The U.S. economy is in its 10th year of economic expansion, and state government budgets are benefiting from a solid growth in tax revenues. State general fund revenues have grown 40 percent since 2010. Many of the nation’s governors have used the growing revenues to expand spending programs, whereas others have pursued reductions in taxes.

That is the backdrop to this year’s 14th biennial fiscal report card on the governors, which examines state budget actions since 2016. It uses statistical data to grade the governors on their taxing and spending records — governors who have cut taxes and spending the most receive the highest grades, whereas those who have increased taxes and spending the most receive the lowest grades.

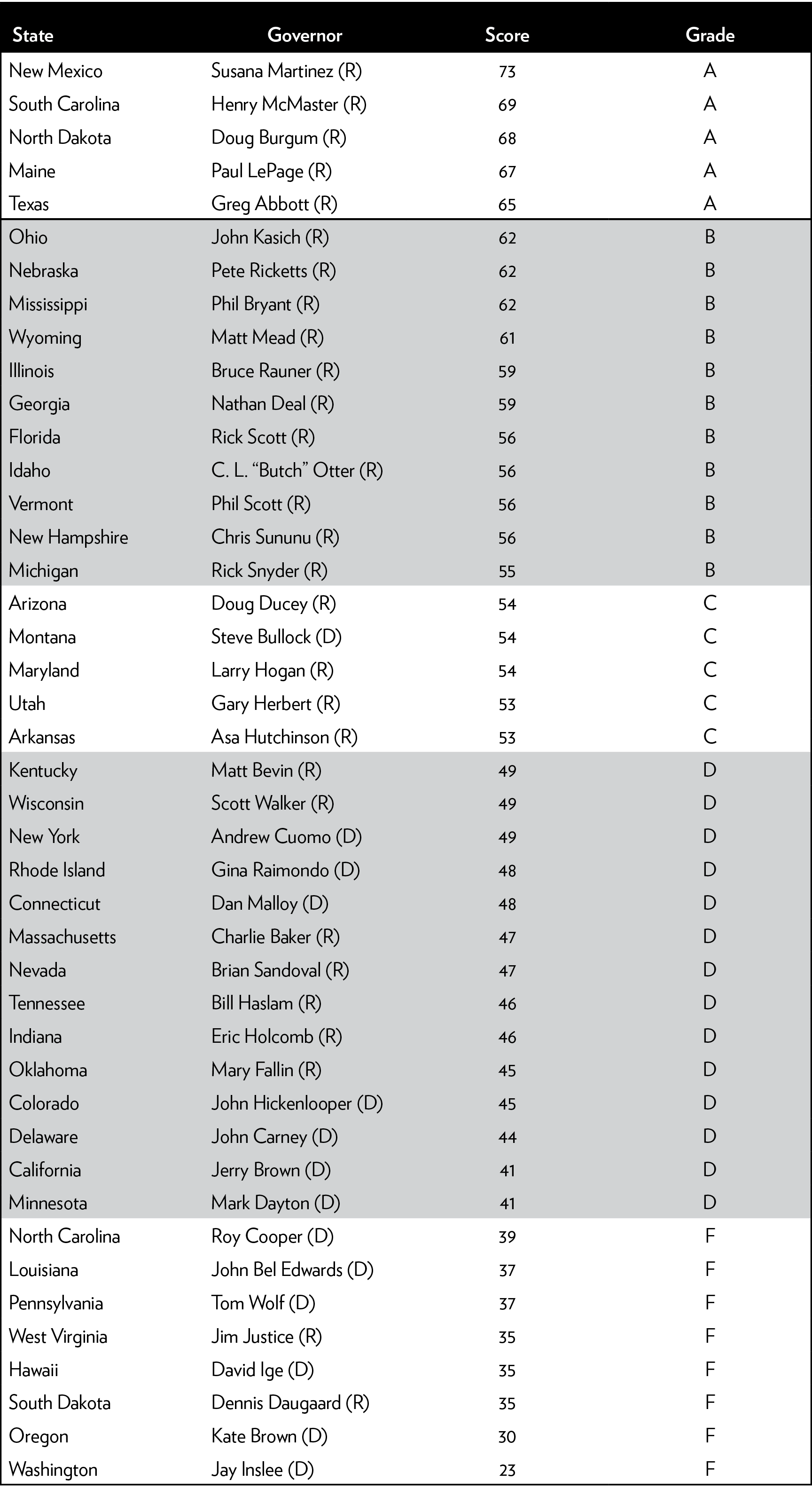

Five governors were awarded an A on this report: Susana Martinez of New Mexico, Henry McMaster of South Carolina, Doug Burgum of North Dakota, Paul LePage of Maine, and Greg Abbott of Texas. Eight governors were awarded an F: Roy Cooper of North Carolina, John Bel Edwards of Louisiana, Tom Wolf of Pennsylvania, Jim Justice of West Virginia, Dennis Daugaard of South Dakota, David Ige of Hawaii, Kate Brown of Oregon, and Jay Inslee of Washington.

Governors of every state are having their fiscal choices shaped by the federal Tax Cuts and Jobs Act of 2017. State income tax bases are tied to the federal tax base, so gover- nors have been considering which federal changes to conform to. Also, the capping of the federal tax deduction for state and local taxes has increased the bite of those taxes for millions of households. The cap has increased the relative burden of living in a high-tax state, and it may induce higher out-migration from those states over time.

The state fiscal environment is also being shaped by recent Supreme Court decisions regarding online sales taxes and public-sector labor unions. Furthermore, the legalization of marijuana has created a new source of revenue for some states.

This report discusses these fiscal policy developments and examines the tax and spending actions of each governor in detail. The hope is that the report encourages more state policymakers to adopt the fiscal approaches of the top-scoring governors.

Introduction

Governors play a key role in state fiscal policy. They propose budgets, recommend tax changes, and sign or veto tax and spending bills. When the economy is growing, governors can use rising revenues to expand programs, or they can return extra revenues to citizens through tax cuts. When the economy is stagnant, governors can raise taxes to close budget gaps, or they can trim spending.

This report grades governors on their fiscal policies from a limited-government perspective. Governors receiving an A are those who have cut taxes and spending the most, whereas governors receiving an F have raised taxes and spending the most. The grading mechanism is based on seven variables, including two spending variables, one revenue variable, and four tax-rate variables. The same methodology has been used on Cato’s fiscal report cards since 2008.

The results are data-driven. They account for tax and spending actions that affect short-term budgets in the states. However, they do not account for longer-term or structural changes that governors may make, such as reforms to state pension plans. Thus, the results provide one measure of how fiscally conservative each governor is, but they do not reflect all the fiscal actions that governors make.

The following section discusses the highest-scoring governors and the differences between governors of the two political parties. The section after that looks at recent developments that have affected state fiscal policy, including the 2017 federal tax law, recent Supreme Court rulings, and the legalization of recreational marijuana. Appendix A discusses the report card’s methodology. Appendix B provides summaries of the fiscal records of the 43 governors included in the report.

Main Results

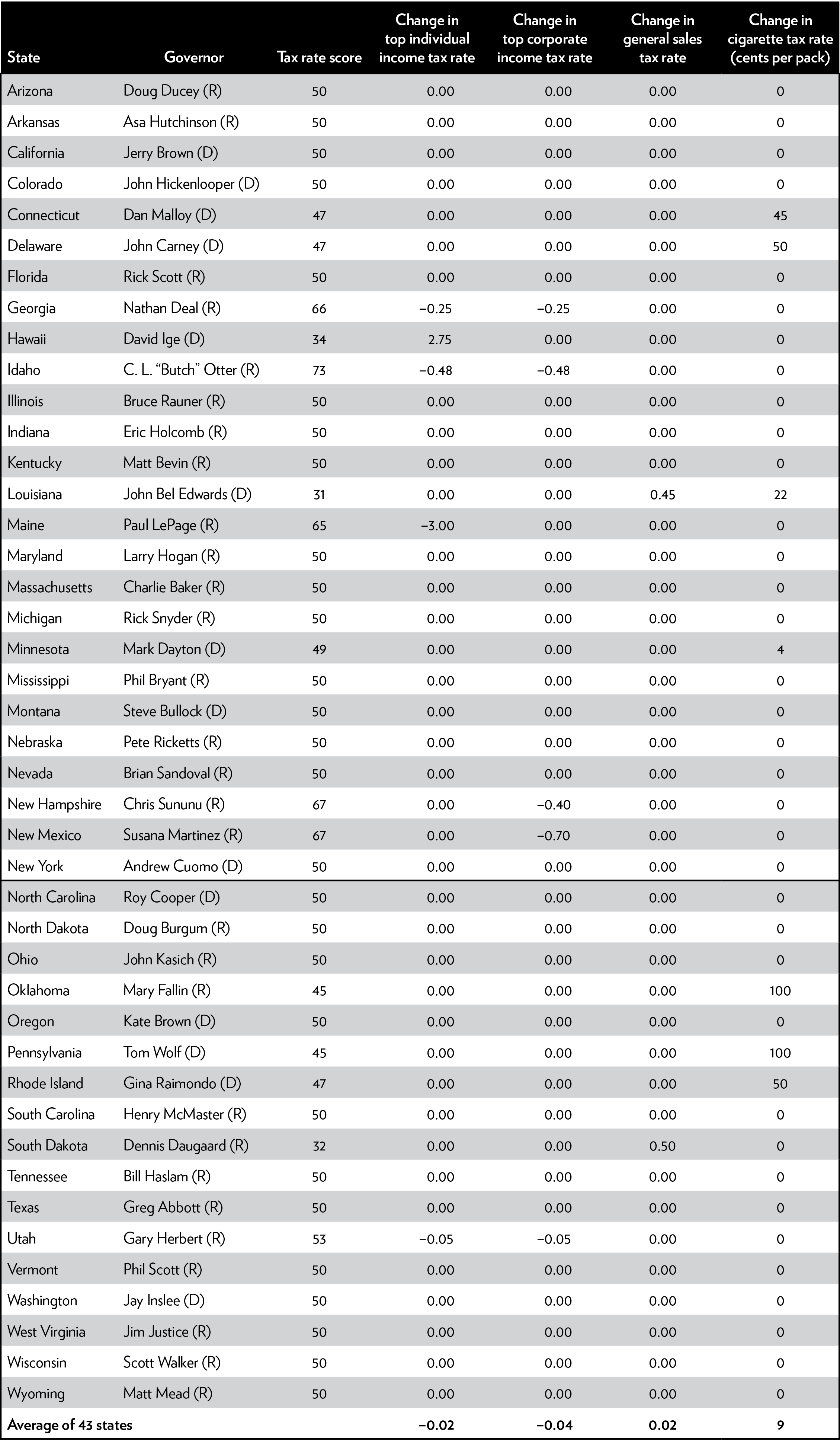

Table 1 presents the overall grades for the governors. Scores ranging from 0 to 100 were calculated for each governor based on seven tax and spending variables. Scores closer to 100 indicate governors who favored smaller-government policies. The numerical scores were converted to the letter grades A to F.

