*****

Thank you for the opportunity to address you this morning. It has become so easy to borrow in America---to compare options, apply for, receive, and repay loans---that many people aren’t aware of the complex infrastructure that enables the large variety of financial services available to most Americans. But this conference, and the size and diversity of RMAI’s membership, are testimony to the importance of that infrastructure, which decades of innovation and market competition have helped to build.

The purpose of my talk is threefold. First, I’d like to go over the evolution of the credit cycle since the financial crisis. Second, I will discuss the impact of some notable recent regulations on access to consumer credit and other financial services, focusing on the patterns of access by different socioeconomic and demographic groups. Third, I will present two distinct (and often opposed) approaches to consumer protection in financial services, and I will discuss their respective policy implications.

The State of the Credit Cycle

America’s economic recovery from the 2007-09 recession is the longest on record, and ongoing.[1] Unemployment has dropped to lows last registered in the late 1960s, and the S&P 500 stock market index is at more than double the level it had reached before the financial crisis. The longevity of the post-crisis expansion and the unusual performance of key economic gauges has caused some to forecast that the cycle will soon turn.[2]

I’m not paid enough to risk my reputation offering economic predictions, but other analysts have questioned that we’re soon "due a recession." For one thing, growth in the immediate aftermath of the last downturn was weaker than in previous recoveries. Research suggests that it takes longer to come back from recessions triggered by financial crises, perhaps because healing the wounds from major credit misallocation---writing off bad loans, recapitalizing financial institutions, and so on---is a difficult and protracted process.[3]

Contrary to popular wisdom, recessions don’t seem to die of old age. An economist at the Federal Reserve Bank of San Francisco went through all U.S. post-WWII recessions and found that an 80-month-long recovery was no more likely to end than a 40-month-long one.[4] The length of an expansion alone tells us nothing about the probability of a downturn. That, of course, doesn’t mean that a recession at this particular moment is necessarily unlikely.

But, rather than engage in dubious forecasting exercises, let’s consider the position in which a hypothetical recession would catch U.S. consumer credit.

