Answering his own question, Knot says,

… Yes – as long as we stay eclectic, pragmatic and flexible. And we take the interactions of monetary and macroprudential policies into account, and coordinate the two policies.

There’s no doubt that monetary and macroprudential policies interact. But if we really are all macroprudentialists now — or even if only all monetary policy makers are—we are headed for disaster. How come? Because because macroprudential policy causes credit to be inefficiently allocated, and may increase the very systemic instability it purportedly aims to curb.

Traditional banking regulation was “microprudential,” meaning that its aim was to prevent any individual institution from taking too much risk. Macroprudential regulation (“macropru” hereafter) is the idea that individual banks can and should be regulated for the purpose of maintaining the soundness of the entire financial system. Specific macroprudential regulations aim at limiting the build-up of systemic risks, or the system-wide extension of certain types of credit.

Capital requirements are a standard example of a microprudential regulation. How a capital requirement applies to a given bank depends on how much risk that bank has decided to take on. Therefore, some banks will be less affected—if they are affected at all—by capital requirements than others.

By contrast, a macroprudential capital requirement (such as a “countercyclical capital buffer”) is an extra capital layer that is set by regulators on a discretionary basis and applies to all banks, regardless of the riskiness of their asset holdings.[1]

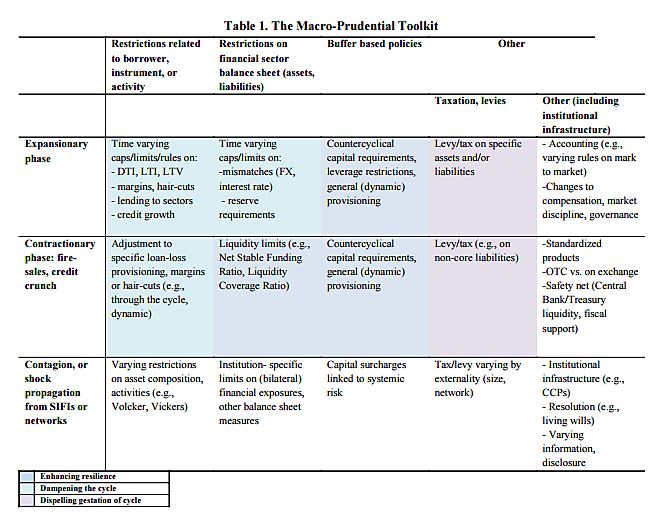

The concept of macropru has a long history (see this recent BIS paper), even though the name itself is somewhat new. Regulators and central banks in the developed world have used macroprudential policies for decades. However, policymakers vastly increased the scope and strength of macroprudential regulations as a response to the financial crisis, as the table below suggests (taken from this IMF paper)

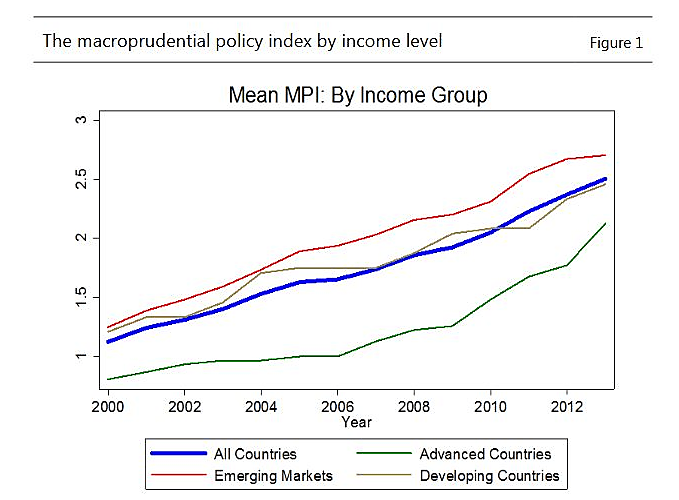

Macropru was regularly used in emerging markets in the couple of decades preceding the financial crisis, with limited effectiveness (the chart below is a macropru utilization index built by researchers at the Fed, ECB and IMF, and published in this paper). However, policymakers in advanced economies thought it prudent to intensify their research in this area after the global financial crisis.

Overall, macroprudential regulation is subject to the following criticisms:

- There is almost no evidence that macropru is effective (see here and here). In a finding consistent with subsequent literature, Aiyar, Calomiris and Wieladek found that macropru had a limited effect, but considerable “leakage”—in an effort to bypass regulatory restrictions, economic agents engage in regulatory arbitrage, and in so doing distort the allocation of credit in the economy.

- Macropru cannot counteract the effect of monetary policy: regulators hope to use their macroprudential toolkit to tame or limit the potentially negative effects of monetary policy on financial stability. Unfortunately, empirical research has shown that when monetary policy and macropru pull in opposite directions, monetary policy prevails. As Jeremy Stein once said, monetary policy is the only tool that “gets in all of the cracks.”

- Macropru assumes away public choice issues and defies the logic that a stable, rule-based framework provides economic benefits. Banks become subject to regulators’ whims, which introduces regulatory uncertainty in the financial system. Moreover, the naïve line of thought taken by the macropru literature assumes that regulators are fully independent from the changing political environment, as well as protected from regulatory capture.