Table 1: Overall grades for the governors

The following five governors received grades of A:

- Susana Martinez is in her eighth year as governor of New Mexico. She scored well on previous Cato reports, and she receives the highest score on this report. Martinez has a reputation for vetoing wasteful spending, and she has kept New Mexico’s general fund budget flat in recent years. On taxes, Martinez has pursued reforms to make New Mexico more competitive, including cutting the state’s corporate tax rate. In recent years, stagnant tax revenues from the oil industry have made balancing the state budget a challenge, but Martinez has held firm against tax increases proposed by the legislature. In 2017, she vetoed bills that would have increased taxes by $350 million a year.

- Henry McMaster of South Carolina is off to a fiscally conservative start as governor since 2017. He vetoed a bill that raised gas taxes and vehicle fees. And he proposed cutting individual income tax rates by 1 percentage point, which would reduce the top tax rate from 7 percent to 6 percent. If passed, the bill would provide more than $400 million in annual tax relief. On spending, McMaster proposed a restrained budget this year, and he is calling for an overhaul of the state’s public pension system to cut costs.

- Doug Burgum is a former technology entrepreneur who is in his first term as governor of North Dakota. He promised to restrain spending, run an efficient government, and not raise taxes, and he is fulfilling those promises so far. North Dakota’s energy boom turned to a bust a few years ago, and state revenues have fallen. Burgum has pursued spending cuts to balance the budget rather than tax increases. State spending was cut by 5 percent during the most recent budget cycle, and this year Burgum directed state agencies to cut their budgets by another 5 to 10 percent.

- Paul LePage of Maine has been a staunch fiscal conservative during his eight years in office. He has restrained spending, cut state government employment, reformed welfare programs, and cut taxes. He frequently speaks about the negative effects of big government programs. He has cut income tax rates and vetoed numerous tax hikes passed by the legislature. In 2017, LePage was able to repeal a 3 percentage point surtax on high earners under the income tax. In LePage’s most recent budget, he proposed cutting the corporate tax rate, repealing the estate tax, and replacing the multirate individual income tax with a 5.75 percent flat tax.

- Greg Abbott is a fiscal conservative who assumed the Texas governorship in 2015. The state general fund budget has been flat in recent years, and Abbott has pursued business tax cuts. In 2015, he approved a 25 percent cut to the state’s damaging franchise tax, which has saved Texas businesses $1.3 billion annually. In his 2017 state of the state address, Abbott proposed cutting the tax further, saying, “We must continue to cut the business franchise tax until it fits in a coffin.”2 Abbott has also approved legislation scrapping annual licensing fees on various professionals, saving Texans $125 million a year.

All the governors receiving a grade of A in this year’s report are Republicans, and six of the eight governors receiving an F are Democrats. There have been some high-scoring Democrats on past Cato report cards, but Republican governors tend to focus their agendas more on tax and spending cuts than do Democrats.

This Cato report has used the same grading method since 2008. In that year, Republican and Democratic governors had average scores of 55 and 46, respectively. In 2010, their average scores were 55 and 47; in 2012, 57 and 43; in 2014, 57 and 42; and in 2016, 54 and 43.

That pattern continues in the 2018 report. This time, Republican and Democratic governors had average scores of 55 and 41, respectively. Republicans received higher scores than Democrats, on average, on both spending and taxes, although the Republican advantage on taxes was greater than on spending.

When states develop budget gaps, Democratic governors often pursue tax increases to balance the budget, while Republicans focus on spending restraint. When the economy is growing and state coffers are filling up, Democrats tend to increase spending, while Republicans tend to both increase spending and pursue tax cuts.

Fiscal Policy Developments

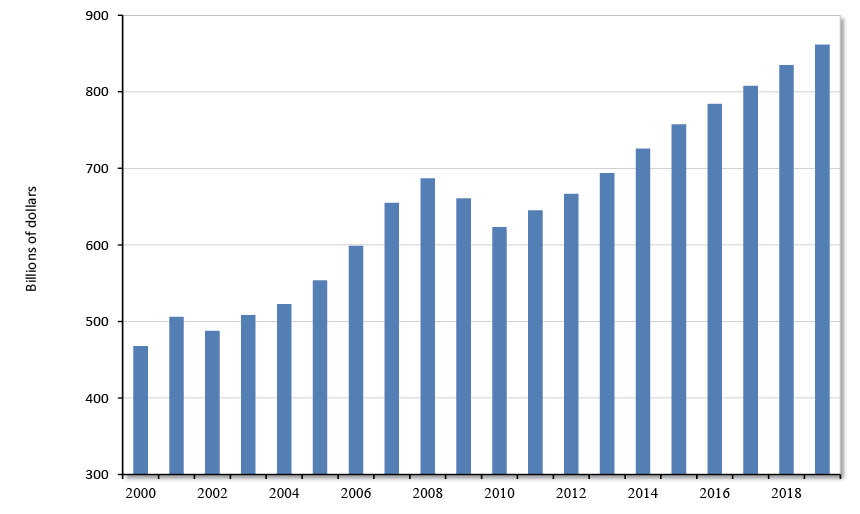

Figure 1 shows state general fund spending since 2000, based on data from the National Association of State Budget Officers.3 Spending soared between 2002 and 2008 and then fell during the recession as states cut their budgets. Since then, spending has bounced back strongly and has grown at an average annual rate of 3.7 percent since 2010.

Figure 1: State general fund spending

Source: National Association of State Budget Officers, “Fiscal Survey of the States,” Spring 2018. Fiscal years.

Education is the largest area of state spending. It accounts for 30 percent of total state budgets, with about two-thirds of the spending going toward K–12 schools and one-third going toward higher education.4 Over the most recent five years of data, state-funded K–12 spending grew at an average annual rate of 4.3 percent.5

The other key driver of state budgets is Medicaid, which is funded jointly by federal and state taxpayers. This giant program pays for the health care and long-term care of 75 million people.6 Medicaid accounts for 29 percent of total state spending. State-funded Medicaid spending grew by 6.0 percent in 2015, 4.1 percent in 2016, 7.8 percent in 2017, and about 7.3 percent in 2018.7

On the revenue side of budgets, states enacted overall net tax cuts in 2014 and 2015 but swung to net tax increases in 2016, 2017, and 2018.8 Cigarette and gasoline tax increases have been pursued by both Democratic and Republican governors. Since 2015, 16 states have enacted cigarette tax increases and 19 states have enacted gas tax increases.9 By contrast, income tax policy divides the parties, with many Democrats supporting increases and Republicans supporting decreases.

Federal Tax Base Conformity

The federal Tax Cuts and Jobs Act of 2017 cut individual and corporate income tax rates, but it also changed individual and corporate tax bases. Those base changes affected state tax systems because nearly every state with an income tax conforms to the federal income tax base to some extent.10

The states are about evenly split between those that automatically conform to federal tax changes (“rolling conformity”) and those that occasionally pass legislation to conform to the federal code that exists at a particular date (“fixed conformity”). There are also a few states that update their tax bases selectively, choosing to conform to only some parts of the federal tax code.

In most states, individuals start their state income tax calculations with federal adjusted gross income (AGI). In other states, individuals start with federal taxable income or a state-specific measure of income. Consider the expansion of standard deductions and the elimination of personal exemptions under the 2017 federal tax law. Those changes altered state tax bases in those states that start with federal taxable income and in states that use federal definitions of deductions and exemptions.

Other federal tax changes altered state tax calculations for itemized deductions, child credits, small business capital expensing, and other items. The new federal deduction for pass-through businesses will affect the tax bases of states that conform to federal taxable income. Other states will have to decide whether to add this new deduction to their codes.

All in all, the 2017 federal tax reform generally broadened state tax bases and thus boosted state tax revenues. In recent months, governors and state legislatures have wrangled over how much of the increased state revenues to return to taxpayers.

