The Biden administration has released its federal budget for 2023. One of the themes is deficit reduction. The president says the budget “keeps us on track to reduce the deficit this year to less than half of what it was before I took office.” The administration will be “the first in history to reduce the deficit by more than $1 trillion in a single year.”

Finally, someone is taking an axe to the bloated federal budget!

Or maybe not. Under the Biden budget:

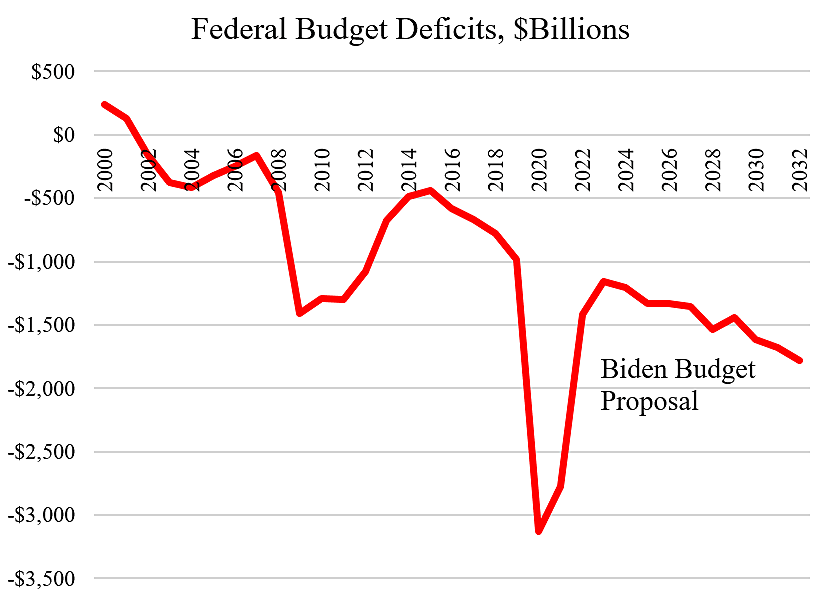

- Deficits are currently falling, but would start rising again in 2024, as shown in the chart.

- Spending would rise from $5.85 trillion this year to $8.87 trillion in 2032.

- Debt held by the public would rise from $24.8 trillion this year to $39.5 trillion in 2032, or 102.4 percent of GDP to 106.7 percent.

- Taxes would be increased $2.5 trillion over 10 years, but these hikes likely won’t pass Congress, so deficits would be higher than proposed unless spending is restrained.

- Interest rates on federal debt are projected to remain low, with the rate on 10-year debt only rising to 3.3 percent by 2032. Thus the budget says the “burden of debt would stay low,” which seems very optimistic. Every 1 percentage point increase in average borrowing costs on $25 trillion of federal debt is $250 billion in added annual interest outlays.