Republicans have enacted the Tax Cuts and Jobs Act, the largest tax overhaul since 1986. While many people seem to think that the legislation favors the rich, it actually delivers the largest relative tax cuts to the middle class. That is clear if you dig beneath the surface of estimates from the liberal Tax Policy Center (TPC).

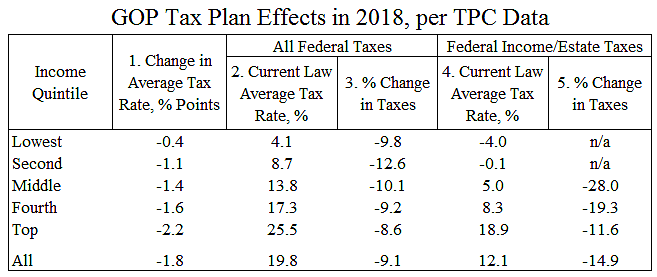

TPC’s new analysis shows tax changes for the final GOP bill for households by income quintile (or fifth). But the data is not presented in a neutral context to understand the relative sizes of tax cuts for each group. I present TPC data in context in the table below.

Column 1 shows the GOP tax cuts as a percent of income in 2018 from the new TPC study.

Column 2 shows total current federal taxes (income, payroll, excise, and estate) as a percent of income for 2018, estimated by TPC here.

Column 3 shows the GOP cuts (column 1) as a percent of total current taxes (column 2). The cuts are fairly equal across-the-board, although a little smaller at the top.

However, the tax bill does not change payroll taxes, so including them in the denominator of the column 3 calculation slants the results. Column 4 removes them. (The tax bill tweaks a few minor excise taxes, but with little effect on overall excise revenues, so I removed them also).

Column 4 shows TPC estimates of current-law income and estate taxes for 2018. The bottom two quintiles are negative because those groups do not pay any income and estate taxes, on net.

Column 5 shows the GOP cuts (column 1) as a percent of total current-law income and estate taxes (column 4). Middle-income households will receive a 28 percent tax cut, which is substantially larger than the cuts received by the higher income groups.

This is the fairest way to present the effects of the Republican tax bill. It indicates that for 2018, the tax changes will make the federal tax system more progressive. The GOP tax bill will result in higher earners paying a larger share of the overall federal tax burden.

A similar analysis of the official Joint Tax Committee data is here.