A Senate Subcommittee chaired by Senator Carl Levin heard from three panels of witnesses today on Apple Inc.’s corporate tax payments.

Democratic senators and some news stories are making it sound like some vast tax cheating has been going on, but that’s not what the hearing actually revealed. My sense in listening for four hours is that Apple pretty well does what many or most U.S. multinationals do to legally minimize their tax payments on foreign income. No one at the hearing said the company is doing anything illegal.

The basic story seems to be that Apple uses a holding company to gather all the after-tax profits from its sales outside of the Americas. Those sales may or may not be subject to tax in the countries where they occur, but that first layer of tax is up to those particular countries. The holding company is apparently not taxed as an entity in any country, but Apple says that its investment earnings are taxed in the U.S. to the Apple parent company.

The purpose of Apple’s corporate structure that the senators focused on seems to be to avoid double-taxation of its foreign earnings. That goal makes sense because the U.S. is one of few major countries left that does not have a territorial corporate tax system. Essentially, Apple and many other companies are trying to create a home-made territorial tax system so that they can remain competitive in foreign markets. Thus, they are doing the job that Congress should have done in reforming the U.S. international tax system.

Note that Apple holds such a big pile of cash abroad in a holding company mainly because the U.S. applies such a high corporate tax rate to profit repatriation. A major goal of tax reform is to slash America’s absurdly high corporate tax rate so that companies can bring home their piles of foreign cash and invest it here. With such a reform, the issue of whether or not investment earnings of foreign holding companies were taxed would become far less important.

Part of the hearing regarded transfer pricing and whether Apple is unjustifiably shifting U.S. profits abroad. Transfer pricing is a gigantic complex mess that is getting worse over time because of the high-tech nature of most modern corporations, and with the rise in the importance of intellectual property. It’s hard to know where much of the income of high-tech corporations is actually “earned.” Transfer pricing has become especially a problem for tax administration in countries—such as the United States—that try to swim against the current and retain high statutory corporate tax rates.

Senator Ron Johnson had the best questions and comments at the hearing. Johnson focused on the fact that much of Apple’s employment, research, supplier network, and shareholders are in the United States, and they benefit if Apple’s affiliates reduce their tax payments to foreign governments. He also noted that the share of Apple’s global income taxed in the United States is just a bit less than the U.S. share of Apple’s global product sales, but that is because Apple’s foreign sales are somewhat more profitable that its U.S. sales. Put another way, the U.S. government seems to getting a roughly “fair share” of Apple’s global profits.

An Apple official noted that 50,000 of Apple’s 75,000 global employees are in the U.S. At the same time, about 60 percent of the company’s sales are abroad. So obviously—as Senator Rob Portman noted—Apple’s foreign sales are great for the United States because it means that U.S. employment, research, and other activities get boosted.

Democratic senators and the liberal witnesses at the hearing seemed to believe that piling more tax regulations on multinationals would be a good idea. But as I discuss in Global Tax Revolution, we’ve been adding more and more tax rules on multinationals since the early 1960s to reduce avoidance, and we’ve ended up with perhaps the most vastly complex corporate tax system in the world. And that approach hasn’t even solved the supposed avoidance problem that liberals worry about, as illustrated by this hearing.

A much better solution would be to sharply reduce our federal statutory corporate tax rate from 35 percent to, say, 15 percent, which is the current rate in Canada. I’ve noted that Canada’s huge tax rate cut does not seem to have lost the country much, if any, tax revenue.

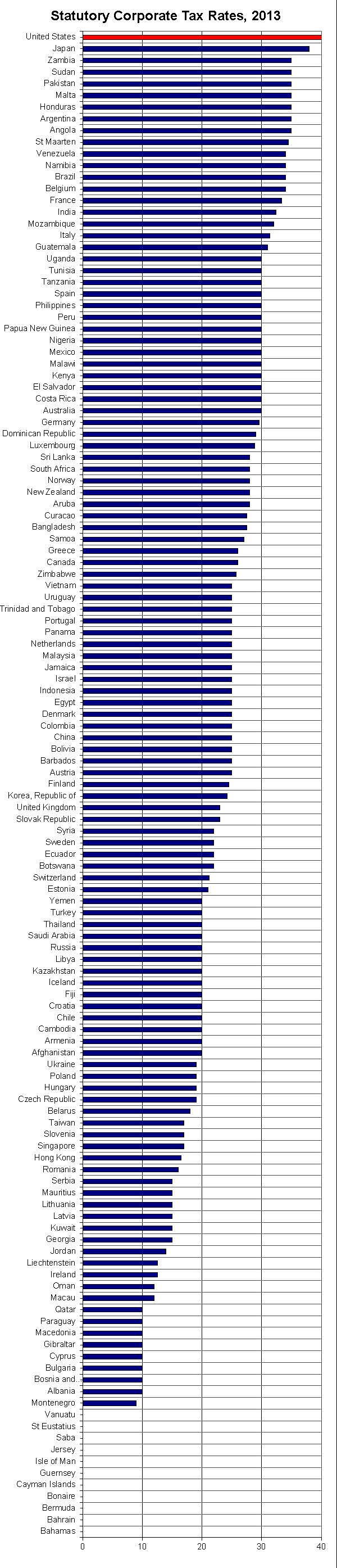

The U.S. rate is the highest general corporate tax rate in the world, as shown in the chart below based on KPMG data. (KPMG lists UAE at 55 percent, but that rate is only applied to foreign oil companies, and even then those companies often cut special deals to reduce the rate). The KPMG global average rate for 130 countries is just 24 percent. Thus, the U.S. federal-state rate of 40 percent is two-thirds higher than the global average.

Given the U.S. tax disadvantage, it’s not surprising that Apple and every other U.S. multinational have strong incentives to move their real investments and paper profits abroad. That Apple may or may not be doing so is the non-story of these hearings.