America’s Bank, Roger Lowenstein’s

2015 book on the founding of the Fed, is, as I said in reviewing it for Barron’s, both well-written and well-researched. Few pertinent details of the story appear to have escaped Lowenstein’s notice. However, in assembling and interpreting these details, Lowenstein appears not to have entertained the slightest doubt that the Federal Reserve Act, for all the political maneuvering that led to it, was the best of all possible means for ending this nation’s periodic financial crises.Instead of turning a critical eye toward the 1913 Act, Lowenstein writes as if history itself were a reliable judge. What it has condemned he condemns as well; and what it has favored he favors. Consequently he treats all those persons who contributed to the Federal Reserve Act’s passage as right-thinking progressives, while regarding those who favored other solutions to the nation’s currency and banking ills as so many reactionary bumpkins.

That some strains of triumphalism should have found their way into Lowenstein’s account of the Fed’s origins is hardly surprising. Though research by economic historians and others supplies precious little support for it, the view that the Fed has been a smashing success is, after all, a well-established element of conventional wisdom, and one that Fed officials themselves never cease to promote. Nor have those officials ever devoted more effort to doing so than in the course of celebrating the Fed’s recent centennial. Even a much more hard-bitten journalist than Lowenstein could hardly have been expected to resist setting considerable store by an institution so universally (if undeservedly) hallowed.

Still, one might have expected a note of skepticism, if no more than that, to have found its way into America’s Bank. Lowenstein was, after all, writing about an institution that was supposed to end U.S. financial crises once and for all, and doing so in the wake of a crisis at least as bad, in many respects, as those that inspired its creation. (Those who suppose that the Fed did all it could and should have done to combat the recent cataclysm are encouraged to read this, this, this, and this.) He had, furthermore, encountered the many arguments — and most were far from being plainly idiotic — of pre-1913 experts who favored other reforms, as well as those of some of the pending Federal Reserve Act’s critics, who predicted, correctly, that it wouldn’t be long before its results would acutely disappoint those of its champions who sincerely yearned for financial and economic stability.

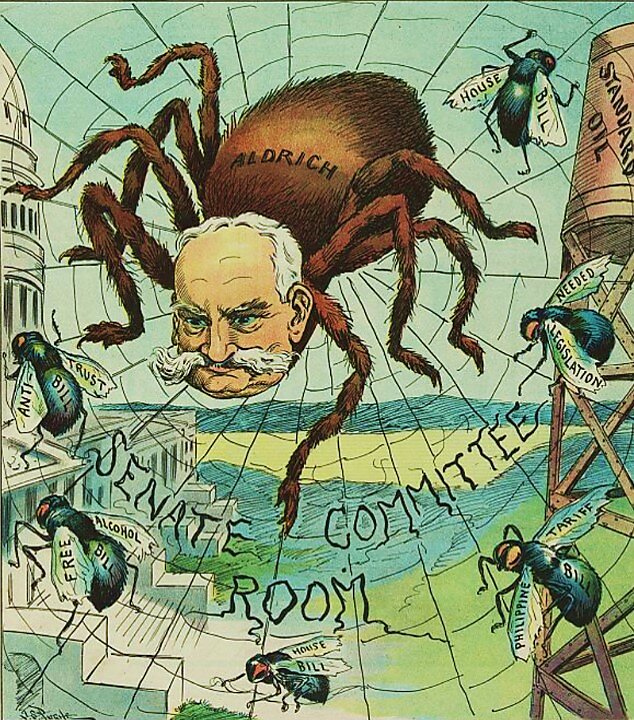

Perhaps most importantly, Lowenstein knew very well that Nelson (“Admit nothing. Explain nothing”) Aldrich, whom he (following Elmus Wicker) rightly regards as the man most responsible for clearing the way for the Fed’s establishment, was the outstanding crony capitalist politician in an epoch when such politicians were thicker on the ground than ever before or since. Although Aldrich presented the plan known by his name, much of which ended up being incorporated into the Federal Reserve Act, as a product of the collective efforts of the National Monetary Commission’s 16 members, the plan was actually one he himself drafted, with the help of several Wall Street bankers, in secret at Jekyll Island. The commission’s other members contributed nothing save their rubber stamp.

It’s wise to view Lowenstein’s assessment of Aldrich’s contribution in light of what other journalists have had to say about the long-serving Rhode Island Senator. Consider, for starters, Lincoln Steffens’ opinion, as expressed by him in a 1908 letter to Teddy Roosevelt. “What I really object to in him,” Steffens wrote, “is something he probably does honestly, out of general conviction. … He represents Wall Street; corrupt and corrupting business; men and Trusts that are forever seeking help, subsidies, privileges from government.”

Bad as this sounds, it’s nothing compared to the portrait muckraking journalist David Graham Phillips drew of Aldrich in The Treason of the Senate, his sulphurous 1906 exposé of an upper-house rife with corruption:

Various senators represent various divisions and subdivisions of this colossus. But Aldrich, rich through franchise grabbing, the intimate of Wall Street’s great robber barons, the father-in-law of the only son of the Rockefeller — Aldrich represents the colossus. Your first impression of many and conflicting interests has disappeared. You now see a single interest, with a single agent-in-chief to execute its single purpose — getting rich at the expense of the labor and the independence of the American people.

