I blogged about how Canadian government spending cuts since the mid-1990s coincided with strong economic growth.

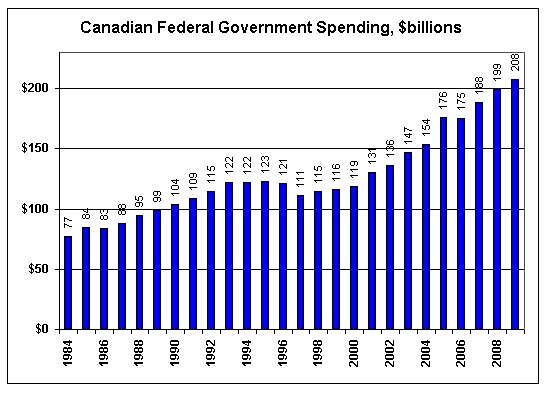

Let’s take a closer look at the spending cuts. The chart shows Canadian federal spending from 1984 to 2009 in actual, or nominal, dollars. Spending includes all “discretionary” and “entitlement” programs, as we would call them, but excludes interest payments. (Data are here).

Spending peaked in the early 1990s, and it relied on massive deficit finance. As a result, interest costs were spiralling out of control. The prime minister and his finance minister–members of the center-left Liberal Party–decided to reverse course and start cutting.

They cut spending from $123 billion in in 1995 to $111 billion in 1997, a 10 percent reduction. Then they held spending at roughly the lower level for another three years. With the Canadian economy growing–due to pro-market reforms such as free trade with the United States–this amount of restraint was enough to start a virtuous cycle of falling interest costs and a shrinking government as a share of GDP.

Cutting total non-interest spending by 10 percent would be like cutting President Obama’s 2011 annual budget by $360 billion. Cato analysts could do that pretty easily, but for some reason American politicians–even of the conservative variety–so far seem to be alot more spineless than the politicians elected by Celine Dion and Anne Murray.

Canadian spending did grow during the past decade, but much less than U.S. government spending. Between 2000 and 2009, total Canadian federal spending increased 47 percent, but total U.S. federal spending rose 97 percent.

From a libertarian point of view, Canada’s spending cuts were modest. But the Canadian experience illustrates that a lot of progress can made if even modest cuts are made and then spending is constrained to grow at a slower rate than the overall economy.

For more on the Canadian fiscal reforms, see The Canadian Century by Brian Lee Crowley, Jason Clemens, and Niels Veldhuis.