- Macropru assumes omniscient regulators and rejects the conclusions of the socialist calculation debate, as well as the insights of Hayek’s concept of knowledge dispersion. Macropru theory shares theoretical foundations with Keynesianism: it virtually ignores the limitations of central planning and overstates government’s economic control abilities. It emphasizes market failures and disregards government failure.

So what does the current state of macropru research look like? Based on the research papers presented at last September’s BIS/Central Bank of Turkey seminar on macroprudential regulation, it appears that groupthink has become so widespread that economists employed by regulatory agencies and central banks are supressing or toning down some of their own findings. The papers’ authors include many important and explicit caveats and limitations within the core of their papers, yet suddenly “forget” them once it is time to write the abstract and conclusion. Macropru works, we are told, and who cares if its effects are minimal or if there is collateral damage?

Out of 19 papers, only one refers to some of the issues listed above and questions some the fundamentals behind macropru reasoning (Horváth and Wagner’s Macroprudential policies and the Lucas Critique—an interesting read). Many others, meanwhile, question the very fundamentals of a market economy. We’re told that individual agents fail to “internalize” the damages that their actions have on the market and economy as a whole; therefore, an external regulator—who obviously knows better—must intervene to stabilize the entire economy by controlling the agent’s action.

This is absurd. The same reasoning could be applied to any good: an agent overproducing a certain good fails to “internalize” the damage doing so causes to the market and his industry. As a result, this industry needs a central planner to organize it in the most efficient way. We know the fallacy of this logic. Yet it prevails in today’s macropru theoretical foundations.

When considering the entirety of central bank research and thinking, Knot’s proclamation that, yes, we are all macroprudentialists now might actually be somewhat moderate. Take this recent speech by Alex Brazier, executive director for financial stability strategy at the Bank of England, made during a financial regulation seminar at the London School of Economics. It is quite remarkable: Brazier manages to avoid referring to any of the issues listed above (and argues against point 2, despite the evidence). He depicts macropru as an almost ideal regulatory apparatus, and exemplifies central bankers’ fundamental distrust in free markets. His speech accumulates inaccuracies which naturally lead his argument towards its only logical conclusion: that government must act, and that regulators can provide macroeconomic stability thanks to their new macroprudential toolkit.

Let’s look at some of Brazier’s statements:

It’s well known, for example, that banks would choose to have too little capacity to absorb losses – too little equity capital – because their current shareholders don’t bear the full economic costs of their failure or distress. The economy needs better capitalized banks than the free market would deliver.

Well known? Not exactly. This statement contradicts all historical experience of financial stability without capital requirements.

More troubling are Brazier’s subsequent remarks about capital buffers:

The results have been transformative. A system that could absorb losses of only 4% of (risk weighted) assets before the crisis now has equity of 13.5% and is on track to have overall loss absorbing capacity of around 28%.

This is wrong (but convenient). Mr. Brazier is comparing apples and oranges. Banks had regulatory Tier 1 ratios of 8 to 9% before the crisis. Not 4%, which was the regulatory minimum. You can’t compare the pre-crisis regulatory minimum with banks’ current average capital ratios today.

Ironically, Brazier’s speech also includes a whole section regarding the limits of regulators. He says that “clairvoyance is not a reasonable standard to be held to,” and that regulators’ “mandate is to break free of the shackles of forecasting, to free us from trying to predict if the economy will turn down, and to apply economic analysis to the question of how bad it could be if it did.” Yet precisely this sort of regulatory clairvoyance is necessary for macropru to work!

Macroprudential tools are discretionary policies that are supposed to be applied countercyclically: they are devised to specifically reflect regulators’ forecasts (or beliefs) about where the economy—or certain segments of the economy—is going. So how is macropru supposed to work if regulators do not even attempt to understand how the economy is evolving or where the imbalances are building up in the first place? This is all very confusing.

The contradiction between Brazier’s full-fledged support for macropru and his avowed skepticism of economic forecasting reveals the crux of the issue. It is bewildering to see some economists, and virtually the whole central banking and bank regulatory profession, tell us that despite all its shortcomings, unknowns, internal contradictions, and inherent risks and distortions, macroprudential regulation is the way forward.

We seem to be reliving the post-Great Depression era, which was marked by renewed trust in government’s ability to manage the business cycle. Economists have (painfully) learned something since then; macropru’s ambitions are not as wide-reaching as those of the Keynesianism of that time. Yet this old pretense of knowledge hasn’t disappeared. Keynes is making a comeback in a more subtle form: macropru rests on obsolete theoretical foundations, and by ignoring its inherent problems regulators are at risk of distorting the allocation of capital in the economy, with devastating consequences.

Milton Friedman would certainly not have said that “we are all macroprudentialists now.”

P.S.: Thankfully Kevin Dowd is also supposed to speak at this LSE seminar later in the year, which should help to dispel some of the myths that are being spread.

P.P.S.: Brazier and Knot are two examples of regulators/central bankers who are questioning the very fundamentals of free markets. See for instance Vítor Constâncio, vice-president of the ECB, and Sabine Lautenschläger, member of the ECB Executive Board, here and here.

_____________________

[1] For a categorization and explanation of macroprudential policies see Justin Merril’s primer.

[This article is expanded from an original version that appeared on Spontaneous Finance.]