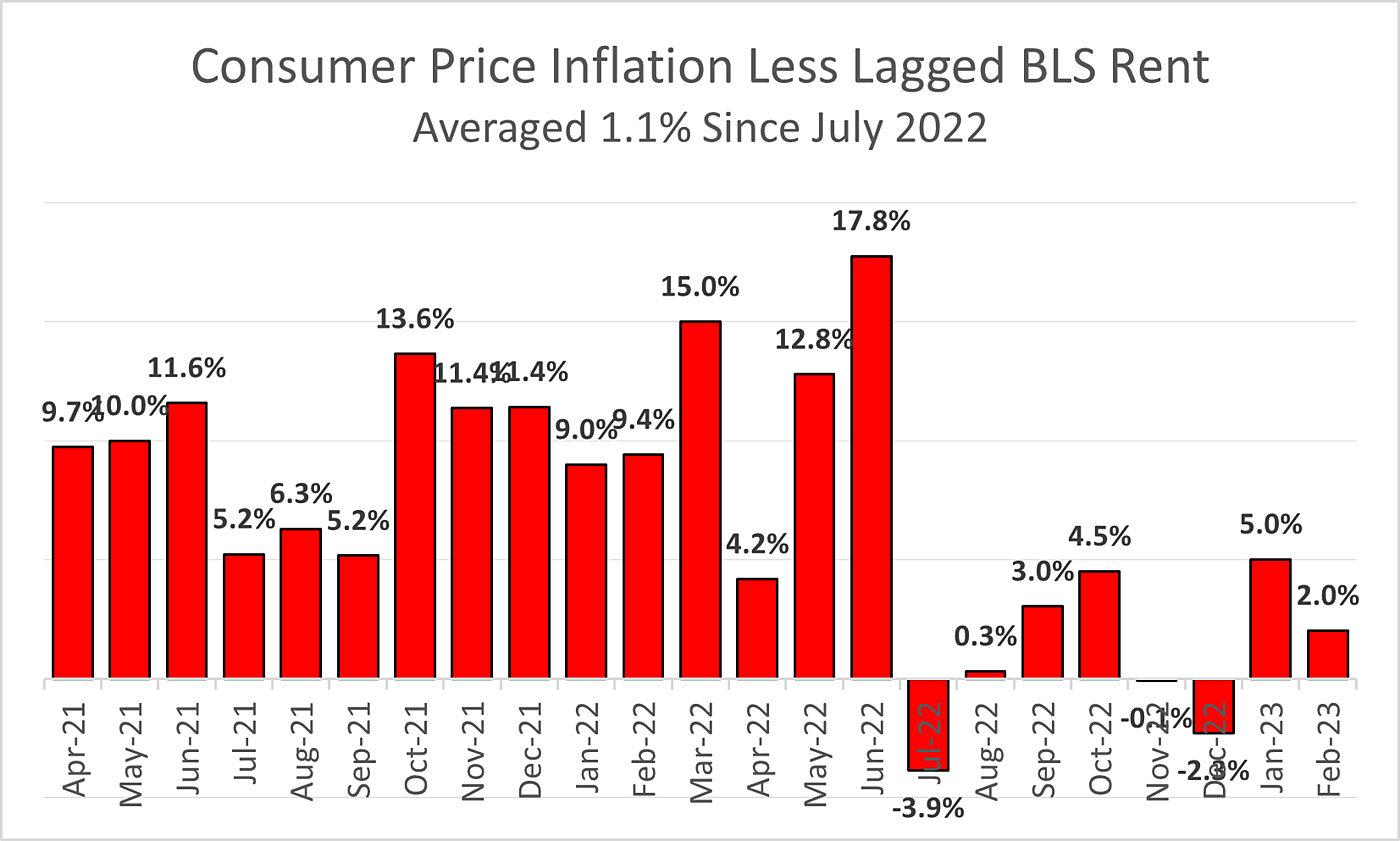

Aside from Bureau of Labor Statistics surveys of rent and estimates of owner-equivalent rent (OER) that are notorious for being lagging indicators, inflation for everything else (65.6 percent of total CPI) has averaged just 1.1 percent for eight months.

The CPI report for February warns, “The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase.” For everything else, the CPI rose at just a 2 percent annual rate last month.

Ever since November 30, Fed Chairman Jerome Powell has rightly advised us to ignore flawed estimates of housing inflation until they catch up with the reality of falling rents and falling house prices. Once we exclude those flawed estimates of rent and OER, however, average CPI inflation has long been well below the nebulous Federal Open Market Committee target of 2 percent inflation (which was for 2026 anyway — not 2023).

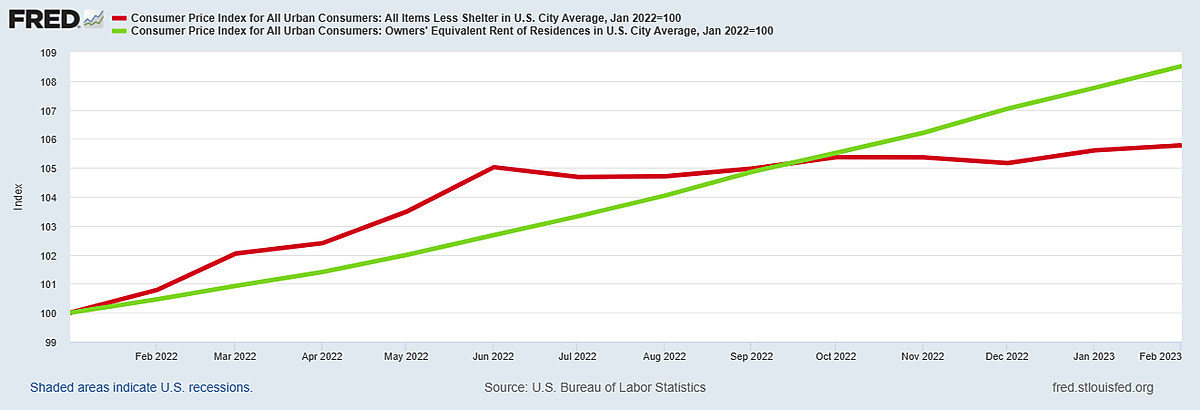

In the second graph, the green line for CPI Shelter is on autopilot — always heading for the sky, and totally unresponsive to rapid-fire FOMC rate hikes that were apparently aimed at sinking home prices (which are no longer even included in the CPI).

The red line is the average inflation rate for the other two-thirds of the items on the CPI—everything except those untrustworthy rent estimates. Notice how the red line has flatlined since June — rising at a 1.1 percent annual rate.

The green line consists of (1) slow samples of rents on leases signed long ago and (2) heroic efforts to use those rent surveys to estimate what homes would rent for based on even older surveys of house prices.

When Fed hawks and vultures whine about inflation being “stubborn” they mean the green line — rent and OER. Other prices are rising and falling, but the average has risen very slowly since last June. Those using the green line to advocate for more rate hikes on T‑bills (to suck deposits out of banks) must imagine that having the Fed pay higher and higher overnight rates on bank reserves can force the BLS to fix the misleading ways it collects and reports shelter inflation.