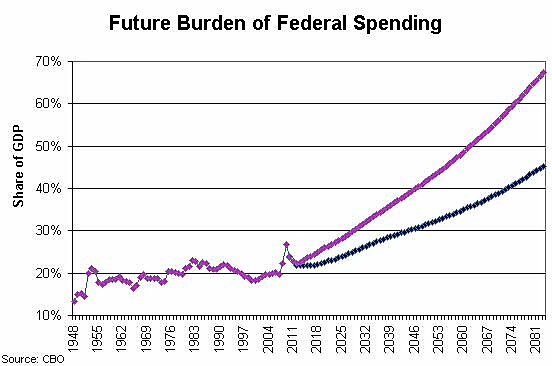

Since we’re already depressed by the enactment of Obamacare, we may as well wallow in misery by looking at some long-term budget numbers. The chart below, which is based on the Congressional Budget Office’s long-run estimates, shows that federal government spending will climb to 45 percent of GDP if we believe CBO’s more optimistic “baseline” estimate. If we prefer the less optimistic “alternative” estimate, the burden of federal government spending will climb to 67 percent of economic output. These dismal numbers are driven by two factors, an aging population and entitlement programs such as Medicare, Medicaid, and Social Security. For all intents and purposes, America is on a path to become a European-style welfare state.

If these numbers don’t depress you enough, here are a couple of additional observations to push you over the edge. These CBO estimates were produced last year, so they don’t count the cost of Obamacare. And as Michael Cannon repeatedly has observed, Obamacare will cost much more than the official estimates concocted by CBO. And speaking of estimates, the long-run numbers in the chart are almost certainly too optimistic since CBO’s methodology naively assumes that a rising burden of government will have no negative impact on the economy’s growth rate. Last but not least, the data above only measures federal spending. State and local government budgets will consume at least another 15 percent of GDP, so even using the optimistic baseline, total government spending will be about 60 percent of GDP, higher than every European nation, including France, Greece, and Sweden. And if we add state and local spending on top of the “alternative” baseline, then we’re in uncharted territory where perhaps Cuba and North Korea would be the most appropriate analogies.

So what do we do? There’s no sure-fire solution. Congressman Paul Ryan has a reform plan to reduce long-run federal spending to less than 20 percent of GDP. This “Roadmap” plan is excellent, though it is marred by the inclusion of a value-added tax. Bill Shipman of CarriageOaks Partners put forth a very interesting proposal in a Washington Times column to make the federal government rely on states for tax revenue. And I’ve been an avid proponent of tax competition as a strategy to curtail the greed of the political class since it is difficult to finance redistribution if labor and capital can escape to jurisdictions with better tax law. Any other suggestions?