Having learned my monetary economics from both the great monetarist economists and their Austrian counterparts, I’ve always chafed at the tendency of people, including members of both schools, to treat their alternative explanations of recessions and depressions as being mutually exclusive or incompatible. According to this tendency, a downturn must be caused either by a deficient money supply, and consequent collapse of spending, or by previous, excessive monetary expansion, and consequent, unsustainable changes to an economy’s structure of production.

During the 1930s and ever since, this dichotomy has split economists into two battling camps: those who have blamed the Fed only for having allowed spending to shrink after 1929, while insisting that it was doing a bang-up job until then, and those who have blamed the Fed for fueling an unsustainable boom during the latter 1920s, while treating the collapse of the thirties as a needed purging of prior “malinvestment.” As everyone except Paul Krugman knows, the Austrian view, or something like it, had many adherents when the depression began. But since then, and partly owing (paradoxically enough) to the influence of Keynes’s General Theory, with its treatment of deficient aggregate demand as the problem of modern capitalist economies, the monetarist position has become much more popular, at least among economists.

It is, of course, true that monetary policy cannot be both excessively easy and excessively tight at any one time. But one needn’t imagine otherwise to see merit in both the Austrian and the monetarist stories. One might, first of all, believe that some historical cycles fit the Austrian view, while others fit the monetarist one. But one can also believe that both theories help to account for any one cycle, with excessively easy money causing an unsustainable boom, and excessively tight money adding to the severity of the consequent downturn. I put the matter to my undergraduates, who seem to have little trouble “getting” it, like this: A fellow has an unfortunate habit of occasionally going out on a late-night drinking binge, from which he staggers home, stupefied and nauseated. One night his wife, sick and tired of his boozing, beans him with a heavy frying pan as he stumbles, vomiting, into their apartment. A neighbor, awakened by the ruckus, pokes his head into the doorway, sees our drunkard lying unconscious, in a pool of puke, with a huge lump on his skull. “What the heck happened to him?,” he asks. Must the correct answer be either “He’s had too much to drink” or “I bashed his head”? Can’t it be “He drank too much and then I bashed his head”? If it can, then why can’t the correct answer to the question, “What laid the U.S. economy so low in the early 1930s?” be that it no sooner started to pay the inevitable price for having gone on an easy money binge when it got walloped by a great monetary contraction?

In insisting that one shouldn’t have to blame a bust either on excessive or on deficient money, I do not mean to expose myself to the charge of making the opposite error. My position isn’t that excessive and tight money must both play a part in every bust. Nor is it that, when both have played a part, each part must have been equally important. The question of the relative historical importance of the two explanations is an empirical one, concerning which intelligent and open-minded researchers may disagree. The point I seek to defend is that those who argue as if only one of the two theories can possibly have merit cannot do so on logical grounds. Instead, they must implicitly assume either that central banks tend to err in one direction only, or that, if they err in both, only their errors in one direction have important cyclical consequences.

The history of persistent if not severe inflation on one hand and of infrequent but severe deflations on the other surely allows us to reject the first possibility. What grounds are there, then, for believing that money is roughly “neutral” when its nominal quantity grows more rapidly than the real demand for it, but not when its quantity grows less rapidly than that demand, as some monetarists maintain, or for believing precisely the opposite, as some Austrian’s do? New Classical economists, whatever their other faults, are at least consistent in assuming that money prices are perfectly flexible both upwards and downwards, leaving no scope for any sort of monetary innovations to affect real economic activity except to the extent that people observe price changes imperfectly and therefore confuse general changes with relative ones. Both old-fashioned and “market” monetarists, on the other hand, argue as if the economy has to “grope” its way slowly and painfully toward a lowered set of equilibrium prices only, while adjusting to a raised set of equilibrium prices as swiftly and painlessly as it might were a Walrasian auctioneer in charge. Many Austrians, on the other hand, insist that monetary expansion necessarily distorts relative prices, and interest rates especially, in the short-run, while also arguing as if actual prices have no trouble keeping pace with their theoretical market-clearing values even as those values collapse.