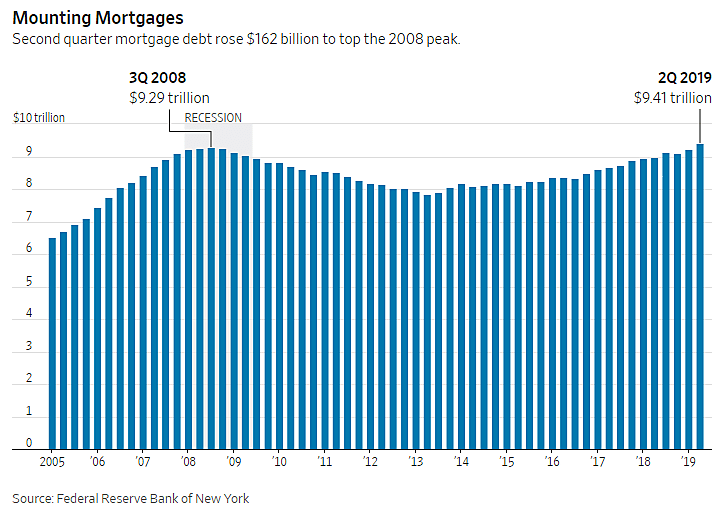

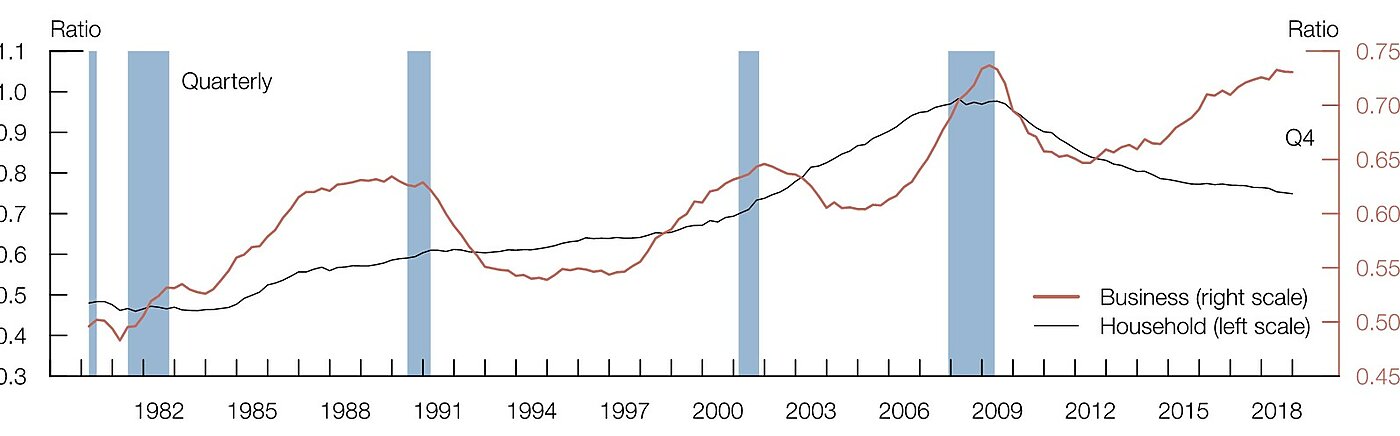

The incautious observer might take it for an ominous sign that outstanding mortgage debt surpassed its 2008 peak in the second quarter of 2019.[5] Other consumer debt, notably student loans and car loans, has also increased substantially since the last recession. But the dollar amount of debt outstanding gives a misleading picture, because U.S. national income has also increased---by around 22 percent---since the last peak. Increasing income gives households more borrowing power, so it’s right to measure credit in terms of income. And as a share of income, household debt is well below pre-crisis levels. This is not the case with business credit, which is close to but still below the high it reached in early 2009.

U.S. Household and Business Credit as a Share of U.S. GDP

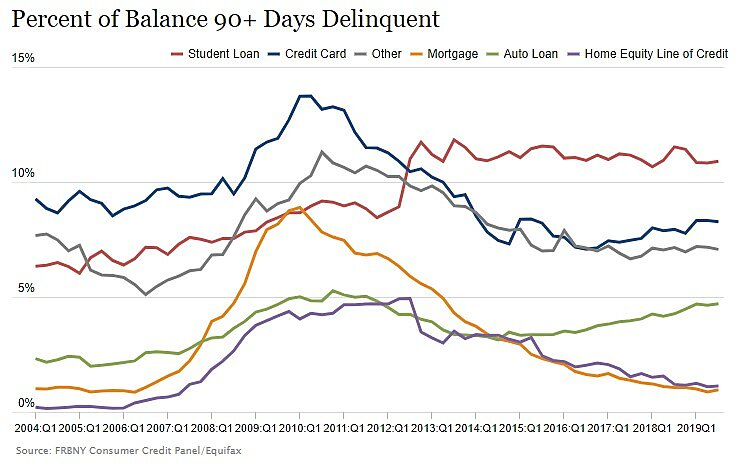

There are some areas of concern: Student loan delinquencies rose before and during the financial crisis. After reaching nearly 12 percent of outstanding balances in late 2012, they have stayed around that level, despite a strengthening economy and rising employment. In dollar terms, delinquent balances are around $123 billion higher than at the end of the last recession.[6] Car loan delinquencies have also increased in the last five years, albeit more moderately and to much lower levels. But, for other classes of consumer credit, and notably for mortgages, the single-largest credit category, delinquencies are at pre-crisis lows.

As many of you know, student loans are a special form of consumer credit, because the federal government owns virtually all new loans and issues them without underwriting prospective borrowers. There are also several forgiveness programs that write off unpaid balances after a period. The lax controls on student lending explain not only rising delinquencies, but also the real-terms doubling of outstanding balances over the last decade, and---according to the New York Fed---as much as 60 percent of tuition increases.[7] To repeat: Research suggests that every additional dollar of federal student aid pushes up tuition by as much as 60 cents. Not an impressive outcome for a policy that is often justified on grounds of college affordability.

But these dysfunctions, concerning as they clearly are, present more of a problem for taxpayers than borrowers or private creditors. It’s unfortunate that some policymakers have focused on allegedly improper practices on the part of student loan servicers, who are government contractors and play no role in origination and underwriting policy.[8] The evidence suggests it would be more beneficial to students and taxpayers if the government recognized its involvement in this market is pushing up costs and imperiling the financial well-being of borrowers.

The growth in car loan delinquencies, for its part, seems to be concentrated among subprime borrowers.[9] Analysts point out that the bulk of the more recent increase in auto lending went to the most creditworthy borrowers.[10] They also argue that easier repossession and the size of the auto lending market---7.5 times smaller than the market for home credit---make comparisons with the 2006-2008 subprime mortgage meltdown seem hyperbolic. To that I would add that there is no equivalent in U.S. auto lending to the political drive for homeownership that loomed so large in the growth of subprime mortgage credit before the financial crisis.

The aggregate data for consumer credit therefore give a broadly healthy picture, despite the length of the recovery and the dollar-terms growth of household debt.

Consumer Credit Policy and the Credit Cycle

The evidence above notwithstanding, policy changes since the financial crisis have affected access to, and the composition of, consumer credit. While the spirit behind such policies was often to protect consumers and to make credit more widely available, they haven’t always achieved those goals. Access by many borrowers to certain forms of consumer credit has in fact worsened in the past decade. Meanwhile, in other areas, portfolio risk has increased in a way that may end up harming borrowers.

Let’s start with housing credit, which at $9.83 trillion outstanding as of the end of September 2019 is by far the single-largest consumer credit item. The prevailing interpretation following the financial crisis was that inadvisable lending policies (sometimes misguided, other times predatory) caused a proliferation of high-risk mortgages that eventually went sour.[11] This interpretation informed the Dodd-Frank Act of 2010, which made important changes to financial laws and added several new laws to the books.

