The Wall Street Journal just offered two articles in one day touting Robert Shiller’s cyclically adjusted price/earnings ratio (CAPE). One of then, “Smart Moves in a Pricey Stock Market” by Jonathan Clements, concludes that, “U.S. shares arguably have been overpriced for much of the past 25 years.” Identical warnings keep appearing, year after year, despite being endlessly wrong.

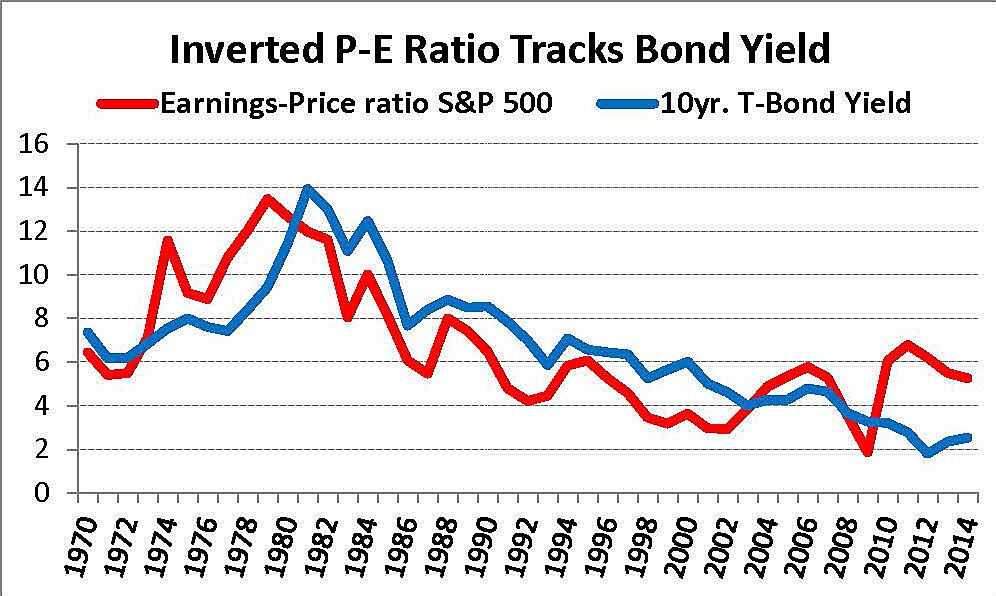

The Shiller CAPE assumes the P/E ratio must revert to some heroic 1881–2014 average of 16.6 (or, in Clements’ account, a 1946–1990 average of 15). That assumption is completely inconsistent with the so‐called “Fed model” observation that the inverted P/E ratio (the E/P ratio or earnings yield) normally tracks the 10 year bond yield surprisingly closely. From 1970 to 2014, the average E/P ratio was 6.62 and the average 10‐Year bond yield was 6.77.

When I first introduced this “Fed Model” relationship to Wall Street consulting clients in “The Stock Market Like Bonds,” March 1991, I suggested bonds yields were about to fall because a falling E/P commonly preceded falling bond yields. And when the E/P turned up in 1993, bond yield obligingly jumped in 1994.

Since 2010, the E/P ratio has been unusually high relative to bond yields, which means the P/E ratio has been unusually low. The gap between the earnings yield and bond yield rose from 2.8 percentage points in 2010 to a peak of 4.4 in 2012. Recylcing my 1991 analysis, the wide 2012 gap suggested the stock market thought bond yields would rise, as they did –from 1.8% in in 2012 to 2.35% in 2013 and 2.54% in 2014.

On May 1, the trailing P/E ratio for the S&P 500 was 20.61, which translates into an E/P ratio of 4.85 (1 divided by 20.61). That is still high relative to a 10‐year bond yield of 2.12%. If the P/E fell to 15, as Shiller fans always predict, the E/P ratio would be 6.7 which would indeed get us close to the Shiller “buy” signal of 6.47 in 1990. But the 10‐year bond yield in 1990 was 8.4%. And the P/E ratio was so depressed because Texas crude jumped from $16 in late June 1990 to nearly $40 after Iraq invaded Kuwait. Oil price spikes always end in recession, including 2008.

Today’s wide 2.7 point gap between the high E/P ratio and low bond yield will not be closed by shoving the P/E ratio back down to Mr. Shiller’s idyllic level of the 1990 recession. It is far more likely that the gap will be narrowed by bond yields rising.