The American Compass recently published a series of pieces about the economic successes of the Trump administration and whither national conservatism after his defeat by Joe Biden. Several commentators criticized the pieces for arguing that restrictive immigration policies were responsible for wage and employment growth during the Trump administration. Oren Cass, the executive director of American Compass, responded to that criticism with a piece arguing that lower immigration did result in higher wages and lower unemployment.

Cass wrote that those critics “fascinate me, in the same way an old-timey ‘cabinet of curiosities’ might capture the attention,” and responded with an essay that contemptuously dismisses social science on how immigration affects the labor market in favor of anecdotes from news stories. This blog post is a response to one of Cass’s points that fascinates me. He wrote:

The empirical case for the ‘nothing to see here’ approach to immigration economics is paper thin; one can typically guess where the hyperlinks will point before moving the cursor to them. Academics debate endlessly whether a sudden and massive influx of Cuban refugees in Miami in 1980 did or did not depress local wages, as if this deeply unnatural ‘natural experiment’ answers for all times and places the question of how a national economy’s labor market might be affected by the rate at which a given class of workers flows into it.

It is fascinating when someone so casually dismisses a vast body of knowledge. This blogpost will explain some basics about labor economics, dive into the immigration literature, and hopefully explain why Cass and others who ignore economic research do so at their own peril.

Economic Theory and Labor Markets

Employers pay workers to perform tasks because employers value the performance of those tasks more than they value the money that they pay in wages. That demand for workers is determined entirely by the marginal value product (MVP) of the worker. The MVP is the quantity of goods or services supplied by a worker multiplied by the market price for those goods (marginal physical productivity times market price). You see, employers value the tasks that they pay for because they can sell what the employees produce to consumers for a profit. Employers will hire a worker if his wages are below the worker’s MVP. In such a situation, the employer will pay less to the worker than he will receive in revenue from the worker’s production – meaning that it is profitable to employ him (if MVP is equal to the wage then the employer is indifferent to hiring the worker, controlling for transaction costs). Immigrants have higher wages in the United States because their MVP is higher here than in their home countries. In other words, immigrants have higher wages in the United States because they are more productive here.

MVP is determined by the worker’s labor, capital available to the worker, land that the worker uses, and the quality of entrepreneurship. An entrepreneur combines the factors of production of labor, capital, and land to (hopefully) produce a valuable good or service that he can then sell to consumers for a profit that compensates the entrepreneur for organizing those factors. The relative prices of those factors of production affect the MVP, and hence wages, of workers. Other producers supply additional land, capital, and entrepreneurship when the relative price for those items increases.

An increase in the supply of workers might push down wages but that also increases the relative price of capital used by workers. As a result, owners of capital earn higher profits and those higher profits incentivize investors to produce additional capital that entrepreneurs can buy that then increases worker MVP that results in higher wages. For example, imagine a construction site with 10 workers using 10 hammers to build a house. Each worker has one hammer. If the entrepreneur hires an 11th worker and all 11 workers must now share 10 hammers, those workers that share are going to have a lower MVP and a lower wage as a result. That also makes hammers relatively more valuable compared to laborers and thus raises the price of hammers. That higher price gives hammer manufacturers an incentive to supply more hammers that the entrepreneur will buy to give to the 11th construction worker. Once that 11th construction worker gets a hammer, his MVP increases and so will his wage. If the employer does not raise the worker’s wages after he gets a hammer then another entrepreneur with enough hammers can hire away the worker for a higher wage.

The amount of time it takes from when additional workers show up to when producers supply additional hammers is called the long run. It’s the amount of time it takes the economy to adjust to a change to again reach equilibrium. The length of time before the long run arrives varies because entrepreneurs, consumers, and workers also try to anticipate the future. For instance, some entrepreneurs anticipate that the supply of workers due to immigration will grow in the future so they invest in making new capital goods even before the workers arrive so that the immigrants will be able to use almost immediately after they arrive. That means that the long run might arrive very quickly and the initial decline in wages described above might not even happen at all because entrepreneurs already anticipated it.

