I’m thinking of inventing a game, sort of a fiscal version of Pin the Tail on the Donkey.

Only the way my game will work is that there will be a map of the world and the winner will be the blindfolded person who puts his pin closest to a nation such as Australia or Switzerland that has a relatively low risk of long-run fiscal collapse.

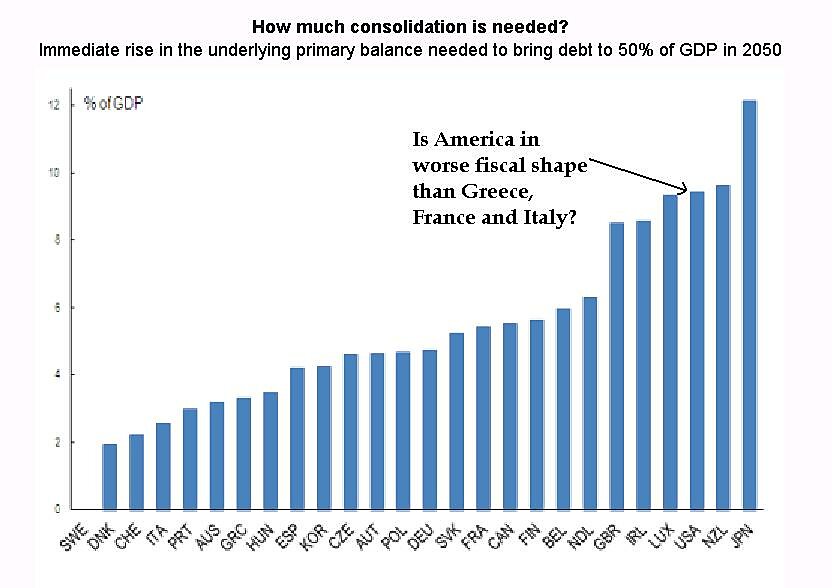

That won’t be an easy game to win since we have data from the BIS, OECD, and IMF showing that government is growing far too fast in the vast majority of nations.

We also know that many states and cities suffer from the same problems.

A handful of local governments already have hit the fiscal brick wall, with many of them (gee, what a surprise) from California.

The most spectacular mess, though, is about to happen in Michigan.

The Washington Post reports that Detroit is on the verge of fiscal collapse.

After decades of sad and spectacular decline, it has come to this for Detroit: The city is $19 billion in debt and on the edge of becoming the nation’s largest municipal bankruptcy. An emergency manager says the city can make good on only a sliver of what it owes—in many cases just pennies on the dollar.

This is a dog-bites-man story. Detroit’s problems are the completely predictable result of excessive government. Just as statism explains the problems of Greece. And the problems of California. And the problems of Cyprus. And the problems of Illinois.

I could continue with a long list of profligate governments, but you get the idea. Some of these governments are collapsing at a quicker pace and some at a slower pace. But all of them are in deep trouble because they don’t follow my Golden Rule about restraining the burden of government spending so that it grows slower than the private sector.

Detroit obviously is an example of a government that is collapsing sooner rather than later.

Why? Simply stated, as the size and scope of the public sector increased, that created very destructive economic and political dynamics.

More and more people got lured into the wagon of government dependency, which puts an ever-increasing burden on a shrinking pool of producers.

Meanwhile, organized interest groups such as government bureaucrats used their political muscle to extract absurdly excessive compensation packages, putting an even larger burden of the dwindling supply of taxpayers.

But that’s not the main focus of this post. Instead, I want to highlight a particular excerpt from the article and make a point about how too many people are blindly–perhaps willfully–ignorant of the Laffer Curve.

Check out this sentence: “Property tax collections are down 20 percent and income tax collections are down by more than a third in just the past five years—despite some of the highest tax rates in the state.”

This is a classic “Fox Butterfield mistake,” which occurs when someone fails to recognize a cause-effect relationship. In this case, the reporter should have recognized that tax collections are down because Detroit has very high tax rates.

The city has a lot more problems than just high tax rates, of course, but can there be any doubt that productive people have very little incentive to earn and report taxable income in Detroit?

And that’s the essential insight of the Laffer Curve. Politicians can’t–or at least shouldn’t–assume that a 20 percent increase in tax rates will lead to a 20 percent increase in tax revenue. They also have to consider the degree to which a higher tax rate will cause a change in taxable income.

- In some cases, higher tax rates will discourage people from earning more taxable income.

- In some cases, higher tax rates will discourage people from reporting all the income they earn.

- In some cases, higher tax rates will encourage people to utilize tax loopholes to shrink their taxable income.

- In some cases, higher tax rates will encourage migration, thus causing taxable income to disappear.

Here’s my three-part video series on the Laffer Curve. Much of this is common sense, though it needs to be mandatory viewing for elected officials (as well as the bureaucrats at the Joint Committee on Taxation).

P.S.: Just in case it’s not clear from the videos, we don’t want to be at the revenue-maximizing point on the Laffer Curve.

P.P.S.: Amazingly, even the bureaucrats at the IMF recognize that there’s a point when taxes are so onerous that further increases don’t generate revenue.

P.P.P.S.: At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy governments.

P.P.P.P.S.: I offered a Laffer Curve lesson to President Obama, but I doubt it had any effect.