South Carolina’s situation is representative of that faced by many states. A state report noted that if “the state doesn’t take action to account for the federal changes, South Carolina would receive a few million dollars more in income tax revenue but, by default, create a duplicative tax system that would likely be a nightmare to tax filers. Meanwhile if legislators decide to conform to federal reform without making major changes to the state’s tax code, South Carolina could generate a whopping $200 million in extra revenue. . . . Yet another option would be for the state to conform to the federal code and make changes to the state’s tax code to offset the extra revenue.”11

As a fixed conformity state, if South Carolina does not respond to the federal change, taxpayers will deal with new tax rules that differ between their federal and state returns. A second option would be for South Carolina to pass legislation simply conforming to the federal law, but that would result in a large state tax increase. A third option would be to pass legislation conforming to federal law but also cutting state taxes. That approach is favored by South Carolina’s governor, Henry McMaster, but he and the legislature have not yet agreed on a plan to do so.12

Other states have pursued different paths. The best response has been from states that have conformed to the federal law but cut state income tax rates to hold taxpayers harmless, such as Idaho and Georgia. Idaho, for example, conformed to the federal tax law, which raised the state’s taxes by about $100 million a year, but Governor Butch Otter more than offset that increase by signing legislation that cut individual and corporate income tax rates and saved taxpayers about $200 million.13 Other states, such as Michigan and Nebraska, offset the tax-increasing effect of the 2017 federal tax law with state tax base adjustments rather than tax rate cuts. Still other states conformed to the federal law and pocketed the extra cash rather than giving it back to taxpayers. Colorado, for example, will pocket at least $200 million a year in extra state tax revenue and state policymakers plan to spend it.14

Supreme Court Ruling on Labor Unions

The government workforce is heavily unionized. In 2017, 36 percent of state and local government workers were members of labor unions, which was five times the private-sector share of 7 percent.15 About two-thirds of government education workers are members of unions.16

The union share in state and local government workforces varies widely, from less than 10 percent in North Carolina to about 70 percent in New York.17 Union shares are correlated with state rules regarding collective bargaining. Three-quarters or more of the states have collective bargaining for at least some state and local workers. But North Carolina, Virginia, and some other states ban collective bargaining in the public sector.

Public-sector union shares are also correlated with “agency shop” rules. These rules require workers to either join their workplace union or pay the union an agency fee. In 2018, 23 states were agency-shop states, and 27 states were right-to-work states, where workers cannot be forced to join a union or pay union fees.18 Right-to-work states generally have lower union shares in their workforces.

Union rules for public employees changed in June 2018 when the U.S. Supreme Court decided Janus v. American Federation of State, County, and Municipal Employees (AFSCME). In that case, the court found that public employees cannot be forced to pay agency fees as a condition of their employment.

This ruling will weaken unions in state and local governments. The New York Times predicted that public-sector unions “are going to get smaller and poorer in the coming years” and cited experts who expect membership to shrink by 10 to 30 percent. As the Times noted, “in the five years after Michigan passed a law ending mandatory union fees in 2012, the number of active members of the Michigan Education Association dropped by about 25 percent.”19

A drop in union membership would improve government finances because lawmakers would have more flexibility to restrain costs and improve state efficiencies. Unions tend to use their political power to push for higher wages and benefits. On average, public-sector unions increase compensation levels for their members by about 8 percent.20 When he was running for governor of Illinois in 2002, Rod Blagojevich apparently promised AFSCME large wage increases for their members if he was elected in return for their support on his campaign.21

Unions reduce government efficiency in other ways. Unions tend to protect poorly performing workers, they often push for larger staffing levels than are required, and they discourage the use of volunteers in government activities. They also tend to resist the introduction of new technologies and to create more rule-laden workplaces.

In Wisconsin, Governor Scott Walker signed into law public-sector union reforms in 2011. These reforms imposed restrictions on collective bargaining, including rules requiring that unions be recertified every year. Walker also signed legislation in 2015 making Wisconsin a right-to-work state. In response, the share of Wisconsin’s public-sector workers who belong to unions plunged from 50 percent in 2011 to 19 percent in 2017.22 With the Janus ruling, we may see similarly large drops in union membership in other states.

Supreme Court Ruling on Online Sales Taxes

Before a U.S. Supreme Court decision in 2018, businesses were generally not required to collect online sales taxes for a state unless they had a physical presence in that state. That approach limited online taxation and allowed e-commerce to boom over the past two decades.

Prior to the ruling, large businesses with physical property or employees in many states, such as Amazon, collected online sales taxes, but the physical presence rule shielded smaller businesses from the compliance burden of collecting all the different sales taxes across all the states that their customers lived in. There are more than 10,000 state and local jurisdictions in United States that impose sales taxes.

The 2018 Court decision, South Dakota v. Wayfair, overturned the physical presence rule and opened the door to broader online taxation.23 In the decision, the court identified features of South Dakota’s online tax approach that it viewed favorably. South Dakota’s law exempts small online retailers whose revenue from South Dakota falls below a certain threshold and who complete fewer than a certain number of transactions in the state. And South Dakota has a single state-level administrator of sales taxes and fairly uniform sales tax bases and rates statewide. In response to the Supreme Court’s approval of South Dakota’s approach, many other states are modifying their online sales tax efforts to conform to it.

Some analysts fear, however, that the Wayfair decision will lead to a “wild west” of states aggressively expanding their taxation beyond their borders.24 In turn, that would advantage larger online businesses over smaller ones.25 Even when the physical presence standard held, many states stretched it with a patchwork of tax rules tied to computer cookies, airport stopovers, and other dubious measures of presence. The Wayfair decision may encourage states to adopt simpler approaches to taxing online commerce, but we will have to see.

The Wayfair decision has caused consternation among the five states that do not impose statewide retail sales taxes. New Hampshire Governor Chris Sununu issued a press release declaring that the state “will erect every possible and constitutionally permissible legal and procedural hurdle to prevent other states from forcing our businesses to collect sales and use taxes. . . . We will send a message to every out-of-state taxing jurisdiction and authority. If you try to come into our state and force our businesses to collect a sales tax in a manner that violates our laws or the United States Constitution, you will be in for the fight of your life.”26 Montana officials are also concerned about the Supreme Court decision.27 One Montana newspaper said that the ruling “will create a huge and expensive burden for small and medium-size Montana businesses that sell online but don’t have the capacity or financial ability to track and collect sales taxes.28

Online sales are still less than 10 percent of all retail sales, so there is no desperate need for states to grab more revenue in this manner.29 About half of all e-commerce is already taxed. Uncollected e-commerce taxes are, at most, $13 billion nationally, which is only about 4 percent of total U.S. sales tax collections.30

Despite the rise of online sales, sales tax revenue has kept pace with the growth of the economy over the past three decades. General sales tax revenues as a percentage of gross domestic product have dipped only slightly, from 2.1 percent in 1990 to 2.0 percent today.31

States that expand their online sales tax efforts should minimize the compliance burden on businesses by simplifying their sales tax structures. They should also offset the added revenues collected with a reduction in sales or income tax rates.

Marijuana Taxes

Recreational marijuana is now legal in Alaska, California, Colorado, Maine, Massachusetts, Nevada, Oregon, Vermont, Washington State, and the District of Columbia. One incentive for states to legalize marijuana is to raise tax revenues. All these jurisdictions except Alaska impose special retail sales taxes on marijuana, ranging from 10 percent in Nevada and Maine to 37 percent in Washington State.32 In addition, Alaska, California, Colorado, Maine, and Nevada impose taxes on growers. Vermont policymakers have not yet settled on tax rates.

In 2017, Colorado raised $247 million from marijuana taxes, Washington State raised $319 million, and Oregon raised $70 million.33 Cato’s Jeffrey Miron estimates that nationwide legalization could raise about $12 billion for federal, state, and local governments.34

However, we do not know the tax rates in states that may legalize pot in coming years, nor do we know the consumer responses to those taxes. If states set their tax rates too high, a substantial part of consumer demand will continue to be satisfied on the black market. A recent empirical study found that the “medium-run elasticity of demand for marijuana is higher than the consensus estimates for cigarettes or gasoline.”35 Thus, policymakers should take care to keep marijuana tax rates low.

Legalizing recreational marijuana will be on the ballot this November in Michigan, and governors and legislators in many other states are considering legalization. North of the border, recreational marijuana will be legal nationwide in Canada starting in October 2018.

Interstate Migration

The 2017 federal tax reform law was the largest overhaul of the federal income tax in decades. The law changed deductions, exemptions, and tax rates for individuals while also changing the tax base and rates for businesses.

One key reform was the capping of the federal deduction for state and local taxes (SALT) at $10,000. That cap, along with the doubling of the standard deduction, will reduce the number of households deducting state and local income, sales, and property taxes from 42 million in 2017 to 17 million in 2018.36 For taxpayers who continue to take the deduction, the average benefit will be much smaller.

Before this change in the law, federal deductibility effectively subsidized high-tax states and encouraged them to load taxes onto high earners. It also encouraged government expansion. As the Congressional Budget Office noted of the SALT deduction, “Because of the subsidy, too many [government] services may be supplied, and state and local governments may be bigger as a result.”37

With the capping of the deduction, millions of households will feel a larger bite from state and local taxes, and thus become more sensitive to tax differences between the states. The tax law may increase the outflow of mainly higher-income households from high-tax states to low-tax states. The states where SALT deductions were the largest relative to incomes were high-tax states such as New York, New Jersey, and California.38

If high earners move out of high-tax states in substantial numbers, it would be a blow to state revenues. In New York, the top 1 percent of earners pay 41 percent of state income taxes, and in New Jersey the share is 37 percent.39 In California, the top 1 percent pay a remarkable 50 percent of state income taxes.40

The Internal Revenue Service (IRS) publishes data showing the interstate movements of tax-filing households.41 The data show that 2.8 percent of households moved between states in 2016. There are an average 2.1 people per household in the IRS data.42

Some states gain residents from interstate migration, and some states lose them. The largest loser from interstate migration is New York. In 2016, it lost 218,937 households to other states and gained 142,722 households from other states, for a net loss of 76,215. The other states with the largest net migration losses were Illinois (41,965 households); New Jersey (25,941); California (25,913); Pennsylvania (19,516); Massachusetts (14,549); Ohio (13,254); Connecticut (12,254); Maryland (12,068); and Michigan (10,325).