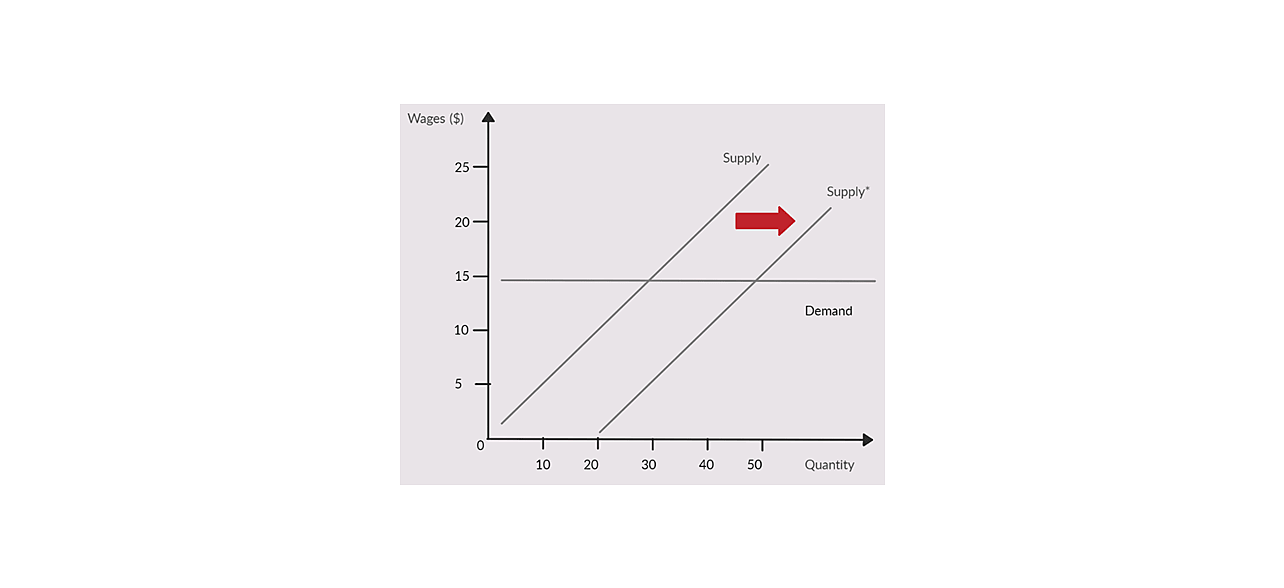

The lesson from this example is that the labor demand curve is flat in the long run meaning that an increase in the supply of workers doesn’t lower wages in general (Figure 1). Sometimes this doesn’t hold for workers in certain occupations or in specific regions of the country, but it holds overall in the long run. The overall long run wage effect of immigration to the U.S. economy is zero and it can’t be any other way because of how the supply of the factors of production changes in reaction to the immigrant-induced change in price. Capital increases the MVP of labor, so more capital, relative to the size of the larger immigrant-infused workforce, raises overall nation-wide wages back to where they were prior to the arrival of the immigrants. The relative long run wage effect for native-born American or immigrant workers will differ based on their skill level, with native-born American workers gaining and longer-settled immigrant workers losing on average, but the overall impact on nationwide wages will be zero in the long run.

Figure 1

Supply and Demand for Labor in the Long Run

The above paragraphs in this section mention labor demand. If you’ve only read Cass’s writings on the economics of immigration, then this is likely the first time that you’ve seen the labor demand curve mentioned. Cass’s writings focus almost exclusively on the supply of workers. Of course, market prices are where supply and demand meet and the labor market is no different even with the quirks I mentioned above and others about labor supply. It is impossible to understand how immigration affects wages without understanding the labor demand curve but understanding the labor demand curve should convince you that immigration does not lower wages.

Empirical Evidence

The above theory section is important in understanding how shifts in the supply of workers caused by immigration, increased fertility, internal migration, or any other cause can affect wages. This section will focus on the empirical evidence. To begin, the wage elasticity measures how much an increase in the supply of workers affects the wage. For example, if a 1 percentage point increase in the supply of workers leads to a ‑0.1 percentage point decline in wages then the wage elasticity is ‑0.1. Importantly, the papers that measure wage elasticity of native-born workers in response to changes in the supply of immigrants look at the relative change in wages. Even if the elasticity is negative, that does not mean that wages declined as the prices are relative to each other. It can and frequently does mean that wages went up for all workers but that they went up a lot more for some workers than for others.

The National Academy of Sciences (NAS) literature survey reported long-term ranges of wage elasticities for all native-born Americans and native-born high school dropouts. The effect of a 1 percent increase in labor supply due to immigration on the relative wages of native-born Americans ranges from ‑0.4 to +0.1. Just to reiterate, this means that a 1 percent change in the supply of labor caused by immigrants has an effect on wages of between negative 0.4 and positive 0.1. The effects do differ by experience and education.

The two most interesting and widely cited studies in this vast wage literature are from George Borjas and Gianmarco Ottaviano and Giovanni Peri. They are both part of the so-called skill cell subset of the literature that also combines structural methods to study how immigrants with specific levels of experience and education affect the relative wages of natives with the same levels of experience and education. Structural methods help estimate the long run effect by including other research that estimates the speed and extent to which capital adjusts to changes in the labor market as well as elasticities of substitution between workers by skill.

