The Congressional Budget Office has released new projections for the federal budget. Much has changed since CBO’s last outlook in July 2021, including soaring inflation, the war in Ukraine, and new spending passed by Congress. The new outlook shows higher debt and deficits over the coming decade, and it underscores the need for policymakers to sharply change budget direction.

Debt held by the public is expected to rise from 98 percent of gross domestic product (GDP) this year to 110 percent by 2032, which would be the highest in U.S. history. The deficit will dip to $984 billion in 2023, and then start rising relentlessly to reach $2.3 trillion by 2032. The CBO notes that legislative changes since their last outlook—mainly the infrastructure bill—increased projected deficits by $2.4 trillion over the coming decade. So we are headed for the highest debt in history, and Congress keeps on boosting spending.

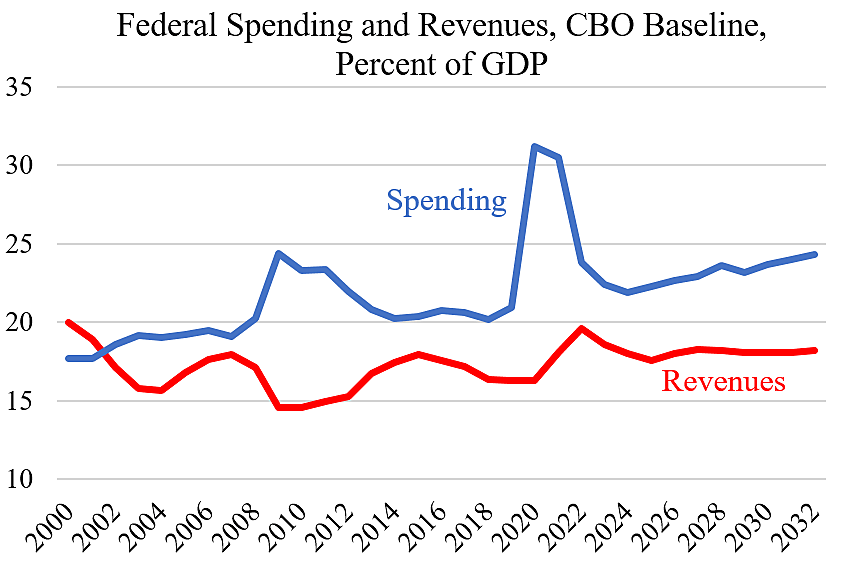

The chart below shows federal spending and revenues as a percent of GDP, including CBO’s baseline projection. Spending peaked during the recession in 2009 at 24.4 percent then declined, and then it peaked again at 30.5 percent in 2021 during the pandemic. Spending is now declining but is expected to start rising steadily after 2024.

CBO projects federal spending to hit 24.3 percent in 2032, which would be up from 17.7 percent back in 2000. Thus, without reforms, federal spending in 2032 will consume a 37 percent larger share of the economy than under President Bill Clinton. And that assumes we don’t have further crises, recessions, wars, and new spending programs—none of which are included in the CBO baseline.

Federal revenues are expected to rise above 18 percent of GDP in coming years, which the CBO notes is above the average over the past five decades. The chart shows that revenues dipped after the 2017 Tax Cuts and Jobs Act (TCJA), but that dip was temporary. CBO expects that revenues in coming years will be solidly above the pre-TCJA level in 2017 of 17.2 percent.

The government’s huge deficit spending is damaging the economy. It is likely adding to today’s high inflation, and thus undermining the living standards of every family. Also, government debt above about 90 percent of GDP tends to reduce economic growth, and federal debt has surged above that level. And we know from international experience that high and rising government debt can trigger financial crises and recessions that take years to heal.

So what will the Biden administration and Congress do about the new CBO projections? The new figures show that revenues are buoyant but spending is abnormally high. Even if the economy continues to grow as CBO projects, we still face annual deficits topping $2 trillion by 2031. Republicans and Democrats should take deficits seriously, they should recognize that CBO’s projections are optimistic in many ways, and they should start cutting low-value spending programs in every federal department.