Where did those domestic migrants go? The largest net inflows were to Florida (95,072 households); Washington State (30,480); North Carolina (25,601); Colorado (24,672); Arizona (24,211); Oregon (21,729); Texas (19,414); South Carolina (18,519); Georgia (17,798); and Nevada (14,236). These 2016 migration flows generally reflect extended trends. New York has been losing residents to other states for decades, while Florida has been gaining residents for decades.

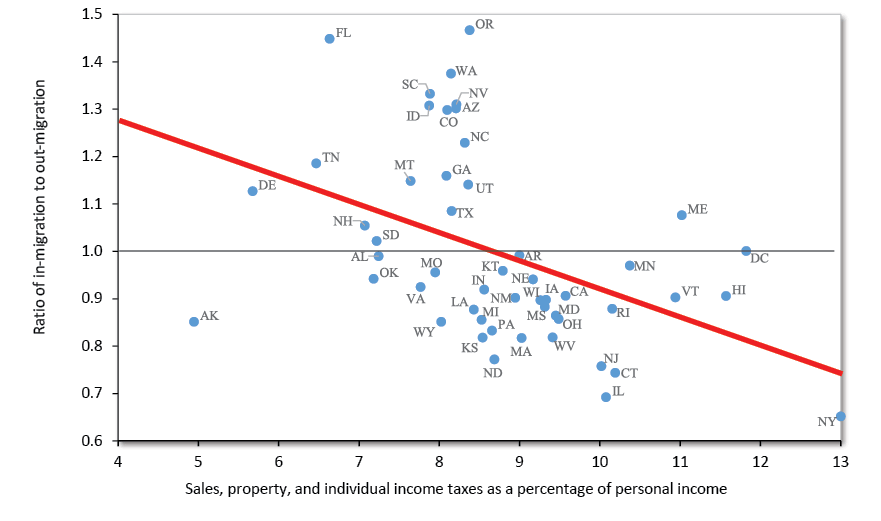

Each state’s attractiveness can be measured by the ratio of gross inflows to gross outflows. States losing population have ratios less than 1.0, whereas states gaining population have ratios greater than 1.0. New York’s ratio was 0.65 in 2016, meaning that for every 100 households that left the state, only 65 households moved in. Florida’s ratio was 1.45, meaning that 145 households moved in for every 100 that left.

Even before the new federal tax law, Americans tended to move from higher-tax states to lower-tax states. Looking at the 2016 migration flows, 286,431 households (consisting of 578,269 people) moved, on net, from the 25 highest-tax states and the District of Columbia to the 25 lowest-tax states in that single year. Taxes are measured as state and local sales, property, and individual income taxes as a percentage of personal income.43

Figure 2 plots state migration ratios on the vertical axis and state tax ratios on the horizontal axis. The figure shows a clear negative relationship between migration ratios and tax levels. On the left, states have lower taxes and net in-migration (a ratio greater than 1.0). On the right, states have higher taxes and net out-migration (a ratio less than 1.0).

Figure 2: Tax levels and net migration ratios, 2016

Source: Author’s calculations based on data from the Internal Revenue Service and U.S. Census Bureau.

Of the 25 highest-tax states, 24 had net out-migration. Of the 25 lowest-tax states, 17 had net in-migration. The figure includes a fitted regression line that shows the correlation between interstate migration and tax levels.44

Interstate migration is influenced by many factors other than taxes, including job opportunities, housing costs, and climate. Experts disagree on how large a role taxes play in migration, but that role will certainly increase under the 2017 federal tax law. A recent Cato Institute study explored these relationships in more detail.45

The new federal tax law has ushered in an era of increased interstate tax competition. Governors should rethink their tax codes with an eye to retaining and attracting residents and businesses. They should consider how to reduce tax rates and improve the efficiency of their state’s public services to give their taxpayers more value for their money.

Appendix A

Report Card Methodology

This study computes a fiscal policy grade for each governor based on his or her success at restraining taxes and spending since 2016, or since 2017 for governors who entered office in that year. The spending data used in this study come from the National Association of State Budget Officers (NASBO) and, in some cases, from the budget documents of individual states. The data on proposed and enacted tax cuts come from NASBO, the National Conference of State Legislatures, news articles in State Tax Notes, and many other sources.46 Tax-rate data come from the Tax Foundation and other sources.

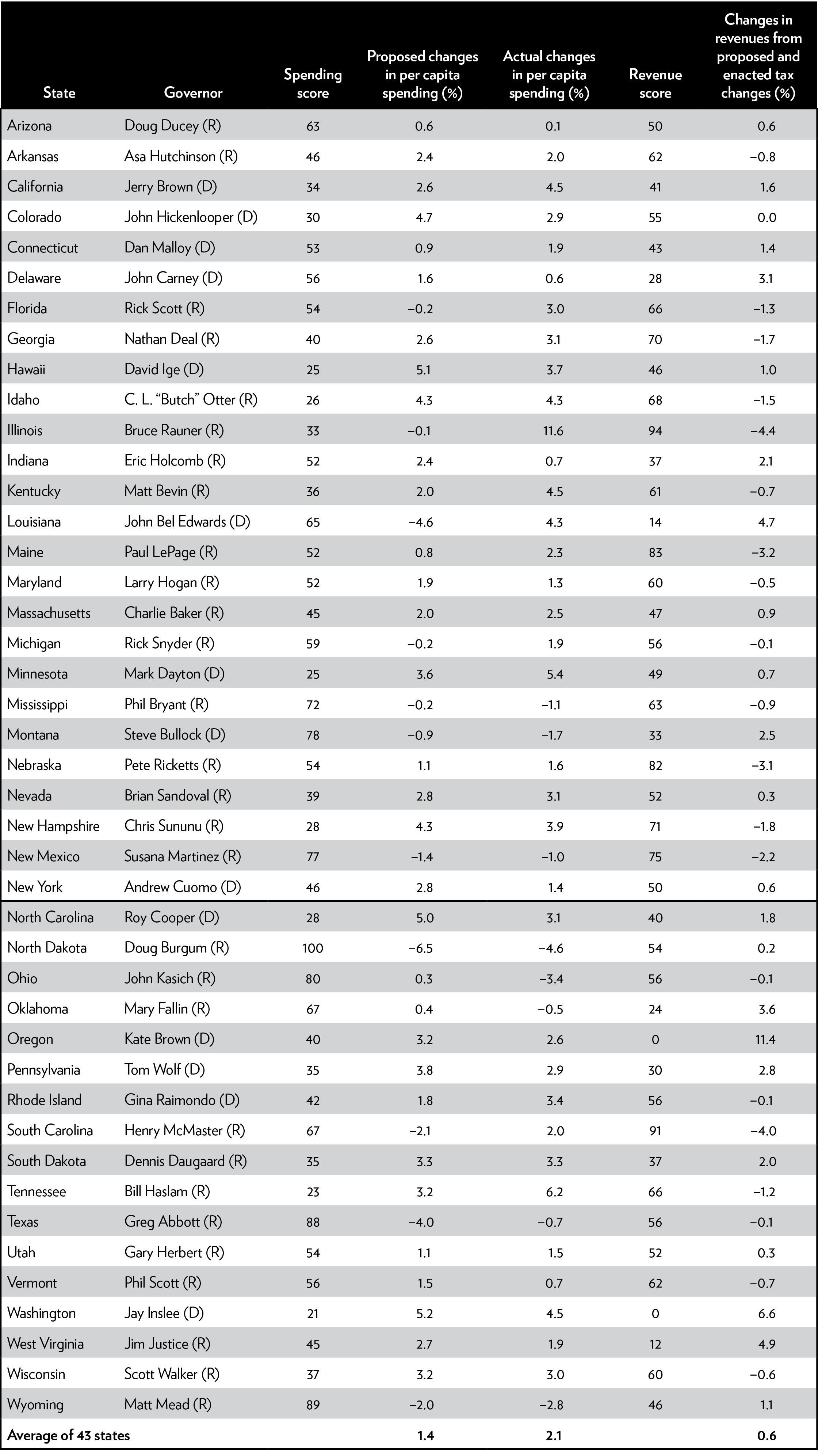

This year’s report uses the same methodology as the 2008, 2010, 2012, 2014, and 2016 Cato fiscal policy reports. The report focuses on short-term taxing and spending actions to judge whether the governors take a small-government or a big-government approach to fiscal policy. Each governor’s performance is measured using seven variables: two for spending, one for revenue, and four for tax rates. Their overall score is calculated as the average of their scores in these three categories. Tables A.1 and A.2 summarize the governors’ scores.

Table A.1: Spending and revenue changes

Note: This table shows the changes in tax rates since 2016 that were approved by the governors. It excludes the expiration of previous temporary changes. The changes shown are the differences in percentage points between the old and new tax rates. For example, Chris Sununu cut New Hampshire’s corporate tax rate from 7.9 to 7.5 percent, so the table shows –0.40.

Spending Variables

- Average annual percent change in per capita general fund spending proposed by the governor

- Average annual percent change in actual per capita general fund spending.

Revenue Variable

- Average annual dollar value of proposed, enacted, and vetoed tax changes. This variable is measured by the reported estimates of the annual dollar effects of tax changes as a percentage of a state’s total tax revenues. This is an important variable, and it is compiled from many news articles, budget documents, and reports.47

Tax Rate Variables

- Change in the top personal income tax rate approved by the governor

- Change in the top corporate income tax rate approved by the governor

- Change in the general sales tax rate approved by the governor

- Change in the cigarette tax rate approved by the governor.

The two spending variables are measured on a per capita basis to adjust for state populations that are growing at different rates. Also, the spending variables measure only the changes in general fund budgets, which are the budgets that governors have the most control over. Variable 1 is measured through fiscal 2019, and variable 2 is measured through fiscal 2018. Variables 3 through 7 cover changes from January 2016 to August 2018, or from January 2017 to August 2018, for governors who entered office in 2017.

