Cato has released the 16th biennial Fiscal Report Card on America’s Governors. The report grades the governors on their tax and spending records since 2020. Governors who have restrained taxes and spending receive higher grades, while those who have increased taxes and spending receive lower grades.

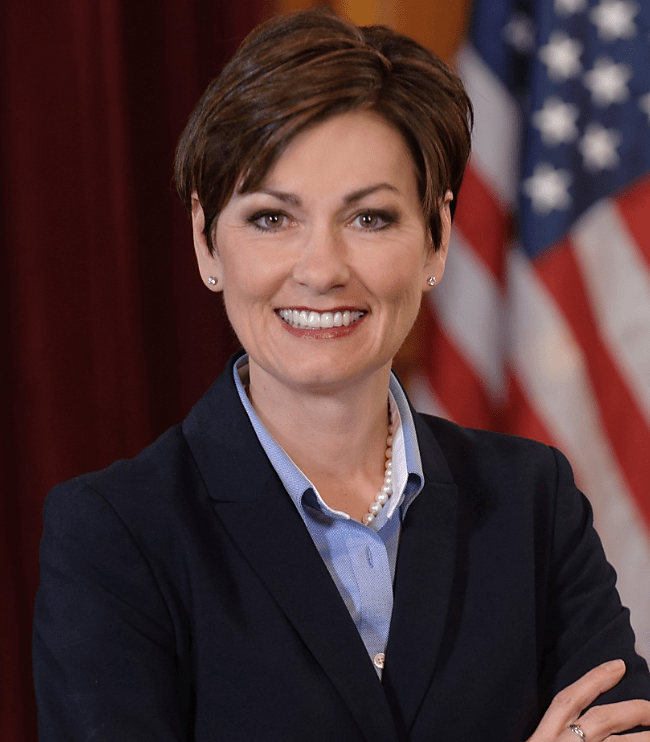

Five governors were awarded an A: Kim Reynolds of Iowa, Chris Sununu of New Hampshire, Pete Ricketts of Nebraska, Brad Little of Idaho, and Doug Ducey of Arizona.

These governors have led the largest wave of state tax-cutting in more than four decades. As discussed in the study, 21 states have cut individual or corporate income tax rates since 2020.

Kim Reynolds of Iowa is the highest-scoring governor. She has held the line on spending and signed into law a series of impressive tax reforms since entering office in 2017.

The report discusses each governor and looks at trends in state fiscal policy. State budgets are flush with revenues despite the wave of tax cutting. One reason is that many states have expanded tax bases to include revenues from marijuana, gaming, and online sales.

The report also looks at the continued migration of Americans from higher-tax to lower-tax states. High-earners seem particularly drawn to lower-tax states, which is one reason why many governors are focusing on cutting top income tax rates.

The report card by Chris Edwards and Ilana Blumsack is here.

A National Review piece summarizing the study results is here.