Of these two equally one-sided treatments of monetary non-neutrality, the monetarist alternative seems to me somewhat more understandable. For monetarists, like New Keynesians, attribute the non-neutral effects of monetary change to nominal price rigidities. They can thus argue, in defense of their one sided view, that it follows logically from the fact that certain prices, and wage rates especially, are less rigid upward than downward. That’s the thinking behind Milton Friedman’s “plucking” model, according to which potential GNP is a relatively taught string, and actual GNP is the same string yanked downward here and there by money shortages, and his corresponding denial of the existence of business “cycles.” But “less rigid” isn’t the same as “perfectly flexible” or “continuously market clearing.” So although Friedman’s perspective might justify his holding that a given percentage reduction in the money stock will have greater real consequences than a similar increase, other things equal, it alone doesn’t suffice to sustain the view that excessively easy monetary policy is entirely incapable of causing booms. What’s more, as Roger Garrison has pointed out, the fact that real output appears to fit the “plucking” story doesn’t itself rule out the presence of unsustainable booms, which (if the Austrian theory of them is correct) involve not so much an expansion of total output as a change in its composition.

Austrians, in contrast, tend to attribute money’s non-neutrality, not to general price rigidities, but to so-called “injection” effects. In a modern monetary system such effects result from the tendency of changes in the nominal quantity of money to be linked to like changes in nominal lending, and particularly to changes in the nominal quantity of funds being channeled by central banks into markets for government securities and bank reserves. The influence of monetary innovations will therefore be disproportionately felt in particular loan markets before radiating from them to the rest of the economy. It is not easy to see why monetary “siphoning” effects, to coin a term for them, should not be just as non-neutral and important as injection effects of like magnitude. To the extent that the monetary transmission mechanism relies upon a credit channel, that channel flows both ways.

A division of economists resembling that concerning the role of monetary policy in the Great Depression has developed as well in the wake of the recent boom-bust cycle. Only this time, oddly enough, several prominent monetarists and fellow travelers (among them, Anna Schwartz, Allan Meltzer, and John Taylor) have actually joined ranks with Austrians in holding excessively easy monetary policy in the wake of the dot-com crash to have been at least partly responsible for both the housing boom and the consequent bust. With so many old-school monetarists switching sides, the challenge of denying that monetary policy ever causes unsustainable booms, and of claiming, with regard to the most recent cycle, that the Fed was doing a fine job until until house prices started falling, has instead been taken up by Scott Sumner and some of his fellow Market Monetarists.

Sumner, like Milton Friedman, forthrightly denies that there’s such a thing as booms, or at least of booms caused by easy money, to the point of taking exception to a recent statement by President Obama to the effect that, among its other responsibilities, the Fed should guard against “bubbles.” But here, and unlike Friedman, Sumner basis his position, not merely on the claim that prices are more flexible upwards than downwards, but on a dichotomy erected in the literature on asset price movements, according to which upward movements are either sustainable consequences of improvements in economic “fundamentals,” or are “bubbles” in the strict sense of the term, inflated by what Alan Greenspan called speculators’ “irrational exuberance,” and therefore capable of bursting at any time. Since monetary policy isn’t the source of either improvements in economic fundamentals or outbreaks of irrational exuberance, the fundamentals-vs-bubbles dichotomy implies that monetary policy is never to blame for changes in real asset prices, whether those changes are sustainable or not. If the dichotomy is valid, Sumner, Friedman, and the rest of the “monetary policymakers shouldn’t be concerned about booms” crowd are right, and the Austrians, Schwartz, Taylor, and others, including Obama and his advisors, who would hold the Fed responsible for avoiding booms, are full of baloney.

