Conservative and libertarian scholars are clashing over the findings and political implications of the new Heritage Foundation immigration study. The study spans 92 pages and is jam-packed full of statistics and detailed calculations.

I’ll leave the immigration policy to my colleagues who are experts in that area. To me, the study provides a very useful exploration into how massive the American welfare state has become. Here are some highlights:

- “There are over 80 of these [means-tested] programs which, at a cost of nearly $900 billion per year, provide cash, food, housing, medical, and other services to roughly 100 million low-income Americans.”

- “The governmental system is highly redistributive … For example, in 2010, in the whole U.S. population, households with college-educated heads, on average, received $24,839 in government benefits while paying $54,089 in taxes … [and] households headed by persons without a high school degree, on average, received $46,582 in government benefits while paying only $11,469 in taxes.”

- “Few lawmakers really understand the current size of government and the scope of redistribution. The fact that the average household gets $31,600 in government benefits each year is a shock.”

Total federal, state, and local government spending in 2010 was $5.4 trillion, or $44,932 per U.S. household. The figure of $31,600 in “benefits” is total spending less spending on public goods, interest, and government pensions.

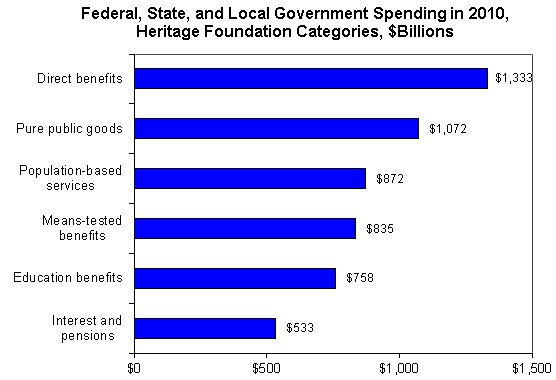

A useful feature of the Heritage study is a breakdown of the $5.4 trillion in spending into six categories constructed by the authors. “Direct benefits” includes mainly Social Security and Medicare. “Pure public goods” includes programs such as defense and scientific research. “Population-based services” includes programs aimed at whole communities, such as police and highways. (Some of these also seem to be public goods). “Means-tested benefits” includes programs such as food stamps. Education includes both K‑12 and college subsidies. “Interest and pensions” is the current costs of past spending, which includes servicing the debt and paying for government pensions. The chart shows spending in 2010.

This spending breakdown is useful for thinking about the proper size of government. From a libertarian standpoint, governments ought to be spending only on public goods and population-based services, as a first cut. That would be $1.94 trillion, or just 36 percent of the current total of $5.4 trillion. As a percent of GDP in 2010, that would be spending of 14 percent, rather than current spending of 38 percent.

But some of the population-based services mentioned by the authors could be privatized, and spending on some of the public goods could be cut. So a good libertarian target might be less than 36 percent of current spending, or less than 14 percent of GDP.

The Heritage study is sparking a debate about what type of immigration reform the nation should have. But hopefully, it will also spur more discussion about the massive size of the American welfare state. Immigration is partly, or mainly, such a contentious issue because we have such a huge welfare state.

The study includes projections about how many trillions of dollars of government benefits will flow to immigrants and their children in the decades ahead. But conservatives and libertarians agree that we ought to cut trillions of dollars in benefits to immigrants and nonimmigrants alike.

So is there some common ground here? Can we work toward an immigration reform that cuts government dependency in general and downsizes the welfare state?