I’m a big fan of the flat tax because a low tax rate and no double taxation will result in faster growth and more upward mobility.

I also like the flat tax because it gets rid of all deductions, credits, exemptions, preferences, exclusions, and other distortions.

And a loophole-free tax code would be a great way of reducing Washington corruption and promoting simplicity.

Moreover, keep in mind that eliminating all favors from the internal revenue code also would be good for growth because people then will make decisions on the basis of what makes economic sense rather than because of peculiar quirks of the tax system.

Sounds great, right?

Well, it’s not quite as simple as it sounds because there’s a debate about how to measure loopholes. Sensible people want a tax code that’s neutral, which means the government doesn’t tilt the playing field. And one of the main implications of this benchmark is that the tax code shouldn’t create a bias against income that is saved and invested. In the world of public finance, this means they favor a neutral “consumption-base” tax system, but that’s simply another way of saying they want income taxed only one time.

Folks on the left, however, are advocates of a “Haig-Simons” tax system, which means they believe that there should be double taxation of all income that is saved and invested. You see this approach from the Joint Committee on Taxation. You see it from the Government Accountability Office. You see it from the Congressional Budget Office. Heck, you even sometimes see Republicans mistakenly use this benchmark.

Let’s look at three examples to see what this means in practice.

Example #1: Because they don’t want a bias that encourages people to spend their income today rather than in the future, advocates of a neutral tax code want to get rid of all double taxation of savings (Canada is moving in that direction). So that means they like IRAs and 401(k)s since those vehicles at least allow some savings to be protected from double taxation.

Proponents of Haig-Simons taxation, by contrast, think that IRAs and 401(k)s are loopholes.

Example #2: Another controversy revolves around the tax treatment of business investment. Advocates of neutral taxation believe in expensing, which is simply the common-sense view that investment expenditures should be recognized when they actually occur.

Proponents of Haig-Simons, however, think that investment expenditures should be “depreciated,” which means companies are forced to pretend that most of their investment costs which are incurred today actually take place in future years.

Example #3: Supporters of neutral taxation think capital gains taxes should be abolished because there already is tax on the income generated by assets such as stocks and bonds. So the “preferential rates” in the current system aren’t a loophole, but instead should be viewed as the partial mitigation of a penalty.

Proponents of Haig-Simons, not surprisingly, have the opposite view. Not only do they want to double tax capital gains, they also want them fully taxed, which would mean an economically jarring jump in the tax rate of more than 15 percentage points.

Now, having provided all this background information, let’s finally get to today’s topic.

If you’ve been following the presidential campaign, you’ll be aware that there’s a controversy over something called “carried interest.” It’s a wonky tax issue that seems very complicated, so I’m very happy that the Center for Freedom and Prosperity has produced a video that cuts through all the jargon and explains in a very clear and concise fashion that it’s really just an effort by some people to increase the capital gains tax.

There are four points from the video that deserve special emphasis.

- Partnerships are voluntary agreements between consenting adults, and both parties concur that carried interest helps create a good incentive structure for productive investment.

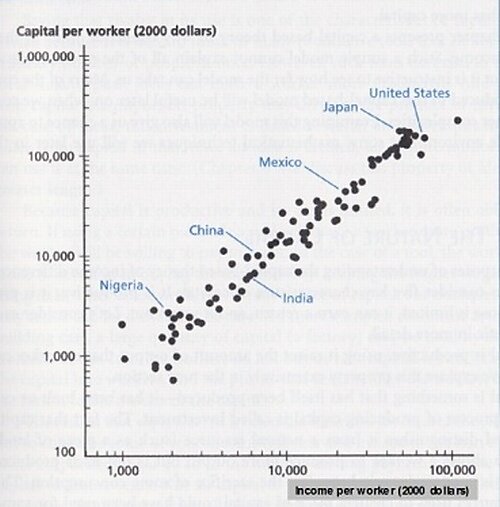

- Capital formation is very important for growth, which is one of the reasons why there shouldn’t be any capital gains tax.

- A capital gain doesn’t magically become labor income just because an investor decides to share a portion of the gain with a fund manager.

- An increase in the tax on carried interest would be the camel’s nose under the tent for more broad-based increases in the tax burden on capital gains.

By the way, I liked that the video also took a gentle swipe at some of the ignorant politicians who want to boost the tax burden on carried interest. They claim they’re going after hedge funds, when the tax actually is much more targeted at private equity partnerships.

But what really matters is not the ignorance of politicians. Instead, we should be focused on whether tax policy is being needlessly destructive because of high — and duplicative — taxes on saving and investment.

Such levies would reduce investment. And that means lower levels of productivity and concomitantly lower wages.

In other words, ordinary people will suffer a lot of collateral damage if this tax-the-rich scheme for carried interest is implemented.