Politicians are, as a rule, no better at dispensing investment advice than your barber. Yet, they have a point when they warn about cryptoasset price fluctuations. In the last two years, the annual volatility of bitcoin and ether — computed from the standard deviation of daily returns — has been 100 to 150 percent, four to six times that of commodities such as gold and oil, and of emerging-market currencies.

There is a danger, however, in basing policy on eye-catching numbers like these. For the current volatility of individual cryptoassets tells us little about the true risk exposure of investors, now and in the future.

What matters is the risk of the portfolio as a whole

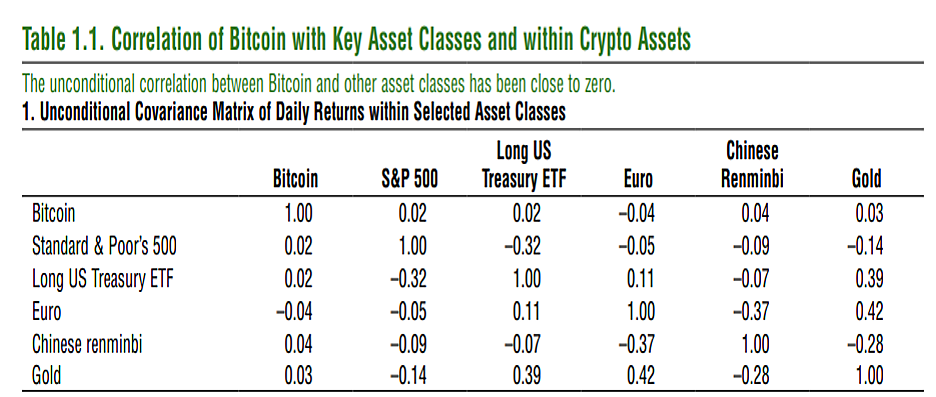

Changes in the price of cryptoassets have so far correlated little with stock market movements. The table below, taken from the IMF’s latest Global Financial Stability Report, shows that daily returns on bitcoin, on one hand, and on stocks, bonds and currency, on the other hand, rarely move together.

This matters because investor exposure has less to do with the risk of individual assets than with the risk of the portfolio as a whole. Portfolio risk in turn is affected by how much the component assets move together.

Consider a multi-stock asset (called ‘Market’) with mean annual return of 7 percent and annual volatility of 20 percent. Consider also an asset (called ‘Crypto’) with mean return of 500 percent, consistent with recent cryptoasset performance, and volatility of 200 percent. ‘Market’ and ‘Crypto’ returns have a correlation of 0.02, equal to the one between the S&P 500 and bitcoin in the IMF table.

Now imagine your portfolio is a 90–10 mix of ‘Market’ and ‘Crypto’. The expected portfolio return is a weighted average of the expected return on each of the component assets. It comes to 56.3 percent — not bad for a year’s investment!

What about portfolio volatility? Here things get a bit more complicated, because portfolio volatility depends on both the volatility of each component asset and on the correlation between these independent volatilities. It turns out that portfolio volatility in this case is 27 percent.

That sounds like a lot: in any year, the return on the portfolio may vary from the expected return by plus or minus 27 percentage points. It’s also clearly higher than the 20 percent volatility associated with owning ‘Market’ alone.

But consider the change in expected returns. Adding in ‘Crypto’ to represent 10 percent of holdings increases the expected annual return from 7 percent to 56.3 percent. An eightfold increase in average gains in exchange for raising volatility by a third.

This is all hypothetical, but it goes to show that a high-volatility, high-return cryptoasset may not increase portfolio risk nearly as much as might at first be apparent.

Volatility will likely decrease as more people use cryptoassets

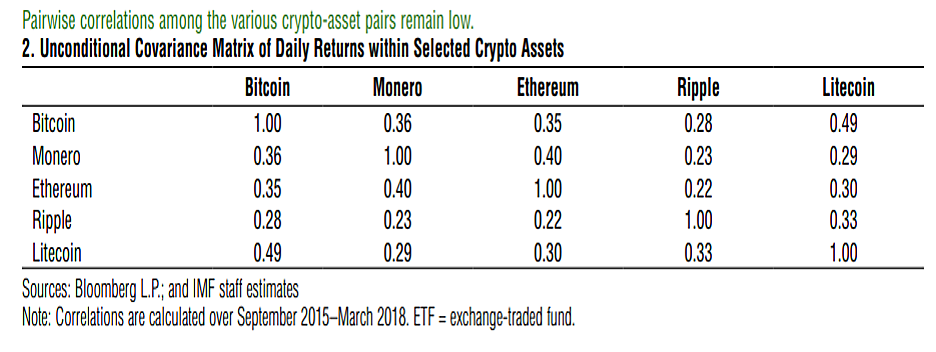

Now consider the table above, also from the IMF, which shows how much individual cryptoassets move together. These correlations are relatively low when compared to stocks: share returns on the S&P 500 had a median correlation of 50 to 60 percent for much of the last fifteen years.

Why does this matter? Because it suggests that cryptoasset prices are relatively independent from one another, rather than moving in unison as is implied by the narrative of an irrational cryptoasset ‘bubble’ popular in some circles.

This also serves to illustrate the second reason why cryptoassets may not turn out to be as risky as some think. To wit, that they feature network externalities. Cryptoassets succeed to the extent that they can attract users, and the more people adopt them, the more attractive it becomes for others to do the same. After all, the only function that cryptoassets serve is as currency to transact on blockchain-based platforms. The more counterparties on the platform, the more interesting it becomes to hold the cryptoasset.

Some may wish to place bets on how willing other people will be in future to hold individual cryptoassets. Yet, in the long run, cryptoassets’ value comes from the goods and services they serve to acquire. Therefore, as networks grow and as the uses of cryptoassets become more widely understood, prices will likely converge to that utility value and may fluctuate less.

None of this should assuage worries about the future performance of individual cryptoassets. That the three-figure returns we have recently witnessed will continue is unlikely. Furthermore, when (and at which speed) cryptoassets will begin to converge to their true values remains unknown. Additionally, in the real world there are sources of risk other than volatility, such as the risk of not finding willing buyers at certain times (liquidity risk) and the risk that cryptoasset ventures will fail (default risk).

Finally, there is no guarantee that the low stock-crypto correlations recorded today will carry on into the future. If cryptoassets are widely adopted by retail investors, their co-movement with other asset classes may well increase, raising portfolio risk.

Nevertheless, the discerning Alt‑M reader should take claims of extreme volatility in cryptoassets with a grain of salt, especially if he or she is a financial policymaker.