Among the key policy changes were the creation of minimum standards for mortgage lending, including a creditor’s obligation to evaluate a prospective borrower’s ability to repay the loan.[12] Dodd-Frank also provided for a safe harbor, called a "qualified mortgage" (QM), which exempted creditors from liability in the event of debtor default. While these provisions may all appear sensible and were no doubt well-intentioned, ten years on, U.S. housing finance has some features that should trouble anyone familiar with the last crisis.

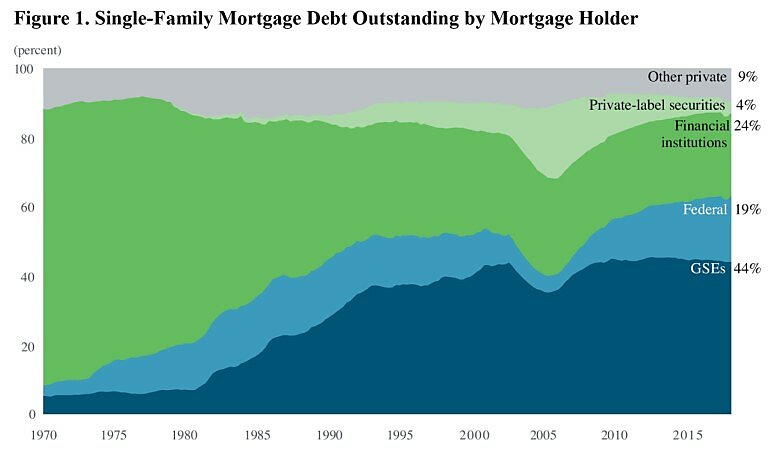

First, Fannie Mae and Freddie Mac, the two government-sponsored enterprises (GSEs) that purchased two-fifths of single-family mortgages in the run-up to the crisis and which the federal government rescued in September 2008, have not stepped back from their dominant role in the eleven years of conservatorship. As of 2019, the GSEs guaranteed 44 percent of single-family mortgage debt outstanding. Among mortgages eligible for GSE acquisition, Fannie and Freddie’s market share is at an all-time high of 71 percent.

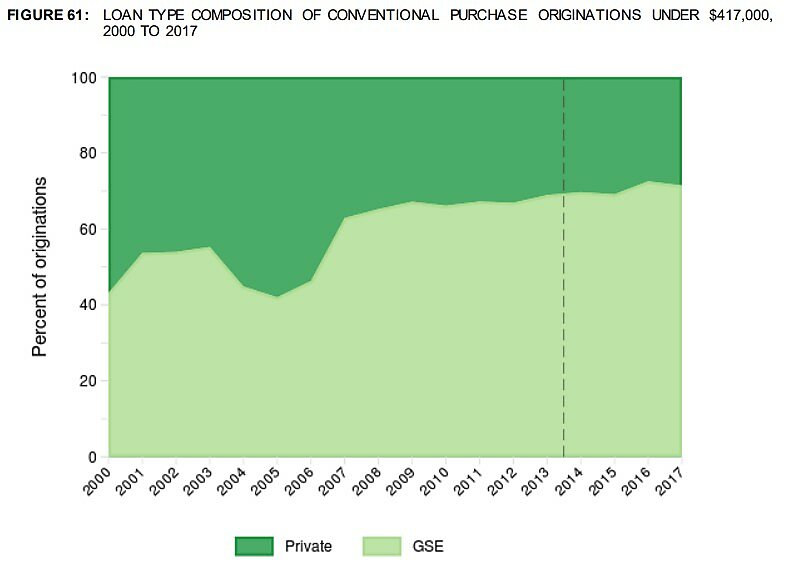

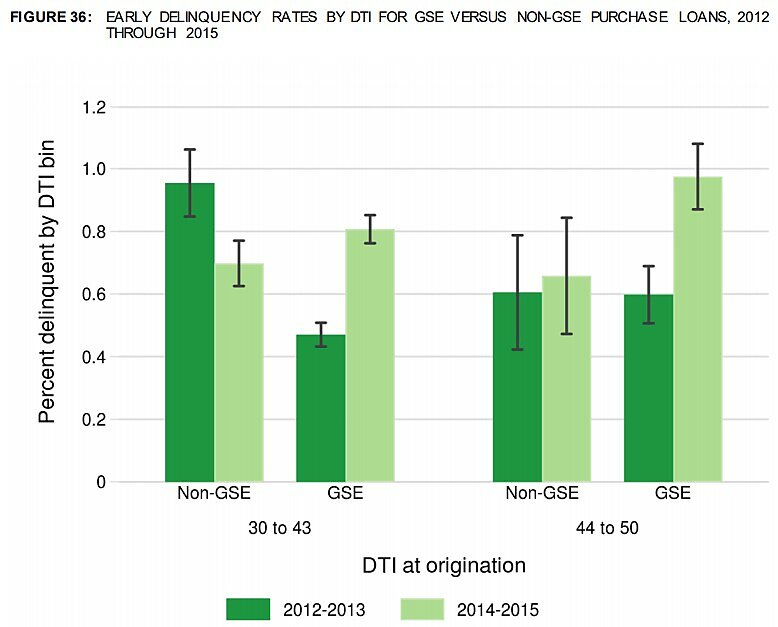

There are many reasons for the GSEs’ continued preeminence, but an important one is their exemption from the Consumer Financial Protection Bureau’s QM standards. Since 2014, the CFPB has set a limit of 43 percent on borrower debt-to-income (DTI) ratios for the mortgage to be a QM. GSE-eligible loans, however, are exempt from this requirement. Not surprisingly, this GSE “patch” has caused lenders to favor loan originations that meet the GSEs’ underwriting requirements rather than the general conditions of the CFPB’s QM rule. Yet the CFPB’s own data suggest GSE-eligible high-DTI mortgage loans have higher default rates than non-GSE-eligible loans of similar characteristics.[13]

