It’s no secret that I dislike the value-added tax.

But this isn’t because of its design. The VAT, after all, would be (presumably) a single-rate, consumption-based system, just like the flat tax and national sales tax.

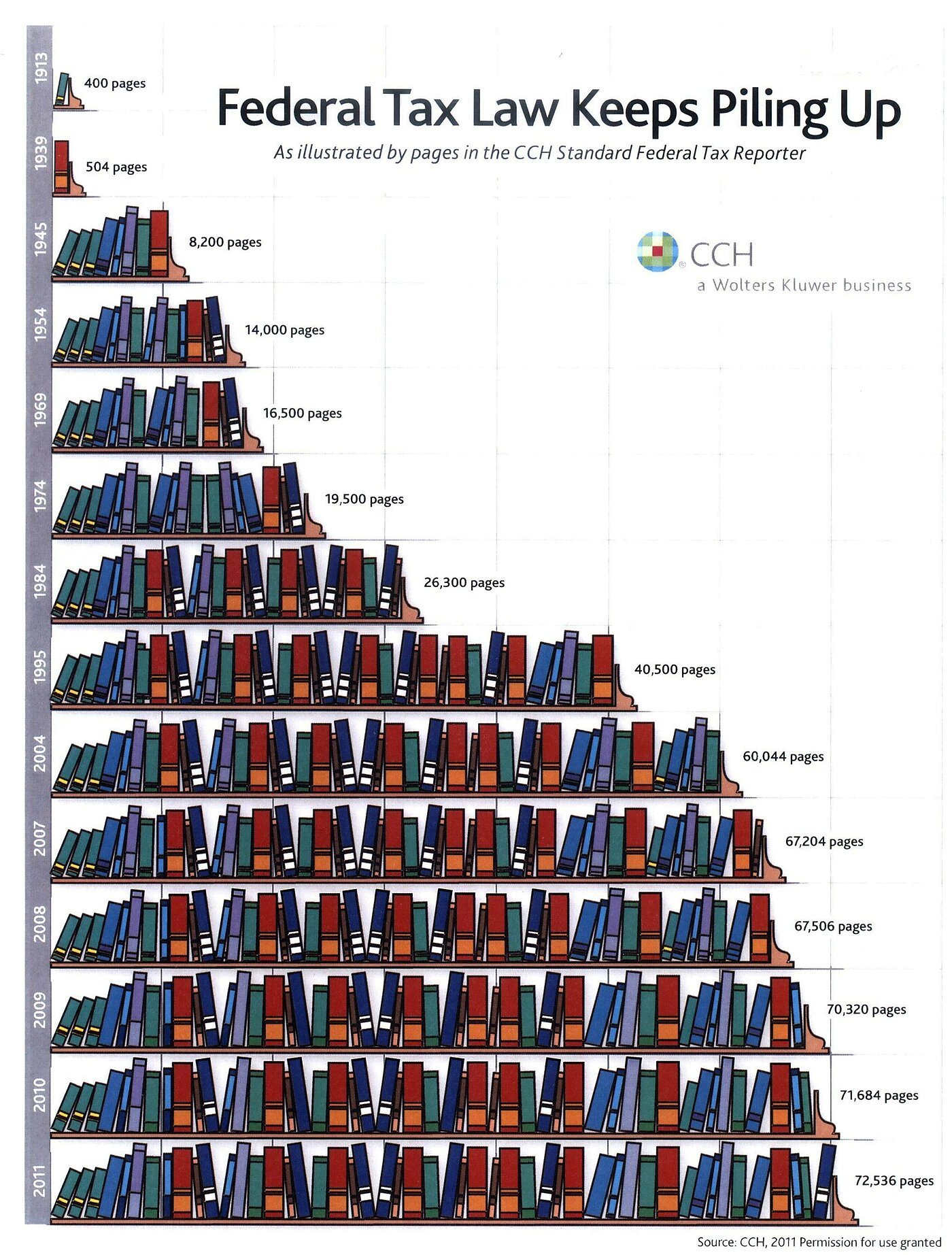

And that’s a much less destructive way of raising revenue compared to America’s corrupt and punitive internal revenue code.

But not all roads lead to Rome. Proponents of the flat tax and sales tax want to replace the income tax. That would be a very positive step.

Advocates of the VAT, by contrast, want to keep the income tax and give politicians another big source of revenue. That’s a catastrophically bad idea.

To understand what I mean, let’s look at a Bloomberg column by Al Hunt. He starts with a look at the political appetite for reform.

There is broad consensus that the U.S. tax system is inefficient, inequitable and hopelessly complex. …a 1986-style tax reform — broadening the base and lowering the rates — isn’t politically achievable today. …the conservative dream of starving government by slashing taxes and the liberal idea of paying for new initiatives by closing loopholes for the rich are nonstarters.

I agree with everything in those excerpts.

So does this mean Al Hunt and I are on the same wavelength?

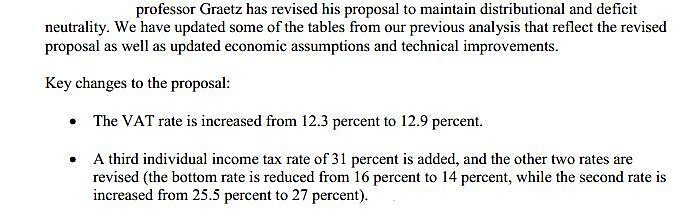

Not exactly. I think we have to wait until 2017 to have any hope of tax reform (even then, only if we’re very lucky), whereas Hunt thinks the current logjam can be broken by adopting a VAT and modifying the income tax. More specifically, he’s talking about a proposal from a Columbia University Law Professor that would impose a 12.9 percent VAT while simultaneously creating a much bigger family allowance (sometimes referred to as the zero-bracket amount) so that millions of additional Americans no longer have to pay income tax.

