The abstract sets the tone:

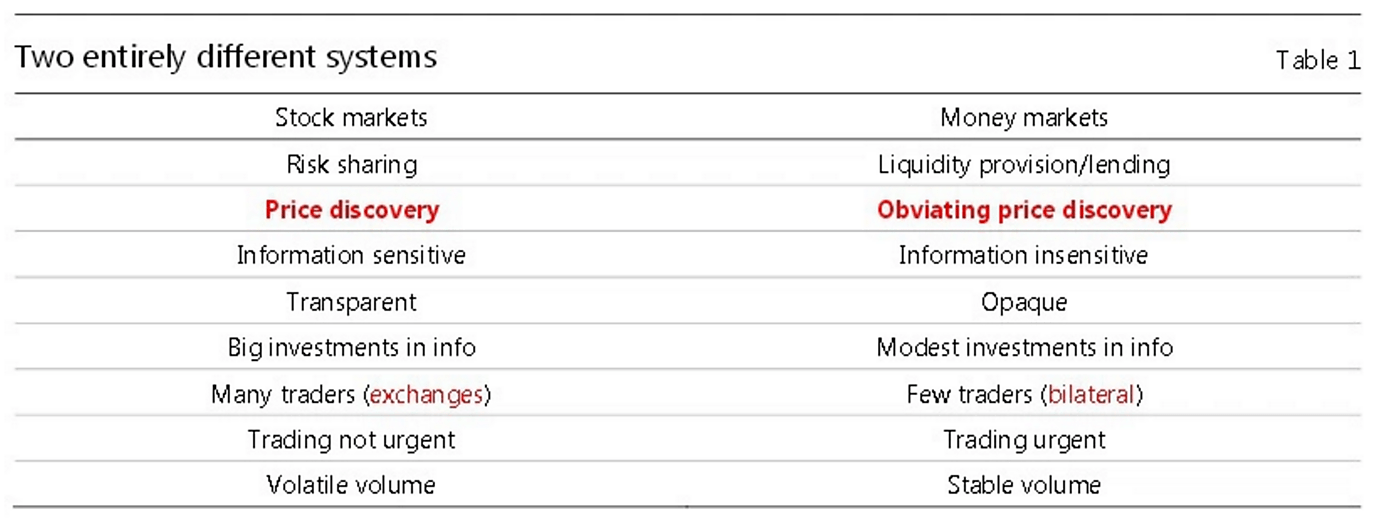

Money markets are fundamentally different from stock markets. Stock markets are about price discovery for the purpose of allocating risk efficiently. Money markets are about obviating the need for price discovery using over-collateralised debt to reduce the cost of lending.

Later, he adds that

Without the need for price discovery the need for public transparency is much less. Opacity is a natural feature of money markets and can in some instances enhance liquidity

His views about the stock market/money market differences are summarized in the following table:

Now let me say that there is virtually nothing in his arguments that is grounded in reality. This theory is completely disconnected from the day-to-day routine of finance workers.

Let’s start with Holmstrom’s definition of ‘money markets’. Following his paper, money markets only involve repurchase agreements. This cannot be further from the truth. Money markets (which we can also call interbank markets) not only involve repos, but also uncommitted and unsecured interbank placements (which include Fed funds). In fact, for many banks, those placements represent the bulk of their money market exposures. For instance, according to the financial database Bankscope, JPMorgan’s assets comprised $213Bn of reverse repos and $340Bn of interbank placements. Citigroup: $120Bn and $112Bn. Deutsche Bank: EUR107Bn and EUR13Bn. HSBC: $147Bn and $96Bn*. Small banks, that have very limited trading activities, have almost no reverse repo transactions outstanding.

So the unsecured, relatively longer-term, interbank market is at the least a sizeable portion of money markets. And it is completely ignored by Holmstrom’s generalization. Given that his arguments rest on the ability of the lender to over-collateralize his exposure, they suddenly weaken considerably.

More fundamentally, Holmstrom really misunderstands the differences between stock and money markets. In reality, both markets are very information sensitive and require transparency. Both markets rely on fundamental financial analysis to assess the riskiness of any investment. Equity markets are more liquid because they involve only a single instrument by issuing firm; instrument whose value is highly sensitive to the profitability of the firm because its yield depends on it.

Credit markets are much, much, larger and involve a multitude of instruments by issuing firm, covering a broad spectrum of hybrids from pure credit to almost equity-like debt. Those debt instruments are ranked differently in the hierarchy of creditors. Senior creditors, including unsecured money market placements, have the first claim on a bankrupt firm’s assets. Does this mean they are information insensitive? Certainly not. But the market value of a firm’s assets fluctuates less than the same firm’s profits/cash flows. Price discovery is continuous; either at issuance (the higher the risk, the higher the interest rate), or on the ‘secondary’ market: given that interest rates on issues are usually fixed, a decline or improvement in the risk profile of the issuer triggers a change in the market price of related issues. Therefore information, and indeed transparency, is crucial in this continuous risk assessment process.