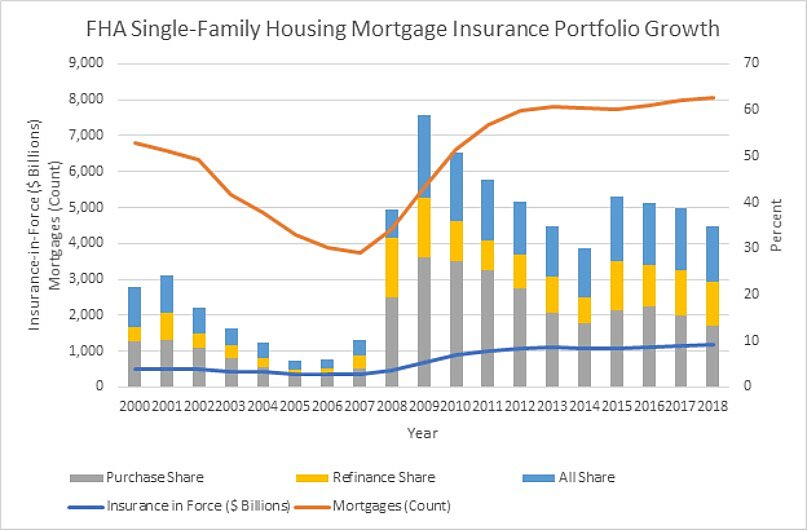

Another potential trouble spot in housing finance are Federal Housing Administration (FHA) loans. Originally intended as a government-supported program for underserved borrowers, FHA loans have historically been used by the federal government to boost homeownership, often at the cost of increasing future foreclosures.[14] With the decline of private subprime lending from 2006 onward, the FHA has taken an increasing share of the mortgage market, accounting for 19 percent of outstanding loans as of 2019. The FHA portfolio is riskier than average, although in March of last year the agency vowed to tighten its underwriting standards.[15]

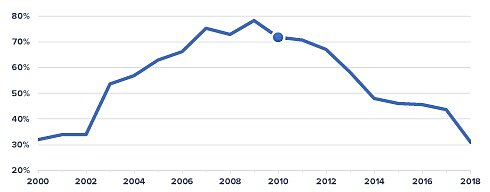

FHA Single-Family Housing Mortgage Insurance Portfolio Growth

Not all of the problems with consumer credit policy involve greater risks to the financial system and, potentially, taxpayers. Indeed, opponents of the CFPB’s hard DTI threshold contend that it may prevent sound borrowers from getting mortgages.[16] Indeed, in creating both the QM standard and the GSE “patch,” the CFPB may have spawned a mortgage underwriting regime that both constrains lending to creditworthy borrowers and encourages lending to unsound borrowers. Quite a feat!

Another area where regulation seems to have constrained access to credit and other financial services is payment cards. Two key post-crisis measures---the 2009 CARD Act and the so-called Durbin Amendment to the Dodd-Frank legislative package---fundamentally changed the regulatory landscape for credit and debit cards, respectively. The CARD Act significantly limited credit card issuers’ ability to raise interest rates on existing balances and to change other terms of the original contract. The Durbin Amendment capped interchange fees on debit transactions for banks with over $10 billion in assets.

Both laws were advocated as benign consumer protection measures. Proponents argued that large banks and payment networks were using their market power to impose unfavorable terms and fees on consumers. Regulation could therefore redistribute income from financial institutions to households without causing changes to other features of the payment card market that consumers liked.

A decade on, the evidence suggests otherwise. A recent paper by researchers at the Federal Reserve Board in Washington finds that credit card issuers---banks---became less responsive to reductions in interest rates by their competitors after the CARD Act came into force.[17] Worryingly, issuers seem to be more reluctant to react to offers of lower, but not higher, interest rates by their competitors. The authors’ finding is especially strong for subprime borrowers, consistent with the theory that issuers’ behavior sought to offset revenue losses from the inability to reprice existing balances and to adjust interest dynamically according to repayment performance.[18]