When Borjas and Ottaviano and Peri both assume some labor market complementarities, they find about the same overall wage impact on native-born Americans from immigration at +0.6 percent relative increase in wages in Borjas and +0.5 percent increase in Ottaviano and Peri (these are not elasticities, but the effect of immigration on the relative wages). But they differ as to the impact of immigration on the wages of native-born American high school dropouts. Borjas finds that the wages of native-born American dropouts fell by a relative ‑1.7 percent compared to Ottaviano and Peri who found a relative +1.1 percent wage increase for the same group. The reason for the varying results between Borjas and Ottaviano and Peri is due to minute differences in methodology.

Immigrants have a tiny effect on the relative wages of native-born Americans, but they have a much larger effect on the wages of other immigrants. Borjas and Ottaviano and Peri agree that immigrants lower the relative wages of other immigrants more because they have the most similar skills, level of experience, and live in the same regions of the United States. Every education group of immigrant workers experiences relative wage declines as a result of immigration, which is in contrast to the wages of native-born American workers that mostly experience relative wage increases. New immigrants substituting for and lowering the relative wages of older immigrants is one of the most common findings in the literature. This is why other writers who oppose liberalized immigration focus on how immigrant wages are the most affected by other immigrants.

It gets more complicated than that. Native workers react to more immigrants by getting more education and taking jobs that require their specific skills that immigrants lack, like language. Economists Giovanni Peri and Chad Sparber found exactly that in the United States whereby foreign-born workers specialize in manual labor occupations where they have a comparative advantage while native-born American workers with the same skills in the same parts of the country specialize in communications-intensive tasks that require English language fluency. By specializing in different tasks and occupations, the supply of labor in different occupations doesn’t increase very much.

One of the best examples of complementary task specialization comes from Denmark over the 1991 to 2008 period. Economists Giovanni Peri and Mette Foged looked at the inflow of non-European immigrants, who were much less skilled than native Danes and other Europeans, on an individual level compared to individual Danish workers to see how they all reacted to the immigrants. The immigrants incentivized native-born Danish workers and other Europeans to pursue communications-intensive occupations inside of firms, in other firms, and in other municipalities without increasing their probability of unemployment. As a result, Danish wages actually increased after about 5 or 6 years because the Danish workers became more productive. In other words, lower skilled Danish natives upgraded their skills in response to immigration.

If immigrants took jobs from native-born Americans then there would be local native job losses where immigrants move and natives would leave those areas. Economists David Card and John DiNardo tested the so-called “skating rink” model of the labor market whereby one new immigrant worker knocks out a similarly skilled native-born worker. They found that natives and immigrants in the same skill groups move toward the same local areas at the same time. Changes in the local economy, such as new business creation and the spread of different industries thanks to immigration, made up for the theoretical displacement of native workers. This result is the opposite of what we’d expect from a labor market with a fixed supply of jobs or a lump of labor.

Building on that, there are other methods besides the so-called skill cell and structural methods literature that attempt to measure the effect of immigration on wages. Economists Peter Diamond, Dale Mortensen, and Christopher Pissarides pioneered the construction of labor market models that explain how firms with job vacancies and unemployed workers try to match up over time. These so-called search and matching models explain how frictional unemployment emerges and how firms and workers react to changes in the labor market.

There are only a handful of papers that simulate how immigrants affect the searching and matching of jobs, but they all find that immigration decreases the unemployment rate for native-born American workers (page 194). One such paper by Andri Chassambouli and Theodore Palivos used a search and matching model to analyze how immigration from 2000 to 2009 affected the U.S. labor market. They found that immigrants increased the size of the U.S. workforce by 6.1 percent, which diminished the wages of high-skilled native-born workers by 0.31 percent and increased the wage of low-skilled native-born workers by 0.24 percent. At the same time, immigration dropped the long-run rate of unemployment simulated in their model from 6.1 percent to 5.5 percent for low-skilled native-born workers and from 2.4 percent to 2 percent for high-skilled native workers. Unemployment dropped for both groups of native-born workers because immigration lowered the costs for firms to search for new workers that increased the likelihood of quickly filling a vacant job. Lower hiring costs results in more overall hiring.

