****

Many discussions of the causes of the worst financial crisis in decades focus on macroeconomic indicators, while overlooking fundamental changes in the mechanics of the financial system that have occurred over the past three decades. That focus has, in my opinion, given rise to two fallacies. The first of these holds the financial crisis to have been unforeseeable. The second has it originating in the US. In truth the crisis was a foreseeable consequence of financial developments common to most of the industrialized world.

Rather than taking a step back and attempting to understand the underlying drivers of the boom and bust, politicians, central bankers and many members of the general public were quick to attribute them to “inherently unstable” and insufficiently regulated financial (and especially banking) industries. This perspective led to the introduction of unprecedentedly sweeping financial reforms.

Was banking an inherently unstable industry that needed stronger oversight? As a financial analyst spending all day looking at banks’ balance sheets and speaking to bankers about their business model, this understanding made little sense to me. My peers and I could see the hundreds of pages of regulation that banks had to comply with. Banking was hardly an unregulated industry.

Might the crisis have instead had its source in developments outside the private financial industry? Some economists, but also many commentators of the finance industry, were quick to accuse monetary authorities of bringing about the boom. While I do think there is some truth to this, my experience led me to believe that there was much more to the story than that. Asset bubbles did not appear at random but involved similar asset classes simultaneously around the world, implying a common denominator. One such common denominator consisted of the Basel accords, an international agreement on banking regulation first implemented in the 1980s, and revised on numerous occasions since. I also noticed that new start-ups, free from Basel regulatory constraints, seemed to be thriving in areas and products avoided by mainstream banks, indicating a supply side rather than a demand side issue.

Equipped with these observations, and inspired as well by the Free Banking literature arguing that past financial crisis were rooted in badly-designed rules, I decided, in 2013, to found the blog ‘Spontaneous Finance,’ with the aim of coming to grips with our recent disaster. I here offer a brief review of some of my postings there, with apologies for the perhaps cryptic nature of the necessarily brief summaries.

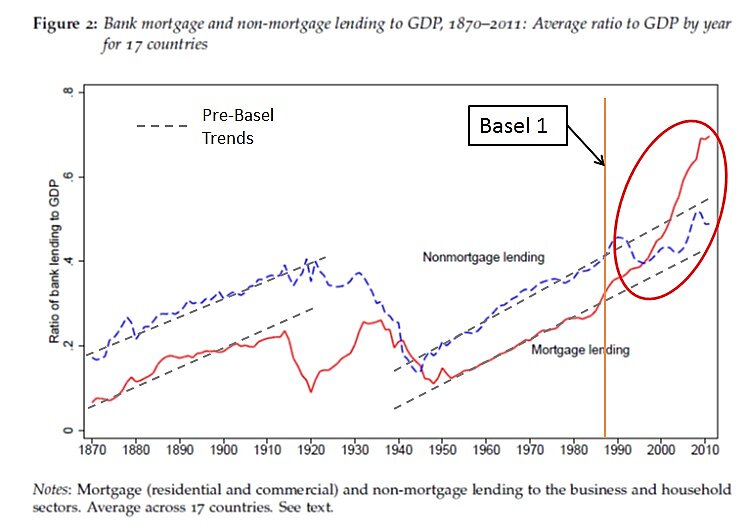

About a year after the creation of my blog, and confirming a trend I had already noticed in the case of the US, Jordà et al published an excellent piece of research that seemed to supply statistical, as opposed to merely anecdotal, support for my theories in the shape of a chart that aggregated lending types across 17 different countries over 140 years, to which I added trend lines as well as a vertical line showing the introduction of Basel 1:

During the 1980s, real estate lending started to accelerate, outpacing other types of credit, whose growth actually slowed down. The acceleration coincided with the introduction of the Basel banking regulatory framework. Theoretically, this makes sense: Basel 1 established fixed capital requirements for various types of bank assets, thereby inspiring regulatory arbitrage.

Not surprisingly, the asset classes that boomed in the decades leading up to the crisis, including mortgages, all benefited from low capital requirements. Sectors with relatively high regulatory capital requirements such as small and medium-sized corporations, were instead starved of funds. That bankers responded to Basel’s incentives was unsurprising. Even assuming that monetary policy was itself neutral, low-risk-weighted asset classes were bound to have more loanable funds allocated to them, pushing interest rates down, while high-risk-weighted asset classes in turn suffered.

To the extent that monetary policy was also excessively easy, the problem was exacerbated. Unfortunately, the combination of Basel capital regulations, easy monetary policies, and bank accounting rules proved a recipe for disaster. As the real estate market collapsed, the market price of a many securities held at fair value on banks’ balance sheet fell. This decline, combined with exploding mortgage-related loan loss provisions, triggered catastrophic losses. In turn, those losses forced banks to contract their loan book in order to comply with capital ratios defined by their regulators, thereby putting pressure on the money supply.

Nor have matters improved much since the crisis. Instead of correcting past mistakes, Basel is putting the world economy at risk once again through new and more diversified requirements that once again amplify artificially the demand for certain assets while simultaneously creating liquidity shortages in the marketplace.

Many central bankers and economists haven’t fully realized what the microeconomic rigidities introduced by those rulesets imply for monetary policy. The predictable failures of misguided policies such as the BoE’s FLS and the ECB’s TLTRO, as well as the weak outcome of QE, partly rest on this ignorance of banking mechanics. Furthermore, regulators have again fallen for the discredited central planning myth, albeit under a new and more subtle form, and despite the very limited evidence that it can exert much control on asset prices: macro-prudential regulation.

The consequence of all this is that interest rates and market prices are now manipulated in myriad ways. Yet many influential economists aren’t even aware of it. Entire yield curves across the whole spectrum of banking products and asset classes have stopped reflecting the pricings that market actors would normally agree on in an unhampered market. The result is a very opaque financial system and a large shift in the structure of relative prices. Within that system the free market has vanished, while malinvestments rule.

Is there anything we can do? Might deregulation give us an antifragile banking system? Fintech — the various alternative financial start-ups that are starting to reshape financial services, which are (so far) mostly free from the red tape that constrains (and protects) established banking behemoths — may offer another way. Innovations like marketplace lending and cryptocurrencies might conceivably give birth to a new system of relatively free banking. Although remote, the possibility is no less exciting, as it would represent an emergent order capable of responding to changing market demand for funds and money — something that traditional banking has ceased to be.

Of course, arriving at such a new system will also take time. But as Israel Kirzner and Immanuel Kant have taught us, patience is required if private-market entrepreneurs are to have a chance of coming up with better solutions to current financial-market disorders than we’ll ever get from government regulators.

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.