Using data stolen from service providers in the Cook Islands and the British Virgin Islands, the Washington Post published a supposed exposé of Americans who do business in so-called tax havens.

Since I’m the self-appointed defender of low-tax jurisdictions in Washington, this caught my attention. Thomas Jefferson wasn’t joking when he warned that “eternal vigilance is the price of liberty.” I’m constantly fighting against anti-tax haven schemes that would undermine tax competition, financial privacy, and fiscal sovereignty.

Even if it means a bunch of international bureaucrats threaten to toss me in a Mexican jail or a Treasury Department official says I’m being disloyal to America. Or, in this case, if it simply means I’m debunking demagoguery.

The supposedly earth-shattering highlight of the article is that some Americans linked to offshore companies and trusts have run afoul of the legal system.

Among the 4,000 U.S. individuals listed in the records, at least 30 are American citizens accused in lawsuits or criminal cases of fraud, money laundering or other serious financial misconduct.

But the real revelation is that people in the offshore world must be unusually honest. Fewer than 1 percent of them have been named in a lawsuit, much less been involved with a criminal case.

This is just a wild guess, but I’m quite confident that you would find far more evidence of misbehavior if you took a random sample of 4,000 Americans from just about any cross-section of the population.

We know we would find a greater propensity for bad behavior if we examined 4,000 politicians. And I assume that would be true for journalists as well. And folks on Wall Street. And realtors. And plumbers. Perhaps even think tank employees. Anyhow, you get the point.

Citing a couple of anecdotes, the reporter then tries to imply that low-tax jurisdictions somehow lend themselves to criminal activity.

Fraud experts say offshore bank accounts and companies are vital to the operation of complex financial crimes. Allen Stanford, who ran a $7 billion Ponzi scheme, used a bank he controlled in Antigua. Bernard Madoff, who ran the largest Ponzi scheme in U.S. history, used a series of offshore “feeder funds” to fuel the growth of his multibillion-dollar house of cards.

The Allen Stanford case was a genuine black eye for the offshore world, but it’s absurd to link Madoff’s criminality to tax havens. The offshore funds that invested with Madoff were victimized in the same way that many onshore funds lost money.

Moreover, there’s no evidence in this article — or from any other source to my knowledge — suggesting that financial impropriety is more likely in low-tax jurisdictions.

We then get some “hard” numbers.

Today, there are between 50 and 60 offshore financial centers around the world holding untold billions of dollars at a time of historic U.S. deficits and forced budget cuts. Groups that monitor tax issues estimate that between $8 trillion and $32 trillion in private global wealth is parked offshore.

So we have offshore wealth of somewhere “between $8 trillion and $32 trillion”? With that level of precision, or lack thereof, perhaps you now understand why the make-believe numbers about alleged tax evasion are about as credible as a revenue estimate from the Joint Committee on Taxation.

Speaking of make-believe numbers, the article mentions one of Washington’s worst lawmakers, a Senator who pushed through a law that has united the world against the United States.

Sen. Carl M. Levin (D‑Mich.) has been holding hearings and conducting investigations into the offshore world for nearly three decades. In 2010, Congress passed the Foreign Account Tax Compliance Act requiring that U.S. taxpayers report foreign assets to the government and foreign institutions alert the IRS when Americans open accounts.

He justifies bad policy by claiming that there’s a pot of gold at the end of the tax haven rainbow.

“We can’t afford to lose tens of billions of dollars a year to tax-avoidance schemes,” Levin said. “And many of these schemes involve the shift of U.S. corporate tax revenues earned here in the U.S. to offshore tax havens.”

But FATCA is predicted to collected less than $1 billion per year, and it probably will lose revenue once you include Laffer Curve effects such as lower investment in the American economy from overseas.

The most interesting part of the article, as least from a personal perspective, is that the Center for Freedom and Prosperity is listed as one of the “powerful lobbying interests” fighting to preserve tax competition.

The efforts by Levin and other lawmakers have been opposed by powerful lobbying interests, including the banking and accounting industries and a little-known nonprofit group called the Center for Freedom and Prosperity. CF&P was founded by Daniel J. Mitchell, a former Senate Finance Committee staffer who works as a tax expert for the Cato Institute, and Andrew Quinlan, who was a senior economic analyst for the Republican National Committee before helping start the center. …The center argues that unfettered access to offshore havens leads to lower taxes and more prosperity.

Having helped to start the organization, I wish CF&P was powerful. The Center has never had a budget of more than $250,000 per year, so it truly is a David vs. Goliath battle when we go up against bloated and over-funded bureaucracies such as the IRS and the Paris-based Organization for Economic Cooperation and Development.

The reporter somehow thinks it is big news that the Center has tried to raise money from the business community in low-tax jurisdictions.

According to records reviewed by The Post and ICIJ, the organization’s fundraising pleas have been circulated to offshore entities that make millions by providing anonymity for wealthy clients, many of them U.S. citizens.

Unfortunately, even though these offshore entities supposedly “make millions,” I’m embarrassed to say that CF&P has not been able to convince them that it makes sense to support an organization dedicated to protecting tax competition, financial privacy, and fiscal sovereignty.

But maybe that will change now that the OECD has launched a new attack on tax planning by multinational firms.

Let’s close by returning to the policy issue. The article quotes me defending the right of jurisdictions to determine their own fiscal affairs.

