Okay, I’ll admit the title of this post is an exaggeration. How to fix the mess at the IRS is a fiscal policy question, and that requires tax reform rather than spending restraint.

But allow me a bit of literary license. We just had a big debt limit battle in Washington and, after a lot of political drama, politicians kicked the can down the road.

So we need to ask ourselves whether that fight accomplished anything?

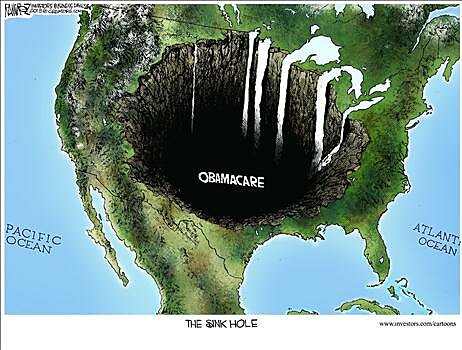

It did focus attention of the flaws of Obamacare, and I suppose there’s some value in that.

But the debt limit was not a vehicle — as has been the case in the past — for changes in fiscal policy. We didn’t get something good, like the sequester which resulted from the 2011 debt limit legislation. And we didn’t get something bad, like the tax hike in the 1985 debt limit legislation

Some are asking whether we should even have a debt limit. A number of critics have suggested we should get rid of the borrowing cap because it creates the risk of default. I think those concerns are very overblown.

I’m more persuaded by those who argue that the debt limit diverts attention from better options to improve fiscal policy.

Professors Gary Becker and Edward Lazear write in the Wall Street Journal that the debt ceiling is not a very good tool for restraining the growth of government. They look at evidence from the states to warn that fiscal rules that seek to limit borrowing are ineffective.

Many states are required to have “balanced” budgets, but the growth in spending and the size of state governments continues apace. During good times, when tax revenues are high, states “balance” their budgets by spending at the high levels consistent with large revenues. When times get tough, it is difficult if not impossible to eliminate programs that had been initiated during the fat years. Instead, the states resort to budgetary gimmicks, like delaying shortfalls until next year’s “balanced” budget.

Gimmicks are bad, of course, but politicians also respond to fiscal squeezes by raising taxes.

And that can be even worse as the prospect of more revenue leads to a ratchet effect, with periodic tax hikes used to maintain or expand the gravy train of spending. The fiscal mess in Europe is an obvious case study, but if you want a painful example from America, just look at data from Connecticut. The state did quite well without an income tax from the 1600s until 1991.

But then an income tax was imposed, in part to deal with the fiscal shortfall caused by an economic downturn. And, as critics warned, that new tax has produced dismal results. The top rate has jumped from 4.5 percent to 6.5 percent and inflation-adjusted per-capita state government spending has doubled. And there have been zero net private-sector jobs created since the income tax was implemented.

So what’s the answer? Becker and Lazear explain that lawmakers should target the underlying problem of spending rather than the symptom of red ink.

Better than a debt-ceiling rule would be one that controls spending directly, not the debt that results from it. The specifics are less important than the general principle, which is that spending growth should be limited in a way that brings government outlays back down to historic ratios relative to GDP. This would place the attention where it belongs, on spending rather than on the difference between outlays and receipts. Increased spending, coupled with even larger increases in taxes, might bring the deficit down, but it would damage economic growth and well-being.

Well stated. Reducing the overall burden of government spending — measured as a share of economic output — should be the goal of fiscal policy. That’s simply another way of stating my Golden Rule.

And there’s a growing body of academic evidence showing that reducing the size of government is a good way of improving economic performance.

I’ve been highlighting the example of Switzerland, which has successfully strengthened its economy and fiscal policy with a spending cap (which, ironically, is called a “debt brake” even though the real effect of the law is to limit how fast spending can increase over time).

Other countries that have limited spending also have achieved some very impressive results. The video at this link looks at evidence from nations such as New Zealand and Canada in the 1990s, and there’s a more recent data about the positive effects of spending restraint in the Baltic nations.

There has been some interest in spending caps on Capitol Hill. Congressman Brady of Texas has proposed a MAP Act that is somewhat similar to Switzerland’s debt brake and Senator Corker of Tennessee has introduced a CAP Act that also would restrain annual spending increases.

Perhaps if some of their colleagues read today’s Becker-Lazear column, they’ll also understand why it’s better to focus on the underlying problem of government spending rather than getting distracted by the symptom of red ink.