For each variable, the results are standardized so that the worst scores fall near zero and the best scores fall near 100. The scores for each of the three categories — spending, revenue, and tax rates — are calculated as the average score of the variables within the category, with one exception: the cigarette tax rate variable is quarter-weighted because that tax is a smaller source of state revenue than the other taxes measured in its category. The average of the scores for the three categories produces the overall grade for each governor.

Measurement Caveats

This report uses publicly available data to measure the fiscal performance of the state governors. There are, however, some unavoidable problems in such grading. For one, this report card cannot fully isolate the policy effects of the governors from the fiscal decisions of their states’ legislatures. Governors and legislatures both influence tax and spending outcomes, and if a legislature is controlled by a different party, a governor’s control may be diminished. To help isolate the performance of governors, variables 1 and 3 measure the effects of each governor’s proposed, although not necessarily enacted, policies.

Another factor to consider is that the states grant governors differing amounts of authority over budget processes. For example, most governors are empowered with a line-item veto to trim spending, but some governors do not have that power. Another example is that the supermajority voting requirement to override a veto varies among the states. Such factors give governors different levels of budget control that are not accounted for in this study.

Nonetheless, the results presented here should be a good reflection of each governor’s fiscal approach. Governors who received a grade of A have focused on reducing tax burdens and restraining spending. Governors who received a grade of F have pursued government expansion. In the middle are many governors who gyrate between different fiscal approaches from one year to the next.

Appendix B

Fiscal Policy Notes on the Governors

Below are highlights of the fiscal records of the 43 governors covered in this report. The discussions are based on the tax and spending data used to grade the governors as well as on other information that sheds light on each governor’s fiscal approach.48 Note that the grades are calculated based on each governor’s record since 2016, or since 2017 if that year was the governor’s first in office.

Arizona

Doug Ducey, Republican Legislature: Republican

Grade: C Took office: January 2015

Doug Ducey has a background in business and finance, and before taking office he was the head of Cold Stone Creamery. As governor, he has overseen fairly lean budgets, with general fund spending rising 1.3 percent in 2017 and 2.0 percent in 2018. In 2016, Ducey approved pension reforms that trimmed benefit costs and gave new hires the option of a defined-contribution pension plan.

When Ducey was running for office, he promised that he would not raise taxes, and he has signed into law some modest tax cuts.49 He has approved legislation to end sales taxes on some business purchases, to reduce insurance premium taxes, to increase depreciation deductions, and to index income tax brackets for inflation.

However, Ducey also signed into law an extension of a temporary sales tax surcharge to fund education.50 The 0.6 percentage point addition to the sales tax rate raises more than $600 million a year. Additionally, Ducey imposed a new car registration charge on Arizonans, which will raise about $149 million a year.51 These actions amount to substantial tax increases.

Arizona voters had been gearing up to make a big decision on taxes on the November 2018 ballot. They were to decide whether to hike the top individual income tax rate by 4.46 percentage points to fund more school spending. However, the Arizona Supreme Court shot down the measure on technical grounds in late August.52

Arkansas

Asa Hutchinson, Republican Legislature: Republican

Grade: C Took office: January 2015

Former U.S. congressman and federal official Asa Hutchinson entered the Arkansas governor’s office in 2015. Hutchinson campaigned on a middle-class tax cut, which he delivered soon after taking office. He signed into law reduced tax rates for households with annual incomes of less than $75,000, which has saved them about $90 million a year. As the governor said, “Arkansas has been an island of high taxation for too long, and I’m pleased that we are doing something about that.”53

In 2017, Hutchinson approved a further $50 million in tax cuts, primarily for moderate-income individuals.54 And in 2018, as a task force was considering major tax reform, Hutchinson proposed cutting the top individual income tax rate from 6.9 percent to 6.0 percent. He would offset the lost revenue with budget surpluses and the closure of narrow tax breaks.55

California

Jerry Brown, Democrat Legislature: Democratic

Grade: D Took office: January 2011

Governor Jerry Brown received poor grades on previous Cato report cards, and he does so again on this one. He scored poorly on both taxes and spending.

California’s general fund budget increased 4.0 percent in 2017 and 6.2 percent in 2018, and it is set to increase 9.2 percent in 2019.56 Under Brown, the state’s general fund budget rose 52 percent between 2011 and the enacted amount for 2019. State government employment has risen 12 percent since 2013.57

Perhaps Brown’s most wasteful spending is on the state’s high-speed rail project, which despite its high cost will do little to relieve congestion. The projected cost of the project has soared from $33 billion to $77 billion, and officials admit it could rise to $98 billion.58 And those are just the capital costs: taxpayers will also be hit by a share of the project’s operating costs if it is ever completed.59

Brown has been lucky in that revenues have poured into the state’s coffers from growth in Silicon Valley in recent years. However, the next recession will cause a crisis for the California budget, as have past recessions. That occurs because spending keeps rising but state tax revenues are very dependent on high earners and capital gains. In California, the top 1 percent of earners pay 50 percent of all state income taxes, but their tax payments are highly variable.60

Despite the recent surge in state revenues, Brown and the legislature keep piling on more taxes. In 2017, Brown approved a transportation funding bill that raised taxes by $5 billion a year.61 The law increased the state’s gasoline tax by 12 cents per gallon and the diesel tax by 20 cents per gallon. It also imposed a new annual fee on all vehicles. However, voters will have a chance to repeal the new fuel and vehicle taxes on this November’s ballot by approving Proposition 6, the result of a petition that garnered more than 900,000 signatures.

It will be interesting to see which way voters go. In 2016, voters approved Proposition 56, which increased cigarette taxes by $2 per pack to raise $1.3 billion a year.62 And they approved Proposition 55, which extended the state’s top income tax rates for high earners ranging from 10.3 percent to 13.3 percent.63 The latter rate is the highest in the nation.

According to the Los Angeles Times, “The higher tax rates were first implemented in 2012 when voters approved Proposition 30 during a time of severe budget crisis. Under the measure, those rates were set to expire in 2018. Since [then], the state’s revenues have improved dramatically, but Gov. Jerry Brown warned of future deficits unless Proposition 55 was approved.”64 With the growing economy of recent years, any risk of deficits stems from fast-growing spending, not from a shortage of revenue.

In 2017, Brown pushed a bill through the legislature to extend California’s cap-and-trade system for greenhouse gas emissions.65 The system was implemented in 2012 and amounts to a large tax on Californians. Limits on emissions impose costs on businesses and consumers through higher prices on energy and other products.66 The system, for example, is expected to increase gasoline prices from 15 cents to 63 cents per gallon by 2021.67

Auctions of emissions permits raise revenue for California’s “Greenhouse Gas Reduction Fund,” which spends money on a range of politically favored projects, including Brown’s high-speed rail system.68 The fund will raise $1.8 billion in revenue in 2018.69

Brown has pushed other taxes in recent years. His administration proposed a new tax on residential and business water meters that would raise about $100 million annually. However, the legislature has not yet acted on that proposal.

Colorado

John Hickenlooper, Democrat Legislature: Divided

Grade: D Took office: January 2011

John Hickenlooper was an entrepreneur who founded a series of restaurants and brewpubs before entering politics. He first served as mayor of Denver, then was elected governor in 2011. Despite Hickenlooper’s success in business, he has not brought a business emphasis on cost control to the governor’s office.

Under Hickenlooper, general fund spending has ballooned. Spending rose 6.8 percent in 2018 and is expected to rise 7.5 percent in 2019. State government employment has soared under Hickenlooper, rising 16 percent over the past five years.70

Hickenlooper supported a large individual income tax increase on the ballot in 2013, which would have replaced Colorado’s flat-rate 4.63 percent tax with a two-rate structure of 5.0 and 5.9 percent. That increase was rejected by voters by 65 to 35 percent.71

As Colorado’s economy has grown in recent years, revenues have poured into the state’s coffers. A recent story in the Denver Post began, “Colorado’s sunny economic outlook is making it rain tax dollars.”72 Under the state’s Taxpayer Bill of Rights (TABOR), strong revenue growth triggers automatic refunds to taxpayers, and state officials are expecting to issue refunds in the coming years. TABOR is a useful safeguard against government overexpansion, but Hickenlooper wants to change the law so that the state can spend more.73

Colorado will receive hundreds of millions of dollars a year in extra tax revenue as a result of the 2017 federal tax law, and this money will automatically flow into the state’s coffers because it is a rolling conformity state. But rather than using this windfall to reduce state tax rates, the governor and legislature have decided to spend it.74

The state government also has a new source of revenue: marijuana. Citizens legalized it for recreational use on the 2012 ballot. The state is collecting growing amounts of revenue from the product, up to $247 million by 2017.75 Hickenlooper signed a bill raising the marijuana sales tax rate from 10 percent to 15 percent.

Connecticut

Dan Malloy, Democrat Legislature: Democratic

Grade: D Took office: January 2011

Governor Dan Malloy received poor grades on previous Cato report cards because of his large tax increases, and this report tells the same story. In 2011, Malloy raised taxes by $1.8 billion annually. In 2015, he raised taxes by another $900 million annually. He increased the top individual income tax rate and extended a corporate income tax surcharge. He also increased the cigarette tax rate, broadened the bases of the sales and income taxes, and increased health provider taxes.

In 2017, Malloy signed into law increases in cigarette taxes, hospital taxes, and taxes on ridesharing services, as well as on other items, to raise about $400 million annually. In 2018, Malloy proposed raising more than $100 million a year by increasing gasoline taxes.76 He also proposed further increases in cigarette taxes.

Despite all these tax increases, Connecticut faces large budget gaps because of sluggish economic growth. Connecticut’s economy has lagged other states for years, and the state’s high and rising taxes are not helping.77 The state has a troubled fiscal future, with some of the highest debt and unfunded retirement liabilities per capita of any state.