“Aldrich’s real work,” Phillips went on to write, consisted of “getting the wishes of his principals, directly or through their lawyers, and putting these wishes into proper form if they are orders for legislation or into the proper channels if they are orders to kill or emasculate legislation.” The work was “all done, of course, behind the scenes.” As chairman of the Senate Finance Committee Aldrich labored to “concoct and sugar-coat the bitter doses for the people — the loot measures and the suffocating of the measures in restraint of loot.”

Although the opinions of Steffens and Phillips might be dismissed as yellow journalism, the same cannot be said for similar verdicts reached by academic historians, including that of Jerome Sternstein, in his article “Corruption in the Gilded Age Senate: Nelson W. Aldrich and the Sugar Trust.” According to Sternstein, “far from insulating the legislative process from big business and reducing the incentives for corruption, the concentration of institutional authority in the hands of senators like Nelson W. Aldrich had precisely the opposite effect”:

Aldrich was wedded ardently to the concept that legislation affecting businessmen should be drawn up in close collaboration with businessmen. … America’s productive economy was not the work of politicians and theorists, but of innovative businessmen making business decisions in a most practical, efficient way. Members of Congress, therefore, had an obligation to clear appropriate legislation with them. Effective lawmaking, he held, especially that required to carry out the Republican gospel of prosperity and economic growth through vigorous state action in the form of protective tariffs and subsidies, was next to impossible otherwise. …

Thanks to his success in achieving the legislative goals of his corporate clients, Aldrich “found money and favors flowing to him. Businessmen did not bribe him, they did not dominate him — they simply rewarded and supported him.” In return for his efforts to shunt monetary reform onto a spur favoring the big Wall Street banks, for instance, Aldrich earned a token of gratitude from Henry P. Davison, a partner in J. P. Morgan & Company, who arranged and took part in the Jekyll Island meeting:

The enclosed [Davison wrote to Aldrich] refers to the stock of the Bankers Trust Company, of which you have been allotted one hundred shares. You will be called upon for payment of $40,000… It will be a pleasure for me to arrange this for you if you would like to have me do so.

I am particularly pleased to have you have this stock, as I believe it will give a good account of itself. I t is selling today on the basis of a little more than $500 a share. I hope, however, you will see fit to put it away, as it should improve with seasoning. Do not bother to read through the enclosed, unless you desire to do so. Just sign your name and return to me.

In view of Aldrich’s notoriety, Lowenstein might have suspected that, whatever its merits, the Aldrich Plan was bound to be compromised by its authors’ desire to look after Wall Street’s interests. He might therefore have entertained the possibility that neither it nor the Federal Reserve Act that drew so heavily from it was ideally suited to putting a stop to financial crises. But rather than proffer a revised (and not-so-triumphant) view of the Fed’s origins, Lowenstein elected instead to revise the record concerning Aldrich himself, turning him into his story’s unlikely hero. Just as some bolting horses supposedly turned Pascal into a religious mystic, the Panic of 1907 “jolted” Aldrich sufficiently, according to Lowenstein, to inspire his conversion, from Wall Street’s Man in Washington to high-minded proponent of monetary reform.

But did it? The facts suggest otherwise. Of the many shortcomings of the pre-Fed currency and banking system, none struck sincere reform proponents of all kinds as being in more dire need of correction than the tendency of the nation’s bank reserves to flow into the coffers of a handful of New York banks during seasons apart from the harvest, combined with the annual (and occasionally mad) harvest-time scramble for those same reserves. That ebb and flow of reserves from countryside to New York City and back again was the sine qua non of the crises that periodically rocked the U.S. economy. Unfortunately, that same ebb and flow was, so far as New York’s major banks themselves were concerned, good business, for it was the source of funds they lent on call to stock investors, by which they made a tidy profit. Any reform that might undermine their status as the ultimate custodians, for most of the year, of the nations’ bank reserves was, so far as they were concerned, anathema.

Until the Panic of 1907, Aldrich was able to satisfy his Wall Street clients simply by blocking — with the help of fellow standpatters — every monetary reform measure that came his committee’s way. The panic changed things, not by convincing Aldrich to clean up his act, but by forcing him to change his tactics. Realizing that reform could no longer be held off, he resolved to assume control of the reform movement, and to have it result in changes that, however sweeping, would nonetheless preserve, and even enhance, both the dangerous “pyramiding” of reserves in New York and his Wall Street chums’ bottom lines.

Just how Aldrich managed to achieve this goal — and to do so despite the rejection of his own plan in favor of a Democratic alternative — is a story too long to be told here. Interested readers will find it, and many other details besides, in my recent Cato Policy Analysis, “New York’s Bank: The National Monetary Commission and the Founding of the Fed,” which they can view by clicking on the image below. The information there will, I hope, allow them to conclude that, to gain a proper understanding of Aldrich’s part in the Fed’s establishment, one needn’t alter a single brushstroke in muckrakers’ portraits of him.