We’ve had huge federal deficit spending in recent years–$459 billion in FY2008, $1.4 trillion in FY2009, $1.5 trillion in FY2010, and now an estimated $1.4 trillion in FY2011. Despite all the spending, the economy is still sluggish, private investment remains in the tank, and the unemployment rate is stuck at near 10 percent.

The Bush/Obama Keynesian spending experiment has obviously failed. Yet eminent economists Paul Krugman and Martin Feldstein think that the government hasn’t spent enough. They argue that a war-sized package of fresh spending is what the doctor orders for our sick economy.

If big government spending really did spur economic growth, then the Canadian economy would be flat on its back and dying. But the Canadian economy boomed during the 1990s and 2000s as government spending was dramatically reduced.

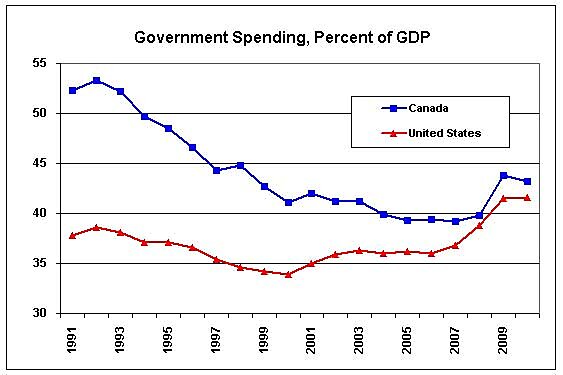

In the early 1990s, overspending had pushed the size of the Canadian government to 53 percent of GDP, and government debt was spiralling upward. But the nation turned course and began cutting spending and making pro-market reforms such as privatization and tax rate cuts. The chart shows that Canadian government spending was chopped by more than 10 percent of GDP. (Data from Table 25).

As spending was cut, the Canadian economy boomed. Average annual growth matched U.S. growth from the mid-1990s until the recent recession (See Table 1). Canada made a mistake in passing a spending stimulus last year, which pushed up spending temporarily, but government spending is expected to fall again and the economy has already returned to solid growth.

U.S. policymakers would be advised to ignore the Keynesian theoreticians who seem intent on bankrupting the nation. Instead they should take lessons from the success of the Canadian model of spending cuts, balanced budgets, debt reduction, open international trading and investment, sound banking, privatization, and corporate tax rate cuts.