Individuals and businesses have been leaving Connecticut in droves. The state’s interstate migration ratio is 0.74, one of the worst in the nation, which means that 100 households are leaving the state for every 74 households moving in.78 For households that earn more than $200,000 annually, Connecticut has the worst interstate migration ratio in the nation, at 0.48.

Delaware

John Carney, Democrat Legislature: Democratic

Grade: D Took office: January 2017

John Carney has had a long political career. Before entering office as governor, he was a member of the U.S. Congress, Delaware’s lieutenant governor, and Delaware’s secretary of finance. He also served on the staff of Joe Biden during Biden’s time as a U.S. senator.

In his first year as governor, Carney approved large tax increases. He signed bills raising corporate franchise taxes, realty transfer taxes, alcohol taxes, and cigarette taxes.79 These tax increases will raise more than $200 million annually. Carney also proposed a plan to raise individual income taxes, but that plan was not passed.

However, in a concession to interstate tax competition, Carney signed a repeal of Delaware’s estate tax, which may have been costing the state revenue by encouraging wealthy individuals to flee. As the repeal’s main sponsor, Rep. Mike Ramone, said, “We came to the realization that it was absolutely necessary to do [estate tax repeal] because we were losing more in income tax than what we would gain in estate tax.”80

Florida

Rick Scott, Republican Legislature: Republican

Grade: B Took office: January 2011

Governor Rick Scott received an A on Cato’s 2012 and 2016 report cards. Although he was edged out of the top spots on this report, he still scores highly.

Florida’s low taxes and nice climate have made it the largest in-migration state in the nation. People from high-tax states are particularly drawn to Florida by its lack of income and estate taxes. That inflow will likely increase in the wake of the 2017 federal tax law.

Scott has worked to make Florida an attractive destination for people and businesses. In 2012, Scott raised the exemption level for the corporate income tax, eliminating the burden for thousands of small businesses. In 2013, he approved a temporary elimination of sales taxes on manufacturing equipment. In 2014, he signed into law a $400 million cut to vehicle fees.

In 2015, Scott approved a large cut to taxes on communication services and modest reductions in sales and business taxes. In 2016, he proposed more than $900 million in tax relief, including a cut to the sales tax on commercial rents and an exemption for manufacturers and retailers from the corporate income tax.81 The legislature did not approve those proposals but did pass Scott’s plan to eliminate sales taxes on manufacturing equipment.

In 2017, Scott proposed more than $600 million in tax cuts, including a large cut to the tax on commercial leases. The legislature scaled back Scott’s plan and passed a smaller cut to the commercial lease tax.82 In 2018, Scott signed into law another package of cuts, including another cut to the commercial lease tax.

Scott championed, and the legislature passed, a state constitutional amendment requiring a two-thirds vote of each chamber to increase taxes. Amendment 5 will need a 60 percent vote on the November 2018 ballot to be added to the state constitution.

Georgia

Nathan Deal, Republican Legislature: Republican

Grade: B Took office: January 2011

Governor Nathan Deal earned a D on the 2016 Cato report due to his poor performance on both spending and taxes. He did better on this report. State spending has increased fairly briskly, but Deal signed into law major tax reforms in 2018.

In the past, Deal has supported tax increases. He supported a ballot measure in 2012 to increase sales taxes, but voters shot down that plan by a large margin.83 Then, in 2015, Deal signed into law a large increase in gasoline taxes, hotel taxes, and other levies to raise more than $600 million a year.

In recent years, Georgia’s strong economy has filled state coffers with revenues. Also, the 2017 federal tax reform was expected to create a state revenue windfall of about $1 billion a year. Under pressure to offset that windfall, Deal backed legislation in 2018 that cut taxes by more than $1 billion per year when phased in.84 The law doubled standard deductions and reduced the top income tax rate for individuals and businesses from 6 percent to 5.75 percent in 2019 and then to 5.5 percent in 2020.

Deal has signed into law other tax changes. He reduced the ad valorem tax on cars and approved a sales tax exemption for data center equipment. He also approved a remote sellers tax that is expected to raise more than $400 million a year in state and local revenues.

Hawaii

David Ige, Democrat Legislature: Democratic

Grade: F Took office: December 2014

Before being elected governor of Hawaii, David Ige was a state legislator and a manager in the telecommunications industry. He defeated the previous governor, Neil Abercrombie, in the 2014 Democratic primary. Ige pointed to Abercrombie’s tax increases as one cause of his defeat, but Ige is repeating his predecessor’s misguided high-tax approach.

In 2016, Ige proposed increases in gasoline taxes and vehicle registration fees. In 2017, he approved a bill to create a state earned-income tax credit but offset the cost by reinstating higher income tax rates on high earners that had expired in 2015. The state’s top income tax rate jumped from 8.25 percent to 11.0 percent, raising about $50 million a year.85

Ige also approved a bill to raise the state’s hotel room tax and extend a surcharge of the general excise tax, which is similar to a sales tax. These tax hikes, which are expected to raise about $2.4 billion over 13 years, will fund a boondoggle rail transit project that is suffering a large cost overrun.86

Idaho

C. L. “Butch” Otter, Republican Legislature: Republican

Grade: B Took office: January 2007

Former congressman Butch Otter is in his third term as governor of Idaho. He has a fairly pro-growth record on taxes, but state spending has risen quickly in recent years.

In 2012, Otter signed legislation cutting the corporate tax rate from 7.6 to 7.4 percent and the top individual income tax rate from 7.8 to 7.4 percent. In 2015, he proposed cutting income tax rates and ending property taxes on business equipment, but those cuts did not pass.

However, in 2015, Otter approved an increase in the gasoline tax. In 2016, he said he was against the tax cuts that were being considered by the legislature because they would jeopardize his spending priorities.87 And in 2017, Otter vetoed a bill that would have eliminated Idaho’s 6 percent tax on groceries.88

The 2017 federal tax reform bill is projected to provide Idaho with an annual revenue windfall of about $100 million. To his credit, Otter used that opportunity to approve a bill that conformed Idaho’s taxes to the federal tax code while cutting the corporate tax rate and reducing individual income tax rates.89 These cuts will reduce Idaho’s taxes by about $200 million a year.

In 2018, Otter signed a bill to reduce unemployment insurance taxes, which will save Idaho businesses $115 million over three years.90

Otter scores poorly on spending. The general fund budget increased 7.3 percent in 2017 and 5.8 percent in 2018. Spending is expected to increase 5.1 percent in 2019.91

Illinois

Bruce Rauner, Republican Legislature: Democratic

Grade: B Took office: January 2015

Businessman Bruce Rauner took office as Illinois’s governor in 2015 eager to fix his state’s severe fiscal problems. Illinois has large unfunded pension and health care obligations, and its pension and health costs already consume one-quarter of the state budget.92 The state also has about $7 billion in IOUs to businesses that have contracted with the state.93 Illinois bonds are the worst-rated state bonds in the nation. As Moody’s Investor Service said, “Illinois has increasingly become an outlier among the 50 states” for its dire fiscal situation.94

Unfortunately, the state legislature has dug in its heels against Rauner’s proposed fiscal reforms. In a 2017 budget standoff, Rauner agreed to raise income taxes, but only if the tax hikes were temporary and accompanied by other reforms. However, the legislature overrode his veto and passed a budget with no structural reforms that increased the individual income tax rate from 3.75 percent to 4.95 percent and the corporate tax rate from 5.25 percent to 7 percent.95 Those increases will cost Illinois taxpayers $5 billion a year.

In 2018, Rauner proposed trimming state worker pension and health care costs and using the savings to partly roll back the 2017 tax hikes.96 But the legislature — led by House Speaker Mike Madigan — blocked the reforms. Madigan has been in office for 48 years and has remarkable behind-the-scenes power over House members, Senate members, and the state judiciary.97

The large 2017 tax increases have not solved Illinois’s budget woes, and the state’s budget continues to be structurally imbalanced.98 The legislature is pushing for even higher taxes and wants to replace the state’s flat income tax with a progressive, or multirate, tax. Kristen McQueary, a member of the Chicago Tribune editorial board, recently observed that “Illinois lawmakers want [a multirate tax] today after loading up more than $130 billion in unfunded pension liabilities, $6.4 billion in unpaid bills and structural deficits so profound that the state has the worst credit rating in the nation and became the first in U.S. history to fall to near-junk status.”99

A state constitutional amendment would be needed to enact a multirate income tax, and to pass, that amendment would require a supermajority vote from the legislature and 60 percent approval by the voters.

However, higher taxes would not help Illinois’s economy, which has trailed the national economy for years. Illinois suffers from chronic net out-migration to other states, and Chief Executive magazine recently graded it the third-worst state in the country for business.100 McQueary noted that higher taxes are not the answer: “Illinois is experiencing an alarming exodus of residents already . . . They don’t want to pay more of their money toward a lousy, debt-ridden state government.”101

Perhaps Rauner’s most important act as governor was to initiate the court challenge to labor union agency fees that led to the U.S. Supreme Court decision Janus v. American Federation of State, County, and Municipal Employees (AFSCME) in June 2018. The case regarded the ability of governments to charge agency fees to their workers who had not joined the workplace union.

Rauner filed a lawsuit challenging agency fee rules as unconstitutional violations of the First Amendment. A district court judge dismissed the suit, saying that the governor did not have standing to sue. However, a subsequent suit by Mark Janus and other plaintiffs wound its way to the Supreme Court, leading to the June decision, in which the court found that public employees cannot be forced to pay such fees as a condition of their employment.

The Janus ruling will weaken unions in state and local governments, which in turn will provide policymakers with more flexibility to restrain government spending. As Rauner said, the ruling will allow for “much different compensation structure, much more flexibility, much more balance of power between the insiders and the outsiders.”102

Indiana

Eric Holcomb, Republican Legislature: Republican

Grade: D Took office: January 2017

Eric Holcomb entered office in 2017 after a career in the U.S. Navy and numerous public service positions, including being an adviser to former governor Mitch Daniels.