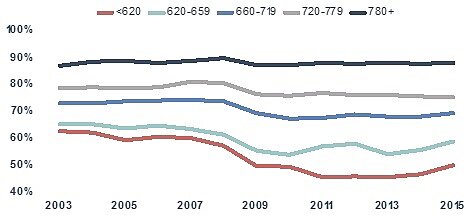

Americans with at Least One Credit Card, by Credit Score Range

Indeed, from 2009, there was a substantial decline in the share of subprime borrowers with credit cards, which the economic recovery hadn’t fully reversed even six years later. Not only that, but according to the CFPB, as of the end of 2018, only two-thirds of subprime and one-third of deep subprime consumers held at least one credit card. Both rates of credit card ownership were below their pre-crisis high.[19]

Large U.S. Banks Offering Free Checking Accounts

The Durbin Amendment also appears to have had adverse consequences for access to financial services. With income from interchange fees capped from 2011 onward, banks cut down on consumer benefits such as free checking accounts, which have dropped by 40 percentage points.[20] Banks only partially recovered the revenue losses from Durbin in this way. But that doesn’t mean consumers are better off thanks to it, as merchants only partially passed through the savings from lower interchange fees.[21]

Two Different Approaches to Consumer Protection

The interventions I have highlighted in mortgage underwriting, revolving credit, and consumer payments reflect one popular approach to financial regulation. This approach has dominated consumer credit policy since the financial crisis, and it consists of restricting the range of products and terms from which consumers may choose. The underlying economic theory is that incomplete information, firms’ market power, and behavioral biases place consumers in a vulnerable position with respect to providers of financial services. Regulation must step in, this approach recommends, to level the playing field.

Without a doubt, regulatory interventions that constrain one party to a transaction can sometimes make the other party better off. According to some, that was the effect of the 1977 Fair Debt Collection Practices Act, although economic studies conducted soon after the FDCPA’s passage found an inverse correlation between access to creditor remedies and loan interest rates.[22] Subsequent research found that consumers are willing to pay far less for restrictions on creditor remedies than the “price” of those restrictions in terms of higher interest and other fees.[23] Comparing state regimes, a 2017 paper by researchers at the New York Fed reported significant decreases in credit availability in the states that increased collection restrictions.[24]

Consumer disclosures that synthesize the most financially significant terms of a credit contract can also help consumers make better decisions, if indeed the information required is such as to improve consumer understanding. But that isn’t always the case. For example, most consumers don’t understand what an annual percentage rate (APR) stands for, yet APR has become the chief measure of cost disclosure in consumer credit.[25]

Yet, often, the impact of restrictive regulation is not straightforward. To take a blunt and headline-grabbing recent proposal, capping APR on consumer credit at 15 or 36 percent nationwide will clearly achieve its first-order aim: to eliminate the legal provision of credit at a price above the cap. But, if we are to properly evaluate the impact of regulation on consumers, it’s not enough to consider its direct effects. For providers of credit will surely respond by limiting the flow of credit to riskier borrowers, since they cannot profitably be served under the rate cap.

As second-order (unintended) consequences go, this one seems easy enough to anticipate. Yet it’s one that policymakers usually discount if not altogether neglect. The CFPB’s October 2017 Payday Rule drew what to many of us seemed the fantastical conclusion that, despite a two-thirds volume reduction as a result of the Rule, only six percent of borrowers would lose access to payday loans.[26] The CFPB is not alone among regulators in its heroic optimism: One of my first empirical assignments in consumer credit policy was to investigate why, after a daily interest cap on short-term loans was introduced in the UK, loan volume dropped by 56 percent, rather than the 11 percent reduction the British regulator had expected.[27]

Politicians are also liable to ignore the potential adverse effects on access from the credit-restrictive legislation they promote. Congresswoman Alexandria Ocasio-Cortez, the House sponsor of the 15-percent national rate cap legislation I cited, has not once---to my knowledge---responded to or even countenanced that her admittedly well-meaning proposal may reduce access to credit.

That’s a pity because the people most likely to lose partial or total access to credit as a result of statutory restrictions are low-income and minority households---communities that Rep. Ocasio-Cortez strives to represent. We saw earlier that consumers with subprime credit scores experienced the steepest drop in credit card access following passage of the CARD Act. The Durbin Amendment one year later caused the share of fee-paying accountholders to double, but low-income consumers, who have a harder time meeting banks’ minimum-balance requirements, were disproportionately---15 times---more likely to be affected.[28]

Despite its status as a global hub of financial innovation and a country where consumer credit options are more diverse and plentiful than elsewhere, America’s consumer financial system remains bifurcated into two groups: the well-served and the underserved. There are different ways of defining the two categories.