Hunt likes this idea.

The Graetz initiative offers something for both sides. It starts, he suggests, with countering the observation once offered by former Treasury Secretary Larry Summers that liberals fear a value-added tax because it’s regressive and conservatives fear it because it’s a money machine. Graetz’s measure overcomes both objections.

Regarding the final sentence of that excerpt, he’s half right. Folks on the left will be happy to know that there will be a lot more redistribution through the tax code.

Graetz addresses the regressivity of most sales taxes, not by exempting food, drugs and other necessities as most of the older European systems do, but with a system of credits and offsets… He provides a payroll tax cut and expanded child-care credits focused on low- and moderate-income workers.

But what do advocates of small government get out of the deal?

Well, they do get something in the short run. Graetz wants to use the VAT money to reduce the burden of the income tax. Rates for households are lowered, with the top rate falling to 31 percent. And the best part of the plan may be that it reduces America’s uncompetitive corporate tax rate to 15 percent.

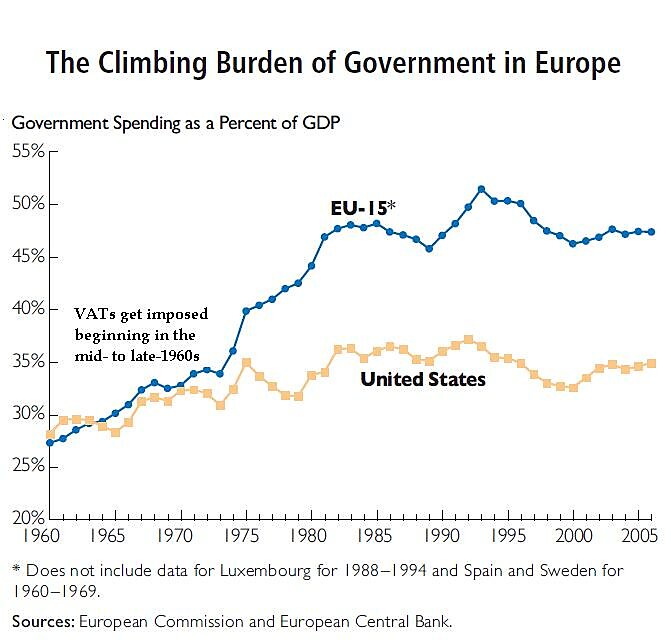

But I’m more worried about the long run, particularly after looking at evidence from Europe and Japan.

What’s in the plan, for instance, that would prevent the VAT from becoming a “money machine”? Or what guarantees would be put in place to prevent politicians from re-expanding the income tax?

Unfortunately, there don’t appear to be any safeguards. Professor Graetz has expressed some support for supermajority rules to protect against tax hikes, but he’s quoted in the article explicitly stating that a VAT could be used to generate more money to prop up the welfare state.

The Tax Policy Center found that his proposal succeeds in raising the same amount of revenue as current law. If revenue is to be part of any longer-term deficit reduction, Graetz observes, the value-added tax or the income taxes could be tweaked. “Actually, this would put us in a better situation to address the fiscal crunch down the road,” he says.

That statement scares the heck out of me. We desperately need the right kind of entitlement reform to save America from becoming another doomed welfare state. But what are the odds of getting good changes if politicians think they can continuously kick the can down the road by raising the VAT every couple of years.

Before you know it, we’re Greece!

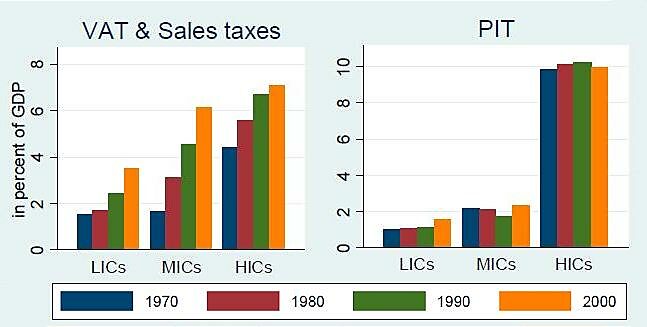

If you don’t believe me about the VAT being a money machine, perhaps you’ll be more trusting of analysis from the International Monetary Fund. That bureaucracy actually supports the VAT,

but the IMF inadvertently revealed in some research last year that the VAT is far more effective at generating new revenue than the income tax.

And that’s true for poor nations and rich nations.

This video from the Center for Freedom and Prosperity, narrated by yours truly, explains why the VAT would finance the road to serfdom.

Last but not least, it’s worth pointing out that Professor Graetz’s proposal has become more punitive over time. Check out this portion of a Tax Policy Center study showing that the VAT rate has been increased and that a new class-warfare tax rate has been added to the proposal.

So if the proposal has become more onerous on paper, imagine how much worse it will get once politicians get their hands on it.

P.S. To be fair, there’s very little indication that Prof. Graetz wants bigger and more expensive government. He’s proposing a VAT for the same reason Cong. Paul Ryan has proposed a VAT. They think the revenue can be used to reduce the burden of the income tax. They’re not wrong in theory. They just don’t appreciate the danger of giving politicians a new source of revenue.

P.P.S. George Will correctly warns that the VAT should be off the table until and unless the 16th Amendment is repealed. And Robert Samuelson gives several reasons why this levy should be rejected.

P.P.P.S. Some advocates say the VAT is needed to forestall higher income tax rates, but that certainly hasn’t been the case in Europe.

P.P.P.P.S. You can enjoy some amusing VAT cartoons by clicking here, here, and here.