U.S. Treasury Secretary Janet Yellen recently complained about a “30-year race to the bottom on corporate tax rates,” and is pushing for a higher U.S. rate and a global minimum rate. Yellen wants to make sure that corporate taxes “raise sufficient revenue to invest in essential public goods and respond to crises.” Economist Gabriel Zucman approved of the proposed tax hike, saying corporations should “pay more in taxes, instead of them paying less and less.”

Zucman’s claim about “less and less” is incorrect when looking across the major economies in recent decades. The New York Times charts the OECD average corporate tax revenues as a percent of GDP since 1965 here. The percent has trended upward since the mid-1980s, although it is currently below the 2007 peak.

The OECD has added new member countries over the years and data is not available for all countries in earlier years, so the NYT average includes different countries in different years. To calculate a more consistent average, I narrowed the group of countries to 22 that have good data back to 1980. For the same 22 countries, I calculated the average corporate tax rate, which for all countries includes the federal plus the state or provincial tax rates. The data is mainly from the OECD, as discussed below.

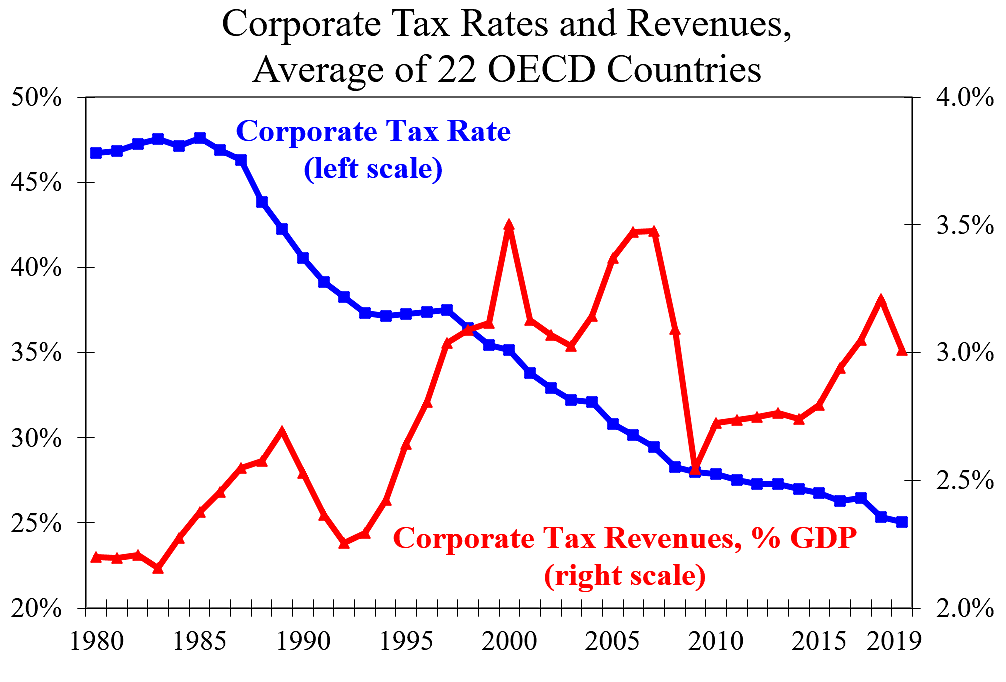

The chart below shows the average corporate tax rate and average corporate tax revenues as a percent of GDP for 22 countries. The average rate fell from 47 percent in 1980 to 25 percent in 2019. As a consequence, Yellen or Zucman might think that corporate tax revenues would have fallen. But corporate tax revenues are up substantially since the 1980s. Corporate tax revenues for the 22 countries rose from 2.2 percent in 1980 to 3.0 percent in 2019.

Of course, revenues follow business cycles. Revenues rose during the 1990s boom, fell during the recession in 2009, and then rose again as economies recovered. When economies grow, governments win as tax revenues rise.

The longer-term trend can be seen in decade averages. Corporate tax revenues for the 22 countries averaged 2.4 percent in the 1980s, 2.7 percent in the 1990s, 3.2 percent in the 2000s, and 2.9 percent in the 2010s. Revenues were down a bit in the 2010s from the 2000s, but they were up from the 1980s and 1990s when rates were much higher. The average corporate tax rate was 46.2 percent in the 1980s, 37.5 percent in the 1990s, 31.3 percent in the 2000s, and 26.7 percent in the 2010s.

When tax rates fall, the tax base expands as corporations increase real activities and report more income. Countries have also legislated changes in corporate tax bases. Yellen seems to worry that the “30-year race” resulted in a shortage of “sufficient revenue,” but that is not what actually happened.

What about the United States? As a share of GDP, U.S. federal-state corporate tax revenues were 2.1 percent in the 1980s, 2.2 percent in the 1990s, 2.1 percent in the 2000s, 1.9 percent from 2010–2017, and 1.0 percent in 2018 and 2019. U.S. corporate tax revenues were stable for decades, but then dropped sharply due to the Trump corporate tax cut.

What is amazing about the stability of U.S. corporate tax revenues when measured against GDP is that a large share of U.S. GDP has moved from corporations that pay corporate tax (C corporations) to other business structures. In the early 1980s, three-quarters of U.S. business income was earned by C corporations (Figure 1), but that share has dropped more recently to less than half. Despite the declining importance of C corporations in the economy, their tax revenues as a percent of GDP was fairly flat from the 1980s until the Trump cuts. By the way, I support the Trump corporate tax cuts regardless of the near-term revenue effects.

In sum, corporate tax revenues are higher today than they were during the 1980s and early 1990s across major economies, even though corporate tax rates are much lower. Rather than creating some sort of social loss, as Yellen and others seem to believe, the reduction in corporate tax rates has been a win-win-win for businesses, governments, and workers. Workers benefit from lower rates because corporate investment raises their productivity and wages, as discussed here.

The win-win-win is possible because the corporate income tax is the most damaging major tax. OECD economists studied different types of taxes and concluded, “Corporate taxes are found to be most harmful for growth.” Thus, it would be beneficial to cut corporate tax rates and replace any lost revenue with increases in other less-damaging taxes. But OECD countries have not had to make that trade-off because cutting corporate tax rates from the previous high levels has generally not resulted in governments losing revenues.

Data Notes

The 22 countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Korea, Luxembourg, Netherlands, New Zealand, Spain, Sweden, Switzerland, Turkey, United Kingdom, and the United States.

Data on corporate tax revenues are here and in Table 3.9 here. Australia was missing 2019 so I used 2018.

The corporate tax rates are the OECD figures for the combined national and subnational rates. OECD has data back to 2000 on its site. Previously it posted data back to 1981, which I have in a spreadsheet.

Using data from a University of Michigan dataset, I filled in tax rates for 1980 for all countries, and I filled in data for missing early years for Korea and Turkey. For Korea and Luxembourg, I estimated the subcentral rates for the early years.