President Biden’s proposed budget for 2023 released Monday reveals strong growth in federal tax revenues. This is good news. If policymakers now put some focus on spending restraint, they can reduce the government’s dangerously high deficit levels.

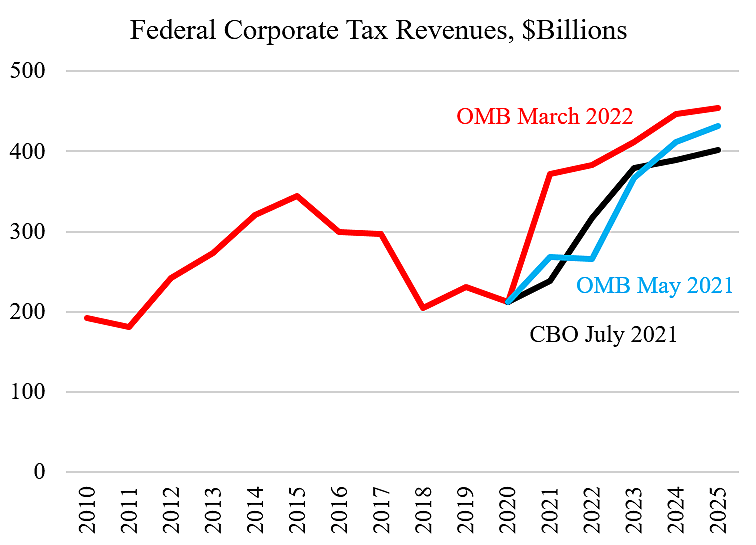

The revenue surge came as a surprise to government economists. The chart below compares the new Office of Management and Budget March 2022 baseline projections to prior baseline projections from the OMB in May 2021 and the Congressional Budget Office in July 2021. These are fiscal years.

The chart shows that revenues fell in 2018 due to the Republican Tax Cuts and Jobs Act. The TCJA slashed the corporate tax rate from 35 percent to 21 percent, although it also broadened the corporate tax base. On net, congressional estimators figured that the government would lose an average $76 billion a year the first four years (2018 to 2021), and then the government would start gaining revenues after 2022. (This is for the “business” and “international” provisions of the TCJA).

Corporate tax revenues were down from 2018 to 2020, but then soared in 2021. Revenues in 2021 of $372 billion (with a 21 percent tax rate) are 25 percent higher than revenues in 2017 of $297 billion (with a 35 percent tax rate). Looking ahead to 2025, corporate tax revenues are now expected to be 53 percent higher than they were in 2017. This is the baseline projection without any law changes.

Part of the current upward trend stems from a provision in the TCJA to apply tax one-time to previously untaxed foreign earnings, and revenues are expected to flatline after 2025. Nonetheless, the strength of corporate tax revenues is impressive as reflected in the upward shift in the baseline. Biden’s proposed tax hikes are not needed for the government to enjoy robust corporate tax revenues.

With the TCJA, we’re learning that a lower corporate tax rate is consistent with strong corporate tax revenues. The TCJA included various base broadeners, but lower rates also broaden bases automatically through reduced tax avoidance and higher economic activity. Other nations have learned the same lesson. Keeping the corporate tax rate low is a winner for businesses and workers, but it can also be a winner for government budgets.