Democrats are proposing to raise capital gains taxes. Ranking member on the Senate Finance Committee, Ron Wyden, wants to tax capital gains on an annual basis, not the current realization basis. He also wants to hike the top capital gains tax rate for high earners to match the top rate on ordinary income. CNBC reports “Almost every major Democratic presidential candidate supports taxing capital gains as ordinary income …Sen. Elizabeth Warren on Thursday outlined an even more aggressive planthat would impose a new 14.8 percent tax on investment income to help finance Social Security.”

These are radical and misguided ideas. This 2012 study discusses why capital gains taxes should be low or even zero. The study found that the United States already has high tax rates compared to other countries. The U.S. federal-state rate on individual long-term gains of 28 percent compared at the time to an average across 34 OECD countries of just 16 percent.

A 2018 study by OECD economists provides newer data for 33 countries. One finding is that “all countries tax capital gains on realization,” that is, when assets such corporate shares are sold. Not one of the 33 countries taxes gains on an annual or accrual basis, as Wyden proposes.

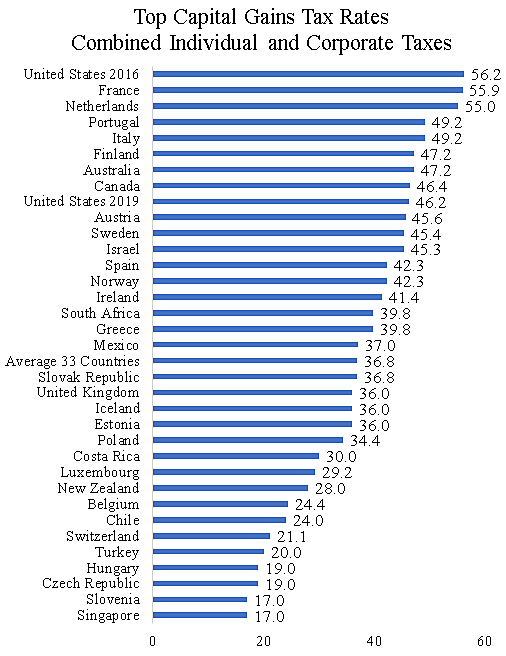

The OECD study calculates the combined federal-state capital gains tax rates on investments in corporations in 2016, which are shown in the chart below. The calculation includes the corporate-level income tax and the tax on individual long-term gains.

The study found that the United States had the highest capital gains tax rate of all 33 countries at 56.2 percent. That rate is the combo of a 38.9 percent federal-state corporate tax and an individual federal-state capital gains tax of 28.3 percent (which is applied to the after-tax corporate income).

Numerous countries in the OECD study do not tax individual long-term capital gains at all, including Belgium, Chile, Costa Rica, Czech Republic, Hungary, Luxembourg, New Zealand, Singapore, Slovenia, Switzerland, Turkey. The individual capital gains tax rate on long-term investments in those countries is zero.

Since the study, the U.S. has dropped its federal corporate tax rate from 35 percent to 21 percent, so I’ve added a bar in the chart to show the U.S. rate in 2019. The new lower U.S. rate of 46.2 percent is still the 8th highest among the 33 countries.

The Democrats would repeal most or all of the GOP corporate tax cut and push the individual capital gains tax rate higher. What they are proposing is extreme. Other advanced economies have low capital gains taxes for sound reasons, as discussed here. Raising the federal corporate and individual capital gains tax rates would be a lose-lose-lose proposition of harming businesses and start-ups, undermining worker opportunities, and likely reducing government revenues.