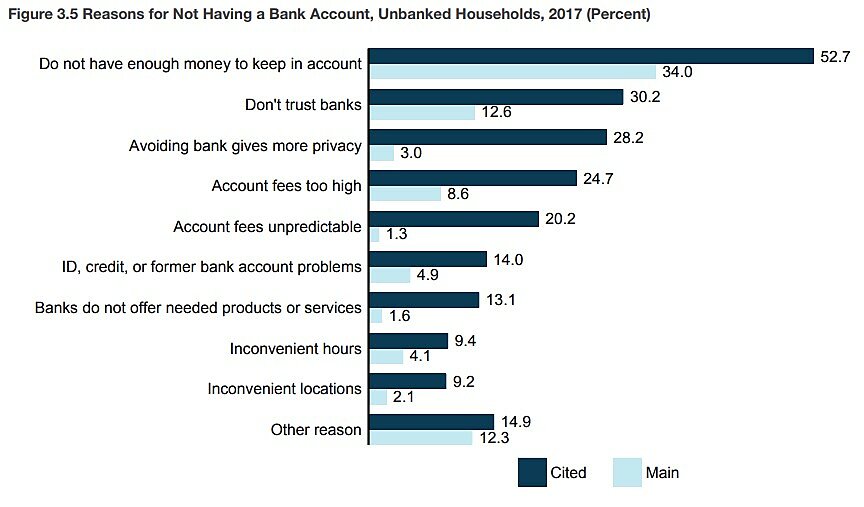

For example, the Federal Deposit Insurance Corporation (FDIC) reports that 8.4 million households were “unbanked” in 2017, with another 24.2 million “underbanked.” I’m torn about the FDIC study, because it seems to rule out the possibility that some people might choose to forego a bank account. Indeed, in the survey accompanying the FDIC’s biennial report, the top five reasons for not having a bank account all involve cost and trust. In other words, unbanked households are choosing to remain so because a bank account is not worth the costs to them.

Still, because a bank account is often necessary for essential activities and acts as a gateway to other financial products, making ownership of bank accounts (or their modern equivalents, mobile money accounts and digital wallets) more accessible is an important policy goal. Furthermore, those more likely to face limited access to financial services---minorities and the young---are also disproportionately represented among the ranks of the unbanked.

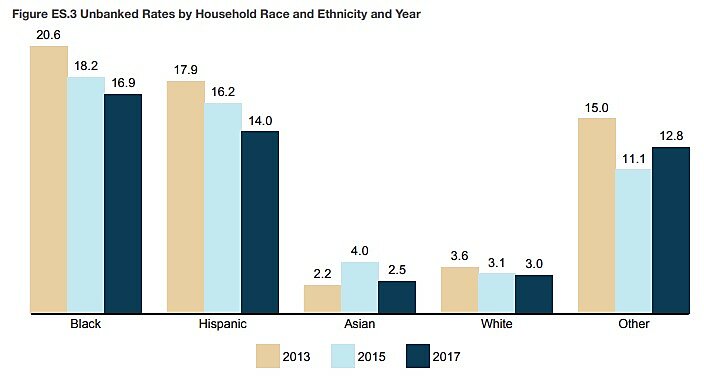

Unbanked Rates by Household Race and Ethnicity, 2013-2017

There are other measures of financial inclusion that give a sense of the scale of the underserved consumer population. In 2015, the CFPB estimated (using mainly 2010 data) that 45 million Americans were "credit invisible," meaning they lacked a credit history sufficient to give them a credit score.[29] Again, African Americans and Hispanics were nearly double as likely as Asians and whites to be credit invisible.[30] Almost 50 percent of consumers living in low-income neighborhoods were credit invisible, compared with 20 percent of those in middle-income neighborhoods and ten percent for upper-income ones.[31]

While the buoyancy of the economy will have allowed many credit invisibles to build credit, just as it has lifted credit scores across the board,[32] between a quarter and a third of Americans, depending on the source consulted, are subprime even in the current economic environment.[33]

The problem with restrictive regulation is that it often makes it less attractive to serve the underserved. Under restrictive regulations, the underserved are themselves discouraged from using financial services. It’s an approach that I’ve described elsewhere as financial inclusion without finance[34]---the paradoxical belief that a systematic reduction in the options available to consumers can improve their access to financial services. My colleague Todd Zywicki has in the past referred to this approach as “market-replacing regulation.”[35] Market-replacing regulation involves substituting the preferences of the policymakers for those of the consumer. But in most circumstances, the policymaker has neither the knowledge nor the economic incentive to choose better than the consumer could for herself.

Another problem with the restrictive approach is that it acts as a hurdle to competitive innovation. If a specific part of the market for financial services is expensive, unpleasant, unreliable, or otherwise subpar, an open environment is the likeliest to improve it, as challengers vie to take custom away from incumbents. This happened to banking with the removal of branching restrictions in the 1980s and 1990s, and to revolving credit after the 1978 Marquette Supreme Court decision preempted national bank-issued credit cards from state usury caps. More recently, a combination of fintech installment lenders, earned-income access providers, and nonprofit organizations have started to offer alternatives to payday loans, which some people regard as needlessly costly. The market will show whether they’re right.

Some of you may have seen the announcement by the CFPB in October of a task force that will review the 18 enumerated consumer financial laws and their associated regulations.[36] Last month, they released the membership of this task force, which Todd Zywicki will chair. I am not only pleased at the impressive membership roster but also regard it as a timely---and exceptional, considering it’s nearly 50 years since a similar national commission was established---initiative that will allow the CFPB to ponder longer-term questions than its day-to-day operations and even than the Director’s statutory five-year term.

