This year marks the thirteenth time since 1954 that the Federal Reserve Board’s policy-making Federal Open Market Committee (FOMC) began gradually ratcheting up the federal funds rate on bank reserves in a series of recurring steps. Eventually, however, the rate increases always stopped and the FOMC began bringing the “fed funds rate” back down.

The inevitable series of interest rate reductions most often did not begin until recession had already begun, or too shortly before, so those monetary policy experiments are now looked back on as “hard landings.”

Whenever the rate increases stopped in time to avoid a recession, we call that a “soft landing.” Among postwar Federal Reserve interest rates cycles only four have been four soft landings, leaving eight hard landings so far.

It is important to note that soft landings always required bringing the federal funds rate back down, not merely stopping the rate increases:

- The fed funds rate was increased from 3.9% in January 1965 to 5.8% by November 1966, but then it was reduced to 2.9% by July 1967.

- The fed funds rate was increased from 8.5% in February 1983 to 11.6% in August 1984, but then it was reduced to 7.5% by June 1985.

- The fed funds rate was increased from 3.1% in January 1994 to 6% that June, but then it was reduced to 4.6% by January 1999.

- The fed funds rate was increased from 1% in July 2017 to 2.4% in July 2019, but then it was reduced to 1.6% in February 2020 (just before the COVID-19 pandemic struck).

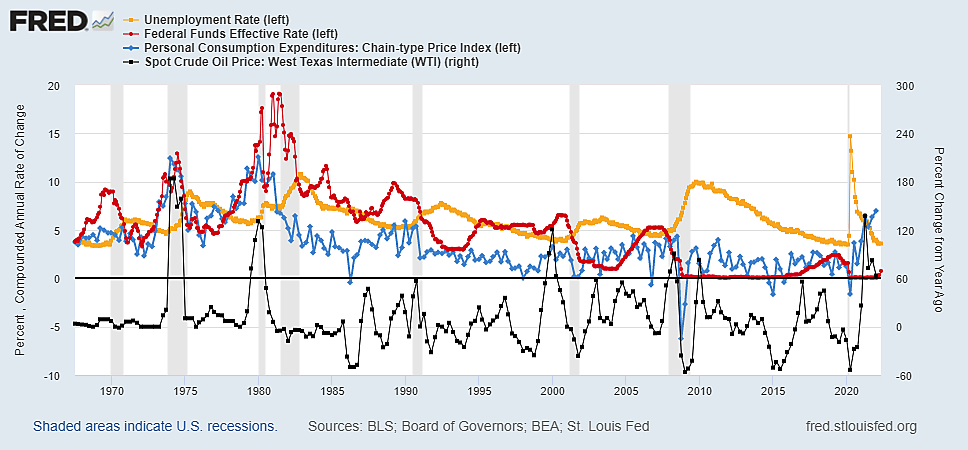

Recessions dates are the shadowy grey vertical bars in the graph.

The federal funds rate is red, the unemployment rate is gold, PCE inflation is blue, and the price of crude oil is black.

Aside from West Texas Intermediate crude oil prices (expressed as a year-to-year percentage change) all other data is in real time – when it happened. Inflation (at an annual rate) and oil prices are quarterly for visual smoothing; the others are monthly.

The red line shows that the fed funds rate peaked in September 1969, July 1974, April 1980, June 1981, March 1989, June 2000, and June 2007. That marked the end of the rising phase of Federal Reserve interest cycles – before rates were reduced.

The black line shows that, like today, we were suffering through 50–100% increases in world oil prices during six of the recessionary fed funds rate peaks (not counting the milder Suez Canal crisis of 1957–58).

The gold line shows that unemployment is an extraordinarily sluggish “lagging indicator” which provides no warning of recessions and usually peaks after recessions have ended. Unemployment was only 4.7% the month before the Great Recession started but 10% four months after it ended.

The blue line is the all-items PCE measure of inflation. It would be inappropriate to use the CPI for long-term historical comparisons The CPI treated fluctuations in mortgage rates as changes in inflation until 1983, making CPI estimates incomparable before and after 1983 (including journalistic comparisons of recent CPI numbers with those of 1980–81).

Since FOMC interest rate cycles always end with the fed funds rate being substantially reduced –often to a rate lower than when the rate increases began– it should not be surprising that significant reductions in inflation commonly ended when the recession ends, with unclear long-term effects (meaning effects from induced recessions rather than from higher interest rates themselves, since they were always reduced).

Since nearly all fed funds rate spikes were also associated with oil price spikes, what happened to overall inflation largely depended on what happened to world oil prices – such as the end of the Iran-Iraq war and the end of Gulf War.

Even core measures of inflation track oil and natural gas prices surprisingly closely because the indirect impact on production and distribution costs is pervasive (such as fertilizers and air fares). Yet changes in the fed funds rate often appear more sensitive to oil prices (or unemployment) than to core inflation per se.

The year-to-year increase in core PCI was 1.7% in June 2000 when the fed funds rate peaked at 6.5% and in November 2002 (a year after the Fed’s first anti-NASDAQ recession) core inflation was still 1.7%. Yet the fed funds rate had fallen to 1.2%. The same measure of core inflation was 2% in July 2007 when the fed funds rate peaked at 5.3%, but it was still 2% in December 2011 when the fed funds rate was 0.1%.

It is impossible to pack so much economic history and so many variables into a single graph, of course, so I am working on a longer narrative covering each fed funds rate cycle in some detail, with references.