So Holmstrom’s generalized arguments about ‘money markets’ are simply wrong. But are secured credit markets, including reverse repos, devoid of the above rules? Does collateral-posting allow the lender to avoid assessing the inherent riskiness of his counterparty?

While it is true that collateral mitigates risk, no serious lender would ever blindly lend merely on the basis of collateral availability. There are a number of reasons for that. First, collateral is also subject to credit risk, and needs separate assessment. Second, collateral is subject to market risk (i.e. market price fluctuations), requiring the application of a haircut. Despite the haircut, when a crisis strikes and markets all fall simultaneously, the value of your collateral can potentially collapse as fast, if not faster, than the amount you lent. Third, legal risk means that there can be a delay between the insolvency event and the moment you can legally take possession of the collateral (depending on the original contract). And fourth, the news that you had exposure to a collapsing firm, even if you were secured, can easily raise risk-aversion towards you and trigger financial difficulties.

In the end, even in the case of secured lending, fundamental analysis, which relies on transparent information, is necessary. Opacity, unlike what our economists believe, is usually ‘credit negative’ and accentuates the compensation and/or the collateralisation that the lender requires. Moreover, how can the collateralisation level of a transaction be determined without some sort of initial price discovery? Holmstrom does not answer this question.

Unfortunately, Holmstrom’s piece is full of facts that are grounded in an imaginary world. For instance, see his claim that

When new bonds are issued, the issue is typically sold in a day or less. Little information is given to the buyers. It is very far from the costly and time-consuming road shows and book-building that new stock issues require in order to convey sufficient information.

Please, I beg you never to say that sort of things at a financial conference if you don’t want to get laughed at. The truth is that specific roadshows targeting fixed income investors are regularly organised by companies. Fixed income managers also employ buy-side analysts who spend their day analysing those firms, as well as reading pieces of financial research published by sell-side analysts. According to Holmstrom, those people do not seem to exist.

He also claims that bond ratings are ‘coarse’, and that this is “another example of what appears to be purposeful opacity.” I find this amazing, given that rating agencies have about 22 different base rating notches, to which a multitude of extra ratings are added in order to provide the information Holmstrom believes is opaque. Now compare this with the usual three-notch stock rating system of Buy/Hold/Sell and you might conclude he got seriously mixed up here.

This tendency to believe that opacity ‘helps’ markets seems to be spreading. In 2014, Gorton et al (which included, unsurprisingly, Holmstrom) published a very weird paper titled Banks as Secret Keepers, which argues precisely that:

Banks are optimally opaque institutions. They produce debt for use as a transaction medium (bank money), which requires that information about the backing assets — loans — not be revealed, so that bank money does not fluctuate in value, reducing the efficiency of trade. This need for opacity conflicts with the production of information about investment projects, needed for allocative efficiency. Intermediaries exist to hide such information, so banks select portfolios of information-insensitive assets. For the economy as a whole, firms endogenously separate into bank finance and capital market/stock market finance depending on the cost of producing information about their projects.

The paper is based on a mathematical model that seems unable to describe what happens in real financial and deposit markets. And indeed they don’t bother providing much empirical evidence of their claims (as I am writing this post, Kadhim Shubber of FT Alphaville quotes the exact same paper rather uncritically).

At the end of the day, Holmstrom’s and Gorton’s theories seem to justify government intervention in deposit and money markets. But as Kevin Dowd just brilliantly reminded us, those ‘opacity’, ‘information asymmetry’ and ‘market failures’ in no way justify banking regulation, unless you disregard all empirical and historical evidences. And, of course, unless you don’t believe in government failure. Sadly, it seems that imagination wins over reality nowadays in academia.

______________

*Moreover, some of the ‘reverse repo’ figures might include collateral posted against other sort of trades, as well as transactions with non-financial counterparties, implying that the ‘pure’ money market reverse repo portion mentioned here is likely smaller.

[This article originally appeared on Spontaneous Finance]

Disclaimer

This post was originally published at Alt‑M.org. The views and opinions expressed here are those of the author(s) and do not necessarily reflect the official policy or position of the Cato Institute. Any views or opinions are not intended to malign, defame, or insult any group, club, organization, company, or individual.

All content provided on this blog is for informational purposes only. The Cato Institute makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. Cato Institute, as a publisher of this article, shall not be liable for any misrepresentations, errors or omissions in this content nor for the unavailability of this information. By reading this article and/or using the content, you agree that Cato Institute shall not be liable for any losses, injuries, or damages from the display or use of this content.