In that spirit, I recently suggested three areas that the CFPB task force should prioritize: consumer financial data, cost-benefit analysis, and financial inclusion.[37] The first is transforming all stages of the consumer credit process, from product recommendations and selection, to applications and underwriting, to payment, collections, and dispute resolution. But the absence of full clarity regarding provider liability, in the context of the CFPB’s extensive powers, has curbed financial institutions’ enthusiasm for the many promising uses of customer data.

Cost-benefit analysis is supposed to feature in every rulemaking, but often it is used to support whatever conclusion the regulator wishes to reach. However, specific forms of cost-benefit analysis---such as evaluating who among the distribution of consumers bears the costs and benefits of prospective rules---can be especially illuminating for America’s bifurcated consumer financial services market. The foremost priority should be to expand access for those overwhelmingly low-income, minority, and asset-poor households who currently face the most limited options.

Many financial regulators see their job as designing or restructuring markets through regulation. Too few, in my view, see their role as mainly that of enabling markets to provide for consumers the financial products they want and need from suppliers eager to compete for their business. But I think recent history suggests that this latter approach, a focus on enabling access and choice, holds greater promise for promoting financial well-being and inclusion than any available alternative.

___________________________

[1] National Bureau of Economic Research, “U.S. Business Cycle Expansions and Contractions,” https://www.nber.org/cycles.html.

[2] Nouriel Roubini and Brunello Rosa, “We Are Due a Recession in 2020 – and We Will Lack the Tools to Fight It,” The Guardian, September 13, 2018. https://www.theguardian.com/business/2018/sep/13/recession-2020-financial-crisis-nouriel-roubini

[3] Arvind Krishnamurthy and Tyler Muir, “How Credit Cycles across a Financial Crisis,” Stanford Graduate School of Business Working Paper No. 3579 (August 2017). https://www.gsb.stanford.edu/faculty-research/working-papers/how-credit-cycles-across-financial-crisis

[4] Glenn D. Rudebusch, “Will the Economic Recovery Die of Old Age?,” Federal Reserve Bank of San Francisco Economic Letter 2016-03. https://www.frbsf.org/economic-research/publications/economic-letter/2016/february/will-economic-recovery-die-of-old-age/

[5] Harriet Torry, “U.S. Mortgage Debt Hits Record, Eclipsing 2008 Peak,” Wall Street Journal, Aug. 13, 2019. https://www.wsj.com/articles/u-s-mortgage-debt-hits-record-eclipsing-2008-peak-11565708431

[6] At the end of Q1 2009, when the recession ended, the delinquency rate on student loans was 7.9 percent on outstanding balances of $707 billion, yielding a delinquent balance of $55.9 billion. As of Q3 2019, 10.9 percent of the $1.64 trillion of outstanding student loans was delinquent, that is, $178.8 billion.

[7] David O. Lucca, Taylor Nadauld, and Karen Shen, “Credit Supply and the Rise in College Tuition: Evidence from the Expansion in Federal Student Aid Programs,” Federal Reserve Bank of New York Staff Report 733 (July 2015). https://www.newyorkfed.org/research/staff_reports/sr733.html

[8] The Consumer Financial Protection Bureau’s three-year-old (and ongoing) lawsuit against Navient, a large student-loan servicer, is one example. See Editorial Board, “Cleaning Up after Richard Cordray,” Wall Street Journal, May 1, 2018. https://www.wsj.com/articles/cleaning-up-after-richard-cordray-1525216332

[9] Jason P. Brown and Colton Tousey, “Auto Loan Delinquency Rates Are Rising, but Mostly among Subprime Borrowers,” Federal Reserve Bank of Kansas City Macro Bulletin, August 15, 2018. https://www.kansascityfed.org/en/publications/research/mb/articles/2018/auto-loan-delinquency-rates-rising

[10] Andrew F. Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw, “Just Released: Auto Loans in High Gear,” Liberty Street Economics, Federal Reserve Bank of New York, February 12, 2019. https://libertystreeteconomics.newyorkfed.org/2019/02/just-released-auto-loans-in-high-gear.html

[11] The majority report of the Financial Crisis Inquiry Commission exemplifies this prevailing view. See FCIC, “The Financial Crisis Inquiry Report: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States,” Government Publishing Office, February 2011, xvii. https://www.govinfo.gov/content/pkg/GPO-FCIC/pdf/GPO-FCIC.pdf

[12] See Dodd-Frank Wall Street Reform and Consumer Protection Act, Public Law 111-203 (July 21, 2010) 124 Stat. 2142 ff. https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf

[13] Bureau of Consumer Financial Protection, “Ability-to-Repay and Qualified Mortgage Rule Assessment Report,” January 2019, 114. https://files.consumerfinance.gov/f/documents/cfpb_ability-to-repay-qualified-mortgage_assessment-report.pdf

[14] Peter J. Wallison, Hidden in Plain Sight: What Really Caused the World’s Worst Financial Crisis and Why It Could Happen Again (New York: Encounter, 2015), 101-103.

