If you were expecting big steps forward on the Higher Education Act from the House Committee on Education and Labor, prepare to be disappointed. Yesterday, the Democratic majority released the College Affordability Act—which for some reason says “Est. 2019”—and it delivers pretty much what we’ve seen established since about 1969: A general conviction that what higher ed mainly needs is more government money…and no openly for-profit schools.

The centerpieces of the bill are federal funds to encourage states to make community colleges free, increases in Pell Grants, cheaper student loans, and cracking down “on predatory for-profit colleges.” Let’s look at each of these very briefly.

Free Community College

The nearly 1,200 page bill, which committee staffers estimate would cost about $400 billion over 10 years, would offer funds to states that agreed to make their community colleges tuition-and-fee free while at least holding steady other higher ed funding. The bill sets up quickly escalating appropriations for this starting at about $1.6 billion in 2021, peaking at $16.3 billion in 2030.

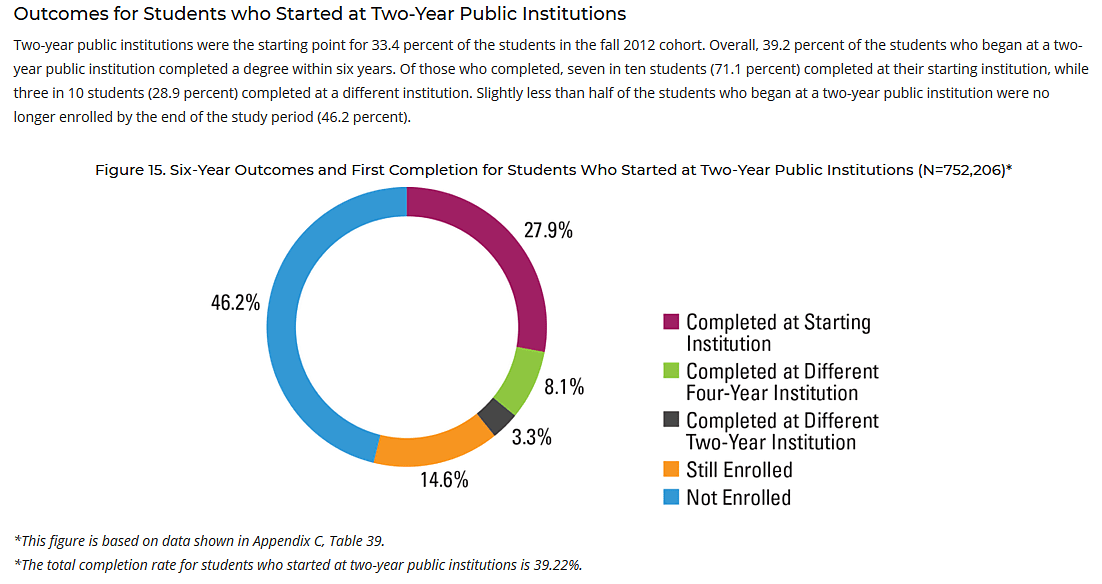

This is short of the free four-year college plans that some Democrats, especially on the campaign trail, are talking about, but it would nonetheless be a new federal effort to incentivize “free” college. But not only is the national debt approaching $23 trillion—where will the federal money come from?—states have major budget constraints of their own. Perhaps even more important, community college appears to be a poor investment, with the National Student Clearinghouse reporting that the share of students completing public 2‑year programs in 6 years is an anemic 39 percent.

Increased Pell

There is little question that student aid has enabled colleges to increase prices—it’s baked right into them. Pell Grants are one band of a rainbow of aid sources, which also includes federal loans, work study, institutional grants, and more. This bill would increase the maximum Pell from $6,695 in 2021 to an estimated $8,305 by 2029. To put that in perspective, the average sticker price at a public four-year institution in the 2018–19 school year was $10,230.

Cheaper Student Loans

This bill would also goose student loans by providing more generous terms; exempting from repayment in income-based plans income under 250 percent of the poverty line (it is currently 150 percent); eliminating loan origination fees; and more. We need less generous aid in order to slow artificially fueled price inflation, as well as incredibly wasteful consumption—yes, waterparks, but also non-learning—and this does the opposite.

For-profit Colleges

Colleges run explicitly for profit—almost all institutions actually seek it—have long been an outsized target of politicians. This bill keeps it up by reinforcing “gainful employment” rules targeted at for-profit schools, despite the fact that most people who go to any college do so to get a job, and enrollment at for-profits has been roughly halved since 2010. It also goes after the “90–10” rule, which requires a school to get no more than 90 percent of its revenue via federal student aid but currently exempts the G.I. Bill. 90 percent is, of course, a lot of revenue to come via taxpayers, but for context one needs to remember that for-profit colleges do not get big direct subsidies like public institutions, or tax-favored donations like publics and private, non-profits. Oh, and unlike those other sectors, for-profits pay taxes.

This is in no way to suggest that admittedly for-profit higher education works well—it does not—but the whole, massively subsidized system is broken. Unfortunately, this bill would only make matters worse.