Holcomb scored poorly on taxes in this report. In 2017, he signed a large transportation bill that increased the state’s gasoline tax from 18 cents to 28 cents per gallon and imposed new fees on vehicle owners. The fees included a new $15 vehicle registration fee, a $50 fee for hybrid car owners, and a $150 fee for electric car owners. The bill will raise about $700 million annually.

In 2018, Holcomb signed further tax measures into law. These included cutting sales taxes on software and increasing income taxes by conforming the state code to changes under the 2017 federal tax law.

Kentucky

Matt Bevin, Republican Legislature: Republican

Grade: D Took office: December 2015

Before his election as governor of Kentucky, Matt Bevin was an officer in the U.S. Army, worked in the financial industry, and owned several businesses. He and his wife have nine children.

Governor Bevin did not make major tax changes his first couple years in office, only approving some narrow breaks, such as a $3 million sales tax credit for aviation fuel. Then, in 2017, he called for larger reforms, including repealing the business inventory tax and the death tax. As he said, “Kentucky has a very complicated, convoluted, non-user-friendly tax code” that “should be simplified, so that it doesn’t penalize the very people we need for our future success.”103

In 2018, Kentucky passed its largest tax reform bill in decades and Bevin’s signature was not on it. The legislature passed the tax overhaul in April, Bevin vetoed it, and he was overridden.104 The bill raised revenues but reduced income tax rates.

The reform replaced multirate personal and corporate income taxes with flat-rate structures. Individual rates of 2 to 6 percent and corporate rates of 4 to 6 percent were replaced with a 5 percent flat rate for both individuals and businesses. The reform also simplified the corporate tax base, broadened the individual income tax base, broadened the sales tax base to include more services, and increased the cigarette tax by 50 cents per pack.

In a letter explaining his veto, Bevin said that the bill fell “far short of comprehensive tax reform” and that he disagreed with the legislature’s revenue projections.105 Bevin seemed to approve of the general direction of tax reform, but he disapproved of the particular bill sent to him. Overall, the tax changes are expected to raise about $240 million a year, but the tax code will be simpler and more supportive of economic growth.

Kentucky’s growth has lagged that of its neighbor Tennessee for years. Kentucky has suffered net out-migration to other states, while Tennessee has enjoyed in-migration. This recent tax reform, along with a 2017 right-to-work law signed by Bevin, should help Kentucky start catching up with its more prosperous neighbor.

Kentucky’s general fund spending jumped 8.2 percent in 2017, but this increase slowed to 1.7 percent in 2018. Bevin proposed a range of spending cuts and a roughly flat budget for 2019, but the state legislature passed a spending increase over his veto. State government employment has been trimmed by 3 percent since Bevin entered office.106

Bevin’s 2018 state of the state address called for reforms to Kentucky’s public pensions, which have some of the lowest funding levels in the nation. The legislature passed, and he signed, some modest changes. Pension spending has risen from 5 percent of Kentucky’s general fund spending in 2008 to 15 percent today.107

Louisiana

John Bel Edwards, Democrat Legislature: Republican

Grade: F Took office: January 2016

John Bel Edwards is a graduate of the U.S. Military Academy at West Point, and he served eight years with the U.S. Army as an airborne ranger. Edwards went on to serve in the state legislature before being elected governor in 2015.

Edwards has spent much of his two and a half years in office pushing for higher taxes. Facing a budget shortfall in 2016, Edwards embraced a slew of tax increases. He signed into law higher taxes on alcohol, cigarettes, health care providers, vehicle rentals, business inventories, and other items, in addition to increasing corporate franchise taxes and broadening the sales tax base.108

The 2016 deal also included a “temporary” increase in the sales tax rate from 4 percent to 5 percent. However, when that hike was set to expire in 2018, Edwards and the legislature decided to retain about half of the increase for another seven years, so the state’s sales tax rate currently sits at 4.45 percent.109 Louisiana’s government will also receive a revenue infusion of more than $200 million a year because the state’s tax code automatically conformed to the 2017 federal law.110

In 2017, Edwards proposed a gross receipts tax which would have raised more than $400 million per year, but the state legislature quickly shot down the bill.111

Maine

Paul LePage, Republican Legislature: Divided

Grade: A Took office: January 2011

Governor Paul LePage is a staunch fiscal conservative. He has restrained spending and cut state employment by 7 percent since taking office.112 LePage has signed into law cost-cutting reforms to welfare and health programs, and he has decried the negative effects of big government: “Big, expensive welfare programs riddled with fraud and abuse threaten our future. Too many Mainers are dependent on government. Government dependency has not — and never will — create prosperity.”113

LePage has fought against Medicaid expansion under the Affordable Care Act, calling it a “boondoggle.” Maine voters approved a ballot measure in 2017 to adopt the expansion, but LePage continues to fight it with legal filings to the state’s Supreme Court. LePage said, “We don’t mind helping people get health care, but it should not be free. ‘Free’ is very expensive to somebody.”114 He has proposed conditions for implementing the expansion in a fiscally responsible way.

LePage has been a persistent tax cutter. In 2011, he approved large income tax cuts, which reduced the top individual rate, simplified tax brackets, and reduced taxes on low-income households. He also increased the estate tax exemption, cut business taxes, and halted automatic annual increases in the gas tax.

In 2013, LePage vetoed the legislature’s budget because it contained tax increases, including an increase in the sales tax rate from 5.0 percent to 5.5 percent. However, the legislature overrode his veto.

In 2015, LePage proposed a plan to reduce the top individual income tax rate from 7.95 percent to 5.75 percent, reduce the top corporate tax rate from 8.93 percent to 6.75 percent, eliminate narrow tax breaks, repeal the estate tax, and raise sales taxes.115 When the legislature rejected the plan, LePage said that he would veto any bills sponsored by Democrats. In the end, the legislature passed a budget that included substantial tax cuts over the veto of LePage, who wanted even larger cuts. The plan cut the top personal income tax rate from 7.95 to 7.15 percent, reduced taxes for low-income households, increased the estate tax exemption, and made the previous sales tax rate increase permanent.

In 2016, LePage pushed for more tax cuts. In his state of the state address, he proposed reducing the individual income tax rate to 4 percent over time and repealing the estate tax.

In November of that year, voters narrowly passed, by a 51–49 margin, an initiative (Question 2) to impose a 3 percentage point income tax surtax on households earning more than $200,000 a year to fund education. LePage opposed the hike.

LePage’s budget in January 2017 called for repeal of the surtax and a major overhaul of the state’s tax system.116 He proposed replacing the multirate individual income tax with a 5.75 percent flat tax, cutting the corporate tax rate, eliminating the estate tax, raising the exemption level on retirement income, and offsetting some of the revenue loss by broadening the sales tax base and raising lodging taxes. After a battle with the legislature and a government shutdown, a deal was struck to increase education spending but repeal the surtax on high earners imposed in 2016.117

In 2018, LePage proposed conforming to changes under the 2017 federal tax law. Simple conformity would raise taxes by about $300 million a year, so the governor proposed to offset the taxpayer cost with tax cuts for lower-income taxpayers, a corporate tax rate cut from 8.93 percent to 8.33 percent, and estate tax reductions.118 The legislature failed to pass the plan.

Maine’s tax battles never end. An initiative on the ballot this November (Question 1) would, if passed, impose a 3.8 percentage point surtax on payrolls and nonwage income of higher earners to fund a new universal home care program for seniors.

Maryland

Larry Hogan, Republican Legislature: Democratic

Grade: C Took office: January 2015

Larry Hogan won an upset victory in 2014 in Democratic-leaning Maryland. Hogan has enjoyed high favorability ratings in polls, and he has nudged Democrats in the legislature toward tax relief. In one early move, he used his executive authority to cut highway tolls and fees for state services.

In 2016, Hogan proposed a package of tax cuts for families and businesses. The plan would have reduced taxes on seniors and low-income families, reduced business fees, and cut taxes on businesses located in certain parts of the state. The legislature did not pass the plan.

In 2017, Hogan proposed a “More Jobs for Marylanders” plan, which involved tax credits for manufacturing businesses.119 The legislature passed the complex plan, which involves different levels of tax benefits by geographic area and the monitoring of recipient businesses, including the number of jobs they create and the training they provide. Hogan has also approved other narrow breaks that attempt to micromanage the economy through the tax code.120

In 2018, to offset automatic tax increases created by the new federal tax law, Hogan signed into law bills to increase the state’s standard deduction and earned income tax credit.

Hogan’s focus on narrow breaks for selected businesses is misguided. Instead, he should aim to cut taxes broadly by chopping Maryland’s 8.25 percent corporate income tax rate. Hogan has not made Maryland’s tax climate worse, but he should spearhead reforms to simplify and reduce taxes across the board.

Massachusetts

Charlie Baker, Republican Legislature: Democratic

Grade: D Took office: January 2015

After a career in the health care industry and state government, Charlie Baker was elected governor of Massachusetts in 2014. He has enjoyed high popularity among Republicans and Democrats.

In running for office, Baker said that he would not raise taxes, and he started out on the right foot. A 2014 ballot measure repealed automatic increases in the gas tax. In supporting that change, Baker said, “I’m not talking taxes, period. Not talking taxes, because as far as I’m concerned we have a long way to go here to demonstrate to the public, to each other and to everybody else that this is a grade-A super-functioning [highway department] machine that’s doing all the things it should be doing.”121

In 2016, Massachusetts voters approved the legalization of recreational marijuana, despite the opposition of Baker. In 2017, a marijuana legalization bill imposed a combined excise and sales tax on the product of up to 20 percent.122 The state will raise about $60 million from those taxes in the second half of 2018.

