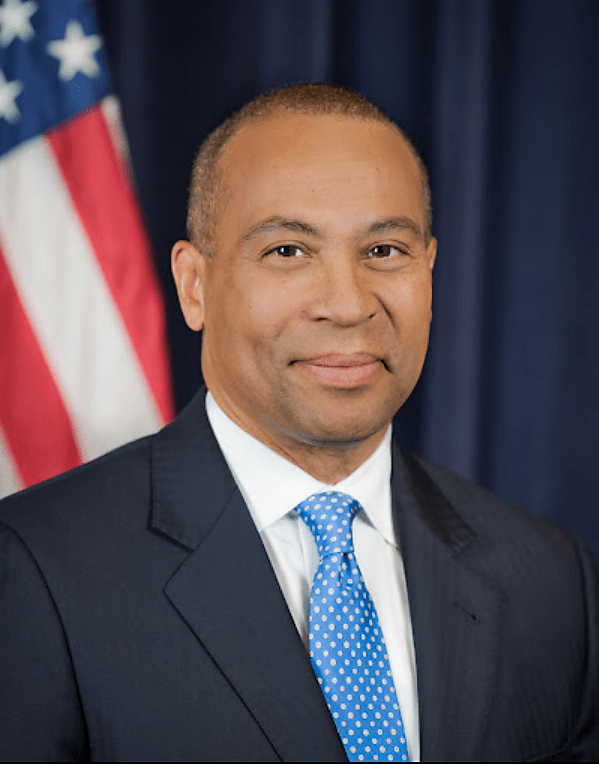

Deval Patrick announced that he is entering the 2020 race for the White House. Patrick was a Democratic governor of Massachusetts from 2007 to 2015.

Cato scores the nation’s governors every two years on their fiscal policy records, assigning grades of “A” to “F” from a limited-government perspective. We assigned Patrick an “F” in 2014, a “B“ in 2012, and a “D” in 2010. The grades cover tax and spending policies only, not other economic policies.

Here’s what we concluded on the 2014 report:

Governor Patrick’s low score results mainly from his record of proposed and enacted tax increases. In 2012 he proposed higher taxes on cigarettes and corporations. In 2013 he signed into law increases in sales taxes, cigarette taxes, and gas taxes. The cigarette tax was increased by $1 per pack. The same year, he proposed a large income tax increase, which would have raised the individual rate from 5.25 to 6.25 percent. The plan would have reduced the sales tax but would have been a large tax increase overall. Luckily for Massachusetts taxpayers, the plan did not pass. In 2014 Patrick proposed higher taxes on corporations and applying the sales tax to candy and soda.

The Cato reports cover overlapping three-year periods. The higher score on the 2012 report stemmed from moderate spending growth at the time and a reduction in the corporate tax rate. The lower grade on the 2010 report resulted mainly from Patrick raising the sales tax rate from 5.0 percent to 6.25 percent and increasing cigarette taxes.

The Cato governor reports are here.