Mitchell, the co-founder of CF&P, added that nations shouldn’t be telling other countries how to conduct their affairs and noted that the United States is one of the worst offenders in the world when it comes to corporate secrecy.

My only gripe is that the reporter mischaracterizes my position. Yes, there are several states that are “tax havens” because of their efficient and confidential incorporation laws, but that means America is “one of the best providers,” not “one of the worst offenders.”

This is something to celebrate. I’m glad the United States is a safe haven for the oppressed people of the world. That’s great news for our economy. I just wish we also were a tax haven for American citizens.

“The United States is one of the biggest tax havens in the world,” Mitchell said. “In general, the United States is impervious to fishing expeditions here, and then the United States turns around and says, ‘Allow us to do fishing expeditions in your country.’”

But I’m not a hypocrite. Other nations should have the sovereign right to maintain pro-growth tax and privacy laws as well.

Other nations shouldn’t feel obliged to enforce bad American tax law, any more than we should feel obliged to enforce any of their bad laws.

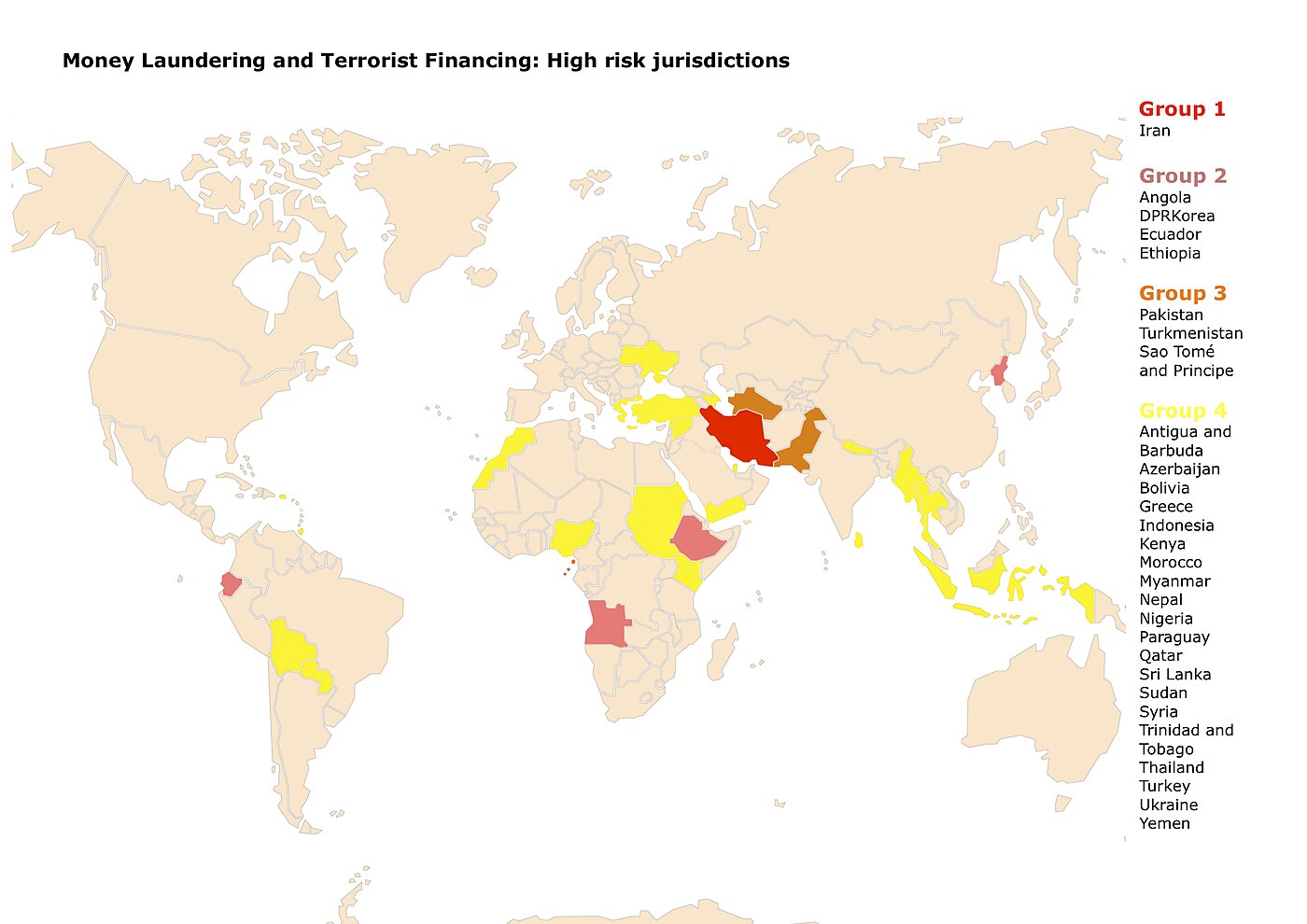

P.S. You probably won’t be surprised to learn that “onshore” nations are much more susceptible to dirty money than “offshore” jurisdictions. Which is why you have a hard time finding any tax havens on this map showing the nations with the most money laundering.

P.P.S. On the topic of tax havens, you won’t be surprised to learn that Senator Levin is not the only dishonest demagogue in Washington. If you pay close attention around 1:25 and 2:25 of this video, you’ll see that the current resident of 1600 Pennsylvania Avenue also has an unfortunate tendency to play fast and loose with the truth.