But it isn’t the Austrian view, but the bubbles-vs-fundamentals dichotomy itself, that’s full of baloney. That dichotomy simply overlooks the possibility that speculators might respond rationally to interest rate reductions that look like changes to “fundamental” asset-price determinants, that is, to relatively “deep” economic parameters, but are actually monetary policy-inspired downward deviations of actual rates from their genuinely fundamental (“natural”) levels. Because actual rates must inevitably return to their natural levels, real asset price movements inspired by “unnatural” interest rate movements, though perfectly rationale, are also unsustainable. Yet to rule such asset price movements out one would have to claim either that monetary policy isn’t capable of influencing real interest rates, even in the short-run, or that the temporary interest-rate effects of monetary policy can have no bearing upon the discount factors that implicitly inform the valuation of amy durable asset. Here again, the burden seems too great for mere a priori reasoning to bear, and we are left waiting to set our eyes upon such empirical studies as are capable of bearing it.

In the meantime, it seems to me that there is a good reasons for not buying into Friedman’s view that there is no such thing as a business cycle, or Sumner’s equivalent claim that there is no such thing as a monetary-policy-induced boom. The reason is that there is too much anecdotal evidence suggesting that doing so would be imprudent. The terms “business cycle” and “boom,” together with “bubble” and “mania,” came into widespread use because they were, and still are, convenient if inaccurate names for actual economic phenomena. The expression “business cycle,” in particular, owes its popularity to the impression many persons have formed that booms and busts are frequently connected to one another, with the former proceeding the latter; and it was that impression that inspired Mises and Hayek do develop their “cycle” or boom-bust theory rather than a mere theory of busts, and that has inspired Minsky, Kindleberger, and many others to describe and to theorize about recurring episodes of “Mania, Panic, and Crash.” Nor is the connection intuitively hard to grasp: the most severe downturns do indeed, as monetarists rightly emphasis, involve severe monetary shortages. But such severe shortages are themselves connected to financial crashes, which connect, or at least appear to connect, to prior booms, if not to “manias.” That the nature of the connections in question, and the role monetary policy plays in them, remains poorly understood is undoubtedly true. But our ignorance of these details hardly justifies proceeding as if booms never happened, or as if monetary policymakers should never take steps to avoid fueling them. On the contrary: the non-trivial possibility that an ounce of boom prevention is worth a pound of quantitative easing makes worrying about booms very prudent indeed, and prudent even for those who believe that monetary shortages are by far the most important proximate cause of recessions and depressions.

Does my saying that Scott and others err in suggesting that monetary policymakers ought not to worry about stoking booms mean that I also disagree with Scott’s arguments favoring the targeting NGDP? Not at all. I’m merely insisting that a sound monetary policy or monetary system is one that avoids upward departures of NGDP from target just as surely as it does downward ones. Nor do I imagine that Scott himself would disagree, since his preferred NGDP targeting mechanism would automatically achieve this very result. But I worry that other NGDP targeting proponents have allowed themselves to become so wrapped up in recent experience, and so inclined thereby to counter arguments for monetary restraint, that they have allowed themselves either to forget that a time will come, if it hasn’t come yet, when such restraint will be just the thing needed to keep NGDP on target, or to treat Scott’s boom-denialism as grounds for holding that, while there can be too little NGDP, there can’t really be too much. (Or, what is almost as bad, that there can’t be too much so long as the inflation rate isn’t increasing, which amounts to tacitly abandoning NGDP targeting in favor of inflation targeting whenever the the latter policy is the looser of the two.) I urge such “monetarists” to recall the damage Keynes did by taking such a short-term view, while disparaging those who worried about the long run. “Keynesiansim” thus became what Keynes himself never intended it to be, which is to say, a set of arguments for putting up with inflation. Let’s not let Market Monetarism become perverted into set of arguments for putting up with unsustainable booms.

