference in the long-run velocity trend for M2 between the U.K. and U.S. during the second half of 19th century, whereas the long run trend was similar in both countries thereafter. They attributed this difference to greater financial sophistication in the U.K. relative to the U.S. as of 1867, with the U.S. converging to the U.K. level over the next half century. As Friedman and Schwartz put it, “the more rapid spread of financial institutions in the United States than in the United Kingdom after 1880 was probably the main reason for the near elimination by 1903 of the wide difference in velocity that prevailed in 1876-77” (p. 216). In other words, increased financial sophistication in the U.S. was generating an increased demand for money as measured by M2, with a concomitant fall in velocity.

Friedman and Schwartz are not the only scholars who have noticed this difference or have tried to explain it. The alternative but complementary explanation that I find the most plausible is provided by Richard Timberlake in chapter 9 of his Monetary Policy in the United States: An Intellectual and Institutional History (1993). He attributes the high velocity (or low demand) for M2 at the end of the Civil War to the shortages of official currency in small denominations that plagued the U.S. economy at that time.

He points out that “denominational hindrances encouraged swaps, barter, payment in kind, and use of unaccounted and unaccountable moneys to a much greater degree than . . . can be measured” (p. 125). Consequently, the measured money stock was not capturing all transactions in the U.S. To give just two examples, privately issued “shinplasters” used as money were quite common during this period, and the prevalence of sharecropping, essentially a barter transaction, throughout the southern states was in large part the result of postwar debilities in the South's financial system. Notice that Timberlake’s alternate explanation gives an even more straightforward justification for adjusting the money stock upward.

Isolating a Bone of Contention

Whatever the explanation for the drastic decline in velocity in the U.S., why did Friedman and Schwartz adjust their series to eliminate this effect?

The primary answer is that they wanted to isolate the impact of interest rates on velocity. After all, this was a major bone of contention between Monetarists and Keynesians. Even today, many macro models assume, implicitly or explicitly, that interest rates are the dominant, if not the only, factor affecting velocity.

This is not to claim that Friedman and Schwartz’s adjustment is necessarily the best approach to this question. But there is certainly nothing illegitimate or misleading about what they did.

Cyclical Variability

Ericsson, Hendry, and Hood also offer some sophisticated econometric criticisms that apply to Friedman and Schwartz's entire velocity series through 1975 and not just to the period prior to 1902. For instance, the VOX authors point out that Friedman and Schwartz "also employed data adjustment to remove cyclical variability.”

Removing cyclical variability was fully justified, given that Friedman and Schwartz were interested in long-run relationships in this volume and had intended to take up cyclical relationships in the never-completed final volume. But the VOX authors show in their graph that the statistical technique employed failed to "fully eliminate the data’s short-run variability [emphasis mine].”

In this case, their almost contradictory complaint is that Friedman and Schwartz did not adjust their data series enough.

Esoteric Debate

More significant, Ericsson, Hendry, and Hood also argue that these data adjustments undermined Friedman and Schwartz's "empirical model constancy and goodness of fit.” I don’t think it is necessary to get into these arcane statistical quibbles. It is sufficient to point out that econometric techniques have seen major innovations since Monetary Trends was published in 1982 and that even the volume's initial publication witnessed debates about its statistical methodology. For example, Thomas Mayer raised such issues as early as his overall favorable review of Monetary Trends in the December 1982 issue of the Journal of Economic Literature.

Ultimately, the VOX article criticism boils down to the claim that a “random walk model” provides a better fit. Given that Friedman and Schwartz never contended that velocity was perfectly constant, notice how the argument has been reduced to an esoteric debate about the best statistical techniques for analyzing velocity’s behavior.

Moot Modeling

Finally, there is an important sense in which these technical questions about how to precisely model velocity have become somewhat moot. Everyone recognizes that the financial deregulation of the 1980s caused the velocity of money to behave in unpredictable ways. Friedman himself conceded as much in, among other places, a Wall Street Journal article on August 19, 2003. This led to the widespread abandonment of monetary targeting by central banks (to the extent that they ever actually practiced it). Indeed, it is one of the reasons Friedman altered his preferred monetary policy from increasing M2 at some fixed rate to instead freezing the monetary base while permitting banks to issue banknotes.

Conclusion

To sum up, claiming that Friedman and Schwartz “fudged their data” or “cooked their numbers” is a gross misrepresentation. Even critics of their theoretical conclusions rely on their raw numbers. Friedman and Schwartz can be challenged on minor econometric issues, particularly their analysis of velocity’s behavior. But the erratic behavior of velocity beginning in the 1980s has diminished the relevance of even these questions. In contrast, Friedman and Schwartz's estimates of the money stock in the U.S. (prior to the Fed’s reporting those numbers) not only remain the best we are likely ever to have but set a standard for historical and statistical research that has been rarely, if ever, matched.