Mariel Boatlift

The literature on how immigrants affect the wages of native-born Americans is not paper thin – it’s as thick as several phone books and we haven’t even gotten to the quasi-natural experiment literature. Cass strongly implied that he was sick of reading Mariel Boatlift papers, but one gets the sense that Cass doesn’t understand why quasi-natural experiments are important. The papers that don’t use quasi-natural experiments, such as those mentioned above, must use complex econometric and structural modeling methods to see how immigration affects labor markets because there are few large sudden exogenous changes in immigration. If there’s not a big change in immigration, it’s difficult to detect a change in wages because so much else is happening the world. Trying to detect a shift in wages without a big change in policy is like trying to discover the freezing point of water by looking out your window. By doing so, you can get pretty close but since you can’t control the temperature outside, keep it steady for long periods of time, and you can’t control air pressure, it would be more difficult than in a laboratory and your findings will be less precise. A quasi-natural experiment is not as good as a randomized controlled trial experiment or an experiment in a laboratory, but it’s the best we have to see how immigration affects the labor market and papers that employ them should not be so casually dismissed.

Papers about the Marial Boatlift are the most well-known quasi-natural experimental evidence in the economics of immigration literature because they occurred at a time with lots of data, in a relatively isolated portion of a rich country, and was caused by policy change in a poor country that had nothing to do with the U.S. economy. The first such paper by David Card found no significant effect on the Miami labor market, even though the Boatlift increased the size of the population by about 7 percent. Later, Borjas examined the effects of the surge and found that it lowered the wages of native-born male Miamians with less than a high-school degree by 10 percent to 30 percent that fade out after less than a decade. I found some very odd effects that you wouldn’t expect if the Borjas results were robust such as a delayed bump in the wages of Hispanic high school dropouts in Miami above other cities (you would expect a wage bump for workers as investors build more capital in response to the sudden immigration shock, but not in the way that I found). More recently, economists Michael Clemens and Jennifer Hunt discovered that Borjas’ findings are an artifact of changes in composition in certain very small subsamples of workers in Borjas’ data. This compositional change is specific to Miami and unrelated to the Boatlift. Correcting for that shrinks the negative wage impact substantially.

Of course, Cass may just be bored with the Mariel Boatlift specifically, so he should instead read about quasi-natural experiments in immigration that happen in other locales such as Turkey, Colombia, Israel, France, Portugal, Central Florida, and other places. They generally find small temporary negative effects that disappear in the long run, no effects whatsoever, or positive effects. The quasi-experimental literature confirms the findings of the non-quasi-experimental research above: Immigration just doesn’t affect native-born wages or employment very much, the negative effects tends to be short term, and the positive effects tend to be long term.

More importantly, Cass wants national conservatives to raise national wages by increasing immigration enforcement and reducing the immigrant population. Another paper by Michael Clemens, Ethan Lewis, and Hannah Postel looks at the wage effects of a sudden decline in the supply of legal immigrant workers, which is exactly the policy that Cass supports. They study the effectiveness of an immigration policy “designed to raise domestic wages and employment by reducing the total size of the workforce” when the U.S. government terminated the Bracero program for Mexican farm workers in 1964. Clemens, Lewis, and Postel found that farm wages in states with many Braceros and those with few Braceros rose more slowly after the government ended the Bracero program. Farmers turned to machine harvesting and planted less labor-intensive crops to take account of the new dearth of workers. Shifting labor supply to the left doesn’t always results in a faster pace of wage growth if labor demand shifts to the left more.

There is a lot more to the labor market than the supply of workers. The greatest decline in the flow of new immigrants from abroad began in March 2020 at the beginning of the COVID-19 recession. If Cass’s supply-only theory of labor markets made sense, we should have expected increased employment and wage growth during that time. Of course that didn’t happen because labor demand fell precipitously in response to fear from the virus and various government restrictions. A supply-only focus in labor economics can lead smart thinkers to silly conclusions.

All of the above findings and more are the reasons why the NAS’ exhaustive literature summary on the economic effects of immigration concluded that: “When measured over a period of 10 years or more, the impact of immigration on the wages of native-born workers overall is very small. To the extent that negative impacts occur, they are most likely to be found for prior immigrants or native-born workers who have not completed high school—who are often the closest substitutes for immigrant workers with low skills.”

Conclusion

Cass and the other writers at American Compass can ignore economic theory, economic evidence, and the huge volume of peer-reviewed and non-peer-reviewed research on the economics of immigration as much or as little as they choose. But they cannot get away with telling the world that it is “paper thin” and focused almost entirely on a “massive influx of Cuban refugees in Miami in 1980.” I do not hope to change Cass’s mind, but hopefully I can at least convince him and some other readers of American Compass that there is a lot more to the economics of immigration than research about Miami 40 years ago.