As part of its 2023 federal budget released today, the Biden administration is proposing a new 20 percent minimum tax on households with a net worth more than $100 million. The tax would be calculated with the inclusion of unrealized capital gains as “income.”

Let’s say a high-tech entrepreneur earns $100 million and currently pays $20 million in federal income tax, or 20 percent. And let’s say her wealth is $2 billion and rises $200 million this year as she grows her company. Apparently, the Biden theory is that her “income” is really $300 million, and she should pay $60 million in tax this year—triple what she currently would pay.

The Biden tax plan is crackers. Unrealized gain is not income. It represents the expectation of future income, which should be taxed in the future under a well-designed tax system. Often, expected future income doesn’t materialize and asset values drop. The stock market is down five percent this year, so our entrepreneur may have negative “income” of $100 million.

Capital gain is not “income” in the government’s National Income and Product Accounts, and it has always been treated differently in tax codes here and abroad. Indeed, most countries have more favorable treatment of long-term capital gains than we do. Our federal-state top rate on realized gains at 29.2 percent is much higher than the industrial country average of 19.1 percent.

Under Biden’s tax proposal, wealthy people would be rewarded for consumption and penalized for reinvesting to grow their businesses. Patience and prudence would be punished. The Biden plan would particularly harm leading edge industries that rely on wealthy investors to take the large risks that drive American innovation.

Not only are the economics of taxing unrealized gains bad, but the IRS could not handle the administration of a new tax structure based on gyrating asset values. The tax agency has trouble trying to value assets a single time at death under the estate tax. The IRS claimed that Michael Jackson’s estate was worth $481 million, but it was wrong, and after a seven-year battle the tax court found that the estate was really only worth $111 million. The IRS may face many such battles every year under the new Biden tax. And remember, the IRS is already overwhelmed trying to administer the current tax code.

In the unlikely event that Biden’s billionaire tax is enacted, it would soon be repealed. Biden’s plan is somewhat different, but wealth taxes were repealed nearly everywhere they were tried in Europe due to the economic damage they caused and the costs and complexities of administration.

The administration’s description of the tax proposal says, “America’s imbalanced tax code means that many millionaires and billionaires end up paying lower tax rates than middle class workers.” That is a falsehood if tax “rates” means what every expert agency says it means, including the Congressional Budget Office, Joint Committee on Taxation, and Internal Revenue Service. As I’ve reported here and here, data from all official sources show that top earners pay much higher tax rates than people in the middle or at the bottom.

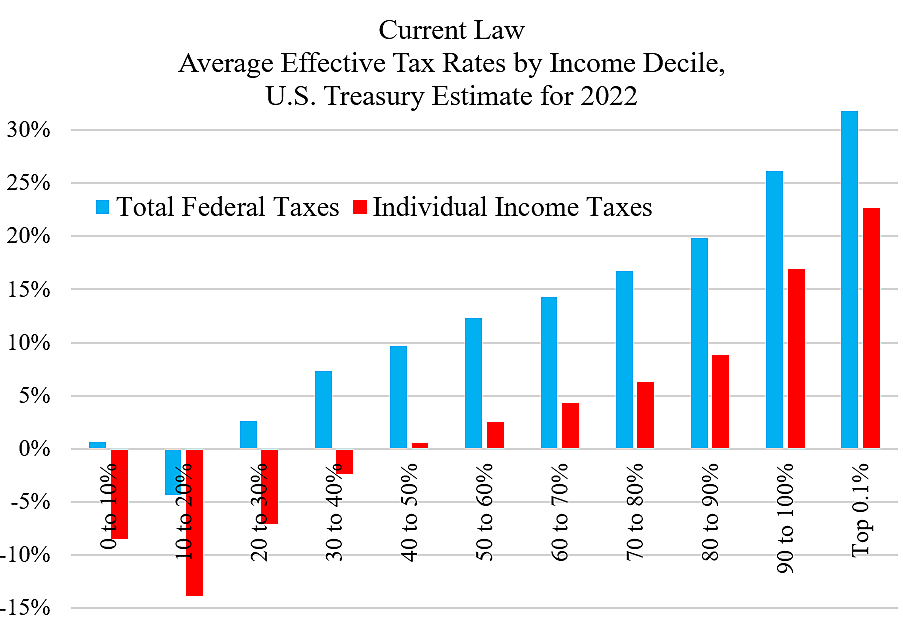

Indeed, data published by Biden’s own U.S. Treasury show that tax rates on millionaires and billionaires are far higher than for everyone else. The chart below shows the Treasury’s estimated average effective tax rates by income decile under current law for 2022. It includes federal individual income, corporate, payroll, excise, and estate taxes. Within each decile (or 10 percent group), the figures are taxes paid divided by income. The chart also shows the top 0.1 percent of families.

The red bars show that average income tax rates range from less than zero for the bottom 40 percent of families to 22.7 percent for the top 0.1 percent. The bottom 40 percent pay less than zero because of refundable tax credits. Note that the top group’s tax rate is much higher than the rates on middle‐ and upper‐middle income groups.

The blue bars show that average rates for total federal taxes range from near zero for the bottom 30 percent of families to 31.8 percent for the top 0.1 percent. The top group’s tax rate is about twice as high as the rate on middle‐income groups.