____________________________________

Addendum: Scott has responded, claiming that I am wrong in portraying him as a money-induced unsustainable boom denialist. I appreciate his attempts to reassure me, and yet can’t help thinking that he has nevertheless supplied some reasons for my having characterized his thinking as I did. For example, when Scott writes that “asset prices should reflect fundamentals. Interest rates are one of the fundamental factors that ought to be reflected in asset prices. When rates are low, holding the expected future stream of profits constant, asset prices should be high. Bubbles are usually defined as a period when asset prices exceed their fundamental value. If asset prices accurately reflect the fact that rates are low, then that’s obviously not a bubble,” he certainly seems to accept the bubbles-vs.fundamentals dichotomy about which I complain above, with its implicit exclusion of the possibility of a boom based on lending rates that have been driven by “unnaturally” low by means of excessively easy money. Scott only reinforces this interpretation by further observing, in the same post, that “[i]t’s not clear what people mean when they talk of “artificially” low interest rates. The government doesn’t put a legal cap on rates in the private markets, in the way that the city of New York caps rents.” Now if that isn’t sweeping aside the whole Wicksellian apparatus, with its distinction between “natural” and “actual” interest rates, then I don’t know what is.

Also, while Scott protests that he does not deny a possible role for easy money in fueling booms, it’s far from evident that he considers this something other than a merely theoretical possibility. He denies (appealing again to the bubbles-vs.-fundamentals dichotomy), that monetary policy played any part in the Roaring Twenties (while asserting that NGDP per capita fell during that decade, though that isn’t my understanding*); and he denies that it played any part in the recent housing boom. With respect to the latter boom he observes, in response to a commentator, that “a housing boom is just as likely to occur with 3% trend NGDP growth as 5% NGDP growth. Money is approximately superneutral. I completely reject the notion that Fed policy is mostly to blame for the housing bubble–it was bad public (regulatory) policies plus stupid decisions by private actors. I’m not saying Fed policy had no effect, but it was a minor factor.” Scott’s claim here, though not altogether wrong as a claim about comparitive steady states, might nonetheless be taken to suggest that there’s little reason to be concerned about adverse effects, apart from inflation, of faster than usual NGDP growth. And this view in turn encourages people to think that, when NGDP grows more rapidly than usual, there’s no harm in sitting back and enjoying it so long as it doesn’t raise the inflation rate much. That is, it encourages them to favor replenishing the punchbowl whenever the party get’s dull, but not removing it when the party starts getting wild.**

Regarded as empirical claims only, Scott’s assertions may of course be valid. But I think the evidence from these and other quotes from him suggests that, while he clearly believes that easy money can influence interest rates, he does not believe, as a matter of theory, and based largely on his acceptance of the bubble-fundamentals dichotomy along with the EMS, as well as his related inclination to brush-aside Wicksell’s arguments as to the possibility as well as the unsustainability of “unnatural” changes in interest rates, that by doing so it can contribute to an unsustainable asset boom.

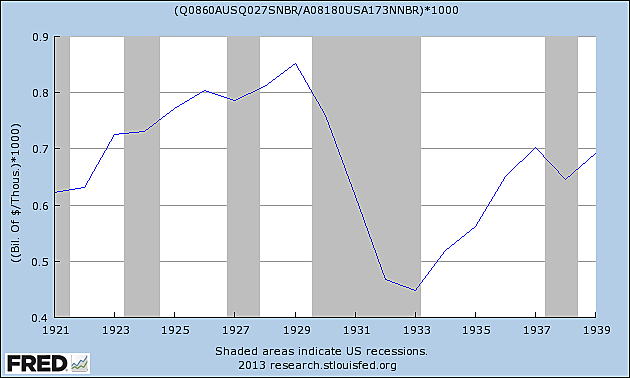

*Here, for what it’s worth, is the plot I get when I divide nominal NGDP (millions) by population (thousands) using stats from FRED’s macrohistory data base:

**Previously I put the matter here in stronger terms that I now see were unjustified. Sorry, Scott! (Added 10/3/2013 at 9:36PM).