[15] Ben Eisen, “FHA Clamps Down on Risky Government-Backed Mortgages,” Wall Street Journal, March 25, 2019. https://www.wsj.com/articles/fha-clamps-down-on-risky-government-backed-mortgages-11553511601

[16] Karan Kaul, Laurie Goodman, and Jun Zhu, “Comment Letter to the Consumer Financial Protection Bureau on the Qualified Mortgage Rule,” Urban Institute, September 2019. https://www.urban.org/sites/default/files/publication/101048/comment_letter_to_the_consumer_financial_protection_bureau_0.pdf

[17] Yiwei Dou, Geng Li, and Joshua Ronen, “Does Price Regulation Affect Competition? Evidence from Credit Card Solicitations,” Finance and Economics Discussion Series 2019-018. Board of Governors of the Federal Reserve System, 4. https://www.federalreserve.gov/econres/feds/files/2019018pap.pdf

[18] Ibid., 5.

[19] Bureau of Consumer Financial Protection Bureau, “The Consumer Credit Card Market,” August 2019, 24. https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2019.pdf

[20] Vladimir Mukharlyamov and Natasha Sarin, “The Impact of the Durbin Amendment on Banks, Merchants, and Consumers,” University of Pennsylvania Law School (January 2019), 21. https://scholarship.law.upenn.edu/cgi/viewcontent.cgi?article=3048&context=faculty_scholarship

[21] Ibid., 31-32.

[22] Todd J. Zywicki, “The Law and Economics of Consumer Debt Collection and Its Regulation,” Mercatus Working Paper, Mercatus Center at George Mason University, 24. https://www.mercatus.org/system/files/Zywicki-Debt-Collection.pdf

[23] James R. Barth, Joseph J. Cordes, and Anthony M. J. Yezer, "Benefits and Costs of Legal Restrictions on Personal Loan Markets," Journal of Law and Economics 29, no. 2 (Oct. 1986): 357-380. https://www.journals.uchicago.edu/doi/pdfplus/10.1086/467123

[24] Julia Fonseca, Katherine Strair, and Basit Zafar, “Access to Credit and Financial Health: Evaluating the Impact of Debt Collection,” Federal Reserve Bank of New York Staff Report no. 814 (May 2017), 2. https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr814.pdf?la=en.%2525205

[25] See Craig Clark, “Does the CFPB Realize the APR May Be Misleading?,” LinkedIn, July 4, 2016. https://www.linkedin.com/pulse/does-cfpb-realize-apr-may-misleading-craig-clark-1/

[26] Todd J. Zywicki and Diego Zuluaga, “Comment on the CFPB’s Notice of Proposed Rulemaking on “Payday, Vehicle Title, and Certain High-Cost Installment Loans” Docket No. CFPB-2019-0006,” Cato Institute, May 15, 2019, 16. https://www.cato.org/sites/cato.org/files/pubs/pdf/zywicki-zuluaga-public-comment-5-15-19.pdf

[27] Financial Conduct Authority, “High‐Cost Credit: Including Review of the High‐Cost Short‐Term Credit Price Cap,” Feedback Statement FS 17/2, July 2017, 11, https://www.fca.org.uk/publication/feedback/fs17-02.pdf; FCA, “Proposals for a price cap on high‐cost short‐term credit,” Consultation Paper CP14/10, July 2014, 6, https://www.fca.org.uk/publication/consultation/cp14-10.pdf.

[28] Mukharlyamov and Sarin, “The Impact of the Durbin Amendment,” 33.

[29] Bureau of Consumer Financial Protection, “Data Point: Credit Invisibiles,” May 2015, 6. https://files.consumerfinance.gov/f/201505_cfpb_data-point-credit-invisibles.pdf

[30] Ibid., 17.

[31] Ibid., 15.

[32] Matt Tatham, “Consumer Credit Review,” Experian, January 13, 2020. https://www.experian.com/blogs/ask-experian/consumer-credit-review/

[33] Ibid. and Bureau of Consumer Financial Protection, “The Consumer Credit Card Market,” 21.

[34] Diego Zuluaga, “Financial Inclusion without Finance? The Misguided Quest to Limit Choice in Consumer Credit,” Speech at the Financial Services Centers of America (FiSCA) Annual Conference, October 21, 2019. https://www.cato.org/blog/financial-inclusion-without-finance-misguided-quest-limit-choice-consumer-credit

[35] Todd J. Zywicki, “Market-Reinforcing versus Market-Replacing Consumer Finance Regulation,” 320-321, in Reframing Financial Regulation: Enhancing Stability and Protecting Consumers, eds. Hester Peirce and Benjamin Klutsey. Mercatus Center at George Mason University, 2016. https://www.mercatus.org/system/files/peirce_reframing_ch12.pdf

[36] Consumer Financial Protection Bureau, “CFPB Announces Taskforce on Federal Consumer Financial Law,” October 11, 2019. https://www.consumerfinance.gov/about-us/newsroom/cfpb-announces-taskforce-federal-consumer-financial-law/

[37] Diego Zuluaga, “A Plan to Give CFPB’s New Task Force Some Teeth,” American Banker, January 22, 2020. https://www.americanbanker.com/opinion/a-plan-to-give-cfpbs-new-task-force-some-teeth