Also, in 2016, Baker approved a bill imposing a 20-cent-per-ride tax on ridesharing services such as Uber, with 5 cents of that tax going to the competitor taxi industry.123 In 2018, Baker proposed a tax on short-term rentals, such as Airbnb, and was still working on the details with the legislature as of August.124

Baker’s largest tax increase came in July 2018, when he approved a 0.63 percent payroll tax to finance a new paid family leave benefit.125 The new tax is expected to funnel an enormous $800 million a year into a new government bureaucracy, which will then hand out benefits to recipients.

The Massachusetts constitution requires that the state income tax be levied at a flat rate, which is currently 5.1 percent. In 2018, there was an effort to put on the November ballot a constitutional measure to impose a new “millionaires” tax on top of the current flat rate. Democrats had pushed the measure partly to encourage turnout at the polls. Fortunately, the state Supreme Court struck down the effort in June. Baker stayed quiet about the proposal.126 Residents of Massachusetts have voted against imposing a progressive income tax five times since 1960.127

Michigan

Rick Snyder, Republican Legislature: Republican

Grade: B Took office: January 2011

After a successful business career, Rick Snyder came into office eager to solve Michigan’s economic problems. The governor has pursued important reforms, such as restructuring Detroit’s finances and signing into law right-to-work legislation.

Snyder has made important tax reforms. He repealed the damaging Michigan Business Tax and replaced it with a less harmful corporate income tax. In 2014, he helped push through a large reduction in property taxes on business equipment to spur capital investment.

In 2015, he signed into law a mechanism that will automatically decrease state income taxes whenever general fund revenue growth exceeds inflation by a certain percentage. The mechanism will go into effect in 2023.

However, Snyder has also increased taxes. In 2015, he increased gasoline taxes and vehicle fees to raise more than $500 million a year. Snyder and the legislature pushed through this tax package despite Michigan voters having rejected by an 80–20 margin a sales and gas tax increase for transportation on a May 2015 referendum (Proposal 1). That rejection was “the most one-sided loss ever for a proposed amendment to the state constitution of 1963.”128 Yet later that year, Snyder and the legislature hiked taxes for transportation anyway.

In 2017, Michigan enacted pension reforms for public school employees, enrolling new hires in a defined contribution plan with the option of a hybrid plan. This reform, championed by Snyder, will substantially reduce the system’s future costs. The American Legislative Exchange Council called it “one of the biggest success stories across the states in 2017” in terms of fiscal reforms.129 That same year, Snyder also approved a bill banning local governments from imposing taxes on food and soda.

In 2018, Snyder signed legislation to offset the expected tax increase caused by the 2017 federal tax law. The legislation increases the state’s personal exemption and reduces state revenues by about $180 million a year.130

In November 2018, Michigan voters will consider an initiative to legalize and tax recreational marijuana. Under the initiative, both a 10 percent excise tax and the state’s 6 percent sales tax would be imposed on the product.131

Minnesota

Mark Dayton, Democrat Legislature: Republican

Grade: D Took office: January 2011

Governor Mark Dayton scored poorly on previous Cato report cards, and he does so again on this one. His poor grades have stemmed from his large spending increases and tax hikes. Under Dayton, Minnesota’s general fund spending has increased by 49 percent in 7 years (2011–2018); it rose 4.7 percent in 2017 and 8.0 percent in 2018.

In 2013, Dayton approved a package that raised annual revenues by $1 billion, which was almost 5 percent of total state tax revenues. The package increased the top individual income tax rate from 7.85 percent to 9.85 percent and hiked the cigarette tax by $1.60 per pack.

In 2014, Dayton reversed course and approved tax cuts of about $500 million a year, including reductions to income taxes, estate taxes, and sales taxes on business purchases. But Dayton reversed again, and in 2015 and 2016 he proposed raising taxes by hundreds of millions of dollars a year, although those proposals did not pass the legislature.

With a budget surplus in 2016, Republicans in the legislature proposed major tax cuts, including reductions in property taxes on business equipment. It seemed as if Dayton might reach a compromise on these cuts, but the bill that passed the legislature included a drafting error, and Dayton refused to sign it.132 That same year, Dayton proposed raising gas taxes and vehicle fees by $400 million a year.133

In 2017, Dayton and the legislature feuded again over a budget surplus. Dayton’s budget called for $300 million in tax cuts, but the legislature wanted to cut $1.15 billion. They reached a compromise on a grab bag of cuts, many of which will do little to spur economic growth, such as expansions in tax credits.

The bad blood between Dayton and the legislature continued in 2018. Minnesota enjoyed further surpluses and is expected to receive a revenue windfall of about $400 million a year if it conforms to the 2017 federal tax law. Dayton wants to increase education spending, expand low-income tax credits, and reverse some of the previous year’s tax cuts that he did not agree with.134

The legislature sent Dayton a bill to increase education spending and modestly cut individual and corporate tax rates. However, Dayton vetoed it because he did not want to cut corporate taxes and because the plan did not include low-income tax credits.135 Without a compromise on federal tax conformity, Minnesota residents will be left with a higher tax burden and a more complicated tax code.

Mississippi

Phil Bryant, Republican Legislature: Republican

Grade: B Took office: January 2012

Phil Bryant was a member of the Mississippi House of Representatives, state auditor, and lieutenant governor before being elected governor in 2011.

Bryant signed into law major tax cuts for businesses and individuals in 2016. His most important reform was phasing out, over 10 years, the corporate franchise tax, which is imposed on businesses in addition to the state’s corporate income tax.136 The tax currently raises about $260 million a year. Bryant gets credit for approving the measure, but business tax reform was mainly driven by the legislature.

The 2016 tax package included other reductions. It cut taxes for self-employed individuals and cut the bottom individual and corporate income tax rates, from 3 percent to zero.137

Bryant also scores highly on spending in this report. Although Mississippi’s general fund budget jumped during his first few years in office, it has been flat since 2016. Also, state government employment has been trimmed by a few percentage points in recent years.

Montana

Steve Bullock, Democrat Legislature: Republican

Grade: C Took office: January 2013

Governor Steve Bullock scored very well on spending in this report. Slower-growing state revenues in recent years have prompted restraint on the spending side of the budget.

However, Bullock’s grade on this report card was pulled down by his proposed and enacted tax increases and his vetoes of tax cuts passed by the legislature. One plan he vetoed in 2015 would have trimmed the corporate tax rate, reduced the number of individual income tax brackets, and simplified the income tax base.

In 2016, Bullock proposed raising the individual income tax rate on top earners from 6.9 percent to 7.9 percent. He has also proposed raising taxes on beer, wine, and spirits, and he proposed a $30 million tax on investments in a workers’ compensation fund.138 These proposals were rejected by the legislature.

Bullock succeeded in getting transportation-related tax increases passed. In 2017, he signed into law an increase to the gas tax of 6 cents per gallon and higher charges on vehicles.139

In November, Montana voters will decide on the ballot (Initiative 185) whether to increase cigarette taxes by $2 per pack to fund an extension of the state’s Medicaid program. Bullock is a strong supporter of the plan.140

Nebraska

Pete Ricketts, Republican Legislature: Nonpartisan

Grade: B Took office: January 2015

Pete Ricketts is an entrepreneur and a former executive with TD Ameritrade. He is a conservative who favors tax reductions and spending restraint.

In 2015, Governor Ricketts vetoed a gas tax increase, arguing that Nebraska should solve its infrastructure challenges without tax hikes. The legislature overrode him to enact the increase.

While running for governor, Ricketts campaigned on property tax reduction, and he signed into law relief for homeowners, businesses, and farmers in 2015. Since then, he has supported further property tax relief. After the 2018 Supreme Court decision regarding online sales taxes, Ricketts said, “Any increased revenue attributable to total enforcement of our sales tax laws must be steered towards property tax relief.”141

In 2017, Ricketts supported a major tax overhaul that would have cut the top individual income tax rate from 6.84 percent to 5.99 percent and the corporate tax rate from 7.81 percent to 5.99 percent.142 The cuts would have been phased in over time and contingent on state revenue growth. In his state of the state speech, the governor said, “If we want to outpace other Midwestern states, we have to be competitive on taxes.”143 Unfortunately, the legislature did not pass the plan.

In 2018, Ricketts supported a plan to cut property taxes and corporate taxes. The property tax cuts would take the form of income tax credits for local property taxes paid, and the top corporate tax rate would be cut from 7.81 percent to 6.84 percent.144 Again, the plan did not pass the legislature.

However, Ricketts did sign into law a bill that adjusts the state tax code to offset the tax-raising effects of the 2017 federal tax law.145 The bill changed the Nebraska tax base rather than cutting tax rates, but it will provide relief of about $300 million annually.

Nevada

Brian Sandoval, Republican Legislature: Democratic

Grade: D Took office: January 2011

Brian Sandoval came into office promising no tax increases, but in 2015, he made a giant U-turn and signed into law the largest tax increase in Nevada’s history, at more than $600 million per year. The package included a $1 per pack cigarette tax increase, an extension of a previous sales tax hike, an increase in business license fees, a new excise tax on transportation companies, and an increase in the Modified Business Tax.

However, the worst part of the package was the imposition of a whole new business tax, the Commerce Tax.146 This tax is imposed on the gross receipts of all Nevada businesses above a threshold size. The tax has 26 different rates based on the industry. It is a complex and distortionary tax.

The Commerce Tax was imposed to increase education funding, even though Sandoval and the legislature had been directly rebuked by the public in 2014 for their effort to impose a new tax for education. In a November 2014 ballot, Nevada voters had overwhelmingly rejected, by a 79–21 margin, the adoption of a new franchise tax to fund education. In recent years, there have been numerous efforts to repeal the Commerce Tax.