I’ve long suspected that the primary reason much of the residential real estate industry supports subsidies such as Fannie Mae or the mortgage interest deduction is in the belief that such subsidies increase house prices. And when your income is commission based, higher prices do indeed sound pretty good from the perspective of the industry. Of course, we also hear that the industry supports these subsidies because they want everyone to be a homeowner, wave the flag and have plenty of apple pie. Yes, those seemingly industry subsidies are really for all of us. Perhaps the best one I heard recently was that homeownership subsidies promoted self-reliance. Here I was thinking subsidies are the opposite of self-reliance. Silly me.

But if the price of a good increases, especially relative to income, it can increasingly become unaffordable, with the result that few sales take place. No sales, no commission income. I think even the industry folks would agree something like a $2 million median house price, given current incomes, would be bad for business. So what is the impact of high prices, relative to income, on market turnover?

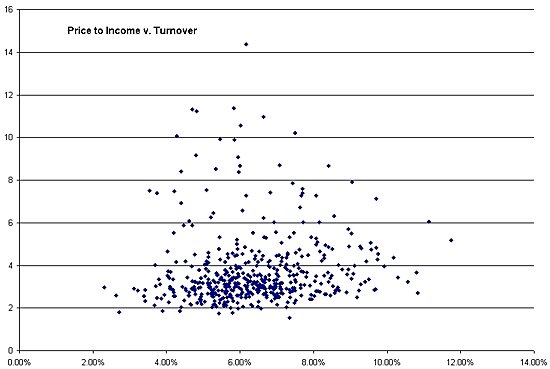

The chart below the jump presents a scatter diagram of the ratio of median house price to median household income by annual home sales as a percent of the occupied housing stock by metro area. 490 U.S. cities represented from the 2005 American Community Survey, conducted by the Census Bureau.

It is generally considered that a house price to income ratio between 3 and 4 is a balanced, healthy market. Some of this is driven by consumer preferences; part by mortgage underwriting standards. Fortunately, even in the bubble year of 2005, about 360 of the 490 cities examined had price to income ratios below 4. But this sample does include small cities like Enterprise, Alabama. Within these balanced cities the relationship between affordability (price/income) to turnover is slightly positive, almost zero, implying that relatively small price increase in affordable housing markets do not have detrimental impacts on sales activity.

When we look at markets with price to income ratios above 4, the highest being Key West, FL, where median home prices were 14 times median household income, we see this relationship become much stronger and negative (-.31). Unsurprisingly when housing markets become increasingly unaffordable, sales volumes fall. These markets are also likely to be supply-constrained, so that subsidies that are demand based, like those that are mortgage based, will largely push up prices.

The point here is to be careful what you ask for. When subsidies end up pushing prices above the price to income ratio of 4, sales turnover tends to fall. So what extra one makes on price, you might more than lose on volume.