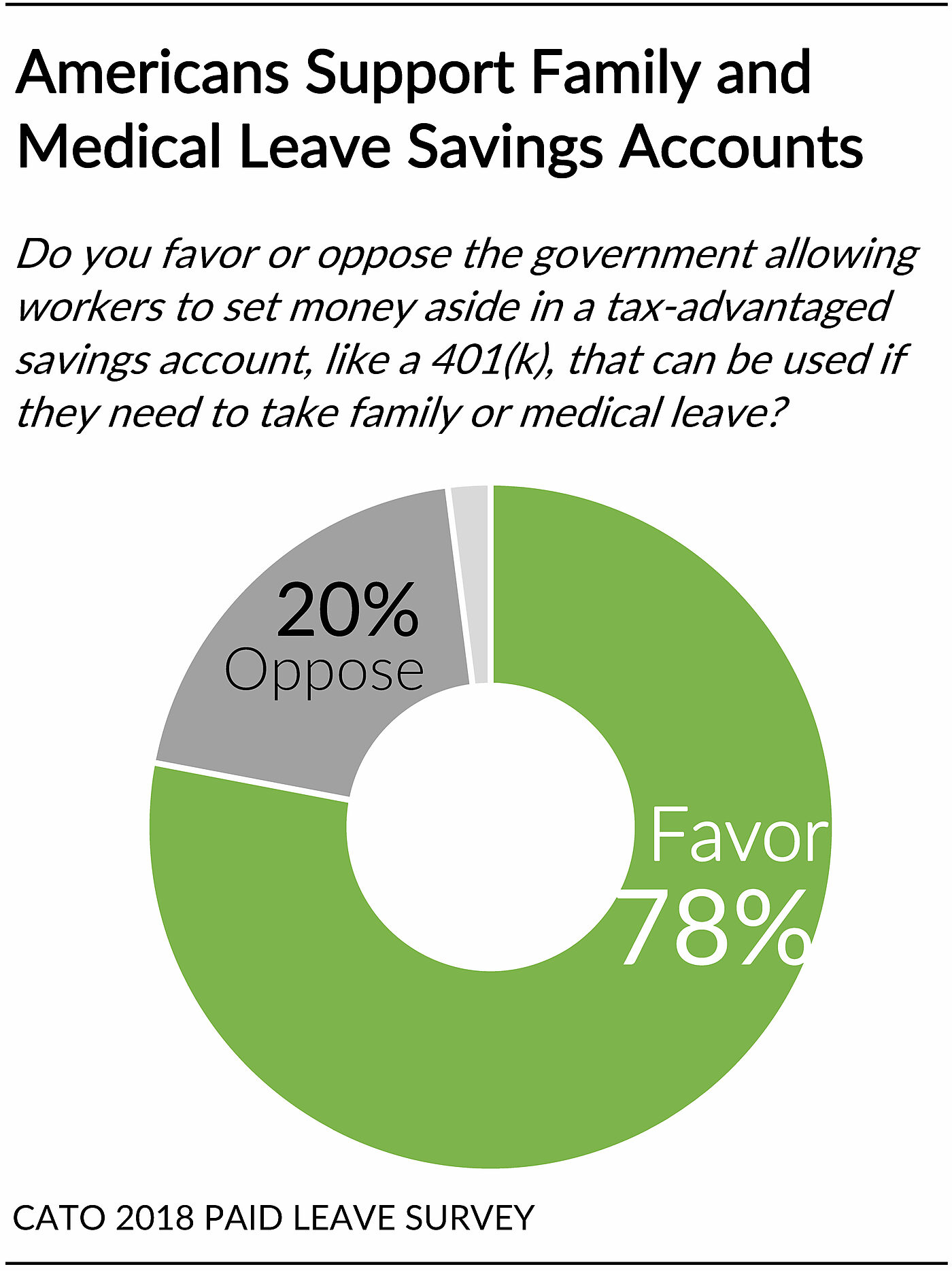

Nearly 8 in 10 Americans (78%) support creating family and medical leave savings accounts. The national Cato 2018 Paid Leave Survey of 1,700 adults finds the public favors allowing workers to set aside money in tax-advantaged savings accounts that could be used if they need to take family or medical leave. A fifth (20%) would oppose the creation of family and medical leave accounts.

Read about the full survey results and methodology here.

Establishing family leave savings accounts enjoys rare bipartisan support: 82% of Democrats, 80% of Republicans and 69% of independents support offering tax-advantages to people who set aside money for parental, family, or medical leave.

Women (80%) and men (76%) also overwhelmingly agree about establishing these types of accounts. These numbers include 85% of Democratic women, 82% of Republican women, and 78% of Democratic and Republican men.

Support for parental and family leave savings accounts aren’t reserved for the wealthy. Nearly three-fourths (73%) of those earning less than $25,000 a year also support such savings accounts. Support heads upwards from there with 86% in favor among those earning $80,000 a year or more.

Finding an image of a piggy bank or savings jar with “family leave” or “parental leave” written on the side to compliment this post was difficult. Instead, one can easily find images of piggy banks and savings jars with labels to save for retirement, to buy a house, for college as well as future travel and stocks. For these needs and wants, we’ve cultivated a culture of saving.

Over time our society has fostered a set of social norms that we instill in our young people starting at an early age. We were reminded when we were young, just as we remind the next generation, to start saving early for an education, a house, big purchases, emergencies, investments in the future, etc. We were reminded to delay consumption today so we have more for later. Doing so can provide peace and security to feel like we’ve done our part to prepare for the future. People usually don’t enter the world with a set of expectations about the value of saving and what they should save for. Thus it’s useful to establish social norms that encourage saving early on.

However, a gap exists in our present cultural norms when it comes to saving for parental and family leave. The fact that I could not easily find an image of a piggy bank or savings jar with “parental leave” or “family leave” as a savings goal is indicative of our culture not yet establishing a norm for these savings goals. While family leave savings accounts need not crowd out other innovations to help support working people who take time to care for new children, family members, or themselves, it can be part of the discussion. These poll results suggest society may be ripe for establishing new social norms of saving for parental and family leave.